Wall Street is descending on crypto. Famous institutional investors declaring their love, bankers falling over themselves to get hired by a hot crypto firm, Goldman launching a desk, and the FT seemingly throwing in the towel on crypto cynicism.

It’s interesting, on the one hand, crypto needs Wall Street’s capital to unlock its potential and realize its vision of a more equitable financial system. On the flipside, Wall Street is the exact opposite of that ideal, and the exact system crypto is looking to democratize. With the arrival of Wall Street, crypto is starting to feel a lot like…Wall Street — a bunch of sharks in a tank.

However, when you cut out the idealism, crypto culture and Wall Street do have a lot more in common than you may think, including: the Patagonia vest, narcissism — invented on Wall Street and embraced by crypto Twitter, and a shared love for money — as described by Nathaniel Popper in Digital Gold:

“the impulse that had propelled [early adopters] into this gold rush had both everything and nothing to do with getting rich.”

Then, Wall Street has been softening too. Goldman CEO David Solomon just said that the firm will “strengthen enforcement” of its “Saturday rule” after complaints from junior bankers that they had to work too hard. This means that they can no longer work from 9pm Friday to 9am Saturday. Bless, I hope the world won’t fall apart. The previous generation of bankers was not impressed…

#1: My aunt still sends me a $20 check for Christmas. #2: Thanks for the gin & tonic Aunt Millie.

— GSElevator (@GSElevator) December 6, 2012

In this issue:

- People are interested in CBDCs again

- The crypto adoption cycle

- How are blockchain-powered financial markets developing?

