Highlights of this week’s rundown:

- The Digital Asset’s institutional crypto infrastructure market map

- Capital Markets influencers are coming around to BTC

- Notes from Multicoin’s fireside chat with Ribbit Capital’s Micky Malka

Top story

The top story this week goes to Bitcoin which is in rally mode once more against the backdrop of the US election. Saturday also marked the 12th anniversary of Bitcoin’s whitepaper. BTC broke $15,000 this morning and is up a staggering 50% over the last six months, looking set to close out 2020 as one of the year’s best performing assets.

Commentary from the market on what has been driving the rally this week:

- “Regardless of who wins, the forecast is for more quantitative easing and stimulus, continuing the favorable conditions for hard assets like bitcoin. Everything in the macro environment points to great opportunity for a major bitcoin bull market.” (Forbes)

- “Many investors agree the renewed surge of interest is tied to bitcoin’s potential as a hedge against inflation.” (WSJ)

- “There just aren’t many sellers left. It feels like every time there’s the slightest dip lately, it just gets bought up.” (Forbes)

- “The longer that we don’t have a president technically and the longer that we don’t have agreement among the population is positive for crypto.” (Bloomberg)

- “Previous Bitcoin resistance at about $10,000 may transition toward $20,000 in 2021,” according to Bloomberg’s commodity strategist. “Certain supply leaves demand as the primary price metric, and most indicators remain positive.”

Trend Follower: Connecting the Dots

Institutional Market Map

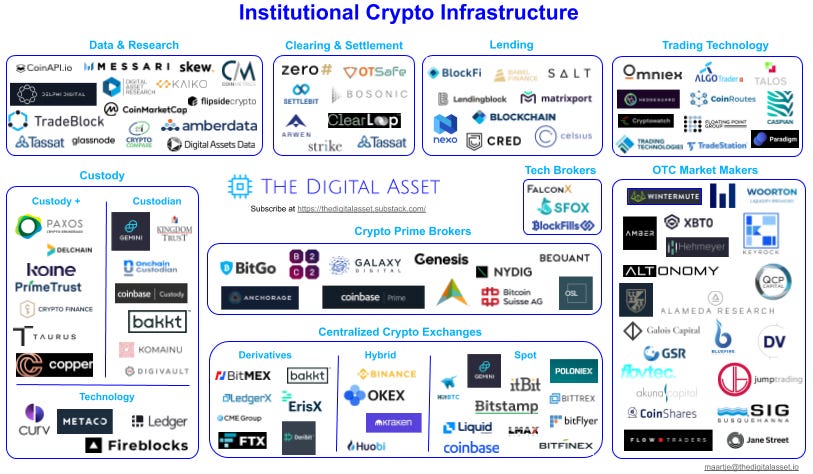

A number of institutional crypto/capital markets market maps were published recently, including here and here. I see things a bit differently so I attempted to produce my own market map of the (CeFi) institutional market infrastructure. It is not meant to be exhaustive, but aims to map out key institutional players based on who I have come across over the past 2 years. Please note that I am US based which has likely impacted the selection to some extent. I intend to keep this as a living document so please feel free to send me your comments and additions.

Now, it was a lot harder than I thought! 😁 Market participant categories in crypto have become quite entangled over time. See below for a brief description of the categories that I settled on.

Crypto Prime Brokers. Crypto prime brokerage has definitely been one of the trends this year. These are the offerings that I am aware of that have either formally announced their prime brokerage offering or are marketing it as such. All firms offer custody and execution, and most also offer lending. Some offer additional services like clearing & settlement, capital introduction, derivatives, and trading technology. Ria Bhutoria of Fidelity Digital Assets recently published a piece on prime brokerage in crypto.

Liquidity providers

- OTC Market Makers: proprietary trading firms that have market making as a core strategy and provide OTC services as part of that .

- Tech Brokers: brokers with an edge in technology.

- Centralized crypto exchanges: these are exchanges that, as far as I am aware, are popular with institutions. Hybrids offer both spot and derivatives.

Lending. Firms whose core business is crypto lending.

