So far for my new year’s resolution to write briefer Thursday Threads posts. I’m sorry folks, there are just too many dots to connect for you this week.

Bitcoin went rogue, generating lots of headlines including some “told you so.” Then there was more M&A, continued institutional momentum, a sharp rise in options trading value, and more regulatory chat. And, last but not least, the return of an old friend, volatility.

In this issue:

- Top story: Bitcoin’s rollercoaster

- Reflexivity, the new buzz word

- ETFs are back

- Cancel your weekends! Bitcoin doesn’t rest, and neither can you

And: momentum tracker, food for thought top picks, the big picture, and quote of the week.

Top story: bitcoin’s rollercoaster

Bitcoin fell sharply on Sunday to reach a near term bottom just above $30,000 on Monday from a ~$42,000 peak last Friday. This sparked a lot of debate about the cause of the drop. Many different opinions as usual.

- In its Jan 4 edition of Flows & Liquidity, JPMorgan said it saw headwinds for bitcoin, with indicators like a buildup of speculative long positions and an increase in retail participation showing potential froth. The speculative investors being momentum traders like CTAs and crypto quants looking to front-run real money leveraging the CME futures market. CME had seen a sharp increase in open interest in recent weeks.

- Others were talking of profit-taking “Taking some profits off the table after an asset — any asset, not only Bitcoin — doubles in value within three weeks is completely understandable.”

- Data provided to Coindesk by South Korea-based analytics firm CryptoQuant suggested miner selling did contribute to the price drop. JPMorgan also noted that “balances held in accounts with more than 10,000 bitcoin have declined significantly, suggesting early investors and miners have been selling bitcoin to facilitate the increase of new entrants.“

- LMAX strategist Joel Kruger and Scott Minerd of Guggenheim said the market was severely overbought and in need of a healthy correction.

Bitcoin's parabolic rise is unsustainable in the near term. Vulnerable to a setback. The target technical upside of $35,000 has been exceeded. Time to take some money off the table.

— Scott Minerd (@ScottMinerd) January 11, 2021

- In December, Minerd said that bitcoin should be worth $400,000 based on its scarcity and value relative to gold. His comments came a month after Guggenheim Partners filed with the SEC to invest up to $530 million into bitcoin through the Grayscale Bitcoin Trust. That filing will go into effect on January 31.

Watching the cryptos trade, it’s EXACTLY like the internet stock bubble. EXACTLY. I think btc, eth , a few others will be analogous to those that were built during the dot-com era, survived the bubble bursting and thrived, like AMZN, EBay, and Priceline. Many won’t

— Mark Cuban (@mcuban) January 11, 2021

Trend follower: connecting the dots

Reflexivity, the new buzz word

It may be me, but it seems like the concept of reflexivity is starting to catch on in crypto. I have seen it pop up in at least four thought leadership pieces in recent weeks. Reflexivity is a concept introduced to economics and finance by George Soros that has its roots in sociology.

Reflexivity theory states that investors don’t base their decisions on reality, but rather on their perceptions of reality instead. The actions that result from these perceptions have an impact on reality, or fundamentals, which then affects investors’ perceptions and thus prices. The process is self-reinforcing and tends toward disequilibrium, causing prices to become increasingly detached from reality. You can see how people like linking this to bitcoin 🤷🏻♀️

Here are a couple of recent pieces and phrases referring to reflexivity:

- Deribit: On Reflexivity & Imitation, Part 1 & Part 2

- Kraken: The Great Debate — Bitcoin & Intrinsic Value. “For instance, the case could be made that bitcoin will “succeed” not purely because of its underlying technology and value proposition, but because people believe it will succeed. It’s this belief that germinates a positive feedback loop; participants believe adoption, or the purchase/use of bitcoin, will continue to accelerate and for this reason, they adopt themselves.” (p12)

- One River: “Most people still view digital assets as worthless. They are not wrong. In the aggregate, digital assets can be created just as easily as the Fed credits banks with digital dollars, which is to say that they can be created at no cost and in unlimited amounts. But imagine if one or two digital assets were to be selected as the object of our collective faith, just as gold and silver were once picked from the periodic table. And now imagine that unlike gold and silver, these digital assets are of finite supply and are the only such objects of that sort in a world of infinite fiat. It is not hard to imagine that such assets will become very valuable.”