- Momentum tracker,

- Some see trouble on the horizon

- Fund raising, flows, and listing activity

- The week in charts

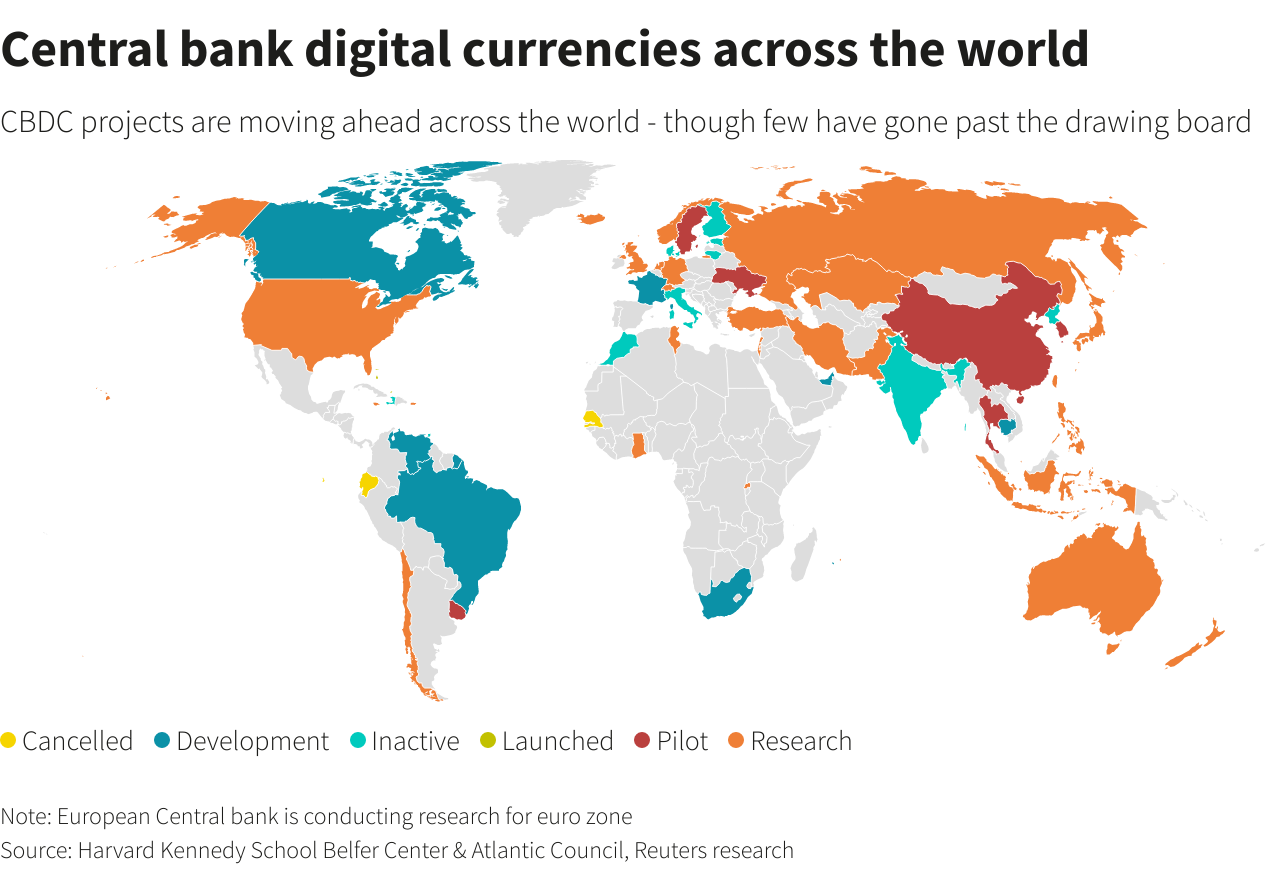

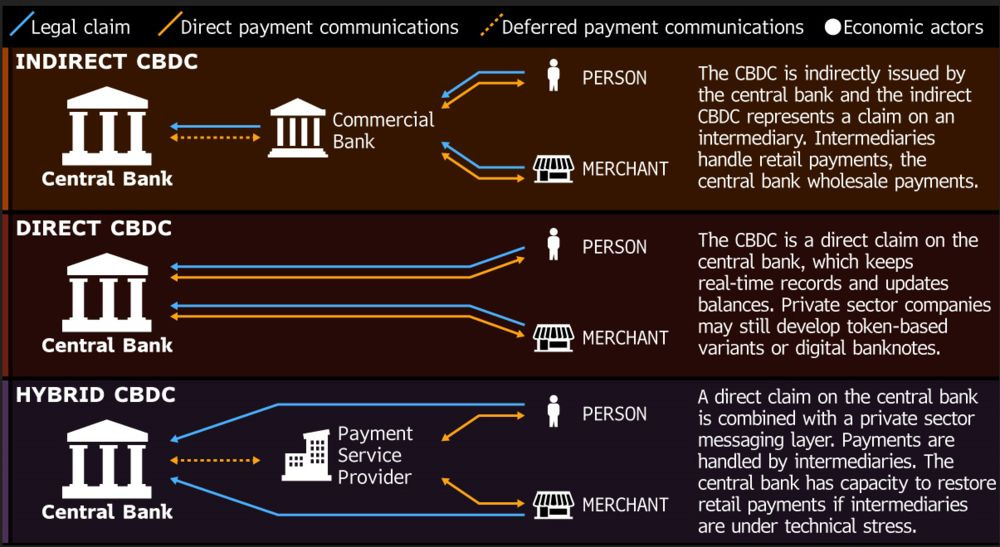

People are interested in CBDCs again

The buzz around a digital dollar is increasing

Jerome Powell said Monday that the Fed is actively exploring the launch of a fully digital dollar and would move to adopt such an offering only with the support of the nation’s elected leaders. “We have an obligation to be on the cutting edge of understanding the technological challenges as well as potential the costs and benefits” of a digital dollar, Powell said “We don’t need to rush this project.”

Wall Street, meanwhile, is not thrilled according to Bloomberg. “Seeing the threat to their profits, the banks’ main trade group has told Congress a digital dollar isn’t needed, while payment companies like Visa Inc. and Mastercard Inc. are trying to work with central banks to make sure the new currencies can be used on their networks.”

As soon as July, officials at the Boston Fed and MIT, which have been developing prototypes for a digital dollar platform, plan to unveil their research.

