Once upon a time when I was an analyst in Equity Capital Markets and people still had video recorders…I would get home from work very late at night and watch a few Friends episodes to relax after an 18-hour day in the office. As you may recall, the episode titles started with “The one where…”. This week in crypto will go down into history as “the one where everybody found out” …about NFTs.

We have been talking about it here for a few months now, how the NFT space has been heating up. Well, the whole world suddenly started talking about it this week. That is, including RollingStone! I reckon the spark got ignited by pieces from the NYT and Chris Dixon and the hype around Christie’s auction of Beeple’s work. Then people started looking at the names and the numbers and got their heads blown off.

If NFTs are the hottest theme, ETFs are right behind it. More on that below. On a more general note, the market starts to feel very hot. I wouldn’t be surprised if we are due for another dip!

In this issue:

- NFTs: Silicon Valley’s next big thing

- The ETF flywheel is in motion

- CoinShares to list on Sweden’s Nasdaq Growth Market

- A few takeaways from Citi’s monster report

- There are now more than 100 million crypto users globally

- Momentum tracker

NFTs: Silicon Valley’s next big thing

“Interestingly, I can’t say I saw this one coming. I thought that Ethereum’s first major inflection point would be related to DeFi, but turns out it’s actually NFTs.”

David Hoffman (Bankless)

The sheer volume of stories was ridiculous this week, way too much to cover. I see a few main themes developing, in order of magnitude:

- Digital art and collectibles (SuperRare, Nifty Gateway)

- The sports theme, as a subset of that (NBA Topshot, Sorare, Chiliz)

- Metaverses (Decentraland, Axie Infinity, The Sandbox), and

- Audio.

Some of the numbers are staggering and clearly blowing people’s minds…

- Singer Grimes made $5.8M in under 20 mins selling NFT artwork

- Beeple NFT containing 10-second video clip sells for record $6.6M

- Sorare raises $50M Series A to transform soccer fandom

- Blockchain sports firm Chiliz to invest $50M in US expansion

- Kings of Leon Will Be the First Band to Release an Album as an NFT

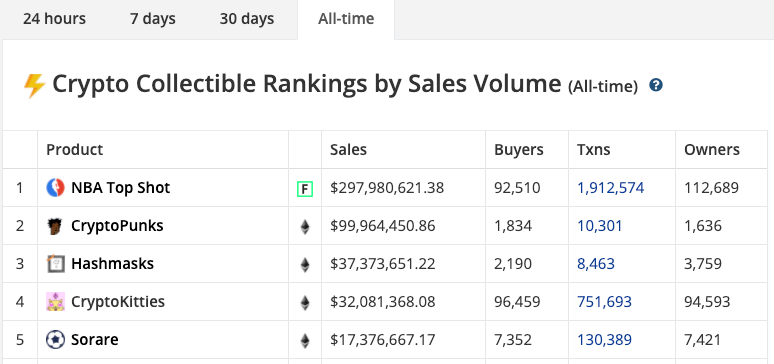

NBA Top Shot has generated nearly $300M in sales to date (https://www.cryptoslam.io/)

