In this week’s issue:

- What’s going on in crypto lending?

- Blockchain and global warming

- More signs of growth

- Who else is turning to bitcoin?

Top story

China Construction Bank (CCB) to raise up to $3B from an offshore blockchain-based bond. The tokens will be listed on Fusang Exchange and can be bought by retail investors globally for as little as $100. Proceeds are to be deposited at CCB Malaysia, the issuing branch. The security rolls over every three months and pays Libor + 50bps. The exchange accepts bitcoin as a form of payment. Fusang’s CEO said the bond is essentially like a three-month fixed deposit product that pays holders more than most USD bank-deposit rates.

This is a big deal. CCB is a state-owned enterprise (SOE). While the Chinese government is committed to market-oriented reforms, it continues to hold absolute control over final decision making of SOEs and SOEs are frequently utilized as a mechanism for implementing policy. IMO this is another sign that China’s CBDC is imminent and that China has big plans for it — as discussed last week on the back of the state-forced postponement of the Ant Group IPO.

Trend Follower: Connecting the Dots

What’s going on in crypto lending?

I remember in 2018 when crypto lending first became a thing and it was hard to get hold of borrow, it was expensive too, and collateralization levels were high. Fast forward and crypto lending is one of the hottest and fastest growing segments in the ecosystem. Many people are wondering about rates that sometimes seem too good to be true and whether there is too much risk in the system. Crypto lender Cred filed for bankruptcy this week, heating up the debate.

I watched the recording of a recent The Block webinar where Matt Ballensweig of Genesis explained market dynamics (28m50s to 32m:00s in the video). In a nutshell: a still inefficient crypto market structure offers opportunities for structural arbitrage. Take the discrepancy between spot and futures markets, futures prices trading far above spot prices on the back of speculative retail demand. Trading firms can borrow cash to buy spot and sell futures against it to capture the premium. Implied return rates can be anywhere between 12 and 20% or more. For these firms it makes sense to borrow at 8%. Given that there are not enough traditional players in the market yet, arbitrage opportunities persist. Firms like Genesis make risk-adjusted bets on trading firms deploying this capital.

Nic Carter offers a different perspective comparing crypto lending and associated risks to bank lending in “The Case for Bitcoin Banking (Despite Cred’s Bankruptcy)”. Nick argues that lending practices and failures are not unique to crypto. There will probably be more hick-ups, and consumers should do their diligence. Over time the industry will learn and adopt best practices around transparency, depository assurances, and reserve ratios. Net-net a bitcoin-based financial system has merit. Worth a read.

Summary take: risk management is key and consumers should do their diligence. There will likely be more failures like Cred but that is not unique to crypto. I am sure regulators have taken note too, for better or for worse.

Lending in the news in recent weeks:

- Crypto lender Cred files for bankruptcy after apparently suffering significant losses in its loan portfolio. Executives are accusing each other of wrongdoing in court filings. In its Chapter 11 bankruptcy filing, the firm’s lists assets of $50-$100M and liabilities of $100-$500M. Sounds messy.

- Celsius Doubles its Crypto Holdings in Six Months to Surpass $2.2B in AUM. Celsius attributes its exponential growth to its community-centric model providing up to 80% of its total revenue back to its customers. Customers can earn rewards on their crypto at rates up to 15% APY paid out weekly. Co-founder/ COO Daniel Leon spoke to Globes. “Confident Celsius Network takes aim at the banks” gives the rundown.

- Nexo Doubled Earn on Crypto Interest Rates, offering yields of up to 8% APY for crypto and 12% APY for fiat and stablecoins.

- BlockFi is planning retail launches in Switzerland, the Netherlands, and Italy in Q1 2021. These countries have regulatory certainty, are more pro-crypto, and are stable regulatory environments too, according to BlockFi’s Europe VP. In the UK the firm remains focused on institutions only for now.

Blockchain and global warming

As of last Wednesday, the US is officially out of the Paris Agreement global climate accord. It is currently not on track to meet its Obama-era greenhouse gas emissions goal. According to the NYT, “while emissions probably won’t rise, they also won’t fall fast enough to avert the worst effects of climate change”. I have been thinking about how blockchain technology can play a role in reducing global warming. Below are a few recent stories.

- How blockchain can reduce global warming via carbon credit investments. Blockchain technology could help SMEs engaged in carbon emissions trading by providing investors easier access to tokenized funds, improving the liquidity of assets through the use of those tokens and increasing the transparency in investment processes. This is the focus of Sonic Capital, a tokenized VC launched in Asia this week.

- Crypto mining is now drawing in the world’s top renewables producers. New venture Bit+ will focus on creating facilities that support crypto mining with a low carbon footprint.

- Climate startup Nori raised $4m to solve carbon market double-spending, a problem in the carbon offset-market. Nori is building a blockchain-based market for carbon credits that will start by paying farmers to remove CO2 from the atmosphere.

- The California Energy Commission is funding an experimental market for carbon-credit trading on a public blockchain. Participating businesses that cut their carbon footprint by powering electric van sharing can earn digital tokens. These “credits” can then be used to pay for electricity consumption, rides and services in the future. The project aims to digitize carbon credit reporting making it easier to hold credits and trade them.

More signs of growth

- Square reports over $1B in quarterly bitcoin revenue for first time: Q3 earnings.

Square Cash #Bitcoin sales going 📈.

— Ryan Watkins (@RyanWatkins_) November 5, 2020

$1.6 billion in Q3'2020. Up 86% from Q2'2020 and 1,002% over the past year.

Square is blazing the trail for large scale financial institutions offering cryptocurrency products. pic.twitter.com/RoRPm8fQQF

- Voyager Digital announces AUM has grown 20X YTD, surpassing $100M.