Is China getting closer to a CBDC? A lot of signal this week.

On Saturday, Mu Changchun, the director-general of the PBOC’s digital currency institute, clarified how the digital yuan achieves privacy and “controllable anonymity.” The Chinese CBDC has four wallet types with increasing transaction limits allowed. The anonymous version allows a maximum of 500 yuan ($77) per payment, a daily limit of 1,000 yuan ($154) and 10,000 yuan ($1536) per month. Although no KYC is required for these wallets, they are ultimately tied to bank accounts that are linked to identity and hence not anonymous.

Speaking at a BIS seminar today, Changchun also said that retail-focused central bank digital cash could provide a key backup for widely-used Chinese mobile payment methods such as Alipay and Tencent. These firms have become key financial infrastructure for the country. Any future digital yuan would exist alongside – and not replace – such payment methods, and cash.

At the same seminar, China also proposed a set of global rules for CBDCs on Thursday, from how they can be used around the world to highly sensitive issues such as monitoring and information sharing.

China also vowed today to quicken pilot programs to develop its digital yuan, as it seeks to boost consumption to shore up economic growth. China will roll out more pilot schemes and choose cities with vibrant new forms of consumption, with an aim of promoting financial operating efficiency and lowering financial transaction costs.

CBDC weekend reading

- BIS Paper: multi-CBDC arrangements and the future of cross-border payments.

- Here’s How CBDC Could Work (Bloomberg).

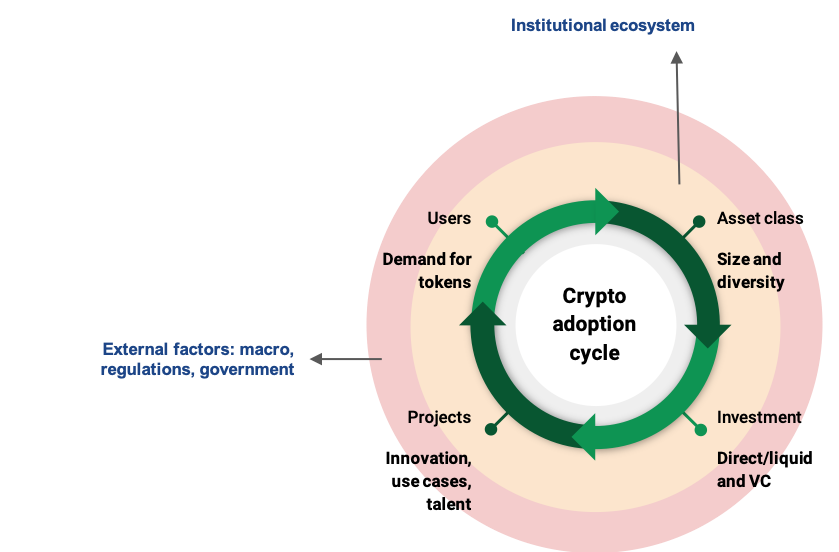

The Crypto Adoption Cycle

Crypto as an asset class has been growing rapidly in the last 12 months, both in terms of size and diversity. Adoption by dApp users, investors, developers, miners, validators, and other stakeholders is at the center of this growth. I see it as a flywheel. At the center of it is the adoption cycle, driven by four forces. Then there is the institutional ecosystem built around it that enables the cycle. Finally there are external factors/forces that influence the cycle, for better or worse. Let me explain.

Crypto adoption cycle

- A larger and more diverse asset class attracts more institutional money.

- This institutional money is invested in VCs and hedge funds who invest the money either in projects directly (equity) or into liquid tokens.

- This gives existing and new projects money to invest in innovation, UX improvement, talent (increasingly superstars from big tech, TradFi, and other large corporates). Innovation here includes new use cases, scaling solutions, bootstrapping mechanisms, etc.

- In turn, this attracts new users and demand for the projects’ existing and new tokens.

- Which drives asset class growth and diversity, diversity meaning more quality tokens with a decent market cap.

