A new chapter. Biden was sworn in as the 46th President of the United States yesterday. With the change of power, there will be a number of new regulators key to crypto’s future too. Notably Gary Gensler as Chair of the SEC and Janet Yellen as Treasury Secretary. Biden is expected to tap Michael Barr as Comptroller of the Currency.

The million-dollar question is what direction the US regulatory environment will be heading in. Gensler is well-educated on crypto and has called for more regulation in the past. This is not necessarily a bad thing as regulatory clarity may bring more institutional investment. Yellen expressed concern on Tuesday about crypto in terrorist financing (see below). Barr helped architect the 2010 Dodd-Frank Act and is a former Ripple advisor. Meanwhile, President Biden has frozen all agency rulemaking pending further review including Mnuchin’s proposal on “unhosted wallets.”

Oh, crystal ball!

In this issue:

- Top story: BlackRock files to add bitcoin futures to two of its funds

- And then there were…the naysayers

- People are worried about terrorists

- What’s up with Tether?

- Trend Watch: Market Data

- What’s JPMorgan saying this week?

And: momentum tracker, food for thought top picks, the big picture, quote of the week.

Top story

BlackRock Files to Add Bitcoin Futures to Two of Its Funds

- BlackRock is the world’s largest asset manager with $8.7T in AUM.

- The updated prospectuses appeared on the SEC website yesterday including cash-settled Bitcoin futures among assets they’re permitted to buy.

- Global fixed income CIO Rick Rieder said in December that there is a clear demand for bitcoin and that “it’s going to be part of the asset suite for investors for a long time.”

- BlackRock declined to comment.

Trend Follower: Connecting the Dots

And then there were…the naysayers

Plenty of them in the past week. Bitcoin’s recent pullback and heightened volatility are sparking debate, with critics seeing gambling, scandal, and manipulation. I think a bit of pushback is healthy and it would be more worrisome if there was nothing but love. Also, some of the commentary was equally applied to other asset(s)(classes).

On a more general note it sounds like some Wall Street analysts are expecting a broader market correction. If and when that happens, bitcoin may dip down too on the back of more institutional involvement. Opportunity to buy?

- UBS Wealth warns clients crypto prices can actually go to zero. UBS says clients have been asking if they should buy bitcoin. The firm likened crypto to Netscape and said “There is little in our view to stop a cryptocurrency’s price from going to zero when a better designed version is launched or if regulatory changes stifle sentiment.” UBS Wealth is skeptical of the real-world utility of virtual tokens, but stopped short of calling crypto prices a bubble.

- Responding to a monthly survey, Bank of America clients with $561B in AUM say bitcoin is the most crowded trade as speculative euphoria hits Wall Street. BofA strategists say a broader market correction could be imminent.

