Encouraging signals from banks and other institutions this week as bitcoin retreated from its all time highs. There is so much happening all at once, it is almost hard to keep up. Here is a run down of the most important developments this week.

In this issue:

- Wall Street is coming to crypto

- Momentum tracker

- Tokens as a digital value container for an increasingly digital world

- Is renewable energy becoming a theme in crypto?

And: regulatory developments and concerns, CBDC highlights, other interesting stories, food for thought top picks, and the big picture.

Top Story

Hot off the press: State Street invests in crypto software firm Lukka

State Street and S&P Global participated in a $15M funding round for Lukka, a cryptocurrency software and data provider that’s already working on a global crypto index with S&P. Lukka will use the proceeds to develop its existing institutional-grade software and data products to attract traditional businesses and funds that are adopting crypto assets. State Street said the investment “enables State Street to actively participate in developing industry/regulatory standards for reporting and administration of digital assets.”

Trend Follower: Connecting the Dots

Wall Street is coming to crypto

We discussed banks a few weeks ago when JPMorgan launched Onyx. IMO we are going to see a number of larger banks starting to offer crypto services in 2021. Institutions are entering the space. This means banks are getting calls from clients about trading crypto. In turn, both of these developments put pressure on regulators to give more definitive guidance on crypto. I expect this to happen in the first half of next year. We have already seen signs in recent months that something is brewing there. On the back of that guidance, assuming that it is accommodative, I expect a few more progressive banks that have been looking at this for a while to open up shop. In my mind that means offering some form of custody as well as trading. Regardless of US, UK, and EU regulations, certain banks may start offering services out of more friendly jurisdictions like Singapore, and Switzerland. The below news stories this week are pointing in that direction. I wouldn’t be surprised if some FOMO will be triggered on the back of these developments.

- DBS to launch full-service digital exchange, SGX to take 10% stake. DBS today announced that it set up a members-only digital exchange, enabling institutional investors and accredited investors to tap into a fully integrated tokenization, trading, and custody ecosystem for digital assets. The exchange will offer exchange services between four fiat currencies (SGD, USD, HKD, JPY), and four cryptocurrencies (BTC, ETH, BCH, and XRP). The announcement follows the in-principle approval by MAS. Trading will start as early as next week. This is big news and it will certainly be really interesting to see how volume will develop and what type of institutions the exchange will attract in the near term.

- Standard Chartered and Northern Trust partner to launch institutional crypto custody provider Zodia in London in 2021, subject to FCA approval. As a refresher, Nomura launched Komainu earlier this year with CoinShares and Ledger. BNP Paribas ran a POC with Curv.

- Separately, Coindesk reported that Standard Chartered is planning to launch a crypto trading platform for institutional investors, quoting sources. The plans involve five large OTC desks and four exchanges. Parties involved include LMAX, ErisX, Metaco, and Cobalt. It will also include an Ethereum-based settlement token. The first test trade is scheduled for January. Speaking at Singapore’s FinTech festival on Monday, Standard Chartered CEO Bill Winters said a digital currency announcement is imminent.

- BBVA launches a solution for the trading and custody of bitcoin in Switzerland. At launch in 2021 it will offer bitcoin only, with plans to introduce other digital assets later. Coindesk, quoting sources, reported the development earlier in the week. Apparently, BBVA is working with Metaco and Avaloq to integrate their SILO custody platform. The offering is expected to go live once compliance hurdles are cleared, likely in January. BBVA is Spain’s second largest bank and has been an innovator in the blockchain space. BBVA chose Switzerland because of its regulatory stance, high adoption rates of digital assets, and the array of blockchain companies in the country.

- Coinbase, Genesis and BitGo are all talking to Wall Street‘s biggest banks about crypto custody. In particular, serving as sub-custodians.

- UBS’s new CEO Ralph Hamers sees “almost unlimited potential” for digital assets and tokenization in Switzerland. UBS has been amongst the more quiet banks when it comes down to crypto. It will be interesting to watch any developments. UBS has a large private bank where customers must have expressed interest in crypto. Banks like UBS have benefited from cross-selling between their private and public banks. It appears to me that trailing too far behind progressive banks that can offer the same could be a risky strategy.