- Go back to start… 🎬

Institutional ecosystem

The institutional ecosystem enables this cycle and positively influences it. This includes the infrastructure that has been built: markets, (prime) brokerage services, custody and wallet technology, payment rails, trading technology, market data solutions, investment products, and so on. It also includes factors that strengthen this ecosystem like investment, M&A and IPOs, talent flowing in from traditional sectors.

External factors

Finally there are external factors that influence the cryptoeconomy. These include macro factors like inflation and quantitative easing, regulation, and government initiatives like digital fiat currencies.

Why does all of this matter?

It matters because it helps in understanding (1) where we are at in this cycle and (2) that growth becomes visible in stages. Markets don’t go up all the time, but that doesn’t mean that no progress is being made. On the contrary, a lot is happening behind the scenes. Things that make the cryptoeconomy and the asset class stronger and more resilient.

Which leads me to the next…

How are blockchain-powered financial markets developing?

I am using a broad term here on purpose because so many things are happening across many different verticals. The essence of it is, many good things are happening, things are slowly coming together, blockchain and crypto are infiltrating into the broader financial system, the pipes are being built, improvements are being made. You get the point.

Here is an overview of things I noted just in the past week.

Crypto Credit Market Breakdown

This post by Peter Johnson of Jump Capital is a must read. It describes why the crypto credit market offers high interest rates which are drawing in billions of dollars of deposits, who the major players are, and how Jump expects the market to evolve over time.

Jump is a long term crypto credit market bull. The market is still in its infancy and has a lot of room to grow. However, more importantly, the crypto credit market has structural advantages over the traditional credit market:

- The crypto credit market is extremely flat

- Crypto is nearly perfect collateral

- In the crypto credit market, anyone can hold, earn interest on, and borrow US dollars.

“The largest segments of expansion in the crypto credit market will come from non-crypto companies and individuals who have borrowing needs and may not even know that crypto is being used on the back-end to meet these needs.”

What happens in the back-end? DeFi!

Off-Exchange Settlement

Bitfinex said Tuesday it has integrated Copper’s “ClearLoop” digital asset settlement and clearing network, which removes the need for institutional customers to move digital tokens from a secure cold wallet into an exchange’s hot wallet.

Trading on crypto exchanges remains a very capital intensive activity because of the pre-funding requirement and fragmented liquidity profile. In absence of well-capitalized prime brokers in the crypto markets, there are a number of firms looking to address this problem using technology. Copper is one of them.

ClearLoop connects custodians and exchanges in one secure trading loop, with real time settlement across the network. Funds delegate assets in custody to exchanges in the loop. They can then place orders instantly from cold storage with trades getting settled automatically. The result: zero counterparty risk for funds, and higher volume trades for exchanges.

Here’s the catch. This is effectively a walled garden and the tricky part is to get (1) exchanges to commit to park assets with participating custodians, and (2) a critical mass of exchanges (because of the fragmented liquidity) and custodians to commit. So far, Deribit is the only other major exchange in the network.

Singapore is making progress in the securities market

A few developments in the tokenized securities market in Singapore this week. Baby steps but interesting to keep on your radar. It feels Asia is further advanced here than the US and Europe, presumably because of a more accommodative regulatory environment. Singapore in particular aspires to be a FinTech innovation hub.

- iStox tokenized private equity bonds issued by a subsidiary of state-backed Temasek. The bonds are backed by the cash flows of a diversified portfolio of private equity funds. iSTOX is a MAS-licensed integrated issuance, custody and trading platform for digitized securities. Sovereign wealth fund Temasek is also one of its investors.

- BondEvalue announced that Citi Securities Services is becoming a custodian for BondEvalue’s bond exchange BondbloX. Northern Trust is already a custodian. The firm’s aim is to fractionalize bonds, making them more accessible to so-called HENRYs, high earners not rich yet. BondEvalue takes existing issues that are invariably high denomination, custodies them with Citi or Northern Trust, and then issues a fractional token, often as little as $1,000. The tokens are tradeable and offer instant settlement, removing counterparty risk.

