Athletes including Patrick Mahomes and Cristiano Ronaldo, Elon Musk (you know it’s a hype when…), mainstream media can’t stop talking about it, Damien Hirst, sneakers, Batman, Sotheby’s trying to one-up Christie’s, tulips, Charmin toilet paper (wait, what?!) — the NFT bandwagon continues its momentum. And with it the broader crypto space, lightening up which is otherwise Groundhog Day for all of us corona hermits.

In this issue:

- Top story: Fireblocks announced $133M Series C

- The crypto IPO pipeline is building

- Perspectives on NFTs

- The banks have conflicting views on crypto

- Momentum tracker

- Crypto exchanges continue institutionalization

- Things to keep on your radar

- The week in charts

Top Story: Fireblocks announced $133M Series C

Fireblocks has long been one of my favorite companies in crypto. I first met Fireblocks CEO Michael Shaulov in September 2018 when it was just him in a co-working space in New York City (and an engineering team in Israel). Fast forward 2.5 years and Fireblocks is one of the most successful companies in the crypto space. Their secret? World class security technology addressing a real problem, fast responses to market/client demand, great partners, a talented team led by a great CEO, and excellent execution all around.

All of this was validated in their Series C that included BNY Mellon (BONY). BONY is the world’s largest custodian bank and asset servicing company with $41.1T in assets under custody/admin and $2.2T in AUM. BONY announced in February that it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients.

- The round was led by Coatue, Ribbit, and Stripes with strategic investments from BONY and SVB.

- “Following significant due diligence and market research, we recognize Fireblocks as a market leader in providing secure technology to support digital asset services.” Roman Regelman of BONY said.

- Fireblocks has raised $179M to date. It launched in June 2019 with a $16M Series A investment including Fidelity and it had just closed its $30M Series B in Nov 2020.

- With the completion of this funding round, Fireblocks is setting its sights on a large-scale expansion of resources to help re-platform the financial system to digital assets.

- The company is now well-funded to remain an independent technology partner to top-tier financial institutions to support their transformation and service the market horizontally.

- Fireblocks institutional digital asset transfer and wallet network secured more than $400B in digital assets for its clients.

Finally, if you feel like geeking out on custody on the weekend, here is a white paper “Introducing Direct Custody: Why Financial Institutions Are Choosing To Custody Their Own Digital Assets.”

The crypto IPO pipeline is building

IPO, SPAC, Direct Listing — the buzz around crypto-related companies considering a public listing has been increasing.

Coinbase updated its S-1 this week registering 114.9M shares for its upcoming direct Nasdaq listing. It said recent private market transactions had valued the company at around $68B. According to PitchBook, Coinbase was valued ~$8B during its last round in Oct 2018. Coinbase’s implied valuation eclipses that of NYSE parent ICE, Nasdaq Inc, and LSE, and puts it $4B short of CME Group. Reuters noted that the latest filing signals heightened confidence that the listing will be approved by regulators. In line with the democratization ethos of crypto the exchange hosted an AMA on Reddit on Tuesday.

eToro to list on Nasdaq through SPAC. The firm announced it will merge with the “FinTech Acquisition Corp. V” SPAC for an estimated implied equity value of $10.4B. The SPAC is raising $650M through a PIPE to support the deal. Investors include Softbank, Third Point, Fidelity, and Wellington. The merger is expected to close in Q3. eToro brands itself as a social trading network. Unlike US rival Robinhood, the Israeli firm doesn’t make money through payment-for-order flow (the practice is forbidden in Europe) but primarily pockets a spread. eToro was also one of the first regulated platforms to offer cryptoassets

Kraken considering 2022 listing. Kraken could go public next year via a direct listing, a spokesperson of the cryptocurrency exchange told The Block. For now, the exchange is fully focused on scaling its business. It is reportedly raising new funds and looking for a $20B valuation.

