In this issue

- Redefining Crypto as an Asset Class

- In case you missed it: summary of the top stories + “food for thought” top picks

Any views expressed are my own and do not represent the views of my employer.

Redefining Crypto as an Asset Class

TL;DR: Many agree crypto is a new asset class and there is even some agreement on key investment theses. However, the waters remain murky when it comes down to clearly defining crypto as an asset class. The indiscriminate use of terms such as digital asset, security token, cryptocurrency, and decentralization doesn’t help here. This article attempts to create clarity around that by establishing conditions that determine whether an asset is a cryptoasset.

2017 was the year that institutions began to think of crypto as a new asset class, distinct from other asset classes. ARK Invest published an influential paper titled “Ringing the bell for a new asset class” against the backdrop of a booming ICO market.

The technologies underpinning the asset class, the applications, and the broader ecosystem have all continued to evolve at the speed of light since then. The conviction that crypto is indeed a new asset class has grown with it. Although skeptics remain, anecdotal evidence suggests that a majority of institutional investors is at the very least researching the asset class. In the meanwhile, a whole new market infrastructure has been built out, attracting billions of dollars in investment. And regulators across the globe are taking crypto very seriously, implicitly or explicitly referring to it as a distinct asset class.

However, the waters remain murky when it comes down to clearly defining crypto as an asset class. The indiscriminate use of terms such as digital asset, security token, cryptocurrency, and decentralization hasn’t helped here.

In my opinion, it is important to create more clarity around this, in particular from the perspective of prospective adopters. In this article I will attempt to define the boundaries of crypto as an asset class. I will first lay some groundwork on digital assets and public blockchain. Next I will define conditions for a digital asset to classify as a cryptoasset, and finally, I will test these on some “edge cases”.

At risk of sounding like a consultant, to leave no scope for murkiness, my aim is to define crypto as an asset class in a “MECE” way. This means that as a class it is Mutually Exclusive (cryptoassets don’t fit into another asset class) and Collectively Exhaustive (all digital assets that are not considered cryptoassets fit into another asset class).

I am looking forward to you breaking that!

What are digital assets?

According to Wikipedia a digital asset is anything that exists in a digital format and comes with the right to use. The emergence of blockchain technology has given a whole different dimension to this term, in particular in the context of major investable asset classes.

In this context, a distinction can be made between blockchain-native assets and tokenized assets. In computing, “native” means designed for or built into a given system. So, in other words, these are assets whose ownership is exclusively reflected by an entry on a digital ledger (aka blockchain) and not by some form of certificate that exists in “the real world”. A tokenized asset, on the other hand, is a digital (on-chain) representation of an underlying real or financial asset that is held ring-fenced off-chain, in the “real world”. Basically a traditional asset wrapped inside a piece of tradable code called a token. An example of this is tokenized real estate that is held in an SPV.

Please note that the recording of an asset on a distributed ledger does not change its economic characteristics.

Cryptoassets are a subset of the blockchain-native category.

Back to public blockchain basics

Bitcoin, the first cryptoasset, was originally conceived as peer-to-peer electronic cash for the internet. Its underlying technology, the Bitcoin blockchain, unlocked a revolution expected to reinvent financial and social structures by cutting out the middleman.

There are four concepts in web applications that have traditionally been in the domain of centralized control: identity, wealth, data, and computing. Each of these requires trust in a provider. This trust is monetized by middlemen in many different ways: big tech selling user data, banks charging hefty fees and controlling access to the financial system, governments printing money (effectively bits and bytes on the ledgers of banks). Public blockchain technology is trustless and allows users to be in control of these things.

