One of the reasons I like curating news on a daily basis is that it makes me see trends and themes develop. Sometimes it remains just the theme of that particular week. Other times it builds up into something more sustainable. And sometimes momentum turns into something significant, and then more significant. In September I wrote, “Why 2021 will be the inflection point for digital asset adoption.” I have to say, the tsunami that is developing right now has exceeded my wildest dreams.

If I look at the news this week and read the tea leaves, everything points in the same direction, UP! It’s happening folks, the crypto revolution is UP-on us, in full force. It will be a rocky ride, but don’t forget to enjoy the journey. You’ve all worked hard for this 💜

PS Thursday Threads skipped a beat last week, the J&J vaccine knocked me out there for a bit.

In this issue:

- TradFi is having DeFi FOMO

- Coinbase listing: Wall Street upside down

- Blockchain in capital markets

- The Crypto Climate Accord

- Momentum tracker, naysayers, and CBDCs

TradFi is having DeFi FOMO

ConsenSys announced it raised a $65M funding round from investors including JP Morgan, Mastercard, and UBS, to build infrastructure for DeFi.

According to TechCrunch “the fundraise looks like a highly strategic one, based around the idea that traditional institutions will need visibility into the increasingly influential world of DeFi and the Web3 applications being developed on the Ethereum blockchain.”

Joe Lubin said the firm is “proud to partner with preeminent financial firms alongside leading crypto companies to further converge the centralized and decentralized financial domains at this particularly exciting time of growth for ConsenSys and the entire industry.”

Jeremy Millar added: “If we want to help the world adopt the technology we need to meet it at its adoption point, which for many large enterprises means inside the firewall first. But similarly, we think, just like the public internet, the real value — the disruptive value — changes the ability to do this on a broader permissionless basis, especially when you have sufficient privacy and authentication available.”

What’s the big deal?

People envision a future where DeFi offers the world a new way to access financial services. The ultimate consumer of these services may or may not know that crypto is being used on the back-end to meet their needs.

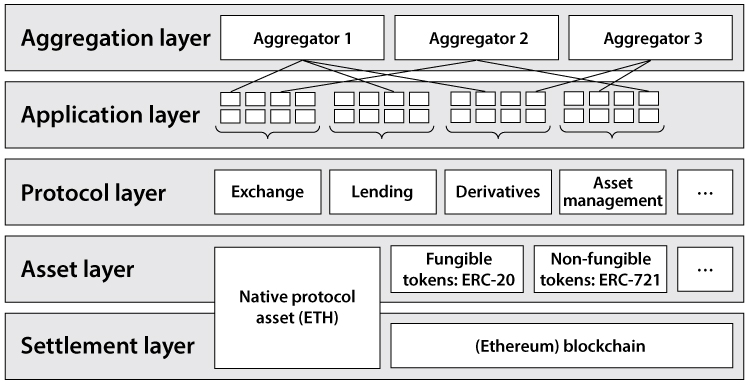

I like using Fabian Schär’s description of the DeFi tech stack as a framework:

Protocols that run on public blockchains provide standards for specific use cases such as decentralized exchanges, debt markets, derivatives, and on-chain asset management. These protocols can be accessed by any user or application and are interoperable. The application layer creates user-oriented applications (financial services) that leverages these protocols. The aggregation layer is an extension of the application layer and connects to several applications and/or protocols to create multi-dimensional financial services and perform more complex tasks.

And just to ELI 60 this, any financial service can effectively be described as a set of rules: If This Then That. What is money in a bank account, a security that lives in the accounting system of DTCC, a token on a blockchain? Exactly, an entry in an accounting system. An electronic accounting system, aka bits and bytes. Now code up a bunch of rules that describe a lending process, house these in a smart contract and you have a protocol. At the application layer these respond to commands typed into a user-friendly interface (or calls made to an API). Voila, financial services product!

