In this issue

- Why investment bankers should start paying attention to digital assets

- In case you missed it: summary of the top stories & “food for thought” top picks

Any views expressed are my own and do not represent the views of my employer.

Why investment bankers should start paying attention to digital assets

TL;DR: Investment bankers are known to be financial engineers but are absent in digital assets. The space offers a blank canvas for much needed innovation in primary markets and bankers can help make that happen. I argue there is enough reason for bankers to start educating themselves: there is money to be made in the near future, a new breed of companies is changing the tides in capital markets, and corporate finance is not immune to disruption.

Investment bankers have long been the kings of financial engineering, coming up with many creative ways to raise primary capital for corporates. My former bread and butter, convertible bonds, is a great example of this. The instrument offers significant structuring flexibility to tailor a security to the issuer’s needs (a sentence straight out of a pitch deck). A prospective issuer wants to get equity credit, a certain accounting or tax treatment, or an impossibly high conversion premium. The ECM bankers collaborate with key stakeholders (incl. accountants, the SEC, and even the Fed) to create a structure that is palatable for all. They give it a funky acronym and sell the idea to other companies that have the same problem. Other banks copy it and give it their own acronym. Voila, innovation.

Given that digital asset markets represent a white canvas and an unprecedented opportunity to monetize value in entirely new ways, you would expect investment bankers to be all over it. They are not. As recently called out by Jeff Dorman of Arca, investment bankers are noticeably absent in digital asset markets.

My view on why this is the case:

- The increased focus on compliance following the financial crisis has killed front-office innovation.

- There is not enough awareness of digital assets and new technologies in general amongst investment bankers. Innovation departments in many banks are struggling to get traction with the front office. And I wouldn’t be surprised if bankers put innovation teams in the same camp as “the IT guy” that comes to your desk to fix your computer.

- If they are aware of it, they may associate it with “boring” middle and back office stuff (cost savings) and not potentially new ways to generate fee revenue for the investment bank.

- Deal volumes are breaking new records this year giving little reason to look for new sources of revenue.

Which brings me to my key point: investment bankers should start paying attention to digital asset markets.

Why? Three main reasons:

- There is an opportunity to tap into new sources of fee revenue;

- A new breed of companies is arising, and with it, the tides in capital markets are slowly but steadily changing;

- Corporate Finance is not immune to disruption.

#1 There is an opportunity to tap into new sources of fee revenue

If you are an investment banker with little knowledge of digital asset markets, you have some catching up to do. The below assumes that you have a high level understanding of crypto-assets and blockchain technology.

Back to basics for a minute

A digital token is a transferable unit of value represented by an entry on a blockchain-based ledger. A digital token can represent many things, including: an ownership interest, a claim on assets, a right to get discounts on a company’s goods and/or services, the right to vote, access to an application, currency, membership. What makes tokens on blockchains special and revolutionary is that it allows for the creation of digital uniqueness. There is no single point of failure.

Through a digital token, we can have something…

- digital

- that is valuable

- easily transferable (globally, 24/7, in small units)

- does not need an intermediary to keep it safe…

- …or administer a ledger

- that cannot not be meddled with

- and is transparent.

The crypto community has leveraged this feature of digital uniqueness creatively, unlocking entirely new ways to capture and share economic value. And with it, create new potential sources of wealth for ordinary people.

What is the opportunity

So what? What does that have to do with investment banking?

In my opinion, one of the killer apps of general-purpose decentralized blockchains, like Ethereum, remains capital raising. Moreover, tokens offer centralized companies across the corporate finance lifecycle spectrum new ways to raise capital. What I am talking about here specifically is raising capital from customers.

This is best illustrated by a couple of examples.

#1 Walmart

It may be coincidence, but I have come across several pieces this past week raving about recurring revenue; “the gift that keeps on giving”, “the modern day miracle”. Recurring revenue companies tend to outperform and build stakeholder value faster. The recurring revenue bundle, coined “Rundle” by Prof. Scott Galloway, is the cream of the crop. It combines two established business trends: the recurring-revenue subscription model and bundling. Amazon Prime is a great example of it. “Americans are more likely to get a divorce than break up with Prime,” according to the professor.