- Forbes: Bitcoin “is a currency, if everyone wants a currency, then it has value. If no one wants it, then it’s worthless. That’s part of the story as to why the US dollar has generally been a better investment over time than the Zimbabwean dollar. Neither currency has anything backing it, but the popularity of the US dollar reinforces its value. This creates a challenge for Bitcoin and can lead to the spirals of fear and greed. If it’s price is rising then that’s good for its popularity, if it’s falling in price and therefore popularity, then that’s bad.”

ETFs are back

- VanEck revived the bitcoin ETF dream in December when it refiled with the SEC. It had withdrawn its previous proposal in Sep-19 after a series of SEC rejections.

- The crypto industry is hoping that the rumored appointment of Gary Gensler as SEC chair will make an ETF more likely.

- JPMorgan strategists made headlines (again) this week arguing that the approval of a bitcoin ETF would be negative for bitcoin in the near term. The reason? It would trigger an unwind of the “GBTC arb trade” as it would erode Grayscale’s effective monopoly status. That would cause a flood of outflows and a collapse of the premium. ETFs allow for daily creation and redemption of shares and as such a more efficient arbitrage of the premium to NAV.

- What’s all the fuss about? An ETF is a mechanism that makes buying bitcoin as easy as buying shares for retail investors. Giving the significant momentum behind bitcoin and the sheer size of the US retail investor base, demand is expected to be significant. This will be positive for bitcoin’s price and market health in the longer term.

- Why is the SEC not a fan? The SEC’s concerns center around (1) valuation, in particular establishing one price for bitcoin in an unregulated, fragmented, and volatile market (hence the importance of market data and reliable reference indices); (2) liquidity, required to facilitate daily redemptions; (3) custody and security; (4) arbitrage, in particular the requirement to have a market price that would not deviate materially from the NAV (as highlighted by JPMorgan above); (5) potential manipulation and other risks associated with crypto as a nascent asset class.

- What is different this time? There are a number of reasons why the SEC may look more favorable towards a bitcoin ETF this time around. For starters, a new SEC that may look more favorable upon letting retail investors benefit from bitcoin growth in a safe manner. Second, the market size has grown a lot since 2018/19. Third, the market infrastructure has matured substantially including the existence of high quality custody and liquid regulated derivatives markets. Finally, growing adoption on Wall Street. — Not to say that it will be easy!