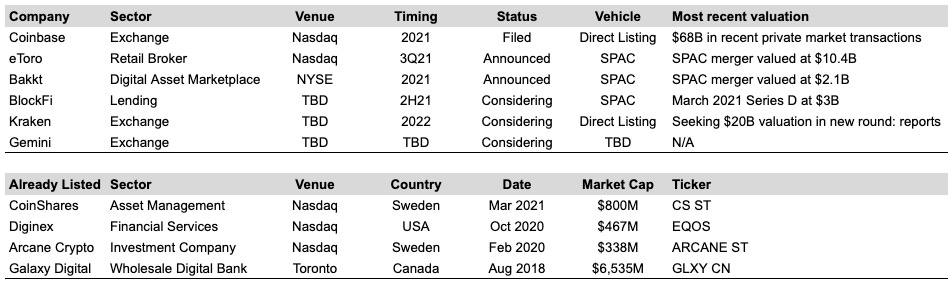

Anyway, I thought I’d start a banker-ish pipeline table including expected transactions and companies already listed. Excluding miners and cheating a little bit on eToro 🤷🏻♀️ I am sure I am missing a few, please drop me a note if you think of any. I should ask Goldman’s analysts but apparently, they are busy 😉

Crypto public listing pipeline and universe (excluding miners)

Perspectives on NFTs

- Beeple’s digital ‘artwork’ sold for more than any painting by Titian or Raphael. But as art, it’s a great big zero. (The Washington Post) No painting by Titian or Raphael has ever fetched as much as “Everydays.” So of course this is big news. But it’s also just one more riotous example of high-roller groupthink, market manipulation and the seemingly unstoppable human urge to commodify everything.

- Why would anyone spend millions on a link to a JPEG file? “Ownership” of crypto art confers no actual rights, other than being able to say that you own the work. You don’t own the copyright, you don’t get a physical print, and anyone can look at the image on the web. There is merely a record in a public database saying that you own the work – really, it says you own the work at a specific URL.

- NFTs are useful, innovative—and frothy (The Economist) Once again, a famous institution is embracing a controversial new genre. Invented a few years ago, NFTs can link not only to digital art but also to text, videos or bits of code. A token brings bragging rights to a unique, authenticated version of a digital artwork, song or cute image of a cat. The bumper Beeple sale, plus the arrival of ever more creators, means a mania that has been largely confined to crypto and techie circles could move mainstream.

- The Memeification of American Capitalism — Common Threads Between GameStop Mania and NFT Mania: the search for belonging and the reclaiming of agency. (Digital Native) Chris Dixon famously said, “The next big thing will start out looking like a toy.” This is meme culture—it’s GameStop and NBA Top Shot and a cat with a cherry poptart body. But meme culture embodies an entire generation that’s coming of age allergic to centralized authorities and gatekeepers. The events of the past three months are harbingers of a huge upheaval of American capitalism that (if successful) will lead to a massive redistribution of concentrated wealth and power.

The banks have conflicting views on crypto

The big banks are starting to comment more on crypto as an asset class, be it through executives in their investment banking and wealth management arms or their research analysts. They don’t all agree with each other though. Take just these last couple of days.

- Citi Private Bank CIO: bitcoin can be a part of the ‘opportunistic side’ of any portfolio. David Bailin said that he believes bitcoin “is going to do well because of the level of interest that’s coming from everyone.” He warned, however, that bitcoin funds and trusts “can be a very, very inefficient way” to invest in the digital currency. Bailin said he was looking at alternative ways to invest in bitcoin for his clients, including total return swaps.

- Morgan Stanley wealth management: ‘Threshold being reached’ on crypto as an investable asset class. “For speculative investment opportunities to rise to the level of an investable asset class that can play a role in diversified investment portfolios requires transformational progress on both the supply and demand sides. With cryptocurrency, we think that threshold is being reached. A firming regulatory framework, deepening liquidity, availability of products and growing investor interest—especially among institutional investors—have coalesced.”

- Deutsche Bank: Bitcoin is now ‘too important to ignore.’ Bitcoin’s market cap of $1 trillion makes it too important to ignore. Big players who buy and sell bitcoins have considerable market-moving power. But bitcoin transactions and tradability are still limited. As an investment asset, Bitcoin liquidity remains low. In 2020, 28M BTC changed hands (150% of total BTC in circulation), compared to 40B Apple shares (270% of its total in circulation). Due to its still limited tradability, Bitcoin is expected to remain ultra-volatile. The root causes of Bitcoin’s volatility include: small tactical asset allocations and the entries and exits of large asset managers. Bitcoin’s value will continue to rise and fall depending on what people believe it is worth — the Tinkerbell Effect. Central banks and governments understand that cryptocurrencies are here to stay, so they are expected to start regulating crypto-assets late this year or early next year

- Bank of America: The Case Against Bitcoin — It’s Dirty, Slow, Volatile and Impractical. ⛈⚡️ We already sensed that BofA wasn’t a fan. In a report “Bitcoin’s Dirty Little Secrets”, analysts said there are no good reasons to own bitcoin “unless you see prices going up”. Those gains, BofA said, were largely driven by institutional buyers announcing big purchases. Just $93M of net inflows triggering a 1% price increase, a level that requires around $1.86B for a corresponding move in gold. It also targeted bitcoin’s environmental impact “A single Bitcoin purchase at a price of ~$50,000 has a carbon footprint of 270 tons, the equivalent of 60 ICE [petrol] cars.” The bank sees DeFi as a radical change to mainstream capital markets but, at $35 billion, has a long way to go compared to mainstream finance.

