In the 1930s, investor John Templeton said, “The four most dangerous words in investing are: this time it’s different.” At market tops and bottoms, investors tend to use this rationale to justify their emotion-driven decisions. When the term is in widespread use, it is typically a good time to take notice.

As bitcoin is flirting with its Dec 2017 $19,862 all-time high there is lots of “this time it is different”. I have shared my opinion on crypto hitting an inflection point in 2021 in terms of adoption. Asset prices will be a reflection of that as adoption means demand for tokens in the case of crypto. They say that you won’t be able to point out that watershed moment until months after the fact. So time will tell if it is really different this time. It surely feels like a lot of traction has been building up in recent months. This is not investment advice btw! 😁

In this issue:

- Crypto cheerleaders: the list grows as BTC is closing in on all-time highs. Hype, or is it really different this time?

- Crypto trading and capital efficiency

- Exchange outages increase as bitcoin reaches all time-highs

Trend Follower: Connecting the Dots

Crypto cheerleaders: the list is growing as BTC is closing in on all-time highs. Hype, or is it different this time?

- According to Cornerstone Macro strategists, holding 6.4% of crypto in equity portfolios can meaningfully reduce risk.

- A senior analyst at Citi says bitcoin could pass $300K by Dec 2021.

- Nouriel Roubini, professor of economics at NYU and crypto’s fiercest critic, has admitted bitcoin could be a ‘store of value’.

- $9.2B hedge fund SkyBridge Capital says it “may seek exposure to digital assets” in SEC filing.

- $35B+ RIA Mariner Wealth offers bitcoin SMA to clients through Eaglebrook

- Ray Dalio thinks he may be missing something about crypto

I might be missing something about Bitcoin so I’d love to be corrected. My problems with Bitcoin being an effective currency are simple… (1/5)

— Ray Dalio (@RayDalio) November 17, 2020

- Jamie Dimon, however, reiterated that bitcoin is “just not my cup of tea.” He also predicted governments will soon regulate it more stringently.

So, is it different this time?

Nic Carter says IS, highlighting nine bitcoin charts that are already at all-time highs: 1) addresses with a balance of $10 or more; 2) open Interest on CME Bitcoin futures; 3) realized capitalization — an alternative to market cap that ignores the market value of bitcoins that haven’t moved since 2009; 4) bitcoin options open interest; 5) bitcoin priced in Turkish Lira, a highly inflationary currency; 6) bitcoin held by Grayscale; 7) stablecoin free float; 8) Silvergate’s Settlement Network; 9) growth of crypto-native credit.

Legendary investor Mohamed El-Erian notes that “The surge in bitcoins continues today. Prices are nearing all time highs with a notable difference compared to three years ago — a lot less hype.“

Analysis: Another bitcoin bubble? This time it’s different, backers hope. Reuters summarized views from a number of market participants, comparing today to 2017. In a nutshell, market structure has developed significantly since then, which has drawn in institutions, that are leading this rally vs. retail in 2017. Although the article isn’t saying that, I think it goes back to the point that this is a real market now, and the price of bitcoin is reflecting that growth and its potential.

Crypto trading and capital efficiency

Capital efficiency remains a key issue in crypto trading. The problem originates in crypto’s retail roots. By default, retail crypto exchanges require users to pre-fund their accounts. As these retail exchanges are amongst the most liquid in the world, this is something institutions have had to deal with.

This is a problem for a number of different reasons, including:

- Capital sitting on exchanges is not productive and vulnerable to hacks;

- As such, funds try to limit this amount. However, this reduces the ability to instantly trade as it takes time to deposit funds to exchanges, in particular to and from cold storage. In addition, it also takes time to transfer funds between exchanges;

- In the case of algorithmic trading for best execution, the algo’s are limited to the capital available on the selected exchanges which could provide for suboptimal execution.

A number of solutions have emerged in the past 12-18 months. They roughly fall into two camps: wallet technology solutions like Fireblocks, Curv and Copper, and crypto Prime Brokerage.

The former uses MPC-based wallet infrastructure to (amongst other things) provide for secure digital asset transfer between parties. It helps make capital more efficient in significantly speeding up transfer processing times. Prime brokers provide capital efficiency by acting as a custodial counterparty executing on the customer’s behalf and by extending credit. This effectively transfers the exchange funding problem to the prime broker, who has a better way of dealing with it by aggregating capital, and using MPC technology from providers like the ones mentioned above.

Both solutions have gained significant traction this year. More news in the past week:

- Fireblocks raised $30M in Series B funding. The company has facilitated the secure transfer of $150B+ in digital assets for institutions since its June 2019 launch, $23B in the last month. The Fireblocks Network currently has 160+ active institutional participants. The firm will use the proceeds to increase headcount from 70 to 130 in coming months.

- Curv announced new client Solaris Digital Assets, a 100% subsidiary of Solarisbank. In October, Curv announced an engagement with BNP Paribas as well as an investment from top 25 global asset manager Franklin Templeton.

- Galaxy Digital acquired DrawBridge Lending and Blue Fire Capital. DrawBridge provides digital asset lending, borrowing, and structured products. Blue Fire is a proprietary trading firm specialized in market-making. Both acquisitions add strength to Galaxy’s prime brokerage offering announced earlier this year.

Exchange outages increase as bitcoin reaches all-time highs

Is the crypto infrastructure ready to handle much higher volumes?

- Coinbase Goes Down as BTC nears $17K (Nov 16). Coinbase has suffered a number of outages during busy trading periods this year, most recently on Oct 27 and Sep 4.

- Crucial Ethereum Service Infura suffers major outage. (Nov 11)

- Another Robinhood outage, affecting equities, options and crypto trading. (Nov 10)

- Deribit suffered an outage over ‘hardware issues,’ in late August.

