Merry Christmas everyone, and thanks for your readership! You are all legends 🦸🏽♀️ 🦸🏻♂️ I hope you get to take a break over the holidays.

A slightly different format this week because of an end-of-year feature that turned out a bit longer than intended 🤦🏽♀️ New years resolution: write more concisely!

In this issue:

- Top story: US Treasury proposes crackdown on crypto transfers

- Feature: thoughts on top 10 institutional trends in 2020

- Momentum tracker

- Quote of the week

Top Story

US Treasury Proposes Crackdown on Crypto Transfers

- As expected, the US Treasury proposed regulations for transactions involving so-called “unhosted” wallets this week. At 15 days, the comment period is short vs. the usual 60 days, and also falls over the holiday period.

- According to Coincenter, the policies proposed by the Treasury are not as bad as the options laid out by FATF.

- However, “there are issues with this proposal, it’s rushed and has complicated new counterparty identification requirements that may be infeasible and innovation-killing in the context of cryptocurrency networks.”

- The proposal requires new counterparty recordkeeping requirements for transactions above $3,000. Satisfying those recordkeeping requirements could be infeasible in the context of cryptocurrency transactions. Existing recordkeeping requirements are risk-based.

- You can think of these obligations as Know Your Customer’s Counterparty requirements. This rule would make recordation of the counterparty’s name and physical address mandatory.

- Examples of problems these regulations may pose for crypto: How would an exchange record a name and physical address when its customer asks it to pay a smart contract? Or the address of a person with whom the customer is making an algorithmically matched decentralized exchange? These are exciting new use cases and the rule may hamper these important innovations.

Further reading

- FinCEN’s new rule is about to wall off the poor from our financial system forever

- The US is targeting crypto to expand the reach of its financial surveillance

- Tell Treasury Secretary Mnuchin to treat crypto equally

Thoughts on the top 10 institutional trends in 2020

I threw these out before diving into my predictions for 2020 last week. I think none of them needs a description, y’all know these were amongst the things that mattered in institutional crypto this year. Instead, I will share for each of these what I find most interesting and/or am most excited about in an institutional context.

Bitcoin

The hunt for yield. In an environment where some $3T of corporate bonds is negatively yielding and inflation is looming, investors turned to bitcoin to add much-needed yield to their portfolios. This same demand for yield is a recurring theme within many of the key institutional trends discussed here.

Price-insensitive demand. Post-March dip, bitcoin has been supported by institutional demand all the way up. In the words of Pantera “The [bitcoin] demand curve seems very price-insensitive. When people want in — like now — price doesn’t seem to have a large impact. On the flip side, supply seems very inelastic. It takes much higher prices to induce [holders] to sell”.

The only way seems to be up. I don’t hold strong views on where bitcoin will be at the end of 2021, except that it will be way up. Rationale? A lot of demand and scarce supply 😁 As I said last week, I believe that institutional demand will gather further momentum in 2021, providing a strong bid. I am bullish on corporate treasuries and retail demand (as access will continue to open up) too. A snowball that is starting to catch on basically.

The rise of the institutional investor

How institutions are gaining exposure. We discussed this a few weeks ago. At the moment, many (not all) larger institutions seem to be gaining exposure to crypto through traditional channels like CME and Grayscale. IMO the main reason is operational risk and complexity vs. current market size.

Institutional investors will pull the banks in, how will this change the game?

- How will this impact how institutions gain exposure to crypto? Will they be comfortable with direct investment if the banks take care of operational complexity?

- How will it change competitive dynamics?

- Will it unlock a war for talent and knowledge?

- How much balance sheet will they bring and how will that impact crypto credit markets?

- Will it accelerate developments in crypto, now that a different pool of talent is getting involved with the space?

The list goes on…

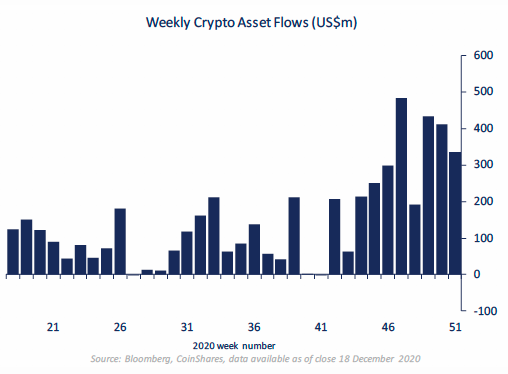

Fund flows became a thing. Grayscale, CoinShares, 3iQ all had banner years. CoinShares started tracking fund flows, an important gauge of investor sentiment within traditional asset classes, sectors, and the market as a whole.

