Fireworks

There are so many signs that something is brewing, it is hard to keep up! PayPal wins head and shoulders biggest news story this week — year, according to Mike Novogratz.

This PayPal news is the biggest news of the year in crypto. All banks will now be on a race to service crypto. We have crossed the rubicon people. Exciting day. 🔥🔥🔥🔥🔥🔥🔥🔥 https://t.co/hXpiJEDOb3

— Mike Novogratz (@novogratz) October 21, 2020

But there was much more to be bullish about.

- As Covid rages on, there is increasing buzz around digitization of everything (including financial services), and with it, the realization of the role that digital assets will play in such a world. PayPal notes “The migration toward digital payments and digital representations of value continues to accelerate, driven by the COVID-19 pandemic and the increased interest in digital currencies from central banks and consumers.”

- Macro trends are further underpinning the case for digital assets — not only as an investment to protect against inflation, but also as a mechanism to create a more level playing field.

- Announcements of digitally-native products are on the rise.

Read on to get the scoop.

Top story: PayPal announces launch of crypto offering

Here is what you need to know:

- US customers will be able to buy, sell, and hold BTC, ETH, LTC and BCH in their PayPal wallets in coming weeks. Venmo + other countries to follow in 1H21.

- “Increasing cryptocurrency’s utility.” PayPal will enable crypto payments for 26 million merchants to finance digital commerce. Merchants will receive payment in their local currency rather than Bitcoin itself, “a lucrative proposition.”

- PayPal is partnering with Paxos to offer the service and has also secured the first conditional Bitlicense.

- The sheer scale of PayPal’s reach caused excitement — and got people wondering if this will go down in history as crypto’s watershed moment. BTC briefly crossed $13,200.

- Critics were quick to point out that the offering has some caveats: (1) user’s won’t be able to withdraw crypto, and (2) it is expensive; users have to pay a spread and fees.

Who is next? It will be interesting to see which payment companies will follow PayPal, against the backdrop of a strengthening case for digital assets.

Trend Follower: Connecting the Dots

This is all based on news from the last 7 days, supplemented by news and commentary from preceding weeks that reinforces the point.

Central Bank Digital Currency (CBDC) frenzy continues

- Fed Takes Cautious Approach. Powell Says Fed has not made a decision on a CBDC, points to concerns about theft, fraud and privacy. The Fed’s interest in a CBDC is motivated by the desire to make improvements to the US payments system. Any digital currency will be a complement to and not replace cash.

- China’s $1.5M digital yuan giveaway impressed analysts. Shoppers, not so much. Some users said they preferred existing shopping tools like the Alipay app. Analysts say attracting users will largely depend on incentives to lure customers from Alipay or WeChat Pay, already used to buy, literally, everything. Reuters explains how China’s digital yuan works.

- The IMF is concerned that CBDCs could raise pressure for ‘currency substitution’ where foreign currencies displace domestic currencies for local use. This may erode control over domestic liquidity. The benefits of CBDCs for cross-border transactions are “conceptually clear” but as yet hard to quantify. Issuing CBDCs may also help currencies achieve reserve currency status, the IMF said.

- In the meanwhile, the Bahamas launched its CBDC, the Sand Dollar.

“If you don’t think CBDCs are coming, you are missing the big and important picture. This is going to be the biggest overhaul of the global financial system since Bretton Woods” starts a thread by Raoul Pal. Leading to my next point…

Financial markets are changing, and digital assets are leading the charge

- The US Comptroller of the Currency believes deposits to be replaced by blockchain. Pre-technology, we needed one place to hold money in order to provide efficiency in deposit taking, enabling payments, and extending loans. Now, technology can substitute for this aggregation function of banks. “What I think banks are great for is value added services” — “advice, fiduciary stuff, and the custody of physical assets”.

- Account-based CBDC may change the role of commercial banks with individuals having their own central bank accounts. Deutsche points out that this may bring the financial intermediary role of commercial banks in jeopardy having to offer higher interest rates than the Central Bank to attract savings.

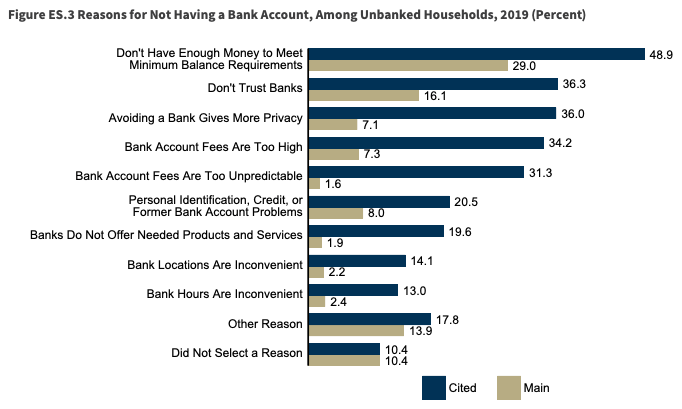

- The FDIC reported an estimated 5.4% of US households (~7.1 million) were “unbanked” in 2019, representing a declining trend. There will likely be an increase in the unbanked rate though, due to changes in the labor market and financial landscape resulting from COVID-19. Note the main reasons for not having a bank account in the chart below. Any solutions that come to mind? 😉

Product is being shipped

- Breitling goes live with an Ethereum-Based system for all new watches. The digital passport proves authenticity, and tracks the service history and any repairs to the watch. This is particularly important for the pre-owned watch market, at $20B roughly 50% of the new luxury watch market. Breitling is using the NFT-based Arianee track-and-trace protocol, and open-sourced its code to encourage industry collaboration.

