BTC crossed $20K, quickly surged past $21K, then $22K, and finally $23… What a crazy year it has been, you can’t make this stuff up! Although most of us will be happy to close it off, 2020 will definitely go down into history as a turnaround point for the crypto industry. In my mind a strong base for many good things in 2021. 🚀🚀🚀

In this issue:

- Ten institutional crypto predictions for 2021

- Institutional momentum tracker

- Further signs of demand for institutional-grade market data

And: food for thought top picks, the big picture.

Top Story

Robinhood pays $65M to settle charges of misleading customers

- The SEC charged Robinhood, whose consumer-facing services include crypto trading.

- In a statement, the SEC highlighted “repeated misstatements that failed to disclose the firm’s receipt of payments from trading firms for routing customer orders to them, and with failing to satisfy its duty to seek the best reasonably available terms to execute customer orders.”

- “Robinhood provided misleading information to customers about the true costs of choosing to trade with the firm.”

- Robinhood did not admit or deny the allegations and said “The settlement relates to historical practices that do not reflect Robinhood today.”

- The event highlights the importance of independent best execution that can be gained through employing institutional-grade crypto trading technology and agency services by intermediaries like prime brokers.

And, HOT 🔥 off the press: Coinbase Files for Initial Public Offering

Connecting the Dots

Ten Institutional Crypto Predictions for 2021

In institutional crypto, 2020 was the year of (in no particular order):

- Bitcoin

- The rise of the institutional investor

- The primer broker

- The stablecoin (and CBDC noise)