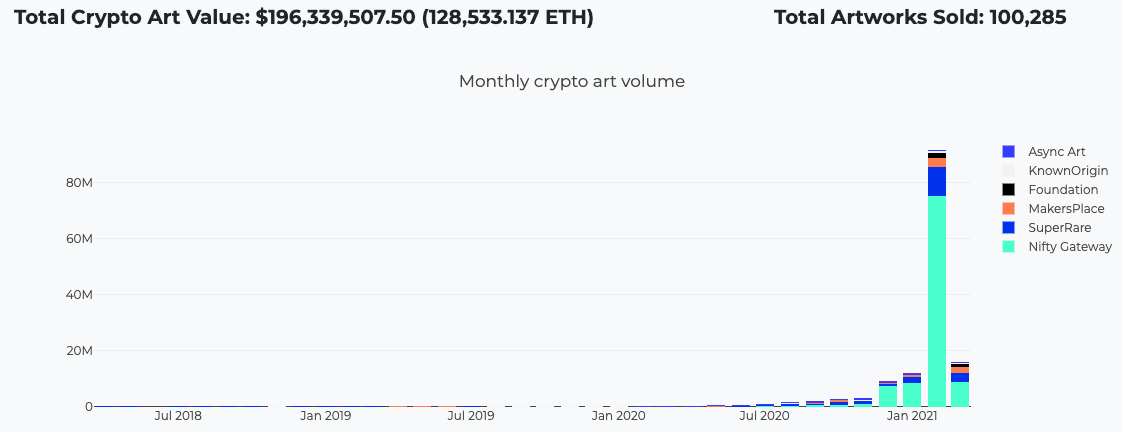

Crypto art is a close second with nearly $200M sold (https://cryptoart.io/data)

Advice for Clubhouse lovers: never stop talking about NFTs, its rule #1.

The ETF flywheel is in motion

We spoke about the ETF theme heating up a few weeks ago and it has been gaining further traction in the last two weeks. Watch this space. Market observers are starting to see a path to a US ETF in 2021. Cathie Wood, the CEO of ArkInvest said that she “doubts US regulators will green-light a Bitcoin ETF before the original cryptocurrency’s market cap hits $2 trillion.” This is not unthinkable this year given the pace we are going at.

A related trend that seems to be developing as discussed in #22 is the diversification in investment products in terms of assets. We are seeing the same for ETFs where the Canadians and CoinShares are branching out to ETH. This is all very positive. This obviously creates further institutional demand for ETH in the spot market. This will be exacerbated later this year as the banks start providing crypto custody and execution and provide easier access to spot markets for institutions. All of this in turn is a path towards a more diverse asset class which means more institutions, etc. See the flywheel?

Further to the comment about the banks, Omniex’ CEO Hu Liang made an interesting comment in the context of ETFs this week. In traditional markets, the big banks act as Authorized Primary market participants for ETFs. In this capacity they have to hold (and trade) large chunks of the underlying. I can’t imagine they would want to miss the crypto ETF boat…

Key themes developing:

- Buzz around US ETF heating up: CBOE Kicks Off Bitcoin ETF Clock With VanEck Filing. State Street Named Fund Admin / Transfer Agent for VanEck’s Bitcoin ETF. Novogratz Positions Galaxy at Center of Hoped-for Crypto ETF Boom. Virtu Financial leans into crypto as designated market maker for BTC ETF. BlockFi just hired a head of investment products with significant ETF experience

- Diversifying into ETH ETFs: Canada’s CI Global and Evolve Funds file for Ether ETF in Canada; CoinShares Is Launching an Exchange-Traded ETH Product with $75M AUM.

- Canadian price war: North America’s first Bitcoin ETF sees explosive debut with $564M in assets → Bitcoin Funds Fuel Near-Record Inflows to Canada ETF Sector → Raging Success of First Bitcoin Fund Shows Who Leads ETF Market → Bitcoin’s Second North American ETF Just Started a Price War.

Is there a negative impact from the launch of Purpose Bitcoin ETF?

JPMorgan argued YES in its Flows & Liquidity notes last Friday. JPM had previously predicted that the introduction of a bitcoin ETF accessible to US based investors would erode GBTC’s flow impulse and cause a collapse of its premium to NAV. In turn it had predicted that this would likely have negative near-term implications for bitcoin markets given the flow and signaling importance of GBTC. And so it occurred last week..

ETFs are a nice segway into CoinShares’ listing that went largely unnoticed last week. CoinShares is a prominent ETF (ETP) issuer in the European market.