Momentum tracker

- Crypto fund inflows hit second highest on record, assets managed surge per CoinShares. Institutional investors pumped $429M into crypto funds and products for the week ended Dec 7 pushing the sector’s AUM to an all-time peak of $15B. In the same category, Bitwise’s Crypto Index Fund became available to US investors. Shares of the fund will be tradable through traditional brokerage accounts. In Canada, 3iQ launched a public offering for a new listed Ether fund which is pricing today.

- Boerse Stuttgart’s Bison Crypto Trading App processed €1B Volume in 2020. This can be compared to US retail investors buying and selling crypto through Square’s Cash App or Paypal. As of the end of 3Q20, Square had done $2.8B in crypto volume.

- SDX and SBI plan to create a Singapore-based digital asset exchange that will launch by 2022, subject to approval by MAS. The JV will offer fully regulated issuance, exchange and CSD platforms. “The real play is global liquidity. That’s what the institutional market wants. It doesn’t want to trade 9 a.m. to 4 p.m. in its own market then go to the next and the next,” according to Tim Grant of SDX. “We’re trying to disrupt ourselves,” said the CEO of SBI Digital Asset Holdings.

- In an AMA on Tuesday, Ray Dalio softened his stance on bitcoin, saying it has a place in investors’ portfolios. On Oct 27, Dalio had told Barry Ritholtz that cryptocurrencies like bitcoin suffer from three problems — they are hard to transact, they are very volatile, and they are at risk from governments banning them. On Nov 17, he said on Twitter that he “might be missing something about bitcoin” and that he’d love to be corrected.” BTC increased 38% between Oct 27 and Dec 8. 😉

Tokens as a digital value container for an increasingly digital world

Some stories of adoption:

- Spotify is staffing up for Facebook’s Diem, other opportunities and innovation stemming from digital assets and crypto.

- A 17-year-old artist sells digital artwork (NFT) for $21,350. Decrypt notes that demand for NFTs that represent unique digitized items has been on the rise — including their prices. Just recently, a part of a virtual F1 race track was sold for $223,000. Likewise, a rare Batman NFT art raised over $200,000 in mid-October

- Artist Pak becomes the first to earn $1M from blockchain-based art, according to analytics platform CryptoArt.io. Pak’s 269 Ethereum-based artworks have been sold on platforms such as SuperRare, Nifty Gateway, MakersPlace, and Async Art. The artworks were auctioned in the form of non-fungible Ethereum tokens, ensuring their uniqueness.

- Atari Wants Developers to Use Its Brand to Build Blockchain Games. Retro gaming company Atari has partnered with blockchain gaming platform Enjin to encourage developers to build games using its Atari token.

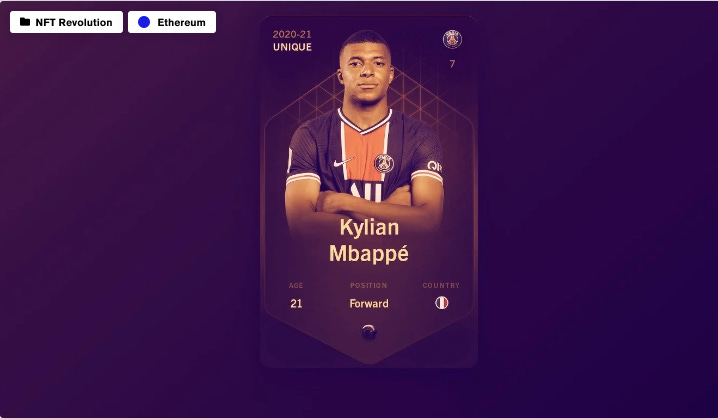

- Kylian Mbappé player card (NFT) sells for $65K on Ethereum-based Sorare. The new owner expects to sell the NFT for twice as much as he bought it for. The NFT-card in question is of “unique” rarity in that only one edition of it exists. Sorare allows football fans to collect and trade digital cards in the form of NFTs in order to compose a “dream team” and pit it against other players. The company has licensed more than 100 soccer clubs including many of the world’s top clubs. I am going to say it again, soccer is the biggest spectator sport in the world. More than half of the world’s population watched the 2018 World Cup. ⚽

Is renewable energy becoming a theme in crypto?

We looked at Sonic Capital, Bit+, Nori and an initiative by the California Energy Commission a few weeks back (TT8). In the news this week:

- Steve Wozniak has launched Efforce, a company that aims to be a marketplace to streamline the process of financing and undertaking energy efficiency projects by enabling them to receive crowd contributions from investors via its token, WOZX.