- Derivatives

- Crypto lending

- Regulatory (in)action

- M&A

- DeFi

- The corporate Treasury

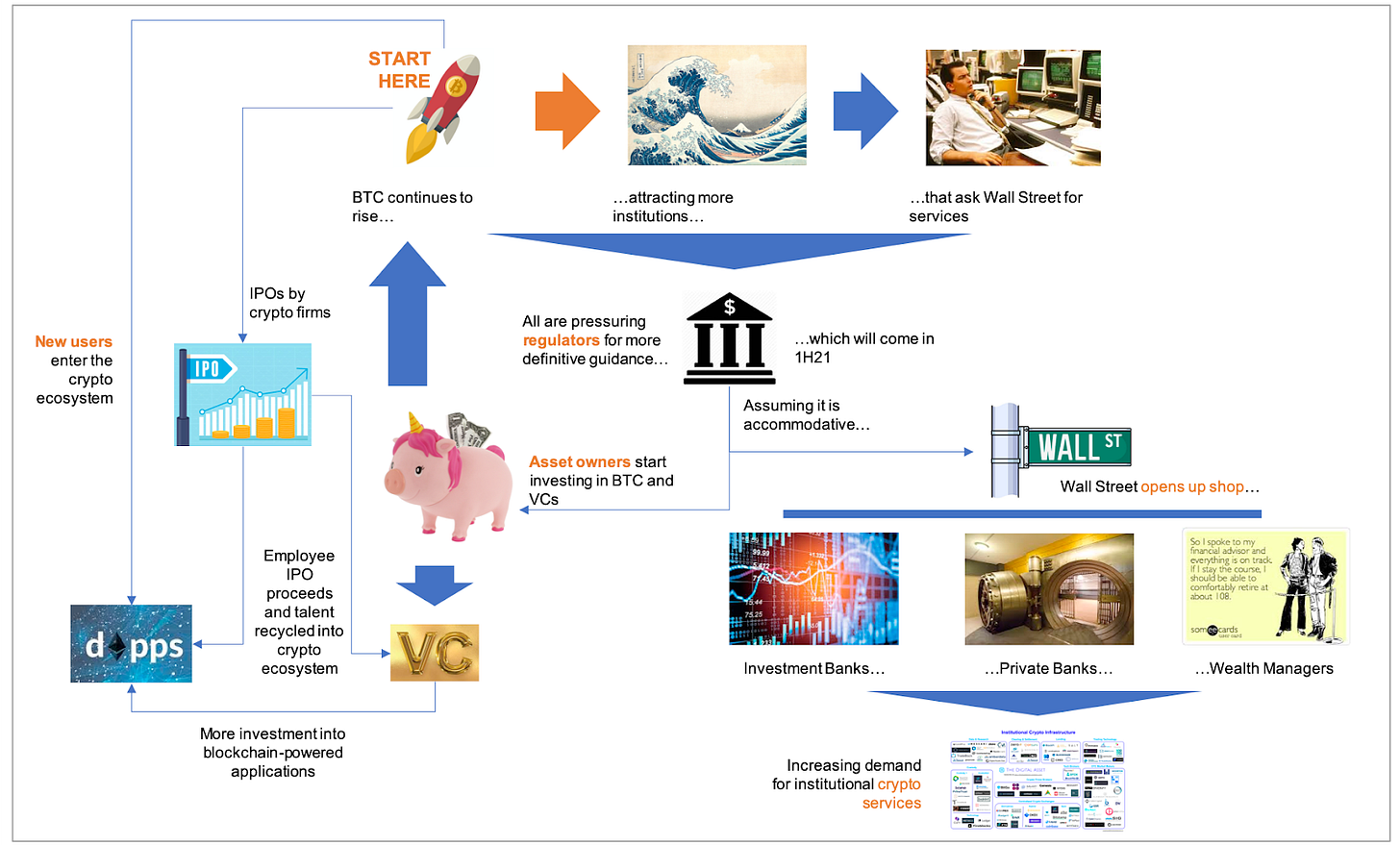

Against the backdrop of the pandemic bitcoin emerged as the top performing asset of 2020 and has brought the institutional momentum we have all been waiting for. What is 2021 going to bring from an institutional perspective, building on what we have got?

Below are my brief thoughts. I would love to hear yours!

#1 More definitive statements from regulators around crypto in 1H21

There are a number of developments contributing to this:

- More retail investors have gained exposure to bitcoin through FinTech providers like Paypal, Robinhood, Revolut who all entered the game this year and made it easier for a broader audience to buy and sell bitcoin;

- Institutional investment products like Grayscale, CoinShares, 3iQ had a staggering year as evidenced by fund flows (see below);

- Bitcoin and crypto are in mainstream headlines every day now;

- Banks must be getting more inquiries from institutional investors and putting pressure on regulators. Banks are powerful, as we saw in case of OCC guidance earlier this year which was reportedly triggered upon request from a major US bank.

All of this will put pressure on regulators to create clarity around, amongst other things, what constitutes a security and therefore what rules investors and institutions have to play by. Hopefully new guidance will be accommodative and in the spirit of the OCC announcements and not kill innovation.

Caveat: on the back of recent statements by the G7 and noise from the current US Treasury there is anxiety around potential harmful regulations for self-custody wallets. If materialized, these regulations are likely to require financial institutions to verify the self-hosted wallet owner by collecting identifying information about them before allowing the withdrawal.

Once there is more clarity around the rules the market has to play by, and assuming these are accommodative, it opens the door to…

#2 Larger banks will start offering crypto services

These will include a few top-tier banks that have taken a proactive and innovative approach towards crypto-assets. At the outset these services will center around custody and trading for BTC and potentially other top crypto-assets including ETH. Demand from corporate clients that are interested in buying BTC for their Corporate Treasury could be a factor here too. Money talks after all, definitely on Wall Street.

We have seen a preview of banks entering the space in recent weeks in more progressive jurisdictions like Switzerland and Singapore, as discussed last week. Banks including DBS Bank, BBVA, and Standard Chartered have already announced their intention to start offering crypto services in 2021. Just this week, Japanese financial conglomerate SBI acquired B2C2 and announced it will launch a crypto trading desk.

In addition to investment banks, private banks and wealth managers will enter the game too. These will be joined by FinTechs that aren’t providing crypto services yet.

This will have the downstream effect of…

#3 Flourishing of crypto-native businesses

This is the moment many crypto market infrastructure providers have been waiting and building for since the 2017 boom. We looked at this space a while back. See map here.

This will include ongoing success for:

- Lenders: on the back of the hunt for yield and demand for credit from crypto traders

- Further derivatives market growth, development, and innovation

- Custody and security (Fireblocks, Curv, Copper)

- Stablecoins: growth and expansion of use cases (regulations allowing)

- Investment products: both “plain vanilla” and more creative yield enhancing structures.

One area in particular where I expect to see significant progress and momentum is crypto market data, called out separately below.

In addition, more traditional finance people getting involved in crypto means talent looking at problems that still have to be solved, through a different lens and with fresh eyes. I am thinking in particular of capital efficiency (credit, cross-margining) and OTC clearing and settlement.