In a nutshell, public blockchains are computing platforms (networks) that are not controlled or owned by any one party but are collectively controlled and owned by all network participants. Public blockchains are decentralized; purely distributed peer-to-peer networks. The key innovation that made this possible (for Bitcoin) is a new incentivization system (proof-of-work) powered by a token (bitcoin). A token is a scarce natively digital asset represented by an entry on a digital ledger (the blockchain). Cryptographic techniques are used in the recording and the transfer of ownership of these tokens, hence the name cryptoassets. In essence, a public blockchain is an encrypted database, a digital ledger, shared across thousands of independent computers rather than held on the server of a single entity. Just like most web applications are effectively a user interface (what you see on your screen) on top of a database kept on a central server (e.g. Facebook, Venmo).

To further clarify the incentivization part, the token (something that can have value and is freely transferable) acts as a mechanism that incentivizes network participants to collectively act as the middleman. A breakthrough in game theory, reflected in the code of the bitcoin protocol, lies on the basis of this invention.

A brief note on the technology stack underpinning crypto assets

Software systems, like blockchain, consist of an implementation layer that deals with everything under the hood and an application layer that is concerned with the user’s needs.

Simplistically, I think of the technology stack underpinning cryptoassets as 3 layers:

- Layer 1 = smart-contract platforms powered by a peer-to-peer distributed blockchain

- Layer 2 = protocols, basically, infrastructure built on top of a blockchain, that can be leveraged by applications to do certain things

- Layer 3 = decentralized applications

Tokens play different roles at each of these three levels but all of these tokens separately and collectively can be thought of as cryptoassets and can be used to transfer value.

Conditions for a digital asset to classify as a cryptoasset

Then, what defines crypto as an asset class? In other words, what conditions determine whether an asset is a crypto asset, or a “mere” blockchain-based digital asset in the broader sense of the word?

Let me first explain how I went about this:

- Brainstorm a number of condition/properties of cryptoassets I thought that had to be true, or false, for a digital asset to be a cryptoasset;

- Next, test these hypotheses:

- Looking at the universe of crypto assets, layer by layer, using the Messari screener to categorize and pick assets;

- Considering “edge” cases like stablecoins, exchange tokens, etc.;

- Select conditions that have to be met for something to be called a cryptoasset.

These are the conditions that I came up with.

The network or application must run on a public blockchain

The application must run on a purely distributed peer-to-peer network, a decentralized implementation layer. Why? This is the basic promise of public blockchains, they are trustless, not controlled by any one party. Blockchains that restrict reading and writing access (permissioned and private blockchains) tend to have some other core objective like cost savings, infrastructure efficiency enhancements, or having a single source of truth.

For actual blockchains, the level of decentralization is very important but can vary based on secondary objectives of the blockchain like security, speed, flexibility, scalability, and cost. At the application level, trust is less binary as most of the business logic may be run off-chain for efficiency and other purposes.

Sub-conditions that may or may not be implied by this

- The network/application is powered by a token (the cryptoasset) that allows for the transfer of value;

- Access to the token is cryptographically secured and solely controlled by a private key that is controllable by the token holder using wallet technology;

- Ownership of the asset is recorded on a digital ledger;

- The network is stakeholder-centric in that there are parties beyond the operator/issuing entity and “pure” investors. This is another way of saying that the token has some form of utility (as an incentivization mechanism, discounts, voting, access, etc.) in the network and is not solely an investment (or speculation) vehicle. Whether that utility is actually valuable depends on the token structure.

The asset does not represent a formal financial claim

The token is not and does not represent a formal financial claim on any identifiable entity. Let’s look at debt and equity to clarify this. Debt is a claim on an entity’s assets (principal) and cash flows (in the form of interest). Equity represents a claim on residual assets and excess profits in the form of dividend (the latter is discretionary). These are formal claims, amounts that by legal agreement must be paid to the buyer of the security.