Crypto-native Prime Brokers

What happens to PBs when big banks come in? The banks are powerful, have investment-grade ratings, and captive customer bases. The investment-grade point is important both from a counterparty risk and a funding perspective. Also, the top tier banks don’t tend to fail at these types of things, they will shoot with precision. Where does that leave crypto-native prime brokers?

Leading to my next point…

What winners will emerge and who will be acquired like B2C2? In my mind, there will be consolidation here. A few powerful ones like Fidelity, Coinbase, and Genesis will be able to survive on their own, others will get acquired or acqui-hired, or, refocus their attention elsewhere.

Developments around cross-margining. This is a capital efficiency concept applied by incumbent prime brokers where margin requirements are set on a portfolio basis. Portfolio margining is intrinsically linked with risk management, in particular, the PB’s ability to have an accurate view of the fund’s overall portfolio. In crypto, cross-margining doesn’t exist yet. Amongst other things, this a function of still developing risk management tools and a lack of sufficient capital and credit in crypto markets.

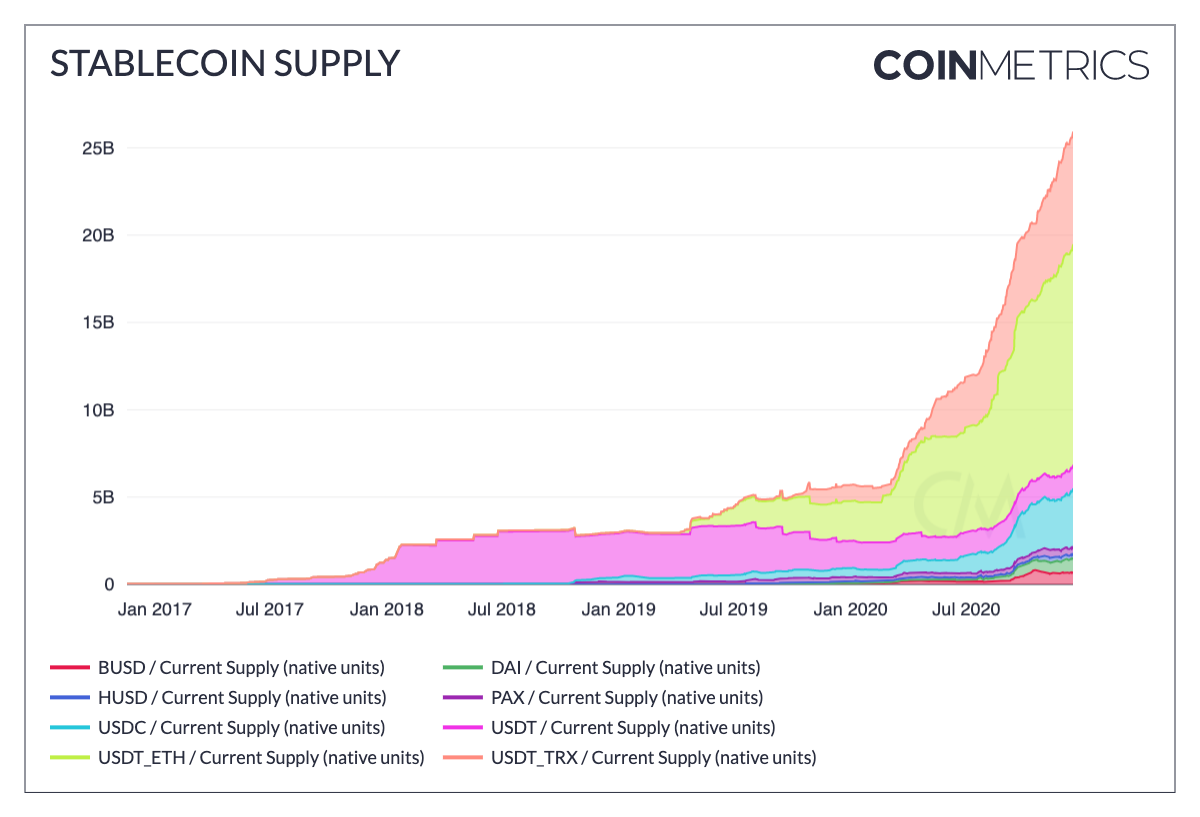

Stablecoin growth

Reasons for growth. Jeremy Allaire (USDC) shared his perspective with Messari:

- Growth in crypto asset markets themselves;

- Rising demand from Emerging Markets;

- Capital flowing into emerging interest rate markets on-chain (DeFi/yield farming), and;

- Businesses are starting to see the benefits of using stablecoins.