Furthermore, it will be very interesting to see how institutions will interact with crypto. As discussed last week, at the moment it looks like large hedge funds are primarily gaining exposure to bitcoin through indirect channels like CME and Grayscale. What will happen when the banks come in, will this change? And what will be the dynamics between the banks and crypto-native providers?

Leading to my next prediction…

#4 Bank-crypto partnerships, M&A, and investments

Banks will be looking for crypto partnerships and M&A targets. These include banks that are ahead of the game, and banks that are way behind and will need to get lots of in-house expertise including through aqui-hiring.

We have seen early signs of this including:

- This week’s SBI/B2C2 acquisition;

- Crypto prime brokers mentioning conversations with Wall Street about sub-custody;

- Recent rumors about JPMorgan looking for custody targets.

Referring back here also to an interesting comment by Michael Shaulov of Fireblocks:

“The small subset of crypto companies that are leading from a tech and servicing standpoint are expensive and banks aren’t going to be able to justify paying $300-$500M for wallet technology at this stage. If they want the shiniest technology, they need to partner with the provider or license it.”

Other high profile financial institutions will continue to look for exposure to crypto by making investments in crypto-native infrastructure providers. State Street/Lukka and AmEx/FalconX are examples within the last week.

#5 Crypto market data will have its moment

As we discussed before, crypto market data has been lagging in terms of institutional-grade quality and services. Reliable high quality market data is an important element though for institutions entering this market. There has been an uptick in announcements in this area recently, and I expect this to be an area that will come to fruition in 2021.

This includes:

- More institutional-grade offerings (market data aggregators, indices) coming to market;

- Key exchanges developing licensing policies for redistributing data and the development and adoption of standards around things like ticker symbology.

To refresh your mind on recent news in this area: Fidelity is piloting Sherlock Analytics, Lukka/IHS partnership (IHS was subsequently acquired by S&P), FTSE Russell DAR Reference Price index.

See feature below as well for further stories in the news this week.

#6 Asset owners making allocations to the space

Crypto funds have been knocking pension funds’, endowments’, and other allocators’ doors since at least 2017. A number of these institutions have been studying the space and tracking funds’ performance for 24-36 months now. I would expect to see some movement here in 2021 on the back of institutional momentum, a nod from the regulator, and historically low yields. Beneficiaries would be crypto-focused VCs as an alternative investment and bitcoin as a portfolio diversification strategy.

These funds tend to make sizable allocations and an influx into VC funds, together with other factors, will hopefully lead to…

#7 Decentralized applications (dApps) gaining more momentum

This is important for the crypto space to grow in the medium term as it will set the stage for a more diversified and bigger asset class 2-3 years down the road.

We have seen some signs of product-market fit in areas like DeFi, with applications around NFT and fan engagement gaining traction. However, adoption by a broader (retail) audience and user friendliness aren’t there yet.

Money flowing into VC’s means a bigger pool of money for applications built on top of Ethereum and other smart contract platforms. Together with trends like more prospective users entering the ecosystem (through retail brokers), DeFi momentum, resulting testing and improvement of token economic mechanisms, and fresh talent, I see this space gaining further momentum in 2021.

#8 The first crypto IPOs

A few crypto companies including Coinbase and BlockFi have hinted at a potential IPO in 2021. (And Coinbase just filed!)

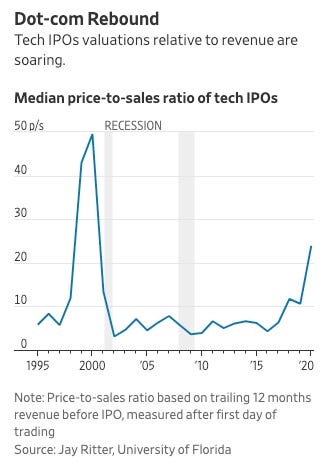

This will be beneficial to the space as a whole and also set the stage for further IPOs by crypto-native companies beyond 2021. Both on the back of potential exponential revenue growth in 2021 and the revival of the IPO market in 2020.

