In this issue

- Mega Trends That Will Drive Digital Asset Adoption

- Summary of this week’s top stories and why they matter

- Digest of “food for thought” top picks and some observations

Any views expressed are my own and do not represent the views of my employer.

Mega Trends That Will Drive Digital Asset Adoption

TL;DR: Although crypto is definitely having its moment, it hasn’t had it Netscape moment, yet. What will drive greater adoption in the near to medium term, and what does adoption even mean in the case of crypto? I argue that digitization, shifting powers in traditional finance, pandemic related macro trends, FOMO, and the need for innovation in capital markets are all playing its part.

Crypto is definitely having its moment: daily headlines in mainstream media, increasing government and regulatory focus (for better or worse), big names investing in Bitcoin — now including corporate Treasuries — and BTC being the best performing asset YTD. There are also amazing things being built, with plenty of examples in DeFi and the NFT space alone. And it is all backed by a great ethos that fits in with some of the bigger problems society is facing, like inequality, unprecedented money printing, data monetization by big tech, and an aging financial system. However, crypto has not had its Netscape moment and broader adoption is yet to take off.

What will drive greater adoption of digital assets in the near to medium term? And what does adoption even mean?

In this article I will share my opinion on

- How it will become apparent for crypto

- Mega trends that will drive adoption

- Major barriers to overcome

How will adoption become apparent?

In my opinion, for crypto, adoption will become apparent in a number of different ways.

Investment

As a hybrid investment/utility vehicle more money flowing into cryptoassets will do a number of things:

- Get people in the ecosystem and more likely to start looking at other cryptoassets for either investment or product usage. Think an institutional investor starting to use DeFi applications like decentralized exchanges or an individual investor playing CryptoKitties.

- More money flowing into the space will drive prices up, increasing the overall market cap of crypto. Increasing prices and key assets breaking certain price levels will in itself draw people in but so will a bigger market cap. The bigger the size of the asset class, the more worthwhile it becomes for larger investors to invest time and money in it, and the least they can ignore it.

- On the other hand, institutions allocating money to crypto VC funds will allow money to flow into new and existing projects, as well as the supporting ecosystem, contributing to the overall growth and thriving of the broader cryptoasset ecosystem. This includes robust infrastructure, next generation layer 1 and 2 infrastructure, and breadth and quality of crypto-powered applications.

Usage of decentralized applications

Decentralized applications or dApps are applications powered by public blockchains. Examples of dApps are decentralized exchanges (DEXs) like Uniswap, games like CryptoKitties, prediction markets like Augur, and virtual world Decentraland. As a hybrid investment/utility vehicle, usage is what is ultimately going to support sustainable growth. Applications like DappRadar track dApp usage.

Real world applications powered by digital assets

Separate from dApps, there are real world applications being powered by digital and crypto-assets. This is usage too, some are visible and relatively easily accessible, like exchange coins and stablecoins. Others are less visible, like cryptoasset XRP powering real world cross-border payments applications provided by Ripple. The Brave web browser that uses the BAT token as its native currency is another example. This is all really exciting and very tangible. The more we see of this, the better.

The emergence of blockchain-native traditional assets like equity and debt, and tokenized real assets like real estate and infrastructure would be other examples.

More quality applications being built on top of public blockchains

Compare blockchain-powered apps to the internet and the Apple app store. In the beginning there were few websites and few apps for your iPhone, and your usage was more sporadic. As the number and breadth of applications grew, so did your time spent on the internet and your smartphone. Same for digital assets. Talent and capital flowing into the space may be a sign of impending adoption in this respect.

Financial institutions getting involved

Financial institutions are highly regulated, even more so since the GFC, and conservative by nature. Few of the world’s largest financial institutions have entered the crypto space as of yet, as regulators haven’t provided much guidance. Large financial institutions can help solve certain problems in crypto markets and remove barriers for more institutional investors to enter the space. Examples are a trusted custodian with a large balance sheet like State Street or BNY Mellon, and a well-funded prime broker like J.P. Morgan or Goldman Sachs.

People in the ecosystem

As mentioned above, once people are in the ecosystem, they are more likely to invest in or use other cryptoassets. The reason being, that it is simply one barrier removed. At the moment, an “on-ramp” is needed to get your money in the crypto ecosystem. This means using fiat money to buy crypto through an OTC market maker, a crypto exchange, or retail brokerage app like Cash App or Robinhood. That crypto is then stored in the ecosystem and can be used to invest in other cryptoassets or to access dApps.