USDC upends Tether’s dominance. Although Tether remains dominant in absolute terms, USDC has gained significant market share. This was in part due to DeFi where USDC had a much broader role than USDT. According to Jeremy, the real shift will occur as more institutions come in and start building products that involve stablecoins. Tether won’t be fit for purpose here from a compliance perspective.

Central Banks are concerned about sovereignty. In particular, stablecoins that are widely adopted as a store of value and could trigger a large shift of bank deposits to stablecoins, which may have an impact on banks’ operations and the transmission of monetary policy.

This has fueled interest in…CBDCs.

CBDCs

Many central banks have announced projects related to CBDCs in 2020. China seems to be the only major one anywhere close to launch. Although broad implementation is still a number of years out, one thing is for sure — it will change monetary policy and the traditional financial system as we know it.

The devil will be in the details. Three variants of CBDCs have been proposed. These differ in intended scope (general vs. wholesale use) and system used (individual central bank accounts vs. token-based). The models have different implications for privacy and peer-to-peer transfer in particular.

Looking at the Bahamas for clues. The Bahamas launched their CBDC in October. Although tiny in comparison, it can offer clues on how CBDCs can be introduced and work in practice. This includes persuading people to use it.

Impact on commercial banks. I am a big believer that public blockchains will transform capital markets as we know them, in many ways. One thing that will likely change is the role of banks. An example is the CBDC model where individuals hold accounts directly with the central banks, which may drain deposits from commercial lenders, shaking up their business models.

Derivatives

The rise of options. In another sign of a maturing crypto market, listed options volumes have increased exponentially in 2020. Options allow investors to hedge unwanted exposure, express views in a levered way, and enhance portfolio yields. Deribit is the king of options while platforms like skew are providing critical data and analytics for traders.

The rise of OTC derivatives. An OTC market providing bilateral derivatives contracts like options and forwards has also developed. OTC derivatives are customized and fill a gap for larger trades where market liquidity isn’t deep enough or investors have specific needs. Paradigm has been front and center to OTC derivatives. Its solution enables institutions to directly negotiate crypto-derivatives trades with counterparties via chat. Deribit handles execution and clearing which eliminates the need to have an ISDA in place with every single counterparty.

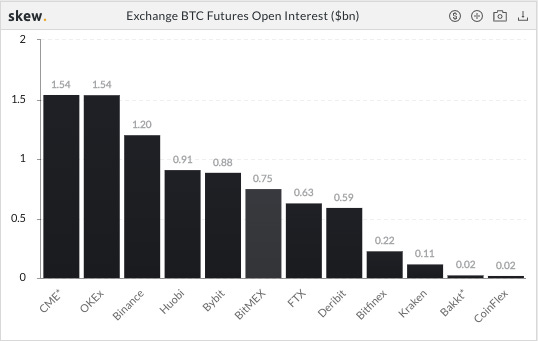

Open interest of CME bitcoin futures has increased significantly in 2020. This is a reflection of institutional demand. Open interest is a measure of market activity, the flow of money into a market. Increasing open interest means new money is coming in.

CME’s open interest for bitcoin futures is currently the highest amongst crypto futures markets.

Lending

The three most common ways to generate yield:

- Spot lending: lock up assets in exchange for monthly interest payments;

- Call overwriting: sell an out-of-the-money call option against a long position and collect the premium as additional yield;

- Liquidity mining: emerging DeFi platforms have bootstrapped growth by incentivizing new users with negative fees. Users receive platform tokens in exchange for locking up capital. Platforms like Yearn help users maximize their yield across platforms.

Why are yields so attractive in crypto credit markets? A still inefficient crypto market structure allows arbitrage opportunities to persist. The carry trade that exploits the price discrepancy between cash and futures markets is one of them. Implied return rates are high while capital is scarce so investors are willing to pay up to borrow.

Risk management is key in lending. The counterparties with the most robust risk management frameworks will win over time. 2020 saw one casualty with crypto lender Cred filing for bankruptcy. One thing is for sure, there will be more.

Regulatory (in)action

Many suits and penalties, little clarity. US regulators went for it this year with actions against high profile targets like BitMEX, Telegram, Kik, and Ripple, amongst many others. In the meanwhile, they gave little more clarity on what rules to play by.