Momentum Tracker

- JPMorgan is eyeing bitcoin and crypto clearinghouse options.

- Morgan Stanley becomes the first big US bank to offer clients access to bitcoin funds. Two of the funds are run by Galaxy, and the other by NYDIG. In Wall Street (and not very crypto) fashion, access will be limited to wealthy clients with “an aggressive risk tolerance” and at least $2M held by Morgan Stanley.

- As Wall Street is preparing to tip its toes into crypto, native prime brokers are expanding their services. B2C2 announced a push into options trading and lending following its recent acquisition by SBI of Japan. It hired an FX veteran to run the options business which is expected to start trading mid-2021. Its lending platform went live earlier this year.

- Ledger, the brand most people associate with hardware wallets, is doubling down on institutional business with a new unit and an aggressive hiring plan. Ledger Enterprise Solutions will build upon the firm’s institution-focused Ledger Vault which is leveraged by Komainu, the firm’s JV with Nomura and CoinShares.

- Americans Could Spend $40B in Stimulus on Bitcoin, Stocks: Mizuho Survey. This could bode well for the further acceleration of crypto’s user base and adoption in general.

- 🦄 🦄 🦄 The number of crypto unicorns is growing steadily. Austrian neo-broker Bitpanda secures unicorn status with $170M raise.

- Bitcoin Lending Firms See Explosive Growth and Surging Demand. BlockFi ($15B), Celsius Network ($10B) and Nexo ($5B) have hit milestones in AUM. Combined, they now hold $30B. Elsewhere, Jeff Dorman at Arca wrote a great essay on centralized lending businesses and transparency. Worth a read!

Crypto exchanges continue institutionalization

- Binance Probed by CFTC Over Whether US Residents Made Trades, Hires Former US Senator Max Baucus to Help Navigate Regulations, Baucus says Binance Weighs Registering With CFTC.

- Trading on OSL, the first licensed crypto exchange in HKG, has gone live.

- Bakkt Receives BitLicense in New York.

Things to keep on your radar

- Could an ETF be upon us soon? The SEC has 45 days to respond to VanEck’s Bitcoin ETF filing amid change of guard. Seems tight. Crypto-friendly SEC Commissioner Hester Peirce admits the agency’s refusal to approve a bitcoin ETF has dug them into a “little bit of a hole” as “a lot of people are looking for a way to access the asset class.”

- NYDIG CEO Robby Gutmann hinted on the “On the Brink” podcast earlier this week that major firms will announce Bitcoin ‘milestones’ next week. Bring on the magic!

- Pipe dreams of turning recurring revenues into an asset class. Pomp sold the rights to some of the future subscription revenues from his email newsletter. The middleman was Pipe Technologies that connects businesses with investors offering to purchase their future revenues at discounted prices. We talked about them before. The company plans eventually to securitize the revenue streams on offer. I won’t be surprised if crypto will be added to this mix some time soon…

- Crypto is going mainstream. Crypto.com Signs NHL Sponsorship Deal With Montreal Canadiens, FTX in Talks to Sponsor Miami Heat’s NBA Stadium.

- Loyalty use case is gaining further traction: French retail giant Casino will leverage a newly launched stablecoin for use in a loyalty program and payments. Deposits are held by SocGen and PwC is the auditor.

- In a similar spirit, the new Fiat 500 will reward “sustainable” drivers with the KiriCoin in a ‘virtual’ wallet shown in the Fiat app. The coins can be spent in a dedicated marketplace. I love this environmental theme. In my mind crypto is the perfect mechanism to incentivize climate-friendly behavior in consumers. It is also highly relevant given the heightened focus on crypto’s environmental impact.

- Nasdaq-listed Diginex launched its EQUOS Origin (EQO) exchange token and it is not for sale. EQO will reward traders with fee reductions, yield enhancement and can be used as collateral.

- Diversity in crypto is coming! Grayscale adds 5 new trusts: Chainlink, Filecoin, Livepeer, BAT, Decentraland. The offering will allow institutional investors to diversify their crypto exposure through traditional channels. Although it ain’t the real thing, it will increase demand for the underlying tokens. Market size and diversity are key for institutional crypto adoption to continue its momentum.