Technical market indicators

Technical market metrics like consistently higher volumes, tighter bid/ask spreads, and better order book depth will likely go hand in hand with more money entering the space. A greater variety of market participants may also contribute to dampening volatility. This in turn will draw more money into the space.

Mega trends that will drive adoption

In no particular order.

Digitization

Our world is increasingly dominated by digital commerce, and digital goods and services. Digital companies are more customer-centric by nature and tokens present ample opportunity to interact with customers in new and creative ways. Digital companies also increasingly have global customer bases requiring seamless digital payment methods like the ones powered by public blockchains. Last but not least, crypto can enable new digital experiences for customers, i.e. like is the case with digital collectibles.

Shifting powers in traditional finance

Slowly but steadily the powers in traditional finance are shifting. Many products and services that were traditionally the exclusive domain of commercial and investment banks are now partially provided by others, benefiting from regulatory arbitrage and better technology.

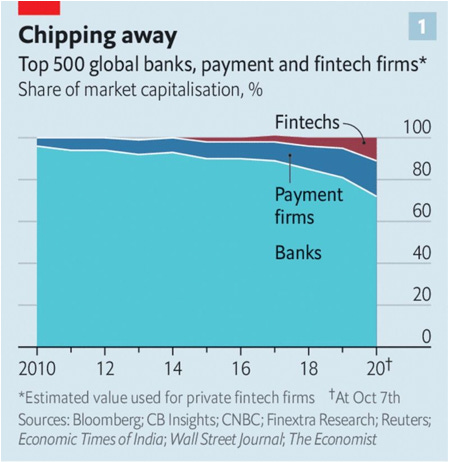

A recent example from the Economist: “conventional banks now account for only 72% of the total market value of the global banking and payments industry, down from 81% at the start of the year and 96% a decade ago.”

Many of these new providers are either technology first companies or companies powered by high tech. They don’t have legacy technology, understand their customers better (powered by superior data), are more nimble, and less burdened by regulators. If the banks don’t innovate fast enough, they will. And they are.

Crypto has been a beneficiary of this already through centralized intermediaries: retail investors can buy and sell crypto with little friction through Robinhood, Square or Revolut; Samsung offers a blockchain wallet; Facebook has plans for Libra. All of these, and others, will continue to drive new users into crypto with their ease of use. JP Morgan analysts expect “other payments companies to follow [Square’s Cash App] in facilitating client bitcoin investments or risk being left behind.”

Furthermore, the unbundling of financial services bodes well for the future of crypto. Although still in its infancy, DeFi is effectively a selection of components that can be combined to create new and innovative financial products.

Pandemic related macro trends

Crises are fertile ground for innovation. Crises tend to expose friction in the financial system in inconvenient ways, spurring innovation and increasing the likelihood of adoption of alternative products. We saw this in the aftermath of the Global Financial Crisis. Examples include the birth of Bitcoin itself, alternative lenders like Lending Club (bank lending dried up), the rise of FinTech (solving for all sorts of friction in the banking system), and crowdfunding.

Inflationary monetary policy. Lots has been written about this, but in a nutshell, we are witnessing an unprecedented monetary expansion on the back of Covid-19. This is expected to drive up inflation in the medium term. Bitcoin is considered an asset that holds its purchasing power. In proponents’ view, owning a small percentage of bitcoin in one’s portfolio is a great way to defend against inflation. This narrative has started to resonate with a broader audience in the last 6 months.

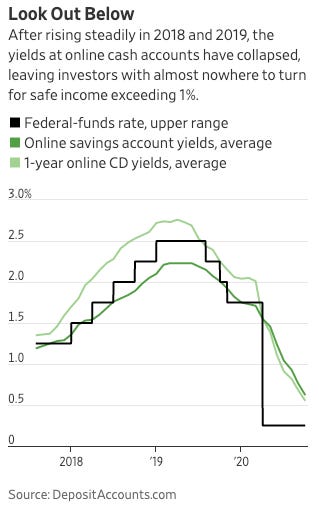

In addition, the WSJ reported this week that the US national average interest rate on savings accounts at banks is 0.16%. You can buy BTC, hodl it, while making a yield of 6% by parking it at BlockFi. With more risk, but the trade-off may start to turn in favor of BTC investment for an increasing audience, especially if things get bad for a prolonged period of time.

Accelerated pace of digitization including digital payments.

We discussed digitization as a driver of adoption above. The pandemic has brought about a surge in digitization, speeding up transformations in retail, e-commerce, and finance. According to the Economist “The shift from physical to digital payments this year has been dramatic. Pundits canvassed by The Economist reckon that the share of cashless transactions worldwide has risen to levels they had expected it to reach in two to five years’ time”.