Imagine the following: a tech company like ConsenSys provides a platform that connects to several protocols, accessible through APIs. These APIs can be leveraged by FinTechs and banks to create financial products. A simple example would be Cash App providing high interest rates on dollar deposits. Behind the scenes these dollars are converted into USDC stablecoins and locked up into the Compound lending protocol. In this example, the crypto part of the business is abstracted away from end-users. A similar rationale can be applied to structure products, exchange services, asset management, and other financial services.

If you want to see this in action, read Peter Johnson’s excellent essay on crypto credit markets.

The banks cannot afford to stay on the sidelines

Why not? Well for starters over $57B is locked in DeFi and it is increasingly the case that major investors are involved in the space. No wonder, with returns significantly higher than for traditional yield products, in particular in the current inflationary and low yielding environment.

Moreover, crypto-powered financial products are going to be more attractive because crypto markets have structural advantages over traditional markets. Also, Gen Z, the beneficiary of “the great wealth transfer” is digitally- and crypto-native. They don’t trust banks and intuitively understand the concepts of crypto and trustless services. Finally, global commerce, products and services are all digitizing at the speed of light and their transactional rails will be based on public blockchains.

Technological advances brought together in crypto are making banks obsolete. People have an internet connection, indicate demand for a service, algorithms do the rest. Rent-seeking matchmaking middlemen disintermediated.

Why are banks only scratching the surface?

It’s complicated. Banks are highly regulated and operate in a very siloed way, and neither is great for innovation. There are many stakeholders: innovation team(s), senior management, risk and regulatory compliance teams, technology/IT, the frontline — which is typically quite averse to new technology and very siloed in itself, different teams don’t necessarily work together. Quite the opposite, they may compete! And then there are different generations, characters, arrogance…

I think a number of banks are getting there. However, they are all massively behind the game. And they know it. The Consensys news this week is another sign of that. However, banks are not going to dominate this next chapter or the future of finance. The community is. Stakeholders in aggregate will be benefiting. Jamie knows.

Is this happening today? What’s missing?

DeFi has been growing very fast in the last 12 months on the back of the liquidity mining and yield farming frenzy last summer. Wait! What?! Oh, yes, that’s a whole different topic.

In a nutshell, innovative protocols started rewarding users (liquidity providers) with free tokens to bootstrap adoption and growth. Users then started providing liquidity (i.e. using) protocols because of the free token rewards and “liquidity mining” was born. Other smart people then coded up algorithms that allowed users to allocate capital across a number of different protocols to maximize their yields from liquidity mining, aka “yield farming” (investment management in a box). DeFi protocols attracted a lot of capital and got a lot of usage which allowed them to get very fast feedback and iterate / improve their products. This has translated into very fast innovation cycles when compared to Web 2.0.

However, we are not there yet. Protocols are learning very fast but there are still many details to be ironed out — related to security, risk, user experience, and economics. Other important features that are still missing are related to privacy, regulatory compliance (digital identity, KYC) and regulatory clarity in general. And then last but not least, Ethereum, the main host of DeFi, has been experiencing scaling issues resulting in a high cost of transacting.

The ecosystem isn’t ready, yet. But it will be before too long. The banks know it.

Coinbase listing: Wall Street upside down

Coinbase direct listing yesterday got a staggering amount of attention from mainstream media. Newsweek called it the confirmation of “crypto’s arrival as asset class”. The article quotes D.A. Davidson analyst Gil Luria “We believe that crypto assets and the distributed technology they represent will become the foundation for a more efficient future financial system that reduces the number of intermediaries for a large range of transactions.” In line with the theme discussed above.

Anyway, some of the headlines surrounding the event made me think how the world has changed for crypto as an asset class in less than twelve months. It feels like the world turned upside down, Wall Street upside down to be more precise. Although Coinbase is benefiting from regulatory arbitrage and its revenue is at the mercy of volatile crypto markets, for now, it is outperforming its traditional peers by many metrics.