People are concerned about innovation. At the moment, regulators seem to favor bans and restrictions.

A few bright spots: the OCC, the SEC’s Hester Peirce, and — I know, it’s tiny — the modernized accredited investor definition.

M&A

2020 brought the highest crypto M&A volume on record. According to The Block, 83 acquisitions happened in 2020 for a total volume of $691M.

Brokerage and market data were major themes. Notable deals included:

(Prime) Brokerage

- Coinbase/Tagomi

- SBI/B2C2

- BitGo/Lumina

- Gemini/Vo1t

- Voyager/LGO and Voyager/Circle

Market data

- Binance/CMC

- CB Insights/Blockdata

- FTX/Blockfolio

DeFi M&A is here. Yearn pioneered this new trend where DeFi protocols are merging. Lex Sokolin noted that the value of the “deals” is not in the rails, but in the communities and the people that built the protocols.

DeFi

A lot has been written about DeFi by people a lot more qualified than I am. Here is what I am excited about from an institutional standpoint.

Testing and innovation of token mechanisms. Not strictly DeFi, but definitely an area where a lot of innovation and testing is happening right now. Two thoughts:

- New ways of doing things. Take the concept of liquidity mining. This is a mechanism for bootstrapping user growth that can be applied in many different contexts as we build this new financial system.

- One of my favorite things about Ethereum is the role that it can play in capital formation for “centralized” companies, too. Token mechanisms are front and center to that. The sky’s the limit in terms of design opportunities. I imagine that over time blueprints for primary markets will emerge. It will be interesting to see what is to come and what will stick.

Lego blocks. People like to describe DeFi protocols as lego blocks that can be mixed and matched to build new capital markets products at the application level. Mutualized infrastructure built for the industry by the industry that can be used by anyone freely and makes markets interoperable. There are examples of this in the “old world”, like SWIFT for cross-border payments and FIX for electronic trading. DeFi protocols can take this many steps further.

DeFi protocols are algorithms. DeFi protocols do so much more than the traditional mutualized ones. The purpose of CeFi protocols like FIX is the exchange of messages. DeFi protocols on the other hand are vibrant algorithms, they can execute logic. Think about that!

The Corporate Treasury

MicroStrategy is a very interesting case study. With $1.6B in BTC treasury holdings, the firm is very exposed to BTC, obviously. Although that is great for crypto, and we are all bullish on bitcoin, the magnitude of the holdings significantly changes the profile of the company from an investor’s perspective. Regardless, corporate treasuries diversifying into bitcoin is an exciting development for crypto.

Banks will generate demand from corporate treasuries. As soon as banks open crypto trading desks investment bankers will start pitching bitcoin to corporate treasurers. Their trading desks will execute the trades.

Corporate Crypto Derivatives (“CCD”) will become a thing. Next, bankers will pitch corporate crypto derivatives. Strategies like call overwriting to enhance yield or buying puts to hedge downside risk on their crypto treasury holdings. Mind you, these trades are lucrative business. The same CCD bankers will recognize the novelty of the token and start innovating primary markets. Watch my words.

Momentum tracker

- Jefferies’ Chris Wood cuts exposure to gold, invests in Bitcoin. This is a big deal. Woods’ “GREED & fear” is widely followed.

- Elon Musk inquires about converting ‘large transactions’ into Bitcoin. On Twitter of course 🤷🏻♀️

- $9.2B hedge fund SkyBridge is launching a bitcoin fund, $25M invested. Fidelity Digital Assets is the “back office” and “storage mechanism.” SkyBridge granted two of its funds permission to “seek exposure to digital assets” in mid-November without specifically mentioning bitcoin.

- Reuters reports that total crypto fund inflows top $5.6B this year, up more than 600%.

- BlackRock is hiring a blockchain investment VP.

- Bitcoin is not money, it’s a form of exchange, Pimco‘s Tony Crescenzi says. “Bitcoin has no trusted source, and that’s where it gets a little dicey,” Crescenzi said on “Bloomberg Surveillance.” Interesting, I watched the video, and — with all due respect — he sounds confused. I think there are a lot of people from a certain generation that find it hard to grasp the concept of bitcoin and crypto. Lots of “translation” work to be done still…

Quote of the week

[Dan Morehead’s] Tiger Cub friend/TMT investor: “We don’t invest in bitcoin because there are no cash flows to discount.”

Dan Morehead: “Well, there are no cash flows to EUR/USD either, but nobody thinks twice about trading it.”

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.