- Atari seeks new cachet with crypto. Atari’s new gaming computer will have internet connectivity and let users buy in-game products with Atari Tokens. $1M worth of $0.25 tokens go on sale on Bitcoin.com to retail investors outside of the US Oct 29. Atari is aiming to create a standard currency for the gaming industry.

- Filecoin mainnet launches bringing $200M ICO to fruition. However, miners went on strike one day after launch, keeping a majority of their machines off because they did not have sufficient FIL tokens to use as collateral. In response, Filecoin sped up token rewards. Read more about Filecoin and why it matters here. Also, ConsenSys announced a collaboration with Protocol Labs to bring filecoin to Ethereum.

- Digital collectible platforms SuperRare and Rarible were put in the spotlight by Our Network. Both have done well on the back of the recent rise in popularity of NFT platforms. Volumes are still tiny, but exponentially increasing. Messari published a report on the NFT market. It is behind a paywall but they are offering a free trial.

- We recently discussed BrainTrust, the community-owned talent network. Here is a post by Paul Veradittakit of Pantera. The platform, powered by the BTRUST token, solves a real problem and has great traction with big companies.

Food for thought top picks

- Does a digital euro challenge the dollar’s global dominance? This story by FT Alphaville, although always the cynic on crypto, does a good job of explaining what it could mean for the future of cross-border payments.

- The Music Industry is Waking Up to Ethereum. Podcast + transcript on how the business of music is changing and why Ethereum-based digital art could be a path many popular musicians will follow. This plays nicely into the hype around NFT and also audio’s opportunity as a medium, which has gotten a lot of attention recently.

- Digital bonds and how to make it happen. I have been thinking a lot about why digitally-native bonds aren’t here yet because it makes so much sense to me. Bottom line is that we are getting there, “the momentum is building” but through small steps and not a Big Bang. 🤷🏻♀️

The Big Picture

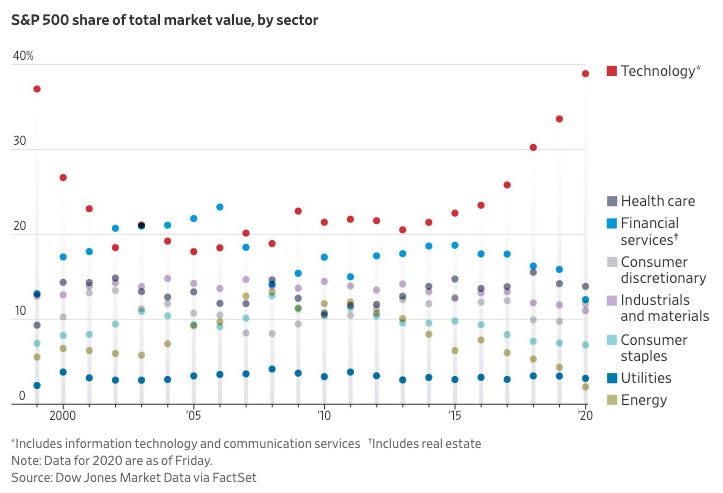

Tech now accounts for nearly 40% of the S&P 500, eclipsing the dot-com bubble peak and the latest illustration of their growing influence on global consumers. The analysis of tech’s concentration in the S&P 500 is based on companies in the IT and communication-services sectors. It excludes $1.6T Amazon. The Covid-driven “mandated digital lifestyle” helped tech businesses expand while others struggled.

Goldman warns of more job losses with jumbo mergers on the rise. In a nutshell, unprecedented monetary easing is making money cheap. Big companies are using the cheap money to buy struggling companies. This consolidation will lead to job losses, which “will be complicated societally.” Goldman Sachs has been one of the biggest beneficiaries of this year’s turmoil, its profit nearly doubled, and trading revenue rose 29% from a year ago.

The saver’s dilemma: Low interest rates leave savers with few good options. The one-year Treasury bill yields 0.13%. This means that if you would invest $100 today and reinvest the annual interest income, it would take 530 years for your money to double. Savers have three options: (1) save less/spend more, (2) save more, or (3) put more savings into risky assets. With their savings stuck in cash, elderly people around the world risk running out of money before they die. This is already happening in Japan.

Quote of the week

Billionaire tech entrepreneurs need to school regulators on the future of money

Summarized comments from DeVere CEO in response to Square’s Bitcoin investment:

Billionaire tech entrepreneurs know that digital currencies are to money what Amazon was to retail. Yet, some financial regulators of major markets are adopting a head-in-the-sand approach and issuing bans rather than focusing on establishing robust regulatory frameworks. Do they honestly believe that there is no place for, and no value of, digital, global, borderless currencies in an increasingly tech-driven world? Some regulatory bodies display a staggering lack of understanding of this sector and perhaps they need to be educated by billionaire tech entrepreneurs, amongst others, on what is the future of money.

Disclaimer: any views expressed in this weekly newsletter are my own and do not represent the views of my employer.