Custody. This is an interesting category as there are literally hundreds of parties offering crypto custody services. These are the businesses that I have come across in an institutional context. I have excluded banks — in particular in Switzerland there seem to be quite a few banks offering crypto custody already. There are also some global banks that have crypto custody in the works, as I mentioned last week — including BNP Paribas (with Curv), DBS Bank, and Standard Chartered. Nomura launched its Komainu joint venture with CoinShares and Ledger in June.

- Custodians: custody is sole or separate (in the case of a few exchanges) product offering. “Custodians turned prime broker” are included in the prime brokerage category (e.g. BitGo, Anchorage).

- Custody +: Custodians that provide additional services including executions, settlement, fiat, and lending. Some offerings look similar to a prime brokerage offering but are API based and meant for enterprises (Paxos, Prime Trust).

- Technology: wallet, security, and transfer.

Trading Technology. Institutional software offerings that include order and execution management. Some of these offerings are pure institutional (e.g. Omniex, Talos, CoinRoutes), whereas others deal with professional traders as well (e.g. Trading Technologies, Cryptowatch). Paradigm’s offering is slightly different from the others but included here for lack of a better category.

Clearing & Settlement. This is an emerging category that is looking to solve the “who goes first” problem in the crypto OTC market, in absence of a central counterparty and settlement standards. A number of offerings have sprung up over the last year or so with different approaches. The jury is still out.

Data and Research. A tough nut to crack in crypto with exchanges that have their origin in retail and lots of unconventional data sets. These are the offerings that I have used or have come across in an institutional setting.

Let me know what you think!

Capital Markets influencers are coming around to BTC

As Bitcoin has attracted an increasing amount of institutional attention over the course of 2020, a number of key capital markets influencers have either become (more) infected with the crypto bug or had a change of heart about it. This week I stumbled upon Tracy and Jeff’s comments below. This is not insignificant in the age of social media. Gradually, then suddenly…

- Tracy Alloway of Bloomberg announced in the firm’s “Five Things Asia” daily newsletter and on Twitter (where she has more than 100K followers) that she is “bullish on Bitcoin now” .

Oh yeah, I’m bullish on Bitcoin now.https://t.co/ViCeAp2YCi pic.twitter.com/i15kDeU56j

— Tracy Alloway (@tracyalloway) November 3, 2020

- Jeffrey Gundlach aka the “Bond King” said on a webcast that listeners should own something to hedge against inflation. He mentioned gold and Bitcoin as good possibilities. Just last month he called Bitcoin a “lie” in an interview with Business Insider. Gundlach is co-founder of $140bn fixed income firm DoubleLine Capital and is known for his bold calls. He correctly predicted the housing crash in 2007.

- Influential macro investor Raoul Pal, a long-time bitcoin advocate, has been public about significantly increasing his bitcoin allocations on the back of Covid-19. The crypto community has taken notice and media attention around him has heated up. Business Insider recently reported Pal saying that Bitcoin will surge to $1 million in 5 years by an “enormous wall of money.” 🚀

Regulatory movement

- The SEC amended rules to harmonize registration exemptions. This is relevant for crypto tokens looking to raise funds without triggering SEC registration. Relevant caps were increased as follows: Reg Crowdfunding from $1M to $5M, Reg A+ from $50M to $75M, and Rule 504 of Reg D from $5M to $10M.

- Hong Kong’s SFC is regulating all virtual-asset business, raising big questions for the industry’s future. “This is a significant limitation, as under the current legislative framework if a platform operator is really determined to operate completely off the regulatory radar it can do so simply by ensuring that its traded crypto assets are not within the legal definition of a security”: SFC chief.

- Forbes ran a story about Binance conceiving “an elaborate corporate structure designed to intentionally deceive regulators and surreptitiously profit from crypto investors in the US.” It referred to a document thought to be created by Binance exec team and obtained by Forbes. The story comes at an interesting time with the DOJ filing criminal charges against BitMEX recently.

Food for thought top picks

My notes from Multicoin’s Fireside Chat with Micky Malka of Ribbit Capital.

- The simplification of the user experience is a key success driver in FinTech.

- So: What is it DeFi is trying to solve and for whom? Hard to answer for DeFi, because it is such a broad term. DeFi will evolve over time into different segments. Some will succeed and others won’t. Still in early innings, will be more clear in 2025-2027 time frame, like it took bitcoin nearly 10 years.