- Messari wrote a piece “carbon markets for more efficient C02 removal on Ethereum“. Blockchain networks present a unique opportunity to power non-sovereign markets that enable greater transparency and prevent double counting. Nori is one such solution.

- Square announced a Bitcoin Clean Energy Investment Initiative designed to promote clean energy consumption in Bitcoin mining. The company committed $10M and also announced plans to go net zero on carbon by 2030.

Regulatory developments and concerns

- Nine US lawmakers asked the SEC and FINRA to clarify how crypto firms can become registered broker-dealers and provide custody services for crypto assets.

- US lawmakers tell Mnuchin to back off from potential crypto wallet regulations. The Representatives sent a letter to Mnuchin on Wednesday, “expressing our concern” about rumored self-hosted wallet regulations Mnuchin apparently intends to implement in the coming weeks. Circle CEO Jeremy Allaire wrote a letter to the US Treasury.

1/2 Earlier today I sent this letter to the Senior Staff of the US Treasury Department. This is a critical moment for the crypto and digital currency industry. The US govt may be putting a massive transformation at risk. @stevenmnuchin1 @USTreasury https://t.co/fGdv0kgvw2

— Jeremy Allaire (@jerallaire) December 10, 2020

- Waters tells Biden to rescind OCC crypto guidance. US Rep. Maxine Waters, who chairs the powerful House Financial Services Committee, wants Biden to rescind or monitor all of the cryptocurrency-related guidance issued by the OCC.

More momentum behind China’s digital yuan preparations

- Hong Kong progresses cross-border digital yuan work, discussing technical pilot.

- JD.com will become the country’s first virtual mall to use digital yuan. The pilot program with China’s 2nd biggest online retailer will launch this month. About 100,000 digital cash vouchers, worth ~$3M will be issued to residents of Suzhou city on Dec 11.

Other interesting news

- MicroStrategy raised $550M in a convertible bond offering. The proceeds will be invested in Bitcoin “pending the identification of working capital needs.” There is a $100M greenshoe that may be exercised on top of that. Citi downgraded the stock to a Sell on a ‘disproportionate’ bitcoin focus. I understand Citi’s view as from an equity investor’s standpoint it may change the risk profile of the stock. I am not surprised though that the deal got done and even upsized. Convertible bond investors care a lot less about use of proceeds than equity investors (I was a convertible bond banker in a former life). They are more focused on the technical aspects of the deal. Convertible bond primary markets are red hot too, which means that investors care even less. The deal launched after the company reported in an SEC filing it bought another $50M in BTC at an average price of $19,427. RenTec has emerged as the third-biggest buyer of MicroStrategy’s stock since the summer. In a regulatory filing in March, the firm said its Medallion Fund is permitted to enter into bitcoin futures transactions on CME.

- Is tokenized stock trading becoming a thing? Bittrex Global becomes second crypto exchange after FTX to launch 24/7 tokenized stock trading. Users can now purchase fractions of stock with USD, USDT or BTC. Like FTX, Bittrex partnered with Digital Assets AG.

- Emerging crypto prime brokers are adding services. BitGo launched a capital introduction service this week and Fidelity Digital is partnering with BlockFi for a lending service. NYDIG announced a hire to start selling a white-label offering to banks.

Food for thought top picks

Will CBDCs break the banking system?

The Economist argues that CBDCs might drain commercial banks of the deposits with which they fund their lending today. This may offer an opportunity to rethink the financial system from the ground up. If bank credit must be kept flowing, governments could subsidize it directly — making explicit what today’s architecture obscures. Better that than suppressing useful technological innovations. The real risk of CBDCs to the financial system may be that they eventually precipitate a new kind of run: on the idea that banks need to exist at all.

Elsewhere, Bank of America analysts drew a similar conclusion. They warned that a digital Euro could be bad news for the region’s banking industry if there is mass public acceptance as it would reduce the need for third parties. The OCC’s Brian Brooks, CoinShares’ Danny Masters, and Deutsche Bank made similar remarks recently.