CoinShares to list on Sweden’s Nasdaq Growth Market

The announcement of CoinShares listing on Sweden’s Nasdaq First North Market went largely unnoticed last week. I have always thought that CoinShares is a very interesting company. They have been in the market since 2013, were a pioneer in exchange listed products, and have a very high quality team. They flew under the radar for a long time but have been more in the spotlight in the past two years. CoinShares is the largest native digital asset manager in Europe, are part of Nomura’s Komainu JV, and constantly produces innovative and quality institutional investment products and research. The Gold and Cryptoassets Index, the first ETH ETP, and their weekly funds flow reports are examples.

As such, I went through the prospectus (bed-time reading!). Here are a few interesting tidbits but worth a deeper read if you want to get a better understanding of how a crypto ETF business is being run.

- They have an investment products and a markets division. The raison d’être for the latter is servicing the ETF business and providing cash flow while their ETF fees are unrealized. CoinShares Capital Markets engages in (1) liquidity provision in respect to their ETFs (2) proprietary trading and non-directional stat arb strategies, (3) OTC trading services (liquidity, risk management, and hedging) to external clients, (4) “fixed income activities” to generate yield on the assets held on their balance sheet, (5) custody solutions through the Komainu JV with Nomura and Ledger, of which it owns 14.3%.

- Interestingly, the firm executes orders for one of the biggest US IRA platforms.

- Growth initiatives include active strategies, managed funds, Broker/Dealer activities in the US, Gold Token SA (GTSA) and the CoinShares Gold and Cryptoassets Index (CGCI). The US entity “CoinShares Capital” aims to provide advisory services to early stage digital asset / blockchain companies, and “capitalize on opportunities within the private placement market.”

- They made a few really interesting and important points amongst their reasons for listing: (1) provide counterparties greater transparency over its financial position, and (2) increase the level of regulatory scrutiny on the firm, allowing it to demonstrate its strong corporate governance to external parties. Both seem very important in dealings with traditional institutional investors.

- It sees VanEck, 21 Shares, WisdomTree, and HanETF as its main competitors on the passive management side.

- CoinShares had AUM of $4.56B as of Feb 19, 2021 and traded $7.5B in 2020.

- The Group sees “those companies that offer ancillary services, such as crypto media, compliance, regulatory solutions and research” as “especially attractive targets for acquisition by larger digital asset companies that are looking to complement their current offering.”

- On the fixed income market for digital assets, the firm notes the entry of traditional market makers and bank structuring desks into the market should aid in the construction of the equivalent of a credit curve that will lead to more efficient pricing and market maturity in coming years.

A few takeaways from Citi’s monster report

Citi published a report “Bitcoin: At the Tipping Point” on Monday with contributions from some of crypto’s finest. This report was so needed for crypto. There is a lot of content on crypto out there and the quality has been increasing. However, this report provides a comprehensive introduction to the asset class for institutional investors with a lot of credibility behind it, coming from a blue chip global financial institution. The FT bashed it, of course.

If you have been in institutional crypto (and reading this newsletter) for a while it won’t contain many surprises, but nevertheless, here are a few point of views that are interesting, being penned down by Citi.