- We talked about primary markets a while back, and here we go, Nomura is on it: Nomura to expand structured finance in private markets push incl. STOs. Nomura Holdings Inc. plans to build out a newly created “Structured Finance and Solutions group” that will focus on helping both public and private companies raise cash through non-traditional means. Core to the 30-year Nomura veteran’s plans are unlisted securities. The team will look beyond conventional areas of corporate finance to drive growth in new ways. Product the team envisages include security token offerings and securitization of intellectual property rights and other assets that aren’t widely used for fund raisings.

- The tables are turning. NFT Frenzy Buoys Stocks, Lifting Auction Houses and Game Makers. Who would have thought a year ago that crypto would be leading the stock markets today….

The Week in Charts

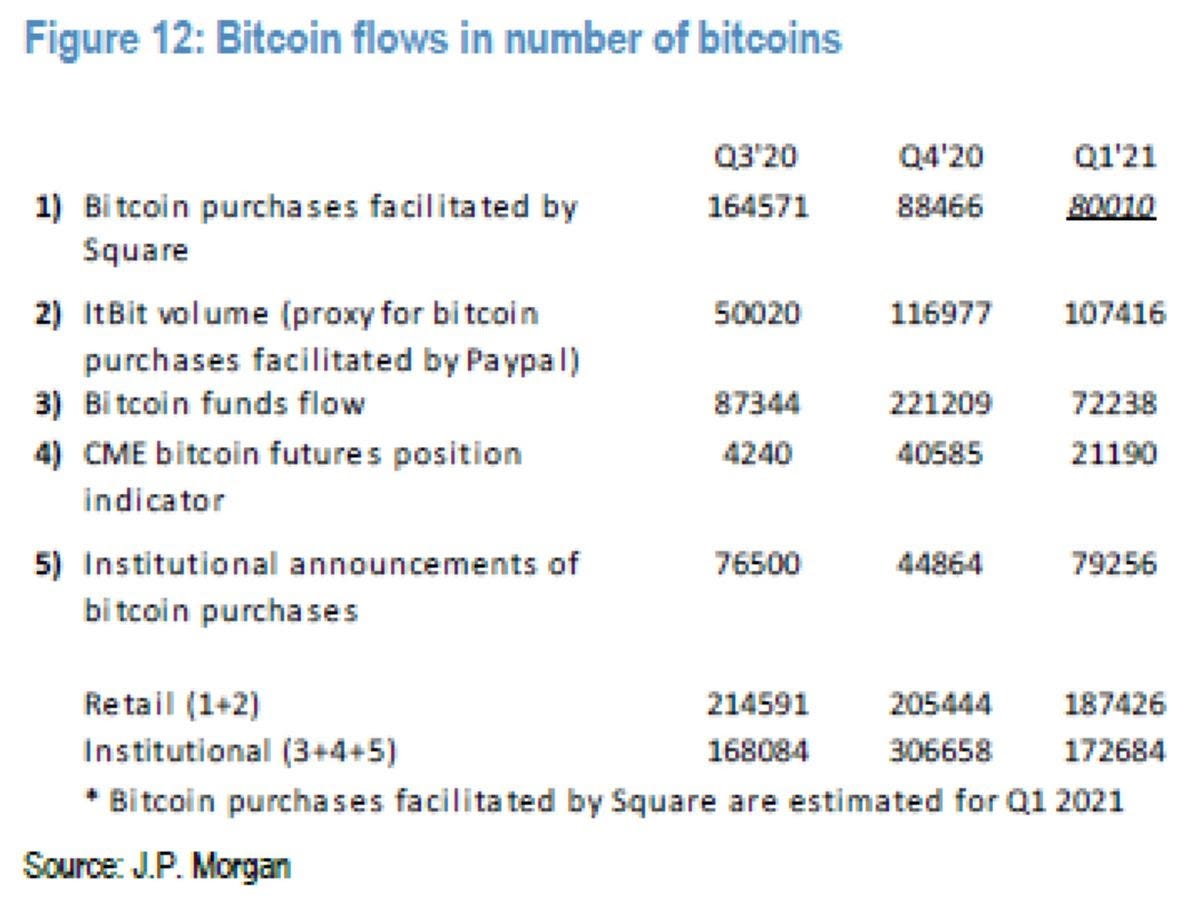

Retail Bitcoin Traders Rival Wall Street Buyers as Mania Builds

Not a bulletproof argument, but JPMorgan notes how retail demand has been building up. As pointed out last week, Paypal’s CEO disagrees that ItBit volumes are a proxy for bitcoin purchases facilitated by Paypal.