On Sept. 15, Walmart launched Walmart+, a $98-a-year membership that includes free grocery delivery, a discount on gas from Walmart parking lots, and the ability to check out via a mobile phone in stores. According to Prof Galloway, if Walmart is successful, this initiative could recast their business translating into greater valuation multiples…providing the cheap capital and opportunities to innovate on the same scale and at the same error rate that Amazon has enjoyed over the last two decades.

What if Walmart would have “tokenized” Walmart+? It could have sold the first 5 million memberships in a (registered) offering of tokens to customers, pocketing $500 million of cheap capital right away. Economically, such tokens would be structured in a way that if the program becomes successful, and its user base grows, token holders (the early adopters) benefit. Structurally, there are many different levers to play with here and we can learn from studying thriving crypto-economic systems and assets. The tokens can offer holders other benefits too, like rewards and special rights (e.g. early access to sales). The tokens are transferable and can be traded from the outset through a few regulated digital asset exchanges where they will be listed.

Benefits to Walmart? Kick-start its program and thereby the potential for success, derisk some of the upfront investment, and increase customer loyalty and engagement. It would deliver immediate shareholder value, potentially translating into a near-term re-rating of the stock. And perhaps it may even score some ESG points?

Interesting fact: Walmart did file a digital currency patent last year.

#2 Coffee as a Service

Panera Coffee launched a $8.99/month ($108 p.a.) subscription model earlier this year offering subscribers unlimited coffee. According to multiple sources a genius move as it creates upsell opportunities, brand loyalty, recurring revenue (obviously), customer data, new customers… The program launched in Feb and was initially impacted by corona but signed up 700,000 customers in July alone. Panera already had a 40 million member customer loyalty program.

Panera happens to be privately held by a German holding company which complicates things slightly, but that aside, a great example. Companies like Panera are impacted by the pandemic, are likely cash strapped on a standalone basis, and have loyal customer bases. Why not offer the first 10% (early adopters) of members of the loyalty program to sign up a token? That’s $432 million of cheap, non-dilutive capital. Token holders will benefit as the program grows, being rewarded for the success they helped create with their early adoption and ongoing loyalty.

#3 Airlines

Arca has been talking about tokens as a capital raising mechanism for quite a while now. Again so this week, and worth a read. Jeff’s point is, why would airlines, impacted by the virus, sell themselves short by selling debt backed by their loyalty programs? They could do the opposite by selling tokens to loyal customers.

These are just a few examples… It will take a lot of work to structure a token that works for the issuer, customers, and other stakeholders. This will require collaboration between the issuer, bankers, accountants, tax people, legal counsels, the SEC, and others. Capital markets bankers are not foreign to this concept and they would do it if a big company like Walmart comes to them.

#2 A new breed of companies is arising and with it, the tide in capital markets is slowly but steadily changing

What am I talking about?

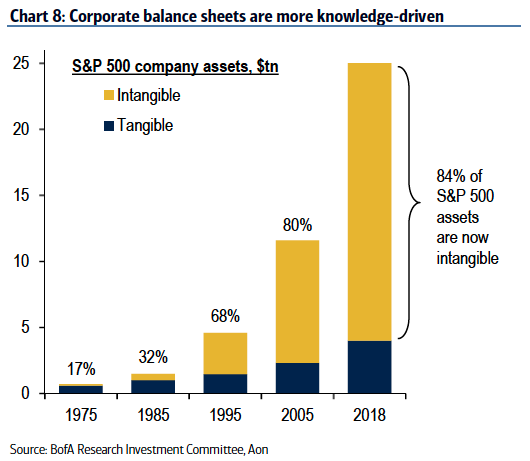

84% of S&P 500 balance sheets are now intangible

Consider the following graph from a recent Bank of America report:

In recent decades, the nature of business capital has changed from investment in tangible to intangible assets like patents, software licenses, proprietary data (code, databases), brand value, and network effects. The nature of technology requires massive upfront investment followed by very low marginal cost. A lot of that funding is taking place in the private space where firms have an easier time protecting their intellectual property. This has contributed to a shrinking number of public companies in the US.