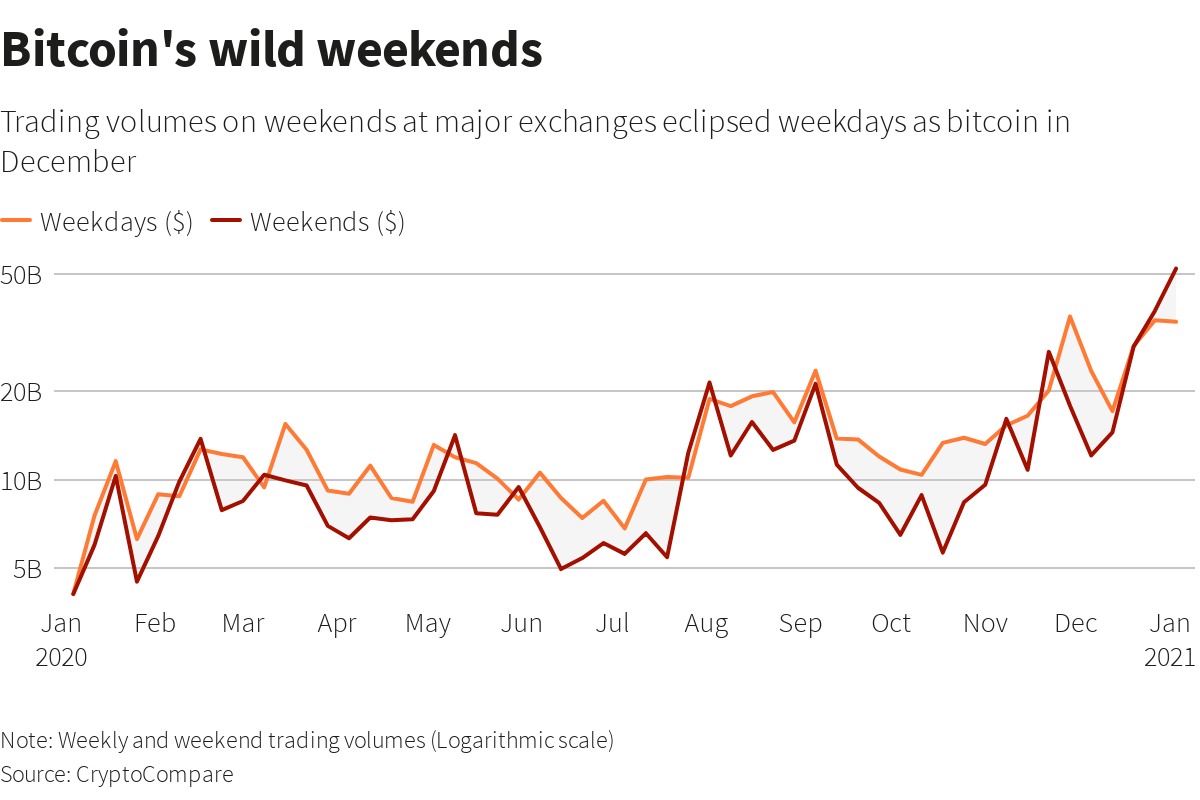

Cancel your weekends! Bitcoin doesn’t rest, and neither can you

.. so reads the title of a Reuters analysis published this week — bitcoin doesn’t sleep. Trading volumes across six major cryptocurrency exchanges have been 10% higher at weekends than weekdays from the start of December to date. That represents a major shift from the previous 11 months, when weekend volumes were 13% lower than traditional trading hours. Per Reuters, the change has been caused by the sizable allocations to bitcoin by large institutional investors, specifically their use of trading algorithms to buy bitcoin. But the technique can trigger outsized price swings at weekends, when liquidity tends to be thinner. In short, fewer bitcoin on the market at any given price, even if trading volumes are still high.

If I am looking back at some of the announcements in December and January, this makes a lot of sense: SkyBridge bought $300M, One River $600M, MicroStrategy $650M, MassMutual $100M. That’s $1.65B, right there. These are amongst some of the largest trades in bitcoin history. As most of this is announced after the fact, there must be much more going on under the hood. Coinbase provided case studies on how they have helped One River and MicroStrategy buy bitcoin without affecting the market price using algorithmic execution strategies.

A side effect is that with increased weekend activity sparked by algos, manual traders must also work around the clock to capitalize on price moves.

Other pieces of news and analysis this week seem to agree with the above:

- Bitcoin’s Wild Weekends Turn Efficient Market Theory Inside Out. It’s on Saturdays and Sundays, when most other assets barely budge, that Bitcoin tends to go “particularly nuts” and volatility spikes — according to Bloomberg. Reasons include that it has a very small effective free float with 2% of holders controlling 95% of available supply. Another is its fragmented market structure, “which consists of hundreds of disconnected exchanges that in effect are their own islands of liquidity.”

- Crypto’s 24/7/365 rhythm also means that there are periods of very thin liquidity (e.g. on weekends when liquidity providers and market makers are lightly staffed) that amplify volatility when larger trades occur.

- Bitcoin Buying on eToro Could Be Curbed This Weekend If Trading Goes Wild. The retail investing platform warns clients that unprecedented demand for crypto coupled with limited liquidity may present challenges for supporting Buy orders. Retail demand has surged on weekends when investors have more free time to play the market.

Momentum tracker

A Bitcoin sculpture is installed at the BitCluster mining farm in the Arctic

M&A

- Coinbase acquires crypto trade execution startup Routefire for an undisclosed sum. At Coinbase, Routefire will expand the exchange’s prime brokerage business.

- NYDIG Announced Acquisition of Digital Assets Data, a data, research, and analytics company building enterprise-grade software and data feeds. It is the second data acquisition this year with Coindesk acquiring TradeBlock last week. NYDIG acquired etale in October and has been on a hiring spree.

