The Swell is Building

The big weeks are building up… BTC flirted with $14K, JPMorgan has gone live with DLT-based payments infrastructure…on top of PayPal entering the space, corporate treasury investment in BTC, and more. Will it grow into the swell we have been waiting for? It definitely feels like that.

This week “connecting the dots” looks into:

- JPMorgans big lead in digital assets

- What are other banks doing?

- Is a hunt for crypto custody (and other assets) brewing?

Plus: food for through top picks, CBDC highlights, the big picture, and quotes .

Top story

JPMorgan launches JPM Coin, creates new unit “Onyx” for blockchain and digital currency efforts. The unit employs 100+. IIN was rebranded Liink.

- The JPM Coin — a “wholesale stablecoin” — that was announced last year, is being used commercially for the first time this week by a large technology company to send payments around the world.

- The bank’s Interbank Information Network (IIN) was rebranded Liink by J.P. Morgan℠. Liink creates Quorum-based software and services to facilitate cross-border payments. More than 400 banks, corporations, and FinTechs have signed up to join the network. On Wednesday, Liink launched two new apps.

- Takis Georgakopoulos, global head of wholesale payments told CNBC: “We are launching Onyx because we believe we are shifting to a period of commercialization of those technologies, moving from research and development to something that can become a real business.” Umar Farooq was named Onyx’ CEO.

- The bank is also looking into creating new, separate payment rails for central banks that have expressed interest in CBDCs. Farooq referred to Singapore where JPM technology has been used for Project Ubin, a CBDC project.

Trend Follower: Connecting the Dots

JPM Morgan’s Big Lead in Digital Assets

When it comes to blockchain and digital assets, JP Morgan has been leading the charge, publicly launching initiatives since at least 2015. I went through my news archives to provide a summary:

- JPM set up its Blockchain Center of Excellence in 2015. The unit had been leading the bank’s efforts for DLT applications pre-Onyx.

- The firm launched Quorum, an open-source enterprise protocol layer for Ethereum, in 2016. Both Liink and the JPM Coin are powered by Quorum. JPM sold Quorum to ConsenSys in August, announcing a strategic investment at the same time. The sale makes sense in the context of this week’s announcement as it makes it easier for competitors to join the network (owned by a technology firm rather than a rival).

- Launched in 2017, Liink enables the transfer and validation of data for payments, supporting multiple use cases to reduce friction within traditional infrastructure.

- The bank tested its digital securities platform prototype Dromaius for a $150m Yankee CD in April 2018. The platform covers the full debt lifecycle. Umar Farooq projected a vision last year of the JPM Coin allowing bond traders to instantly deliver securities in exchange for cash on Quorum.

- The WSJ reported in May that JPMorgan started banking Coinbase and Gemini.

- JPMorgan’s research department has been actively covering bitcoin. Star quant analyst Nikolaos Panigirtzoglou frequently comments on Bitcoin in his closely followed “Flows and Liquidity” report. His view that “bitcoin may be rising up to tenfold as millennials flow in” was widely reported last week.

What are other banks doing?

This is not meant to be an exhaustive list but what I have picked up on in the public domain over the last 2 years. It confirms JPMorgan’s dominance in the blockchain and digital asset space. Scroll to the next blue line to jump directly to commentary.

Goldman Sachs

Recently relaunched digital asset team, is on a hiring spree, and, according to CNBC, is considering its own stablecoin. Using Axoni for equity swaps. Initial client on CLSNet DLT-based forex netting platform. In a client call earlier this year, GSAM said it does not recommend its clients to invest in bitcoin. The NYT reported plans for a crypto trading desk in 2018.

Morgan Stanley

Initial client on CLSNet DLT-based forex netting platform. In 2018 was rumored to be “technically prepared to offer swaps tracking Bitcoin futures” in 2018.