The rise of intangible assets also means that once modern businesses have achieved scale (like FAAMG), they need to employ very little capital. As such, capital markets less so register on the radar screen as a source of funding for these types of businesses.

A side effect of the above is that in recent years we have seen tech companies like Spotify, Slack, Asana, and Palantir opt for direct listings. These companies clearly see benefit in being a public company (for example to have acquisition currency) but don’t need the liquidity event of an IPO (and want so save money on fees and expenses). Whether this is the beginning of a new trend remains to be seen but Silicon Valley insiders expect other companies to follow.

Digital assets for a digital first world

Our world is increasingly dominated by digital commerce (buying and selling goods and services through digital channels), and digital goods and services.

A quote that resonated:

“The rise of digital goods and services present ample opportunities for businesses to grow and enhance customer loyalty; this requires accounting for local payment preferences and nuances, enabling new digital experiences for customers, and ensuring secure commerce that is seamless across channels.”

All of this screams digital assets to me:

- The introduction of digital loyalty tokens into the capital structure;

- The use of on-chain payment methods like stablecoins and digital fiat currencies;

- New digital experiences like fan tokens and in-game assets.

The rise of crypto-native companies

Crypto as a new asset class is still small at $339 billion. Many people believe it will be big, really big. Whether you are one of them or not, a whole ecosystem has spun up around the asset class. Many intermediaries are already making money in this space.

Current opportunities range from servicing crypto-native companies, miners, newly rich people, companies servicing the ecosystem (like Coinbase, BlockFi), crypto hedge funds, and others. Most companies are still small, some are big albeit small on a relative basis. I expect this will change rapidly in the next couple of years.

My point: if you are a banker, you need to start paying attention to digital assets because businesses and primary capital markets are evolving — slowly but steadily.

#3 Corporate Finance (IBD) is not immune to disruption

Innovation is coming to investment banking

Disruption tends to happen where there is a lot of friction and things can be done better by orders of magnitude. Better can mean cheaper in this context. In ECM and DCM things are still done pretty much the same as 20 years ago. There is definitely lots of opportunity for automation and to use technology otherwise to more efficiently approach markets and advise clients.

I know from my time at Thomson Reuters that innovation teams in most banks are getting little traction in investment banking. Fintechs targeting collaboration in this area are having a similar experience. The front office is powerful, and the investment banking fee pool remains big.

Now, let’s do a thought experiment. Imagine a piece of platform software that replaces syndicate (the desk responsible for marketing, pricing, and distribution of a deal). Institutional investors onboard to the platform. They can privately indicate interest in certain companies, sectors, specify important parameters. Details for a potential transaction are entered by the bank. An algorithm consumes data feeds containing historical and real time market data, deals data, company fundamentals, macro-economic data, events calendars, etc. and recommends a marketing price range. Once the deal is ready to launch, the software sends out a message to a filtered list of likely interested investors and puts a press release on social media. Investors attend virtual roadshow meetings and directly enter their orders into the platform. An algorithm, programmed with rules to apply for pricing and allocation, calculates the recommended issue price and allocation. The company signs off, and the system allocates to and notifies investors. Another algorithm watches the aftermarket and algorithmically manages the greenshoe. Enter blockchain in a number of years (for DCM this may not be that far away) and near instantaneous settlement can take place and there is no need for soft underwriting either.

This is a simplified version of reality, but from a technological perspective this stuff isn’t that hard anymore.