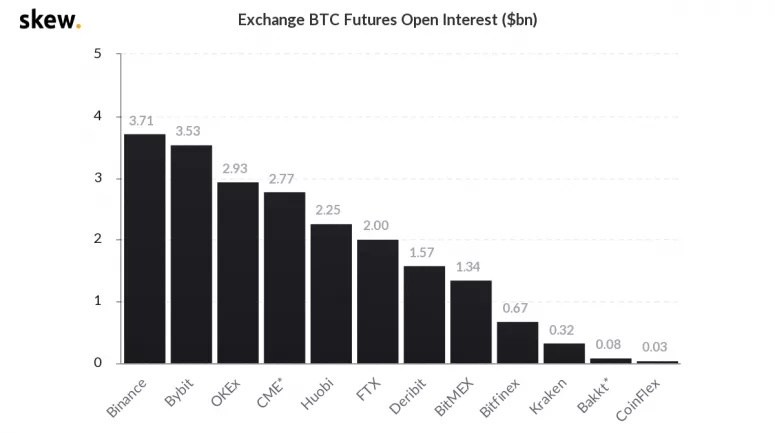

Bybit’s speedy rise to the top

Bybit has quickly become one of the top derivatives exchanges.

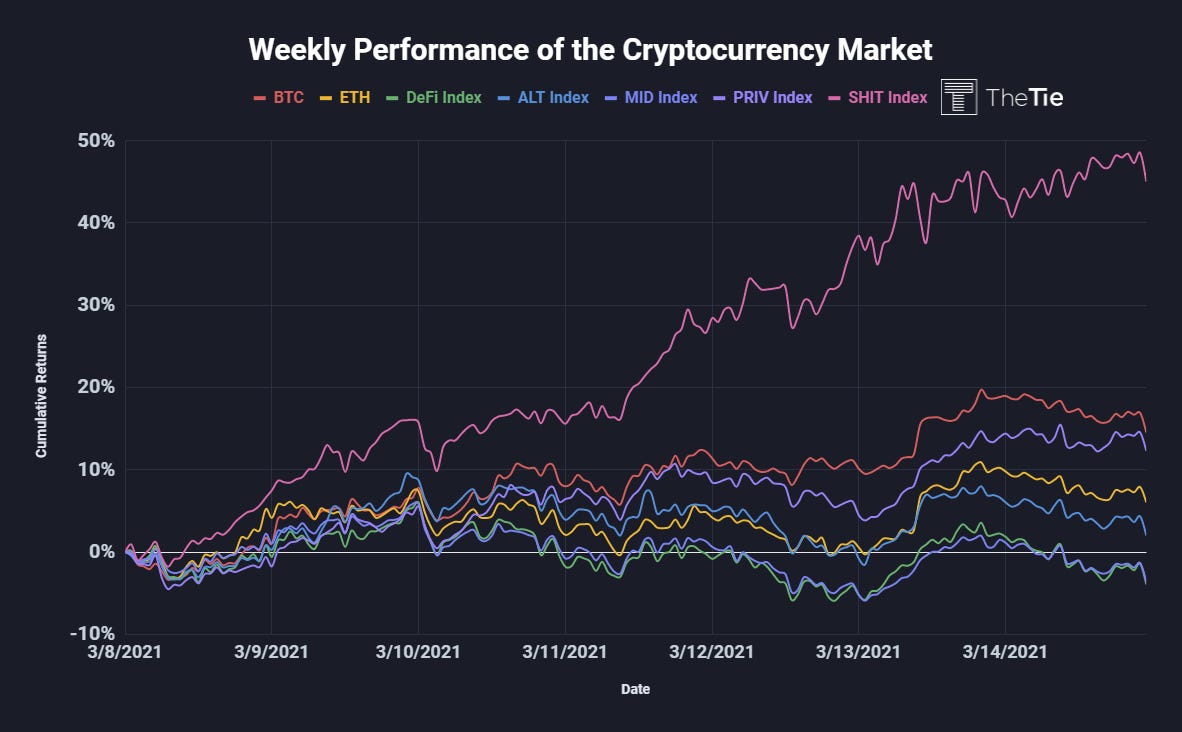

Are we due for a correction?

FTX’ Sh*t Index, made up of 50 lower cap altcoins, outperformed the rest of the market by 30% last week according to data from The Tie.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.