Citi

Investor in Cobalt, a DLT-based post-trade platform for FX and digital assets. Client of CLSNet and DLT-based forex netting platform and Contour trade finance platform. Using Axoni for equity swaps. Working with SDX. The bank reportedly scrapped a plan for a “Citicoin”. It was also rumored to be developing “digital asset receipts” in 2018.

Bank of America

Has been filing patents here, here, and here. Conducted Ripple pilot. Client of CLSNet.

UBS

Spearheaded the Utility Settlement Coin (USC) initiative which was recently delayed. Deutsche Börse-HQLAX securities lending blockchain. Analysts have been expressing doubt over BTC as a safe-haven asset, and in general haven’t been fans.

Credit Suisse

Working with SDX. Deutsche Börse-HQLAX securities lending blockchain. Part of Fnality/USC. Using Paxos Settlement Service for US listed equities.

Deutsche Bank

Analysts have written about digital assets here, here and here. Client of JPMorgan’s Liink. Uses Cobalt.

Barclays

Was banking to crypto firms including Coinbase but pulled out in 2019. Part of Fnality/USC. The bank sounded out client interest in a crypto trading desk in 2018.

HSBC

On-chain settlement solution was used for S$400m Olam blockchain-based bond, in collaboration with SGX and Temasek. Digital Vault is a custody blockchain platform to digitize the transaction records of private placements. FX Everywhere platform for managing intra-company FX flows. Co-founder of Contour trade finance network. Participant in French wholesale CBDC test.

BNP Paribas

Conducted digital asset custody proof of concept with Curv. Co-founder of Contour trade finance platform. Client of CLSNet DLT-based forex netting platform

SocGen

SocGen-Forge is a subsidiary of SocGen that provides “end-to-end services to issue and manage digital-native financial products registered on the blockchain”. SocGen has issued a number of bonds on the platform. Forge is participating in the French CBDC test. Using the Paxos Settlement Service for U.S. equity transactions

Standard Chartered

Hiring, and building a custody solution. Co-founder and user of Contour trade finance platform. Investor in and client of FX and digital assets post-trade platform Cobalt.

DBS

On Tuesday this week, DBS jumped the gun on the announcement of a Digital Exchange including custody. Client of Contour trade finance platform. Analysts recently wrote a special on digital currencies.

Nomura

In June launched digital asset custodian Komainu with partners Ledger and CoinShares. Subsidiary Instinet using Paxos Settlement Service for US listed equities. BOOSTRY JV for ibet open-source token issuance platform. Nomura Research Institute (NRI): price estimates for crypto assets, crypto index.

JPMorgan has clearly been focused on generating new revenue streams and building new products that empower clients to do the same. On a more general note, there seems to be a divide between banks that are focused on new revenue vs. banks that are exploring blockchain as a strategy for efficiency improvement and cost reduction.

It will be interesting to see what happens once there is a regulatory breakthrough and more traditional investors flock into the space. In my mind, the first thing they will be looking for is a reputable prime broker (PB) with a large balance sheet. Top players in the traditional PB space are Goldman, JPMorgan, Morgan Stanley, Credit Suisse, UBS, Bank of America, BNP Paribas, Citi, and Barclays. Most of whom haven’t been public about any digital asset initiatives.

Recent developments at Goldman are, in my opinion, an indicator that something is cooking. The OCC announcement around crypto custody also came from a major financial institution. Which makes me think there must be parties getting ready to offer crypto custody — a core component of prime brokerage services. Leading to my next topic…

Is a hunt for custody (and other) assets brewing?

In addition to custody, other core components of a prime brokerage offering include execution, clearing & settlement, financing (leverage, margin and borrow), and technology. Custody and trading technology are areas where firms will have to build, buy, or partner to acquire crypto-specific capabilities. Signs are emerging that banks, and other large financial players, are getting active here in digital asset custody.

- Staying with JPMorgan, The Block reported the bank is actively exploring digital asset custody. Reportedly, it has sent out requests for information and held discussions with a number of crypto-native custody providers to see how it can offer digital asset custody to its clients via a “sub-custodian.”