Fees

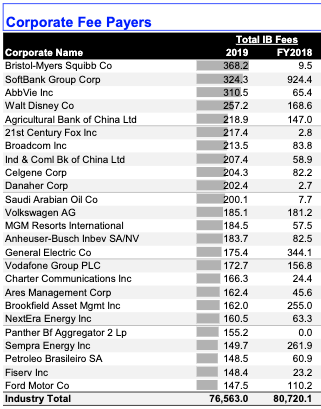

Globally, investment banks made more than $100 billion in investment banking fees (M&A, Bonds, Equity, Loans) in 2019. ECM brought in $17bn and DCM $32bn. The top 25 corporate issuers paid $250 million in fees on average with the #1 Bristol-Myers paying close to $370 million. Only one of the top 25 was a big technology company — Broadcom, which is hardware. “High Tech” as a sector accounted for 8.1% of overall fees. Not apples to apples, but just the FAAMG market cap accounts for 25% of the overall US market cap. To my point above that companies with balance sheets dominated by intangible assets need less capital markets services.

The average gross fee for an equity follow-on transaction in the US in the last 5 years was ~2.25% (source: Refinitiv). For clarity, this means that if a company does a $100 million follow-on offering, it pays $2.25 million in fees to the syndicate of investment banks running the deal. That’s a lot of money as it is, but even more so if technology can take over part of the job and proprietary information is no longer a necessity to do the job well.

There are different reasons, different technologies, and different timetables for disruption to occur, but it would be complacent to think primary markets (and fee revenues) are immune. And technology has been moving at the speed of light in the last decade or two.

Big Tech is getting into finance

Crunchbase recently wrote:

“Today, it seems that every major technology company doubles as a bank. In the past few years, we’ve seen the launch of Apple Card, Facebook’s Libra, Uber Money, Square Cash and Google Pay—all services that promise the most convenient and fastest payment service on the market. “

“From payments to lending to insurance to checking accounts, Amazon is attacking financial services from every angle without applying to be a conventional bank.”

The former is payments related, but the article points out that big tech has superior technological infrastructure that is no match for aging legacy systems that banks operate on. The latter article describes how Amazon is providing financial services to SMEs. Amazon caters to the largest businesses in the world too, through AWS. Google does it through Google Cloud. Companies like Amazon and Google understand the new breed of companies we talked about above and have customer insight that is far superior to financial incumbents.

Investment banks have been getting their lunch eaten before:

- By boutiques in the US, in particular in the M&A space

- By Chinese and other regional banks in Asia

- By commercial banks with large balance sheets like HSBC and the Japanese

- By financial sponsors like KKR underwriting IPOs

It is not unthinkable that big tech expands from providing commercial banking services like checking accounts and lending into services that are traditionally the territory of investment banks.

Conclusion

On a day-to-day basis, we have many great digital experiences: online shopping, streaming video content, gaming, reading books and news, social media, paying electricity bills, video conferencing, collaboration and chat systems. Financial services is a notable exception to this. Fintech companies have made waves in consumer markets. On the wholesale side, Investment Banking and Capital Markets Divisions in particular, are lagging.

I believe that blockchain technology and digital assets will start bringing capital markets and investment banking into the digital age before too long. Investment bankers should start paying attention to digital assets and the opportunities that it offers.

Stay tuned for further thoughts.

In case you missed it…

Filecoin Confirms Mainnet Launch for Next Month

Filecoin is a decentralized storage network allowing users to rent out unused hard drive space. It was funded by a $257 million 2017 ICO. The “network aims to be a next-generation marketplace for data storage and retrieval”, potentially competing with web giants like Amazon, Microsoft and Google. Its USP? “Unlike centralized cloud storage services, which back up data in ways clients can’t change or verify, Filecoin allows clients to easily express their own preferences for reliability and cost.” Filecoin confirmed on Sunday that the mainnet will launch at block 148,888, currently expected on October 15.

Why does this matter?

- Filecoin is a high profile project and an example of a 2017 project that is actually delivering product.

- It is a product that a broad audience can relate to, with prospects for adoption.

- However, current (centralized) cloud storage is cheap, fast, reliable and scalable already and provides a great developer experience.