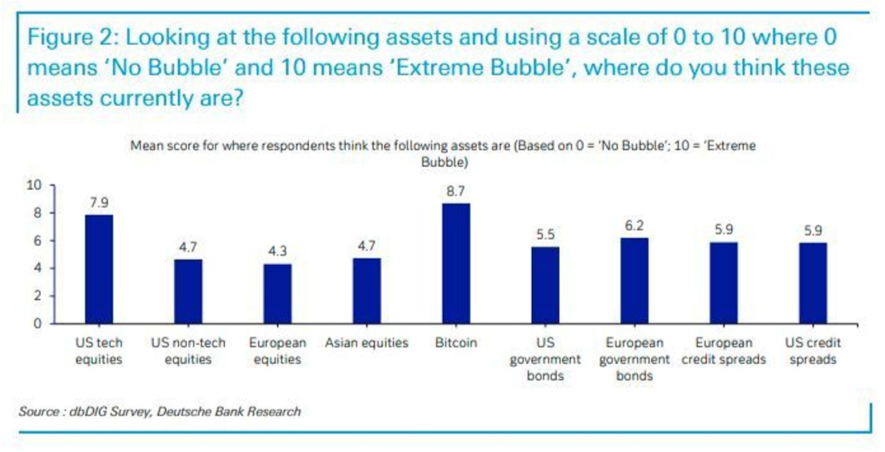

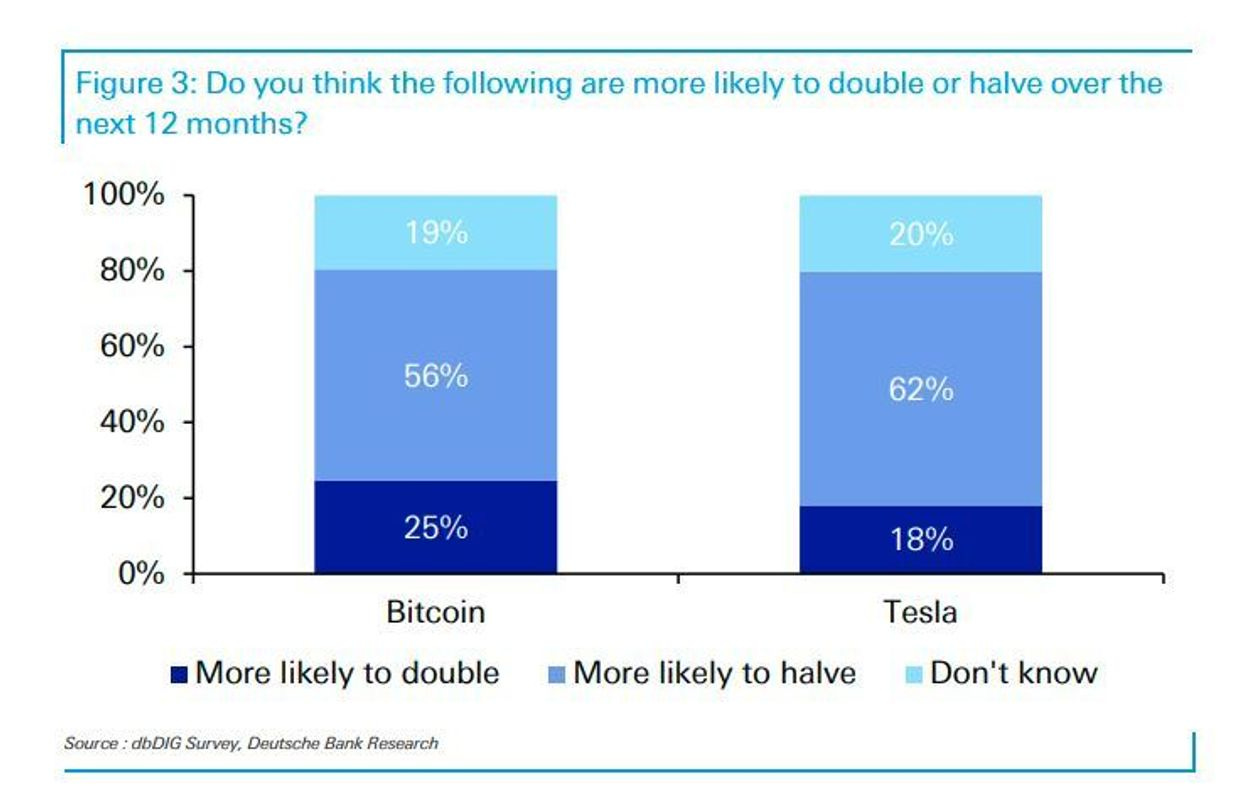

- Almost 90% see bubbles in Deutsche Bank investor survey, bitcoin is one of them. I will let the screenshots speak for themselves.