Benefits include:

- Further increase in visibility and credibility of crypto as an industry and asset class;

- Wall Street investment banking departments will get involved (underwriting and managing the IPO), hopefully unlocking interest in digital assets and new forms of capital ;

- Wall Street research departments will start covering crypto companies which will require them to form a broader view on the space. This will benefit institutional investors and attract further interest, potentially from mutual funds;

- IPO proceeds received by crypto-company employees may be recycled back into the crypto ecosystem through investment, new VC funds, and new companies built on top of public blockchains.

#9 China will launch its CBDC

This is primarily based on the back of all the signs we have seen that point in this direction, including various tests targeting consumers and statements made by high-ranking officials. See “CBDC Highlights” sections in prior Thursday Threads posts for detail.

Jeremy Allaire of Circle made an interesting comment yesterday on a Messari-hosted call. He believes that DCEP is an effort to counter the effective duopoly of AliPay and Tencent in the payments space, which is likely seen as too powerful by China’s communist party. I can definitely see this and this fits in with recent pushback on Ant and other FinTechs. Another signal that DCEP may come sooner rather than later.

#10 Corporates leveraging blockchain to issue securities

This one is not per se crypto, rather digital assets in general, but definitely institutional.

I am thinking of two areas in particular here:

- Private company equity and debt deals (including club deals), and;

- Asset-backed securities (illiquid fixed income).

I have been wondering why we haven’t seen more of this because it seems to make so much sense. However, it is obviously complicated from a regulatory, governance and technical perspective. I am thinking things like integrations with legacy systems, having an onramp, and aligning stakeholders.

It seems that things may finally come together in 2021, both anecdotally as well as judging from market signals like stablecoin momentum, this week’s news that Germany has legalized electronic securities on the Blockchain, and imminent licensing of regulated liquidity venues.

That’s it!

Institutional Momentum Tracker

Crypto witnessed further institutional momentum this week from a number of different angles.

- Japanese financial group SBI acquired crypto trading firm B2C2 for undisclosed sum. Reuters declared this makes SBI the “first major financial group to run a digital asset dealing desk.” According to B2C2 co-founder Max Boonen institutions have no longer an excuse [to not get active in crypto]. “They can now trade electronically on a FIX connection against a bank, then keep their coins with any of a plethora of regulated custodians and have their crypto balances audited by a big four firm.”

- Bitcoin Whale Emerges With $1B, Alan Howard’s Backing. Volatility specialist hedge fund One River Asset Management has quietly bought more than $600M+ in crypto. The firm has commitments that will bring its holdings of Bitcoin and Ether to about $1 billion as of early 2021. One River is joining forces with Alan Howard of Brevan Howard. Howard is an investor in the fund, bought a stake in the firm, and is providing trading services, market analysis and technical support through Elwood Asset Management.

- American Express Dives Deeper Into Crypto With FalconX Investment. “Amex Ventures invests in startups as a way to better understand emerging areas of the payments ecosystem,” Harshul Sanghi, global head of Amex Ventures, said in a statement. FalconX is doing around $3B in transaction volume monthly, and has 250 institutional clients. Revenue has increased by 350% since May.

- British fund Ruffer put on a $745M bitcoin bet. $27.3B Ruffer Investment Management last month made a bet on bitcoin now worth around $745M. The investment “acts as a hedge to some of the risks that we see in a fragile monetary system and distorted financial markets.” The allocation was made through a third-party manager, and represents around 2.7% of Ruffer’s total assets. “We see this as a small but potent insurance policy against the continuing devaluation of the world’s major currencies,” Ruffer said in a memo seen by Reuters.

- Banca Generali Leads $14M Round in Wallet Firm Conio. Banca Generali, a subsidiary of Italy’s largest insurer, is leading a $14M investment round in Conio, a crypto wallet provider popular in Italy. A commercial distribution agreement to start offering Conio’s services to Banca Generali customers in 2021 has also been signed.

- MassMutual Purchases $100M Bitcoin, Invests $5M in NYDIG. Massachusetts Mutual Life Insurance Co. bought $100 million of bitcoin for its general investment account. The general account is where an insurer deposits premiums from policies it underwrites. Insurance companies tend to invest these premiums in order to boost their earnings. The firm purchased the bitcoin through NYDIG, in which it also acquired a $5M minority equity stake .

- Record weekly inflows for Ethereum Products. Ethereum saw its largest weekly investment product inflow on record of $160M, far surpassing the previous week’s record inflows of S$87M per CoinShares data. Bitcoin saw inflows of US$424m.