KPMG: Adoption of cryptoassets will transform banking

“Cryptoasset adoption is moving from the fringes of finance to the largest and most venerable trade centers in the world. Banks cannot afford to miss the moment.”

KPMG wrote a 20-page report. If you know crypto, this summary will do 😉

Three promising areas of crypto innovation that stand out for profit potential (hold your breath): prime brokerage services (custody is a logical first move for banks); yield generation via lending, borrowing, and staking; payments.

Banking blueprint for the crypto world. To meet the needs of cryptoasset owners, especially at the institutional level, bank operations need to evolve: seamless customer’s experience, modernized custody models, reporting and auditing capabilities, integrating blockchain with internal data, next-level cybersecurity, industry standard risk management and controls, robust regulatory compliance.

Considerations for bank infrastructure transformation: determine where to play, build or buy technology (crypto firms take notice!), monitor the regulatory environment, stress scalability.

“The crypto industry is moving incredibly quickly in terms of market growth and diversity of product offerings. If the current pace continues, massive change is coming to the banking sector, and skyrocketing value will be there for the taking.”

Ongoing improvements in DeFi, as well as challenges

- Uniswap Unveils Version 3 in Bid to Stay DeFi’s Top Dog .

- Decentralized Exchange SushiSwap Faces an $880M Dilemma.

Momentum Tracker

- Crypto hedge funds gained 35% in Feb after 200% increase in 2020: EurekaHedge

- FTX Inks $135M Sponsorship Deal for Miami Heat Arena.

- SkyBridge Capital files for bitcoin ETF .

- Fidelity Files for Bitcoin ETF With SEC.

- Cboe CEO Expects to Build Out Crypto Offerings as Demand Rises.

- IBM Ventures Further Into Crypto Custody With METACO, Deutsche Bank Tie-Ups.

Some see trouble on the horizon

- New crypto regulations could initially prove ‘brutal’ for BTC: Amundi.

- Ray Dalio sees ‘good probability’ bitcoin gets outlawed.

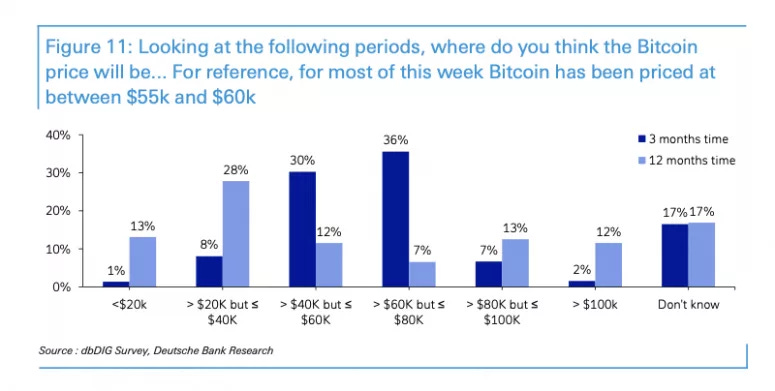

- Deutsche Bank Says 52% of Its Investors Expect Bitcoin Below $60K in 12 Months.

Fund raising, flows, and listing activity

- Blockchain.com raises $300M at $5.2B valuation, raised $120M mid-Feb.

- Soros fund backs Lukka‘s $53M Series D at ~$200M valuation.

- StarkWare raises $75M in Series B led by Paradigm.

- Record $57B AUM in crypto investment products but appetite remains subdued.

- Bitcoin mining firm Greenidge plans to merge with Nasdaq-listed Support.com.

- Robinhood Filed Confidentially for Nasdaq IPO, end Q2 timing.

- Coinbase says it opted against an STO given technological and regulatory constraints. Coinbase’s Listing Pushed Back to April. Coinbase pays $6.5M to settle U.S. false reporting charges. Coinbase Users Say Crypto Start-Up Ignored Their Pleas for Help.