- Meanwhile, Barclays Private Bank chief market strategist said “While it is nigh on impossible to forecast an expected return for bitcoin, its volatility makes the asset almost ‘uninvestable’ from a portfolio perspective,” comparing it to “other risk assets like oil” He seems to think that the rally has been “mostly driven by retail investors joining a seemingly unsustainable rally rather than institutional money investing on a long-term basis,” which we don’t agree with. 🤷🏻♀️

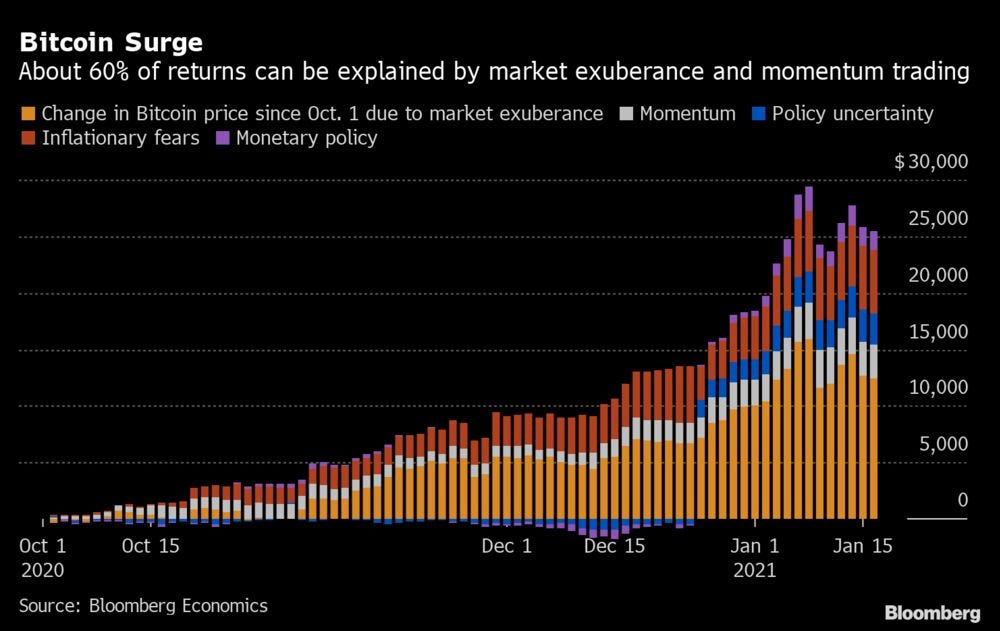

- Bloomberg Economics’ structural empirical model is indicating bitcoin’s surge was built on market exuberance and momentum trading.

- Covid-19 market bubbles [including bitcoin] will end in tears. But when? (SCMP)