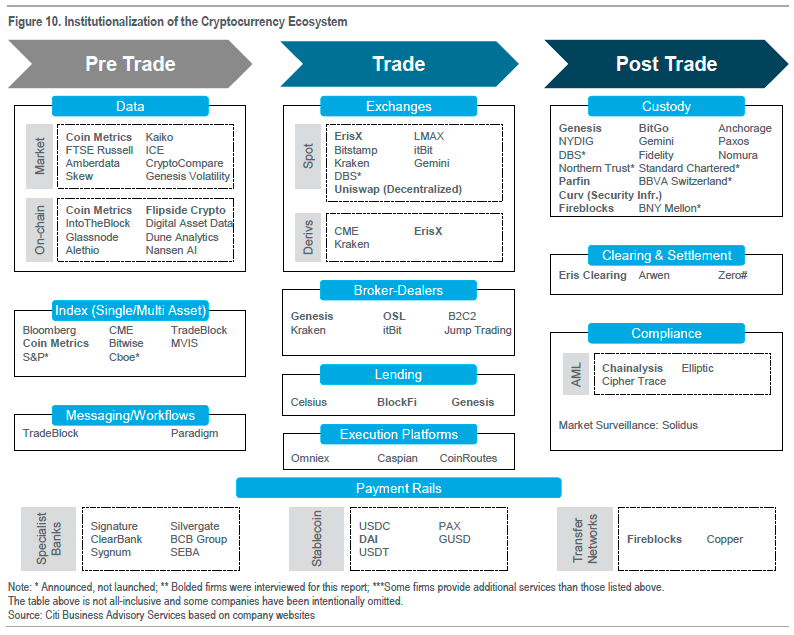

On the institutionalization of the crypto ecosystem

- Hallmarks of robust institutional market infrastructure: ability to deliver the benefits of market data integrity, efficient price discovery, liquidity and depth, capital efficiencies, and asset safekeeping.

- The rise of prime brokerage services, derivatives, and margin financing allows institutions to better utilize and protect their capital.

- Citi notes the challenges around market data that we have been talking about. It recognizes that while crypto exchanges have democratized access to market data, market fragmentation and data quality makes it difficult to directly use this data in the investment process.

- It mentions “Bitcoin Access Products” as a great way to eliminate the operational complexities of trading and safekeeping cryptoassets, providing a bridge with existing market infrastructure.

- Data point: OTC spreads for Bitcoin and altcoin trades have tightened in response to growing demand and improved execution options, narrowing from 50-200 basis points a few years ago around to only 5-10 basis points.

- Growing confidence in crypto custody capabilities is being underscored by the entry of established industry participants. These include large banks with balance sheets in excess of $100 billion include Northern Trust, Bank of New York Mellon, Nomura, Standard Chartered, BBVA, and DBS.

Citi’s view of the crypto ecosystem

On the cryptoasset class itself

“Gains in the value of Bitcoin in turn are drawing attention to and encouraging adoption of other digital currencies and highlighting the experimentation with entirely new business models taking place in the on-chain domain. In this sense, Bitcoin is acting as the North Star to the emerging world of crypto commerce, helping illuminate the financial industry’s path.”

And, a great one sentence summary of bitcoin’s appeal for institutions:

“The intersection of low yields and inflationary expectations has increasingly fostered the view that Bitcoin could represent at once an inflation hedge, a portfolio diversifier, and a safe haven as traditional government bonds no longer offered that feature in 2020.”

Michael Shaulov of Fireblocks is quoted saying:

“Cross margining is still a gap and there are different approaches to that gap. There are transparent ways that aren’t capital efficient and ways that are capital efficient that bring about counterparty risk.”

Obstacles that remain and could stay in the way of progress

Capital efficiency

“Leverage in the system is limited and operates more like a Reg T margin account where participants can only lever their direct account holdings by 100% and no more. Many institutional investors seek much higher velocity of leverage on their money, often putting down as little as 10% in certain investments in order to have access to a much larger exposure.”

Insurance and custody concerns

There are two issues with the lack of a recognized, regulated brand name players in

the digital asset custody space

- It forces institutional investors to split their fiat and crypto holdings between a traditional and crypto-native custodian. This limits the institution’s ability to optimize their potential collateral decisions by forcing them to model their asset pools separately, splitting their buying power and forcing them to create and monitor multiple processes for instructing and moving collateral.

- Asset protections like insurance which remains scarce and expensive owing to limited ability to price and manage the risk. Continued regulatory evolution may speed up development of potential insurance remedies.

Security concerns

“More institutional participants are entering because the presence of other institutions is giving them the confidence to proceed. That dynamic could reverse if there were to be a high profile breach.”

ESG Impact

We discussed this last week in the context of bitcoin. ESG is a hot topic in the asset management industry.