Coindesk wrote a good article laying out some of the issues back in Sept. In summary:

- Hardware failure: solution is redundancy systems which most exchanges have built.

- Bugs in new code: these can be triggered at a later time by an unplanned situation such as a surge in trading volumes.

- Furthermore, “there are many examples of software companies having trouble scaling to serve extremely high demand.” Reducing outages caused by sudden traffic increases on exchanges is “doable,” but it will require time and money.

- Without a threat of penalties from regulators if problems aren’t fixed, fundamental improvements are less likely to occur anytime soon.

Food for thought top picks

#1 Jeff Dorman argues that ESPN should issue a membership token. Once the masses are within the crypto ecosystem “the floodgates will open for token issuance from creative and innovative companies”.

Who better to try this than ESPN, whose business model is dying as fans go direct to the source. ESPN is very profitable but customers don’t share in this upside making stickiness low. ESPN should issue a token to younger customers. This token could have limited supply, creating scarcity value and upward price momentum as new customers want to own the token, because ownership of the token could unlock features exclusive to ESPN (premium content, access to players, etc). By pre-selling tokens to customers, ESPN’s revenue and balance sheet would grow (booking prepaid revenue upfront), which would allow ESPN to continue to compete for content and exclusive sports rights.

#2 Software is Eating the Markets. Flush with cash and empowered by new tech platforms that blur the lines between investing, consuming, experiencing, and participating, a segment of retail investors are shifting money from consumption to investment. The article argues this is not a Covid-trend but here to stay which will alter how markets operate in a number of different ways.

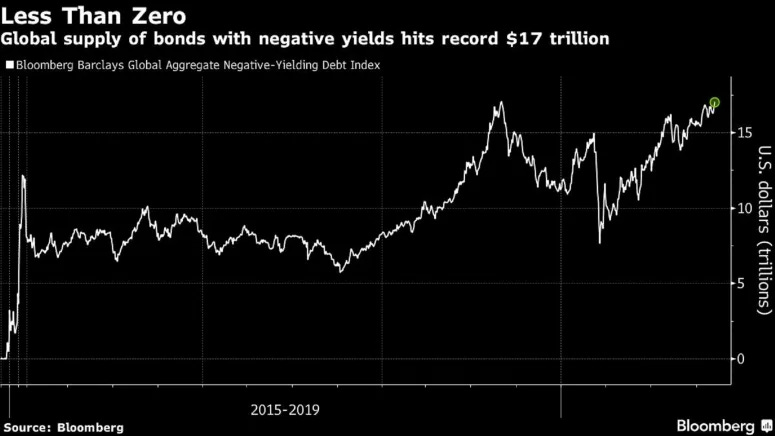

#3 In a speech, Bank of England Chief Economist Andy Haldane said digital currencies could mitigate the need for negative interest rates. “At root, the Zero Lower Bound arises from a technological constraint on the ability to pay or receive interest on physical cash, whether positive or negative,” he said. “In principle, a widely-used digital currency could mitigate, if not eliminate, that technological constraint by enabling interest rates to be levied on retail monetary assets.” (page 10)

The Big Picture

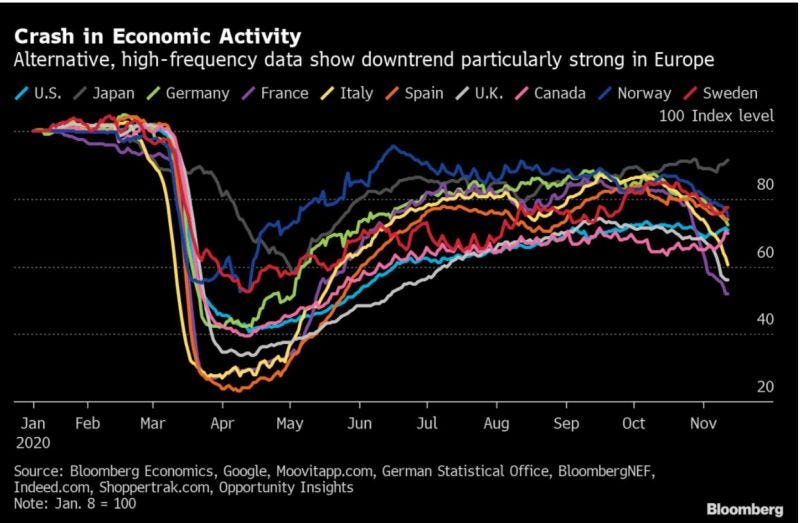

Economic activity dropped steeply amid a stark rise in Covid-19 infections.

Global supply of bonds with negative yields hits record $17T.

Active managers struggle to prove their worth in a turbulent year. Over the past two decades there has been a profound shift of power from active to passive managers. Traditional asset managers have long argued that they would prove their worth in the next downturn. In contrast, the weaknesses of index funds would be revealed, some industry executives predicted. Yet 2020 looks like it will end up as another mediocre year for active management, which may further accelerate its demise.

I have been thinking about the future of active management in the context of crypto. Is there value in active management where tokens make you a user and investor at the same time? And how does the trend of “software is eating markets” (see above) play into this? And then there is the trend of hedge funds going proprietary because it is more profitable, in part because of lower compliance cost. To be analyzed in more detail another time, but food for thought…

Quote of the week

I might be missing something about Bitcoin so I’d love to be corrected. My problems with Bitcoin being an effective currency are simple… (1/5)

— Ray Dalio (@RayDalio) November 17, 2020

Ray’s problems with Bitcoin being an effective currency:

- “Bitcoin Is Not Very Good As A Medium Of Exchange”

- “It’s Not Very Good As A Store-Hold Of Wealth”

- “The Governments Will Outlaw It”

Bitcoin Magazine breaks it down for him.