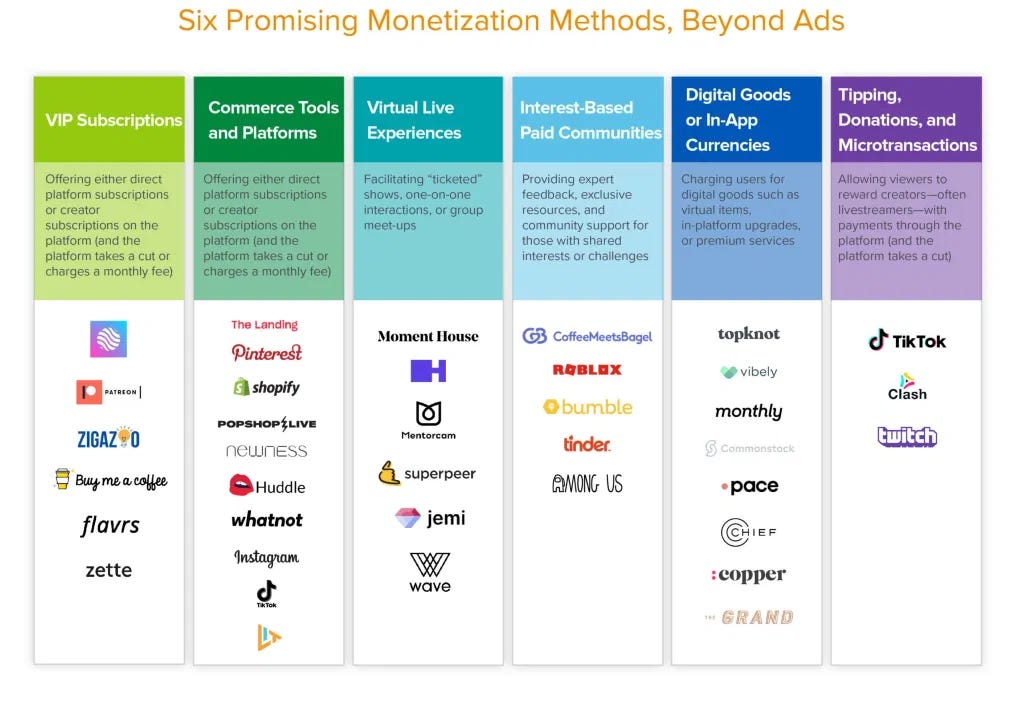

Six Ways New Social Companies Will Monetize

Andreessen Horowitz did an interesting feature “Social Strikes Back.” “Six Ways New Social Companies Will Monetize” is part of it. See the table below. I can see tokens and/or digital currencies play a role in most of these as more consumers, in particular a younger generation, onboard into the crypto ecosystem. China seems to be ahead in terms of creativity around virtual experiences. Food for thought!

The Big Picture

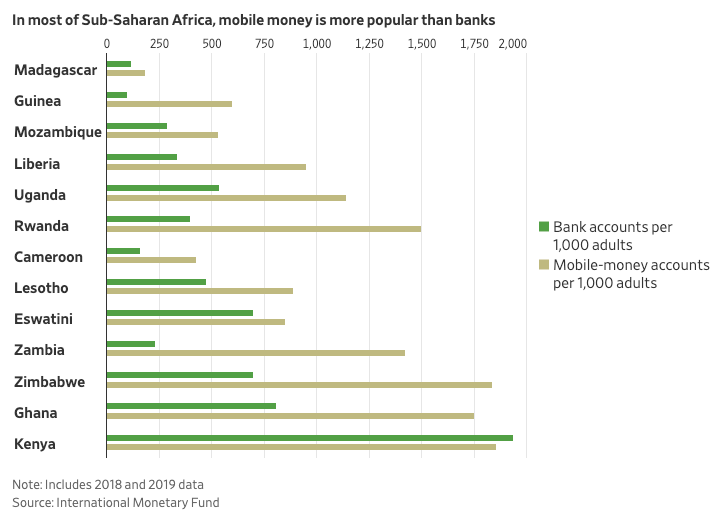

The coronavirus pandemic has supercharged growth of mobile money — and credit — on the African continent.

Companies have raised more capital in 2020 than ever before. At the start of Covid investors panicked as the thinking went public markets would freeze. Nothing could be further from the truth. “In a world of near-zero interest rates, it appears, investors will bankroll just about anyone with a shot at outliving covid-19.”

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.