- PayPal/BitGo. A similar rumor did the rounds following PayPal’s announcement last week, when Bloomberg reported the company is exploring acquisitions of cryptocurrency companies including BitGo.

- Nomura recently launched its Komainu digital asset custody joint venture with Ledger and CoinShares.

- DBS Bank accidentally published an announcement about an imminent digital exchange offering with DBS Bank acting as the custodian. DBS Bank has a market cap of US$38B and a credit rating Aa2 / AA- credit rating.

- Standard Chartered has been working on a crypto custody offering for the institutional market and the first pilot could launch later this year.

- BNP Paribas completed a proof of concept with crypto wallet technology provider Curv. The bank said it is “carefully preparing for the development of custody solutions for regulated digital assets.” BNP bought Deutsche Bank’s PB business last year.

100s of crypto custodian offerings have emerged in recent years, but there are only so many with the type of technology that would be up to the standards of highly regulated global institutions. This, combined with the fact that, at least on the surface, many banks seem to be relatively passive on the digital asset side, makes me think hunting season could be on soon.

Michael Shaulov, Founder & CEO of Fireblocks, shared his perspective (quoted in the DCG survey featured below):

“The small subset of crypto companies that are leading from a tech and servicing standpoint are expensive and banks aren’t going to be able to justify paying $300M-$500M for wallet technology at this stage. If they want the shiniest technology, they need to partner with the provider or license it.”

Food for thought top picks

PayPal’s Crypto Offering May Be ‘a Huge Headache’ for Taxpayers. In my mind the Paypal announcement is big because it adds validation and credibility to crypto + it may have a multiplier effect in that its peers may do the same. However, from a developing world perspective, the payments angle is an interesting one. Why would I use Paypal to make BTC payments? It is expensive because of the point of sales conversion they do and it triggers a capital gains taxation event. And why would I want to sell my Bitcoin? #hodl