- Record weekly inflows into crypto investment products of $255M, for a total inflow over the last 4 weeks of over US$720M. CoinShares started reporting weekly on investment inflows and outflows in popular ETPs, mutual funds, and OTC trusts referencing bitcoin, ether and other digital assets. In the traditional space fund flows are an important metric gauging public sentiment towards markets and asset classes.

New converts and believers: who else is turning to bitcoin?

- Legendary investor Bill Miller told CNBC on Friday that bitcoin’s staying power gets “better every day” and the risks of the currency going to zero are “lower than they’ve ever been before.” “The bitcoin story is very easy, it’s supply and demand.”

- Billionaire investor Stanley Druckenmiller told CNBC he owns bitcoin. His gold position is “many, many more times” larger than his bitcoin allocation but Druckenmiller predicted his bitcoin would outperform because of its relative illiquidity and beta.

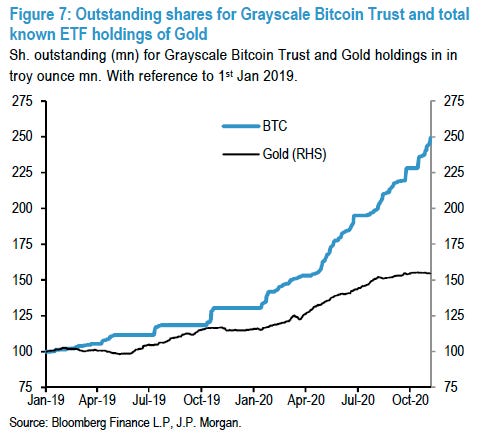

- Family offices may now see bitcoin as an alternative to gold: JPMorgan. Analysts argue that increased flows into Grayscale’s BTC Trust suggest demand from institutional investors like family offices and asset managers. They highlight the contrast with the flattening flow trajectory of gold ETFs, concluding there may be a rotation going on here.

- Meanwhile, Ray Dalio, dealt bitcoin another punch. “I don’t think digital currencies will succeed in the way people hope they would,” Dalio told Yahoo Finance. He also predicted that governments will “outlaw” bitcoin and “other cryptos” if they become material. “They’ll use whatever teeth they have to enforce that.”

CBDC Highlights

- Bank of Russia-led “Central Bank Governor’s Club” discusses CBDCs. Governors of 26 central banks met in Russia to discuss the pandemic and its financial ramifications. The group identified the coronavirus pandemic is a driving force behind growing interest in national digital currencies.

- Norway sees no acute need for CBDC, only 4% of country uses cash. Cash usage has declined in Norway since COVID-19. Physical currency carries strengths that CBDCs may lack.

- Lebanon to introduce CBDC in 2021 to restore confidence in the banking sector and transition into a cashless system. “Lebanon doesn’t have any natural resources and we have to keep the gold because it is an asset that could be liquidated in foreign markets if we face an inevitable, fateful crisis,” Governor Salameh said.

- Brazil’s economy minister confirms its plans to issue a CBDC. It will be part of the scope of “Pix”, a new federal digital payment system. The president of the central bank had previously declared that a CBDC will go into circulation as early as 2022.

- Central bank experiments with CBDC will drive securities onto blockchain, according to Euromoney (speaking to SocGen-Forge). The potential benefit is that CBDC driven DVP might enable real-time settlement of securities that could then immediately be repo’d to achieve greater access to liquidity. Interoperability is key as “you are unlikely to see the cash and the security both moving on the same blockchain, even if they are both built on Ethereum technology.” Worth a read.

- Deutsche Bank (DB): Central bank digital currency will replace cash in long term. The COVID-19 pandemic has accelerated the “digital cash revolution.” DB calls on national governments and private companies to work on alternatives to credit cards, to remove middleman fees. It also warned slow movers: “If other countries do not catch up, they may find that their companies are forced to adopt the digital currencies and policies of other countries as payment mediums.”

Food for thought picks

Podcasting 2.0: new monetization-tool for podcasters powered by Lightning (short video). Cool use case of blockchain-powered tokens.

Digital Voting Is Coming. Let’s Do It Right. The chaos around the US election sparked debate whether blockchain technology could provide indisputable truth here. Currently there is no way of knowing whether your ballot was counted or declared “fraudulent” and thrown out. The article takes a deep dive.

The Big Picture

Hacking democracy: a look at waning digital freedom in Indonesia. Indonesia was once a bright spot for digital freedom in Southeast Asia. Now activists are being hacked, and authorities are using internet blackouts to curb dissent.

What Biden’s Election Means for the Fed. Biden could reshape the Federal Reserve over the coming years through personnel appointments and fiscal policies, though his administration is unlikely to have any immediate effect on the central bank’s interest-rate policy. Chief among those decisions is selecting the next Fed chair in 2022. Until then, Powell is likely to enjoy a more civil and less antagonistic relationship with Biden than under Trump.

China Clampdown on Big Tech. Beijing on Tuesday unveiled regulations to root out monopolistic practices in the internet industry, seeking to curtail the growing influence of firms like Alibaba and Tencent. This comes a week after new restrictions on the finance sector triggered the suspension of Ant Groups $35B IPO. “The Party is faced with the conflicting desires to empower domestic tech companies to be internationally competitive, while keeping their market activities firmly under control at home.”

Quote of the week

They don't call it a 'hard-earned dollar' for nothing. I want sound money that protects the value of every working American's time, sweat and effort. That's why I am excited about #bitcoinhttps://t.co/hGOgOQEyts

— Cynthia Lummis (@CynthiaMLummis) November 10, 2020