In addition to what we already discussed, in the context of crypto

- Digital payments replacing “dirty cash” is a direct use case for digital assets.

- As more people work from home, and many tech companies announce plans to be “virtual first” for good, it will be easier for talent in different areas of the world to work in crypto, which may speed up innovation.

Impending recession. Markets seem optimistic but personally I believe we haven’t seen the worst of this recession and it will get a lot worse before it gets better. As financial conditions tighten and options to raise capital from traditional sources become unavailable or less attractive, companies may become more open to alternative financing methods. These include new token-based financing mechanisms, as highlighted a few weeks back.

The issues of trust and rising inequality. People will be p*ssed. Inflation, governments that didn’t protect them and had to shut economies down, the spread of misinformation by supposedly trusted parties (in particular in the US). And taxpayers are once again footing the bill while not benefiting from the rewards. This could spur interest in Bitcoin and other digital assets that promote a more inclusive financial system.

FOMO

The good old Fear Of Missing Out. There are a lot of institutions and people that may be feeling that way already or will soon do so. Humans are hard-wired to herd. And there is a large body of evidence of herd mentality bias in both primary and secondary capital markets. There is no need to look further than the current US IPO market environment: SPACs, direct listings, tech unicorns jumping back in…

Corporates. First there was MicroStrategy, a $1.6bn market cap US tech company investing $400m+ of its excess cash in Bitcoin to hedge against inflation. Then there was Square, an $82.1bn FinTech company with business lines in crypto, announcing the same for $50m. It also open-sourced the documentation to make it easier for other companies to do the same.

Both of these companies are public, and have large institutional investors. These institutional investors will now have indirect exposure to crypto and be forced to understand that exposure. The Norwegian government’s pension fund is one of them. There may be a multiplier effect from corporate Treasury investments…

Which corporate Treasury is going to be next? You can see it unfold here.

Institutional investors. It has been widely reported that Paul Tudor Jones and Renaissance Technologies publicly announced investments in Bitcoin. And just this week, $10 billion Stone Ridge Asset Management revealed $115 billion in Bitcoin holdings. These stamps of approval remove reputational risk for portfolio managers and force responsible asset managers to at least research Bitcoin and crypto as an asset class for potential investment. This is particularly true in the current environment where many institutional investors are battling negative yields on substantial parts of their portfolio.

Governments. Governments are concerned about stablecoins and cryptoassets impacting their monetary sovereignty. This has resulted in many governments looking at their own digital fiat currency (CBDC). Some governments, notably China, are pretty far advanced with this. This has spurred others to pick up the pace. Although the devil is in the details and there are positives and negatives to CBDCs, on balance they seem positive for the adoption of crypto assets.

Peers. Many well-educated friends hadn’t heard about crypto until recently, or were highly cynical about it. Although the latter group remains skeptic, they also like making money. So they invested some money in Bitcoin, just in case. There are also many people that expect Bitcoin will go through the roof in coming years. Many of their friends are getting curious. The looming inflation may make them curious enough to open a Coinbase account and buy some Bitcoin too.

Need for innovation in capital markets

Trends impacting primary markets. I have discussed this at length, here, and here: the shift from public to private markets, the small size trap, intangible balance sheets, the emergence of new business models (like the “rundle”), and direct listings. All of these show that the tides are changing in primary markets. These changes may bode well for growth of the crypto ecosystem.

One big trade. Secondary markets don’t make much sense anymore. Asset classes are increasingly correlated and markets are high on QE, no longer driven by or reflecting fundamentals. Secular trends like the shift from active to passive and the dominance of quants and high frequency traders in the equity markets have exaggerated this. This has made it hard for active managers with discretionary strategies to consistently generate alpha. And the hedge funds that are successful at this are increasingly going proprietary and closing to outside investment.

Greed is no longer good. Wall Street has long been driven by greed, and not financial innovation for the greater good. As discussed before, digital assets can help break this “winner takes all” mentality, which is much needed. As Foreign Affairs points out in a recent piece “for too long, governments have socialized risks but privatized rewards: the public has paid the price for cleaning up messes, but the benefits of those cleanups have accrued largely to companies and their investors”.

I am seeing various signs that change may be on its way though, slowly:

- SPACs (in my mind the perfect example of greed), or blank check companies, are in effect not very different from token projects raising money pre-product. Great to see that public company investors are getting used to the concept 😉

- J.P. Morgan launched a program with Affinity Capital Exchange to securitize loyalty programs. This is clearly leaving value on the table as participants are adding on more debt. A next step could be to tokenize these loyalty programs and raise cheap capital while allowing customers to benefit from growth.