People are worried about terrorists

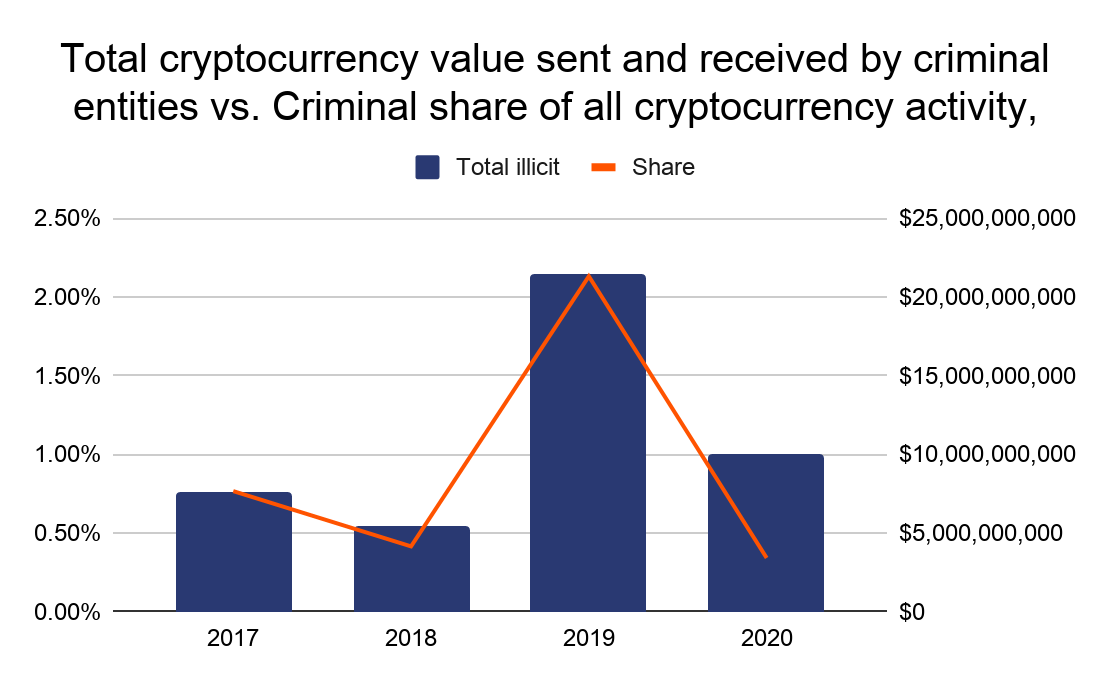

It may be coincidence, but there were a number of headlines this week pointing at crypto use in terrorist financing, although the data told a more encouraging story. There is clearly a lot more education to be done.

- Janet Yellen said crypto is a ‘concern’ in terrorist financing. Cryptocurrencies are “a particular concern” when it comes to terrorist financing, Treasury Secretary Janet Yellen said speaking at a Senate hearing on Tuesday. “I think many are used, at least in transactions sense, mainly for illicit financing and I think we really need to examine ways in which we can curtail their use and make sure that anti-money laundering doesn’t occur through those channels.”

- However, Chainalysis painted a brighter picture in a preview of its 2021 Crypto Crime Report, saying that crypto-related crime fell significantly in 2020.

- Stablecoins are a boon for terrorist groups in Southeast Asia. An analyst in Singapore argues that despite the appeal of anonymity and ease of international fund transfers, large swings in value have made cryptocurrency unattractive to extremist and criminal networks. But stablecoins offer these groups an advantage, as does the widespread adoption of digital payments in SE Asia.

- Before suicide, French programmer made bitcoin bequests to US extreme-right militants.

What’s up with Tether?

“Crypto Anonymous” wrote a rather lengthy piece — “The Bit Short” — arguing that Tether manipulation pumps bitcoin’s price. It caused some drama but people in the know were quick to point out that the conclusions are highly inaccurate and show zero understanding of crypto market structure. On a separate note, Tether and Bitfinex are seeking another 30 days to produce critical trial documents to NYAG.

Anyway, here is the scoop:

- The Tether Controversy: A Brief History

- The Bit Short: Inside Crypto’s Doomsday Machine

- And a great counter thread by David Fauchier of Nickel Digital AM

Some thoughts on this super inaccurate piece.

— David Fauchier (@dfauchier) January 17, 2021

tl;dr: this is not a defence of Tether/ iFinex, who I would like nothing more than to see disappear into irrelevance. However, most of the conclusions here show zero understanding of crypto market structure.https://t.co/FeO1B8pkjV

Trend Watch: Market Data

We have spoken a lot about market data recently. Here, here, and here. Market data imperfections were in the spotlight once again this week while incumbents are set to take advantage.

- Crypto data sites are double-counting tokenized bitcoin, with three BTC tokenization protocols representing more than 1.4% of the reported altcoin market cap. Providers seem aware of the issue and some are working on a solution.

- CoinMarketCap glitch displays 432 quadrillion market cap for wBTC. It made FT Alphaville happy.

- IHS Markit likely to join the race for crypto indexes on Wall Street. Every millennial that works for the company thinks there should be more crypto products offered, said CEO Lance Uggla, speaking on the firm’s earnings call. Adam Kansler told analysts IHS Markit already has “tactical partnerships” with crypto firms like Lukka to source cryptocurrency pricing and reference data.

- “Crypto Indexes” are an absolute farce. Arca argues that the current passive crypto index benchmarks make no sense. BGCI, BITW, GDLC are all over 90% weighted to two assets and don’t reflect the broader industry and its growth. “Any investor who wants to get Bitcoin exposure can now do so easily. Do we really need a “Crypto Index” that is 80% weighted to Bitcoin?”