- The innovator’s dilemma is hitting incumbents (banks). Malka is advising banks to have a team of engineers play with real money in DeFi protocols on a daily basis. To understand what is going on but also to be able to identify use cases that can be brought into the bank. No one is doing this at the moment because no one wants to risk their job (yet).

- The tipping point for crypto is close but we won’t realize until 6 months after it happened.

- He likes China’s plans to connect its CBDC to a number of layer 1 protocols in the next year to build smart contracts. This would make it a controlled currency sitting on a decentralized network that can grow use cases worldwide. China’s ambition is to be a global system. Malka thinks the approach is smart, the “smartest, most innovative aspect in geopolitics” he has seen in over 20 years.

- He sees a future with 2-3 large worldwide currencies, emerging over the next few decades: likely China and the US dollar, with probably BTC as a 3rd. He expects every country will still have their own currency, as this is a matter of national security.

- He contrasted the forking of DeFi protocols with the current banking sector where everyone copies each other. What matters most is having a trusted brand. In the case of DeFi, not enough trust has been built yet and it is also a bit of a catch-22 because of its decentralized nature. The question is what would it take for some of these to become trusted brands? He draws a parallel with Cisco in the 90’s picking TCP amongst competing protocols.

Prime Broker Genesis reported $5.2 billion in loan originations in Q3, its “largest quarter by a landslide” commenting that “the appetite for yield on digital assets continues to grow.” Growth was driven by ETH, USD and equivalents and other altcoins. The main driver of this portfolio shift came from the impact of liquidity mining on DeFi protocols. The firm also noted a rapid uptake in option structures for hedging and expressing views in crypto assets. Worth a read!

CBDC Highlights

- “Early CBDCs will ultimately look closer to eMoney or prepaid cards” — Fed’s David Mills at Ripple Swell conference.

- PBOC Governor says there have been 4M digital yuan transactions so far, totaling over 2 billion yuan ($299 million). Yi was speaking at HK Fintech Week.

- Elsewhere, former central bank governor Zhou Xiaochuan said China’s CBDC aims to push back against US dollar hegemony and boost retail payments. Unlike G7 central banks, China is less concerned with the challenges raised by Libra, bitcoin and other cryptocurrencies.

- The ECB is seeking public comments for CBDC, implying a broad retail offering may be on table and not just a digital EUR for use between banks. This would represent a much more profound change in the way finance works.

It’s already been one year since I took up my role as President of the @ecb. It has been a difficult year for Europe and the world, but together we have achieved some important milestones that I believe are worth reflecting on. pic.twitter.com/b5mVA7t0xN

— Christine Lagarde (@Lagarde) November 1, 2020

November 1st 20201,089 Retweets2,240 Likes

- Reserve Bank of Australia to explore wholesale CBDC using Ethereum tech.

- Central Banks are concerned about sovereignty. Ledger Insights contrasted views of 3 central banks on digital currency, stablecoin sovereignty threats.

The Big Picture

Jack Ma setback reminds investors that Beijing is still boss. China halted Ant’s IPO by introducing tough new rules for online finance groups. The actions came after Ma criticized China’s state-dominated banking sector at a public forum last week. The guidelines could hit Ant’s future profits and drastically change its IPO. I am wondering if there is any relationship with the digital yuan here. Reuters recently reported that participants in the digital yuan test said they preferred Alipay (owned by Ant). This was then disputed by the programme head saying that these are not competing services. Jack’s comments clearly give the PRC leverage over Ant. The CBDC is a key project for China in its quest to replace the USD as the world’s reserve currency and build its status as a global economic power.

Why the bond market might keep America’s next president awake at night. Treasuries are pivotal to the world’s financial system. USD dominance means that everyone holds them, its yield is known as the risk-free rate, and in times of stress it serves as a haven asset. However, per the Fed’s Randal Quarles “the Treasury market’s expansion over the past decade may have outpaced the ability of the private-market infrastructure to kind of support stress of any sort”. This is a problem against the backdrop of sharply rising government borrowing. The Economist is reviewing various solutions including market participants trading directly with each other. 😉

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.