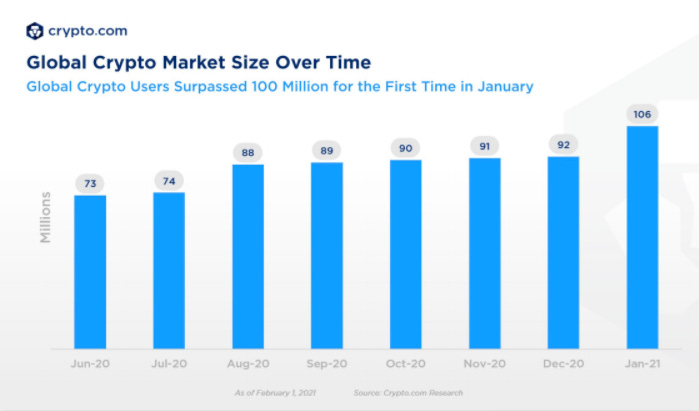

There are now more than 100 million crypto users globally

According to Crypto.com’s calculation methodology, the number of global crypto users reached 106 million in January 2021, a 15.7% increase m-o-m.

It is interesting to put this into context with some of the other numbers we have recently seen:

- As we saw last week (S-1), Coinbase had 43 million users at the end of 2020. Most of Coinbase’ customers are in the US (76%) and Europe (24%).

- Square said last week that in 2020, more than 3 million customers purchased or sold bitcoin on Cash App, and, in January 2021, more than one million customers purchased bitcoin for the first time. That’s another 4 million.

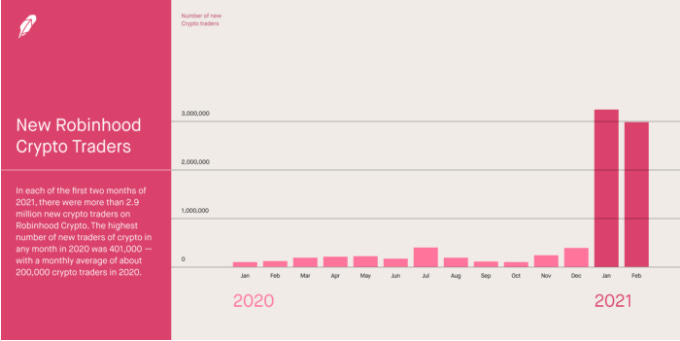

- Robinhood saw 6 million new customers on Robinhood Crypto so far this year.

So that’s 53 million, right there. Obviously, these are just a few of the channels through which investors access crypto. And most of this is just in the US. Despite that there may be some double counting in these numbers, it makes the 106 million seem rather low. It also seems that way comparing Cambridge University’s September 2020 100 million number (3rd Global Cryptoasset Benchmarking Study), the market has grown a lot since.

Paxos’ Chad Cascarilla recently predicted that the number of crypto users will move from 10s of millions to billions in the next 18 months. IMO that likely requires a catalyst such as the launch of Diem.

Momentum tracker

I’m sorry folks, the list is getting longer and longer every week. Mohamed El-Erian and Bridgewater comments didn’t make the cut!

- Goldman restarts crypto desk amid bitcoin boom: Reuters.

- BitGo Wins New York Trust Charter to Bring More Crypto to Wall Street.

- PayPal to Buy Crypto Custody Firm Curv: Sources.

- Charles Schwab is exploring white-label solutions for crypto brokerage.

- JPM institutional survey: 11% already invested in crypto, 22% likely to invest. Most news outlets including the linked headlines reported that 78% is not likely to invest. I see it differently, the glass is half full! 22% is A LOT. (1) many investors are focused on a single asset class, and (2) it just means not NOW vs. never.

- Broker TP ICAP mulls expanding its digital assets operation.

- Billionaire Hedge Fund Manager Dan Loeb Doing Crypto ‘Deep Dive’.

- Crypto.com to sponsor Aston Martin’s Formula 1 team.

- Robinhood to Plan Confidential IPO Filing as Soon as March, sees 6M new users in 2021, average trade size of $500 (see above).

- JPMorgan Says Investors Could Make Bitcoin 1% of Portfolios.

- Anchorage Raises $80M From A16z, GIC and Others.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.