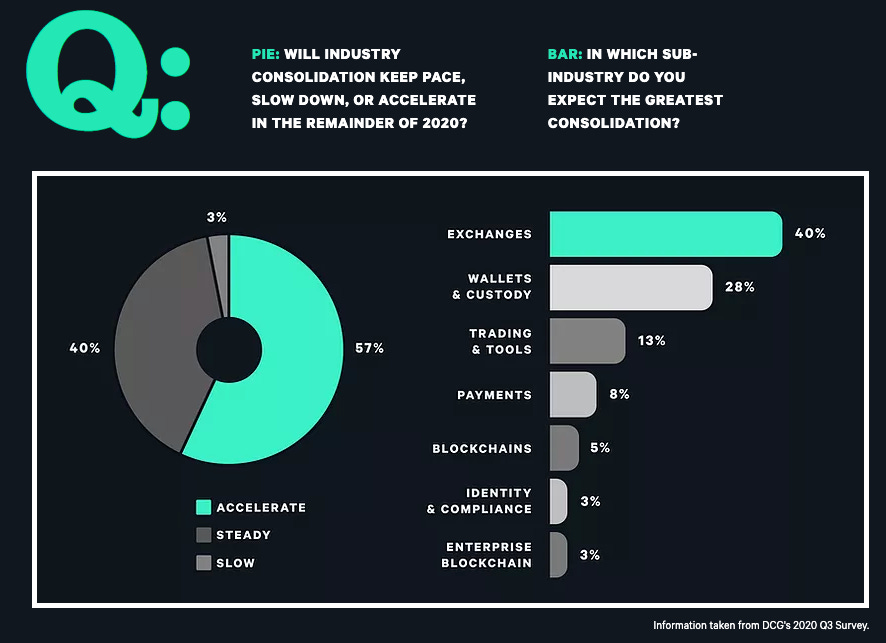

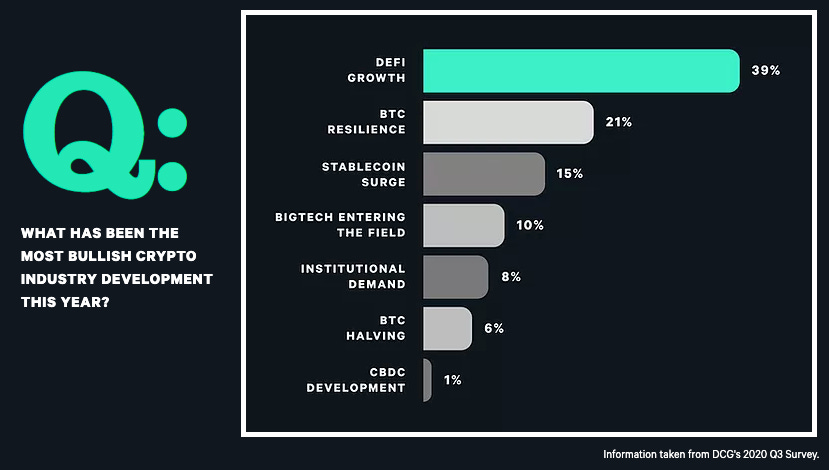

DCG posted the results of its annual founders survey. With a VC portfolio of 150+ crypto companies, DCG is in a unique spot to provide insight on what’s going on within the ecosystem. Two charts jumped out.

Industry consolidation.

Nearly six in ten respondents expect industry consolidation to accelerate, particularly in the exchange and wallets & custody spaces.

DeFi wins head & shoulders as the most bullish crypto industry development this year.

Today, DeFi is a buzzword referring broadly to attempts to offer financial services via decentralized technology. If the movement succeeds in scalably offering faster and cheaper financial services (i.e. credit, loans, savings products) it will simply be the way of “finance” in the future.

Daniel Masters Explains How Blockchain Will End Commercial Banks.

“I think we are going into a new paradigm where central banks issue CBDCs, commercial banks cease to exist and the service layer is filled by crazy new emerging companies like Compound Finance, Uniswap, SushiSwap, and people that are really getting distributed, decentralized finance done today. Then the final interesting layer is who actually faces the consumer.”

Worth a read!

CBDC Highlights

- China’s DCEP will not compete with WeChat and Alipay. Currency issued through DCEP can be used in mobile wallets like WeChat Pay, said Mu Changchun, the program head. “WeChat and Alipay are wallets, while the digital yuan is the money in the wallet.” Interestingly, Mu also commented “We have found counterfeit digital yuan wallets on the market.”

- In other news, PBoC seeks to revise banking law to legalize digital yuan. It also seeks to prohibit circulation of yuan-pegged digital tokens.

- Swiss Central Bank and BIS plan to test CBDC by year end. The POC will pave the way for experimenting with retail CBDC and will also help explore connections to existing payment systems and monitor compliance. BIS plans to work with more central banks to test cross-border usage of digital currencies.

- The WSJ guide to what CBDCs could mean for users, banks and the economy.

The Big Picture

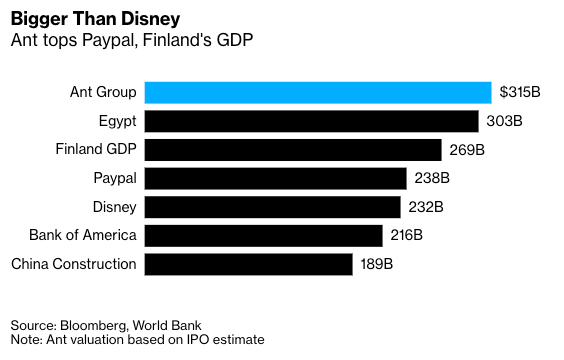

Ant IPO By the Numbers: It’s Bigger Than Finland’s GDP.

- At $34.5B, Ant’s IPO blows past Saudi Aramco’s $29B record, set last year.