The initial sales of cryptoassets are typically pursuant to a white paper which is not a legal document. Token holders do not have legally enforceable rights or guarantees that an issuer will deliver on the promises made in the white paper. Instead, on-chain, open source code manages token settlement and business result verification at the application level. The specific economics behind the token are coded into this. Any protocol rights (access, voting, discount, work, etc.) are governed by code. The owner of the private key of the token is cryptographically entitled to these rights. In effect, the user puts trust into the blockchain-based token and the network as a whole. In this respect, it is important how the token is governed, i.e. what power does the operator/issuer of the token have to change any or all aspects of the network. In particular at the application level this is not binary and users may have to place varying levels of trust into the operator of the token.

Further to the above, there are a whole spectrum of tokens out there that are poorly structured. Many of these were a product of the ICO boom and never delivered on promises made. Others were structured at a time when the space was more nascent and mechanisms less battle-tested. In order for a crypto-asset to have longevity and accrue real economic value, proper structure is important. However, this does not impact the fact whether a token is a cryptoasset or not.

Testing some edge cases

Next, I am looking at some “edge cases” to test the boundaries set above:

- Stablecoins pegged to fiat and issued by a real world institution are digital assets but not cryptoassets because there is a claim on the issuing institution and their fiat reserves.

- Exchange tokens are cryptoassets because they are issued on public blockchains, have utility, and don’t represent any formal claim on the issuer.

- Blockchain-native bonds remain financial claims, whether they live on a digital ledger or not. In addition, corporate bonds don’t need to be trustless, the point is to upgrade the infrastructure for cost and efficiency savings. Therefore, these classify as digital assets but not cryptoassets.

- CBDCs will just be a change of form but remain government controlled and represent legal tender (a claim on an entity) meaning they are digital but not crypto assets.

- Tokenized real estate is securitized through a legal wrapper. This means investors have a financial claim on an investment vehicle like an SPV or a fund. As such, it is a digital (tokenized) asset but not a cryptoasset.

- “Security tokens”: whether a token is a security or not has nothing to do with whether it is a cryptoasset or not. It depends on the structure of the asset, the issuing entity, and the conditions surrounding the offering. It is a confusing term and both digital assets and cryptoassets as a subset can be securities.

In summary

We discussed that blockchain technology enables major asset classes to go digital. It has also led to the emergence of a new asset class of its own, cryptoassets.

We defined the following boundaries to define crypto as an asset class and distinguish crypto assets from “ordinary” digital financial and real assets:

- The network or application must run on a public blockchain.

- Sub-conditions that may or may not be implied by this:

- The network is powered by a token that allows for the transfer of value;

- Access to the token is cryptographically secured and solely controlled by a private key that is controllable by the token holder using wallet technology;

- Ownership of the asset is recorded on a digital ledger;

- The token is not solely an investment vehicle and has some form of utility in the network.

- The asset does not represent a financial claim.

Please share any feedback you may have!

In case you missed it…

BitMEX Faces US Criminal Charges

- The founders of crypto-derivatives exchange BitMEX were charged with evading U.S. laws preventing money laundering and hit with civil sanctions.

- Federal prosecutors claim BitMEX served US customers while defying banking laws; the CFTC brought a parallel civil action.

- BitMEX has disputed the charges saying it has “always sought to comply with applicable U.S. laws, as those laws were understood at the time and based on available guidance.”

Why does this matter?

- There has been an increase in regulatory enforcement against crypto firms recently in the US, but no further regulatory clarity.

- This is not good for the US, and companies like Ripple are considering moving their HQs because of the US “hostile stance” towards crypto companies.

- According to Ben Evans, the US has similar problems in the general arena of the internet.

- There are bright spots like the recent OCC announcement and the SEC’s Hester Peirce, but more is needed.

Ongoing flow of talent into crypto

- Crypto Firms Grow Legal Ranks With Dyson, Goldman Recruits.

- Marty Chavez joining Block.one’s advisory board as chairman.

- Goldman Sachs partner joins Galaxy Digital.

In the meanwhile…

Mike Novogratz of Galaxy Digital told Forbes that “Goldman Sachs is going to have to get into crypto themselves,” adding that Galaxy has an advantage in understanding DeFi and crypto but Goldman has “a ton of talent” that it will use to catch up within the next “three of four years.”