- Bakkt will list on Nasdaq through a merger with a SPAC sponsored by Victory Park Capital. The merged firm has an enterprise value of $2.1B, of which $570M is cash. That includes a simultaneous PIPE of $325M, of which $50M comes from ICE. It announced that Gavin Michael, former head of technology of Citi’s Global Consumer Bank, joins Bakkt as CEO. NYSE owner ICE, which founded Bakkt, will have a 65% equity interest post listing. Bakkt will likely beat Coinbase to market “with far less fanfare, attention, and scrutiny.” As discussed a few weeks back, Bakkt is a really interesting company and much more than the not so liquid exchange. Here is an interesting deck about the transaction and an article summarizing some of the key points.

Goldman says bitcoin is starting to mature but institutional money is a tiny fraction of the market. The investment bank’s head of commodities research said that more money from the financial world would need to flow into bitcoin in order for it to stabilize.

- “I think the market is beginning to become more mature,” Currie told CNBC’s Steve Sedgwick in an interview Monday. “I think in any nascent market you get that volatility and those risks that are associated with it.”

- “The key to creating some type of stability in the market is to see an increase in the participation of institutional investors and right now they’re small,” he said, adding that, of the more than $600 billion invested in bitcoin right now, “roughly 1% of it is institutional money.”

- Strategists at JPMorgan have said bitcoin could surge as high as $146,000 in the long term as it competes with gold as a safe-haven asset. They also noted, however, that bitcoin would have to become substantially less volatile to reach this price.

Meanwhile, AQR is not interested in bitcoin. Cliff Asness told Bloomberg he is not a cynic, but “managed to learn very little about crypto,” he knows it goes up every day 😁

- Host: some quants say bitcoin is impossible to ignore, it is too big, and they are actively trying to build models that work in the crypto sphere.

- Cliff: “Good luck to them.” You can build anything as a trend follower, which is just price in its simplest form and in itself not a super high Sharpe strategy, in particular for one asset. “We have not done this.”

- I don’t know enough to say this with confidence but am somewhat cynical that someone will come up with a good valuation model for what the right price is of bitcoin. That is certainly not how it’s been trading, it’s been trading as a trend…thing. “Quants doing that are a little trendier than I want to be.”

Bitwise’s annual survey of US financial advisors (~1,000 in total) found that :

- The percentage of financial advisors (FAs) allocating to crypto in client portfolios rose from 6.3% to 9.4% in 2020.

- 17% of FAs are considering making their first allocation to crypto in 2021.

- The no. 1 motivation is crypto’s uncorrelated returns, and inflation hedging is of rising interest.

- 81% of FAs are getting questions about crypto from clients.

And:

- SkyBridge’s Bitcoin Fund Crashes the Internet as 6,000 Scramble for Zoom Call.

- Morgan Stanley Unit Boosts Stake in Bitcoin-Loving MicroStrategy.

- PayPal Hits $240M in Daily Crypto Trading looking at itBit data.

- Grayscale sees interest from non-hedge fund institutions including pensions and endowments. It announced today that it raised $3.2B into its investment products, its largest ever quarterly inflow.

Food for thought top picks

Coinbase IPO will be controversial litmus test for crypto offerings

Coinbase is likely to “enjoy a big pop” if history is any guide. Just look at its 35 million customers, $8 billion (2018) valuation, soaring FTX pre-IPO shares and its prolonged profitability, “a rarity amid the recent unicorn parade.”

But Coinbase will also carry significant controversy for some investors — and not just crypto skeptics. Coinbase, the closest thing to a crypto household name in the US, presents a litmus test that regulators will want to get right, since there will be more to come. The firm is no stranger to regulator interference and given this history regulators might hold up the listing with red tape.

It will be fascinating to see how Coinbase describes itself in its S-1. Snap infamously called itself a “camera company” while Casper created the “sleep economy.” 😂 I am sure Goldman’s ECM bankers will be creative!

In other news, Coinbase issued a rare apology for outages in Europe and Asia.

Bitcoin and the value investor

In another epic memo, Howard Marks of Oaktree made an interesting comment about bitcoin and the value investor. The natural state for the value investor is one of skepticism. “This time it’s different” will naturally trigger a deeply dubious reaction. However, in a world where so much innovation is happening at such a rapid pace, instead, this mindset should be paired with a deep curiosity, openness to new ideas, and willingness to learn before forming a view.