- J.P. Morgan also recently launched a desk that is acting as a broker in the secondary market for private company shares. Bringing private equity shares onto a blockchain is a great use of the technology to allow for better cap table management and enhanced liquidity. It may also open up private company investment to a broader audience. J.P. Morgan is one of the banks furthest advanced in blockchain, and private equity is less regulated than the public market.

- A note from John Street Capital recently brought my attention to the phenomenon of securitizing recurring revenue streams. Pipe Technologies created a secondary market place for this. In my opinion a creative solution to allow growth companies to escape the “small size trap.” In a way, the concept is similar to asset-backed securities, a great use case for blockchain that, from what I am hearing, is not too far away from going into production.

Barriers to adoption

Ease of use

At the moment, most dApps are still relatively hard to use. You have to install a bunch of software and chrome extensions to use them. They also tend to be slow, and user retention remains problematic. Gas fees (to pay for computation) are typically pushed to the end user. For most dApps this means it is hard to compete with centralized apps. At least for now.

Education

Still far too few audiences understand crypto, the underlying technology, and the possibilities that it unlocks. This includes people from all walks of life and at all levels in the business and financial community. In my opinion, part of the problem is that resources are scattered, of various quality, and tend to be either too technical or mainly investment focused. Against the backdrop of a learning curve that is still steep and a community that can be alienating to outsiders.

10X factor

How much friction is being felt and by what factor will dApps improve this? The fact is, most people aren’t ideological, they don’t care about centralization or data security or data ownership (yet!). They consider practicalities first and just want something that works well at solving their problems. Easily accessible, easy to use, cheap. The absence of these features in innovative new products and services can form a barrier to entry.

Lack of regulatory clarity

Although there is some regulation at the on and off-ramps of the crypto ecosystem, there isn’t much more. In particular, there is a general lack of clarity whether a crypto-asset is a security or not, and therefore which (ancient) regulations they fall under. What has been on the rise is enforcement. As the BitMEX case and recent papers from regulatory bodies illustrate, governments are getting more concerned about illicit activity and AML. This is in part attributable to the explosion in fiat-pegged stablecoin volume. Monetary sovereignty is another concern. This could pose challenges to the flourishing of crypto.

State of technology

As a nascent technology, public blockchains are facing growing pains like scalability, speed, and cost. As pointed out above, this often makes it more attractive to use centralized applications. There are many smart people working on solving these problems, but it will likely take a number of years.

In Conclusion

There are many variables pointing in favor of near to medium-term adoption of crypto. Barriers to adoption remain, too. As I have argued before, I believe 2021 will be an inflection point for crypto.

Summary of this week’s Top Stories

Square Puts $50M in Bitcoin on Crypto ‘Empowerment’ Bet

- Square said it bought ~4,709 BTC, investing about 1% of its total assets.

- “We believe that Bitcoin has the potential to be a more ubiquitous currency in the future,” CFO, Amrita Ahuja said. “For a company that is building products based on a more inclusive future, this investment is a step on that journey.”

- Square has opensourced documentation to articulate the process behind the execution of its BTC purchase “as others consider similar strategies.”

- Square introduced BTC trading through Cash App in 2018 and formed Square Crypto in 2019, an independent team focused on contributing to bitcoin open-source work.

Why does this matter?

- After MicroStrategy’s $425m investment in BTC in August and September, this could be the start of a trend (you can monitor it here).

- In the words of Cathie Wood of ArkInvest (speaking at a Fidelity webinar earlier this week) “More than their decision to allocate, their decision to open source the documentation and how they executed that allocation will bode very, very well for other companies.”

- ArkInvest did some analysis on the back of this announcement and estimates a potential $30-50K BTC price impact from this use case alone if it were to see widespread adoption.

- The other interesting part is the potential multiplier effect this could have due to institutional investors’ indirect exposure to BTC through these Treasury investments. Decrypt pointed out that Norwegian government’s pension fund holds a 2% stake in MicroStrategy.

- Ria Bhutoria, Fidelity’s Director of Research, made another brilliant observation.

$SQ rationale:

— ria(search) (@riabhutoria) October 8, 2020

– instrument for economic empowerment

– global monetary system

– more ubiquitous currency in the future $MSTR rationale

– dependable store of value

– attractive investment asset

Bitcoin's success is not predicated on serving a singular purpose https://t.co/gvoa0Y6GQu

Stone Ridge Reveals $115M BTC Investment As Part Of $1B Spin-Off

- NYDIG came out of stealth as a full suite of institutional-grade digital asset prime brokerage, execution, and custody services.