- Its $315B valuation it is worth more than the GDPs of Egypt, Chile, or Finland and it is bigger than JPMorgan, the largest US bank.

- Institutional investors put in orders for 76B shares, 284x the initial offering.

- Jack Ma is poised to become the world’s 11th-richest person.

- The IPO is set to generate $396M in fees.

Wall Street will soon have to take millennial investors seriously. Millennials still hold a tiny share of total wealth. But savings and inheritance windfalls mean that millennials’ share will rise rapidly. Technology will lead millennials to invest differently than their parents did, leveraging advances in technology to invest directly through apps like Robinhood. Millennials also have a different mindset. They may eventually change how asset management works—and perhaps the economy, too.

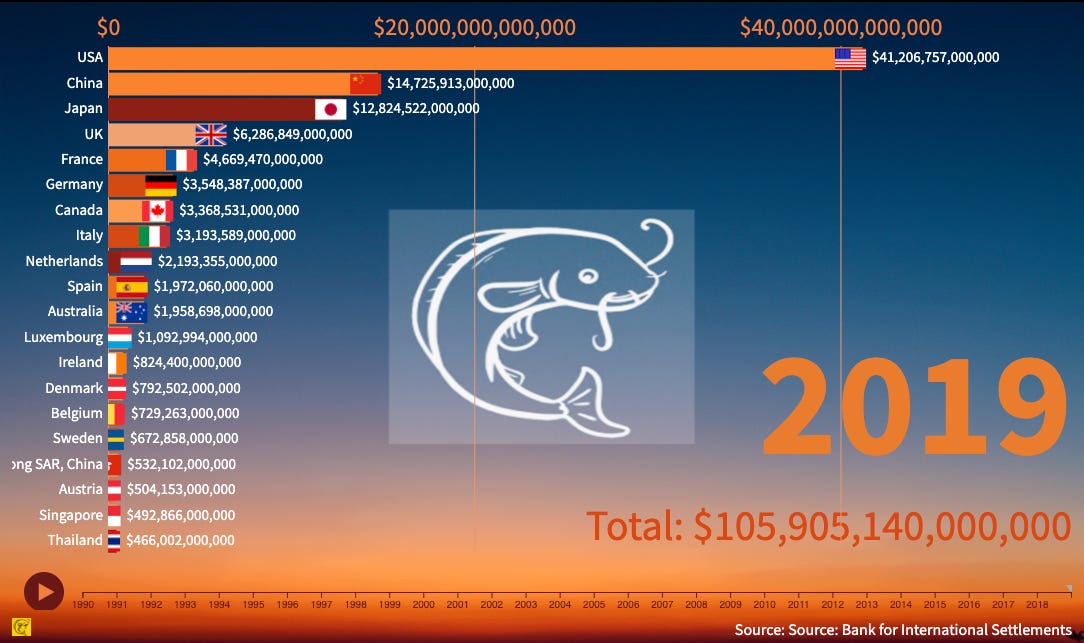

Outstanding Global Debt Broken Down By Country in an interactive chart.

Quotes of the week

Paul Tudor Jones on CNBC’s Squawk Box

Bitcoin has a lot of the characteristics of being an early investor in a tech company.

Meanwhile, Ray Dalio is not so onboard with crypto yet.In an interview with Barry Ritholtz, reported by MarketWatch, he noted that cryptocurrencies like bitcoin suffer from three problems — they are hard to transact, they are very volatile and they are at risk from governments banning them.

There seems to be so much misunderstanding still around bitcoin and digital assets in general, including from people at the highest levels in finance and business.

Speaking at the Fortune Global Forum conference, Mastercard CEO Ajay Banga commented on financial inclusion:

Bitcoin per se is volatile in its valuation. Can you imagine someone who is financially excluded trading in a way to get included through a currency that could cost the equivalent of two Coca-Cola bottles today and 21 tomorrow? That’s not a way to get them [included]. That’s a way to make them scared of the financial system.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.