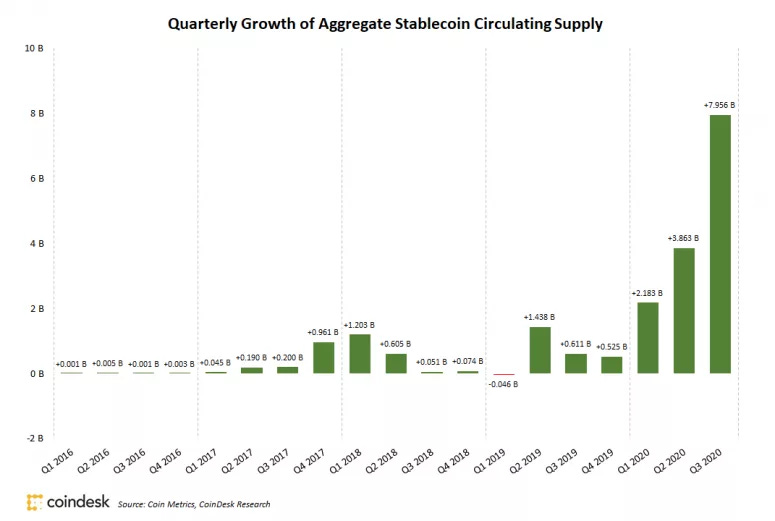

Total Stablecoin Supply Nearly Doubled in Q3, Nearing $20B

Why does this matter?

- Decrypt writes that stablecoins are a catalyst for bringing new crypto users to the market and have the potential to increase b2b efficiency.

- However, “third-party stablecoins run the risk of being made irrelevant” with the potential release of CBDCs.

- According to Fidelity’s Raghav Chawla: “What’s the role of other USD-pegged stablecoins when you can use the central bank’s digital currency? At least for the next decade or more, though, I think stablecoins will play a pivotal role in progress for the crypto industry.”

Food for Thought: Top Picks

Braintrust raises $18M for token-powered freelancer marketplace

- Braintrust is a new tech talent marketplace that employs a token-centric governance system to align the incentives of users and keep fees low

- In Kyle Samani’s words: Braintrust “creates an open and transparent incentivization system for anyone to be able to refer friends, colleagues, and acquaintances into available opportunities.”

- “Soon anyone will be able to be compensated for connecting supply and demand in what is otherwise a very broken market.”

- The BTRUST token is expected to be released publicly later this year.

Why does this matter?

- Crypto is being used to power a new approach to solving a real world problem.

- The live platform was built by a high calibre team and is getting traction in the form of 8-digits monthly volume from high profile Fortune 500 companies clients.

JPMorgan to turn loyalty points into tradable assets

According to a press release:

- JPMorgan is working with fintech startup Affinity Capital Exchange to create a new class of financial assets based around the trading of loyalty point portfolios.

- The firms are looking to provide issuers the ability to augment secured debt financing by utilizing the value of their loyalty programs to raise capital from lenders, institutional investors, and operating partners.

Why does this matter?

- This is a great use case for digital assets as discussed last week.

- Tokenizing these programs will provide companies with a mechanism to raise cheap capital while sharing growth with customers vs. loading their balance sheets with more debt.

Pandemic Hastens Shift to Asset-Light Economy

- The WSJ notes divergent performance between brick and mortar and online businesses in the same industry.

- “Value is increasingly derived from digital platforms, software and other intangible investments rather than physical assets and traditional relationships.”

- That trend has intensified with more interactions gone virtual because of corona

- “…in the digital age, value accrues to ideas, R&D, brands, content, data and human capital — i.e. intangible assets — rather than industrial machinery, factories or other physical assets,” The Carlyle Group notes

- Recessions, Mr. Thomas writes, shock businesses into rethinking their business models and the 2008 credit market freeze spurred asset-light business models

Why does this matter?