- The firm was spun out of $10bn Stone Ridge three years ago with the intention to create non-existent ultra-safe custody for its intended BTC investment.

- NYDIG announced a $50m growth equity fund raise at the same time, on top of $50m in capital raised in 2017. It also said it acquired etale and made key hires.

- Bessemer Venture Partners, a VC that originated from the family office of Henry Phipps, announced it is an investor.

- Stone Ridge told Forbes that it has 10K BTC ($115m) in custody at NYDIG which has more than $1B in AUC, and runs $190m and $140m BTC funds.

Why does this matter?

- Stone Ridge is the third large traditional asset manager to publicly announce BTC investments after RenTec and PJT.

- NYDIG is the first independent firm to come out with a full suite, regulated, institutional prime brokerage offering — a barrier to entry for institutions.

- These are further signs that institutional demand for the asset class is hitting an inflection point and boding well for 2021.

Other key news stories

- Grayscale brought in $1B+ in Q3, Ethereum Trust gains SEC Reporting Co Status

- JPMorgan Strategists See ‘Modest’ Headwind for Bitcoin Price

- DOJ released “Cryptocurrency Enforcement Framework”

- G7 says Facebook’s Libra must not start until properly regulated

Food for Thought: Top Picks

The national average interest rate on savings accounts at banks is 0.16%

- The WSJ points out that “$100,000 in a savings account will earn, if you’re lucky, $220 in interest income in 2020. That’s $1,509 less than you would need to outpace inflation this year, estimates J.P. Morgan Asset Management.”

- On the institutional side, things don’t look much better:

Bond bubble keeps inflating: The world’s stockpile of negative-yielding debt has soared to $16.3tn, highest since Apr 2019 and just $800bn shy of an All-Time High. pic.twitter.com/cn59etIlCc

— Holger Zschaepitz (@Schuldensuehner) October 14, 2020

Why does this matter?

- Retail investors can buy BTC, hodl it, while making a yield of 6% by parking it at BlockFi.

- With more risk, but the trade-off may start to turn in favor of BTC investment, especially if things get bad for a prolonged period of time.

- As pointed out before, for institutions, it may make increasing sense to allocate a single digit percentage of assets to BTC as a portfolio-hedge against inflation.

Crypto Market Structure 3.0

- Arjun Balaji argues that crypto market structure has come a long way.

- Market Structure 2.0 brought us: derivatives liquidity eclipsing spot, electronification of OTC execution, the emergence of lending, stablecoins, and institutional services.

- 3.0 will see capital efficiency, CeFi-DeFi convergence; “Crypto trading remains capital inefficient due to market fragmentation and a lack of industry-wide credit assessment.”

- Specific ways to address this: prime brokerage, crypto-native derivatives clearing, a formal repo-market, lower on-chain confirmation thresholds.

- Sam Bankman-Fried of FTX responded to Arjun’s essay on Twitter.

Why does this matter?

- Market structure is of great importance to the maturitization of crypto as an asset class and removing barriers to entry for institutional investors.

- Capital efficiency, together with the OTC settlement “who goes first” problem remain major issues to be resolved.

- NYDIG’s announcement this week helps in addressing some of these issues.

An ideological war over self-custody & privacy

1/ There's been so much regulatory & enforcement news in crypto lately, it's impossible to keep up.

— Jake Chervinsky (@jchervinsky) October 12, 2020

So instead of getting lost in the details, let's step back & consider the big picture. What's really going on here?

In short: an ideological war over self-custody & privacy. 👇

- Very interesting thread from Jake Chervinsky considering the big picture around recent crypto-related regulatory and enforcement news.

- Jake argues that “policymakers’ approach to AML regulation is shifting significantly toward harsher restrictions on a *global* scale.”

- As Bitcoin has gained geopolitical significance & fiat-pegged stablecoin volume has exploded upward, governments are getting more concerned about both illicit activity & the threat to their monetary sovereignty.

- Jake highlights the “Swiss Rule,” which practically prohibits self-custody in the guise of verifying the owner of a private key” — the FATF may adopt this as a global standard

- “I fear we’re heading for a world where withdrawing crypto from exchanges to self-custody is restricted as a means of attacking privacy.”

Why does this matter?

- In addition to the above, regulations have the potential to stifle innovation and hamper growth and adoption of crypto