Further signs of demand for institutional-grade market data

- Bitcoin’s recent price ‘dislocations’ highlight differences between the crypto and equities markets. Bitcoin can trade at wildly different prices across exchanges which can be blamed on the immaturity of crypto’s market infrastructure, according to The Block. In the equities market, an established system of cooperation and trust between exchanges helps keep prices from dislocating the way they do in the crypto market.

- What Is Bitcoin Worth? Resurgence spurs demand for better tracking tools. Market participants agree that bitcoin hit a record recently. What they don’t agree on is the level of that milestone or even when it was set. “That’s the biggest problem for trading, getting that historical data. Where do you pull the data from? There’s no NYSE, no ICE or Nasdaq that will match up exactly with every other provider.” Too many good points to summarize, worth a read!

- Cboe Plans to Launch Cryptocurrency Indexes in Q2. The exchange owner will launch a suite of tools in 2021 in a licensing partnership with execution provider CoinRoutes. Cryptocurrency indexes, historical data and real-time ticks are all on the table.

Food for thought top picks

Bakkt is aiming to help consumers tap into their loyalty points

Bakkt is rolling out an app where customers can track all of their digital assets, from loyalty points to gift cards, in one place. The app will allow users to exchange rewards and loyalty points for one another or for cash. Bakkt has already partnered with points programs at American Express, Chase, Chipotle, and JetBlue, among others.

This is a really interesting development and a great use case for tokens.

Next step: corporates using tokens as a mechanism to raise funds from and share growth with customers.

Why corporate treasurers may consider bitcoin (Fidelity Research)

The unparalleled nature of the current economic crisis is pushing forward-thinking corporate treasurers to consider adding bitcoin to their balance sheets. Recent announcements from the likes of Square and MicroStrategy represent a trend that could continue to grow as businesses weigh the risks of historically low-interest rates, diminished liquidity, and inflation.

Companies that chose to allocate to bitcoin have benefited from recent outperformance. On the other hand, the value of cash has depreciated this year relative to goods consumers buy and other fiat currencies. According to Bloomberg’s dollar spot index, it is down 5% YTD.

Fidelity expects the trend of diversity in bitcoin participants to continue as different types of investors look for investments with an asymmetric return profile and low correlation to traditional markets.

Trading at 369% Premium, New Crypto Fund Astounds Even Bulls

Bitwise 10 Crypto Index Fund saw its share price balloon 369% higher than the value of the Bitcoin and Ether tokens that it holds. The dislocation means investors are paying up for access to the fund, instead of buying its underlying holdings outright for far cheaper. According to Kyle Samani this is a reflection of buyers that don’t understand crypto (yet) and are looking for a reasonably constructed index. “I don’t think they can justify the premium, I just think they don’t know what they’re buying.”

The Big Picture

Fed intervention saves the corporate bond market

Tracy Alloway quoting Citi in “5 Things”: “The year that nearly broke the corporate bond market revealed a previously unknown fault line in the Federal Reserve’s reaction function. Investors will not soon forget the central bank’s brief but momentous foray to restore the flow of corporate credit at a time of frozen new-issue markets and alarmingly rapid redemptions from credit mutual funds. Even after the Corporate Credit Facilities are deactivated on Dec 31, the tendency of corporate credit investors will be to assume a CCF 2.0 will be waiting in the wings if market failure ever looms. This should lower the liquidity risk premium for U.S. investment-grade credit for years to come.”

Fund managers with $9T in AUM set net zero goals

Thirty of the world’s biggest asset managers, which collectively oversee $9T, have set a goal of achieving net zero carbon emissions across their investment portfolios by 2050 in a move expected to have huge ramifications for businesses globally. The decision means asset managers would be forced to shun companies that are ill prepared for a lower carbon economy if they are to meet their net zero targets.

Google Services Including Gmail, YouTube Suffer Major Outage

The failure stopped users from accessing a wide number of products and is notable for its pervasiveness across services.

Sizzling Tech IPO Market Leaves Investors Befuddled

A frenzy has hit the market for newly listed tech stocks. Valuations of recent IPOs are at their highest levels since the dot-com bubble, relative to the companies’ revenue, sparking concerns among investors about the level of froth. “I have a great deal of difficulty understanding the valuations of some of these companies,” Florida business professor Jay Ritter said.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.