The week in charts

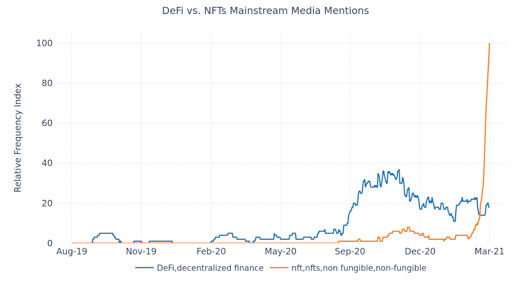

Mentions of NFTs exploding

According to The Tie “Mentions of non-fungible tokens have been absolutely exploding in the mainstream media since the beginning of the year. Despite DeFi being a hot topic that’s outpacing the rest of the industry, NFTs have completely taken over media headlines.”

An increasing sense of optimism amongst Bitcoiners

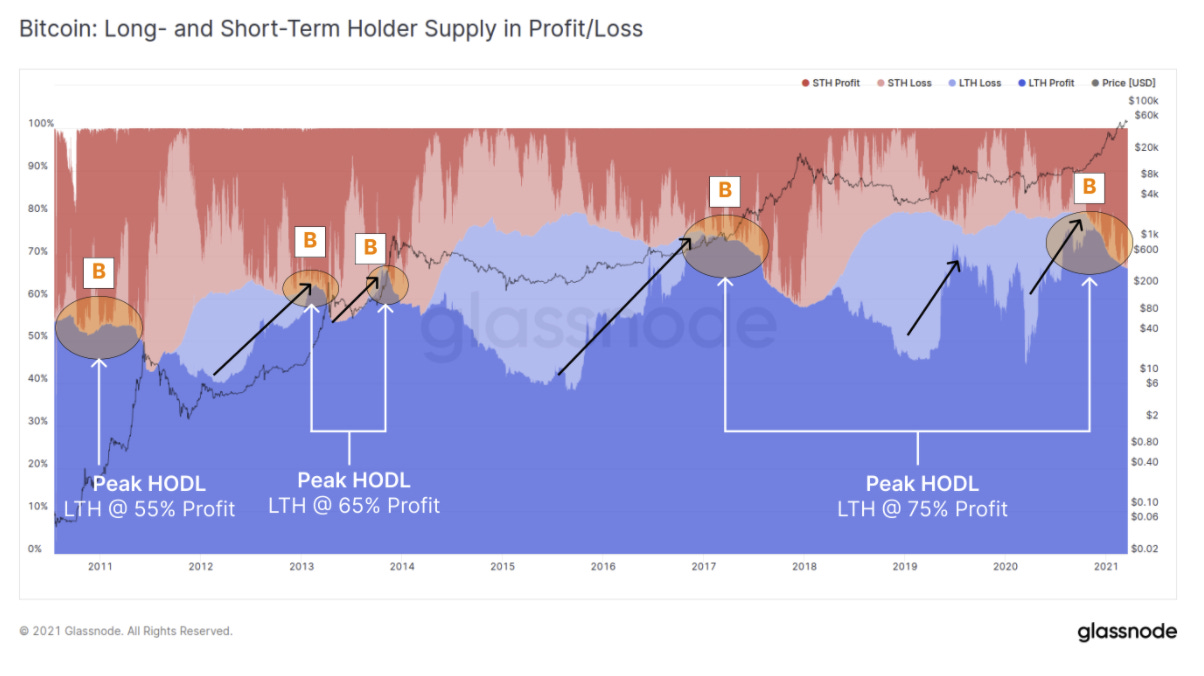

Bitcoiners are holding, which suggests an increasing sense of optimism in their positions. According to Glassnode, we have just passed a period where long-term holders (LTH) enjoyed maximum returns on Bitcoin. With each new cycle, Glassnode observes, we have seen more supply get locked up by LTHs. This is “a reflection of both market strength, improved conviction, maturation of the asset class, available tools to access liquidity, and of course, exponential price increases and wealth generation.” Via Exponential View

Tether market cap surpasses $40B, growing 10x over 12 months

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.