Exchanges tokens rallied ahead of Coinbase’s public debut with BNB grabbing the top 3 spot in the cryptoasset market value ranks at $84B. Binance launched tokenized stock trading while the NYSE released an NFT collection commemorating notable IPOs.

You see my point?!

Blockchain in capital markets

Speaking of “foundation for a more efficient future financial system”, blockchain is finally gathering more traction in the broader financial services ecosystem too.

- EIB Poised to Deploy Blockchain for Bond Sale, hires Goldman, SocGen

- GameStop and Bitcoin Renewed a Push to Digitize the Stock Market

- Blockchain may change equities trading for good

- Stock clearing stalwarts face increasing threat from blockchain

The Crypto Climate Accord

As discussed before, crypto’s environmental impact has become a key debate in recent months. No surprise, as ESG is a hot topic for institutional investors everywhere in the world. Last week saw the launch of the “Crypto Climate Accord,” a private sector-led initiative committed to making the crypto industry 100% renewable. The Accord intends to achieve this by working collaboratively with the industry — including all blockchains — to transition to 100% renewable energy by 2025 or sooner. CoinShares, ConsenSys, Ripple, GSR, and Hut 8 are amongst the agreement’s initial supporters.

Here are a few articles just from the last week or so if you need to read up on the topic:

- ESG and Crypto: considerations for market participants. Where and how crypto is mined is a growing area of focus for investors who do not want to buy crypto that is created in a way that causes excessive energy waste or environmental damage. Today nearly 40% of crypto mining relies on renewable energy sources, as an increasing number of miners aim to reduce carbon emissions and meet investors’ demands.

- Totting up bitcoin’s environmental costs. Without regulation, mining in China could consume as much energy as Italy by 2024 according to The Economist.

- Crypto’s Carbon Emissions Problem and the Projects Trying To Solve It.

- Brevan Howard-Backed One River AM Plans Carbon-Neutral Bitcoin Funds.

- Bitcoin Power Consumption Jumped 66-Fold Since 2015, Citi Says.

- NYT trolling? Nic Carter calls it lazy journalism. “In Coinbase’s Rise, a Reminder: Cryptocurrencies Use Lots of Energy” and “NFTs Are Selling for Millions. Are They Warming the Planet, Too?”

Momentum Tracker

- NYDIG raises another $100M from partners including Liberty Mutual.

- Crypto traders on Robinhood jump six-fold to 9.5M users in Q1.

- State Street is helping build a crypto trading platform for institutions.

- $48B Hedge Fund Millennium Latest to Trade Bitcoin Trust.

- $17B Hedge Fund Third Point Is Keeping Crypto With Coinbase.

- Galaxy Digital becomes latest firm to file for a bitcoin ETF.

- Goldman CEO David Solomon talks bitcoin and crypto during earnings call.

- Switzerland’s largest insurer AXA starts accepting Bitcoin as payment.

Naysayers

- Wait! What?! HSBC bans customers from buying bitcoin-backer MicroStrategy shares.

- Nearly 3 in 4 professional investors in BofA survey see bitcoin as a bubble

- First Inverse Bitcoin ETF to Debut for Betting on Crypto Plunge

- For laughs: Bitcoin is Dead LOL

CBDCs

- Shanghai, Hainan added to trials as China inches towards e-yuan launch. Latest digital yuan trial is 10x the first. Hong Kong cross-border tests start.

- Biden Team Eyes Potential Threat From China’s Digital Yuan. The Biden administration is stepping up scrutiny of China’s plans for a digital yuan, with some officials concerned the move could kick off a long-term bid to topple the dollar as the world’s dominant reserve currency.

- Michael Hasenstab, who runs the Templeton Global Bond fund, agrees in a piece “China’s digital currency is a threat to dollar dominance” in the FT. China’s pioneering approach should accelerate the elevation of the renminbi on the world stage.

- ECB releases results of digital euro consultation, privacy valued most.

- Russian central bank considers digital rouble in 2023.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.