- Therefore, it will be an interesting and important case to watch as it evolves.

EU Plans to Regulate Crypto in Digital Finance Push

- The EU unveiled a proposal last Thursday seeking to establish clear ground rules for crypto assets. It also seeks to regulate stablecoins.

- The “Regulation on Markets in Crypto Assets” (MiCA) aims to protect the EU’s financial markets while “embracing the digital transformation proactively.”

- Crypto firms like trading platforms would need a physical presence in the EU and will become subject to capital requirements; critical stablecoins will be supervised by the European Banking Authority.

- It will take a while before any law will be in place, the aim is 2024.

Why does this matter?

The proposal is considered one of the most comprehensive and could serve as a global model for the regulation of crypto-assets. The EU has been vocal about its concern for stablecoins like Libra to impact its sovereignty. In particular its ability to exercise effective monetary policy when such coins gain widespread adoption.

On the other side of the pond, it was a busy week for the SEC…

- SEC issues no-action letter in response to digital asset securities questions

- SEC hits Salt Lending with cease-and-desist over $47 million ICO

- SEC Wins Historic Lawsuit Against Kik Over $100 Million ICO

…but regulatory clarity is what is really needed, and a lot is at stake

- Ripple argues that the US is falling behind in digital asset regulation, allowing “China to dictate important parts of a new global payment system.”

- There is still no clarity around the key regulatory question of which digital assets are securities.

- So far the SEC has only exempted two digital assets from securities laws, BTC and ETH; “both [assets are] controlled by China” (through the mining sector).

- “Ceding this innovation to Communist China raises national economic and security concerns” and is damaging to the idea financial inclusion at the core of crypto’s ethos.

Food for Thought: Top Picks

Recurring Revenue: The Rise of an Asset Class

Interesting analysis by John Street Capital; too much to summarize in a few bullets and worth a read on the weekend if you are interested in this topic.

- Investors are searching for yield on the back of negative interest rates.

- What if you create a new asset class that isolates recurring revenue streams allowing investors to earn a fixed rate of return on the underlying contracts instead of taking equity or credit risk?

- Pipe Technologies created a two-sided marketplace connecting companies that have monthly or quarterly recurring revenue with investors who bid these contracts for their annual value, upfront.

- Pipe integrates with a company’s banking, payment processing and accounting systems to “rate” their business instantly to reduce end-client credit risk.

- Pipe solves a pain point for SaaS companies across the continuum allowing to turn MRR into ARR and therefore continue to invest in growth for a very attractive cost of capital.

Why does this matter?

- It is a creative solution that allows growth companies to escape the “small company trap” I highlighted a few weeks back.

- It screams digital asset IMO: in a way it is similar to asset-backed securities, a great use case for blockchain that is, from what I am hearing, not to far away from going into production.

- It appears to me that it will offer plenty of structuring flexibility too; combine that with digital assets and it allows for solving corporate finance problems in new and creative ways.

- It is applicable to companies across the corporate finance lifecycle spectrum and therefore scalable.

Paris Saint-Germain signs for Sorare blockchain collectibles

- Sorare is an Ethereum-based global fantasy soccer game that uses the ERC721 non-fungible token (NFT) standard.

- PSG is one of the top soccer clubs in France and is following other top tier global clubs that already signed up with Sorare, for a total of ~100 clubs.

- Users, as managers, compose virtual teams of five soccer players, from blockchain cards generated by the Sorare platform that are limited edition digital collectibles.

- The article highlights that the space is getting competitive and mentions Fantastec, Stryking, and Socios as other players.

Why does this matter?

- This is a real world use case that is seeing adoption bringing Ethereum-based applications to the masses which is exciting.

- Soccer is the biggest spectator sport in the world with over half of the world’s population ($3.572 billion people!!!) watching the 2018 FIFA World Cup final.

- The concept seems to have built some momentum with numerous high profile clubs signing up and various firms competing in the space.

- As mentioned last week, NFT as a sector has been gaining momentum in crypto.