“In the case of cryptocurrencies, I probably allowed my pattern recognition around financial innovation and speculative market behavior – along with my natural conservatism – to produce my skeptical position [expressed in 2017].” Thus, with help of his son, a bitcoin investor, he has concluded that he is “not yet informed enough to form a firm view on cryptocurrencies.”

Get ready for self-driving banks by Brian Brooks (FT Op-Ed)

I wish I could write like Brian Brooks. In an Op-Ed for the FT Brian likens banking regulations required for DeFi to those for self-driving cars. Most automotive laws are written to protect against dangerous drivers, not dangerous cars. He argues that lenders run by algorithms and blockchain technology will require 21st century regulation.

“Could we usher in a future where we eliminate error, stop discrimination, and achieve universal access for all? Optimists like me think so.”

A few interesting comments

- Although these “self-driving banks” are new, they are not small. They are likely to be mainstream before self-driving cars start to fly.

- There is also a risk that, in the absence of federal regulatory clarity, US states rush to fill the void and create a patchwork of inconsistent rules that impede the orderly development of a national market

This will be an interesting space to watch and traditional finance should start paying attention.

The Big Picture

UBS to charge negative rates on holding above 250,000 Sfr, euros

“It’s becoming increasingly clear that we’ll have to contend with negative interest rates for years to come. That’s why we decided to lower the threshold for deposit fees,” Swiss banking head Axel Lehmann told employees in the memo.

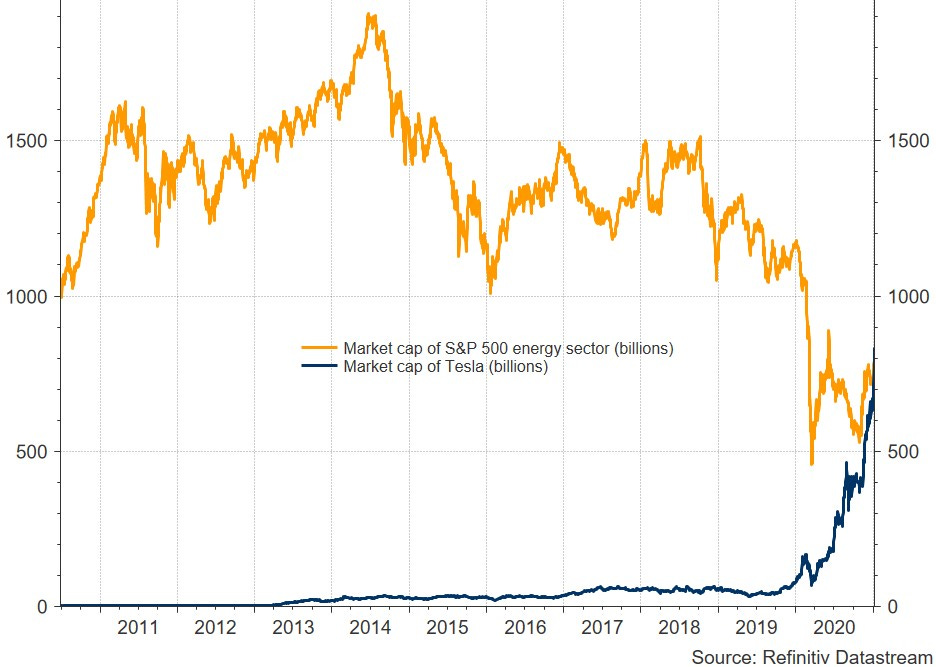

Tesla is now worth more than the entire S&P 500 energy sector

Quote of the week

When to trade bitcoin? When Saturn crosses Mercury, of course

22-year-old New Yorker Maren Altman has been following the movements of celestial objects to predict bitcoin price fluctuations since last summer. She has built up a 1 million-strong social-media following on TikTok.

Last week, the 22-year-old told her followers to watch for a price correction on Jan. 11. Why? Saturn was going to cross Mercury. Bitcoin fell as much as 21% on that day, before recovering most of its losses.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.