What’s JPMorgan saying this week?

- Jamie Dimon says JPMorgan Chase should be ‘scared s—less’ about fintech threat. Competition will be particularly tight in the world of payments, he said: “I expect to see very, very tough, brutal competition in the next 10 years,” Dimon said. “I expect to win, so help me God.” 🙏

- JPMorgan distances JPM Coin from public blockchain stablecoins on earnings call. CFO Jennifer Piepszak said that the recent OCC guidance doesn’t impact JPM coin. “It’s obviously very early. We will assess use cases and customer demand. But it’s still too early to see where this goes for us,” she said.

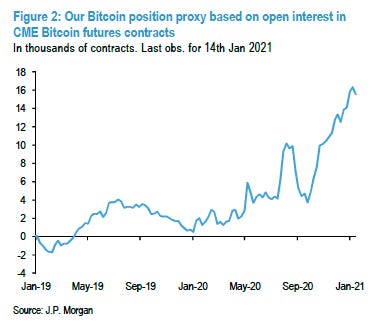

- JPMorgan analysts say getting back to $40,000 is key for bitcoin. The two main institutional indicators to track the institutional pulse are the position build up in CME bitcoin futures and the flow into Grayscale’s bitcoin trust. The former experienced a steep decline last week, likely on the back of momentum traders unwinding. “The flow into the Grayscale Bitcoin Trust would likely need to sustain its $100M per day pace over the coming days and weeks” for a breakout above $40K to occur.

Momentum Tracker

- CoinShares to launch $200M Bitcoin ETP on SIX Swiss Exchange.

- Goldman Sachs to enter crypto market ‘soon’ with custody play: source. The bank apparently sent out an RFI to custodians. The Goldman source said the bank’s custody plans would be “evident soon.” Goldman, JPMorgan and Citi are all said to be looking at crypto custody.

- 3iQ’s bitcoin QBTC fund hits $1B milestone. The fund launched in April 2020. Its previous milestone of $100M was recorded in October.

- Coinbase acquires crypto infrastructure provider Bison Trails. Market observers expect the transaction value to come in between $80-100M. Coinbase said that Bison Trails will serve as the foundation of its Infrastructure-as-a-Service business operation. Coinbase announced the acquisition of Routefire earlier in Jan.

- Winklevoss twins consider taking Gemini public.

- BlockFi adds OTC trading desk for institutional investors.

Food for thought top picks

Bain outlines digital assets strategy for incumbents

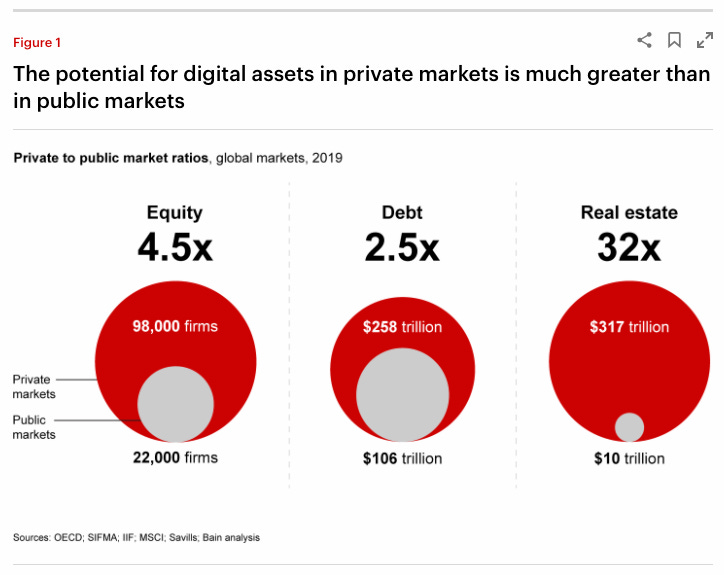

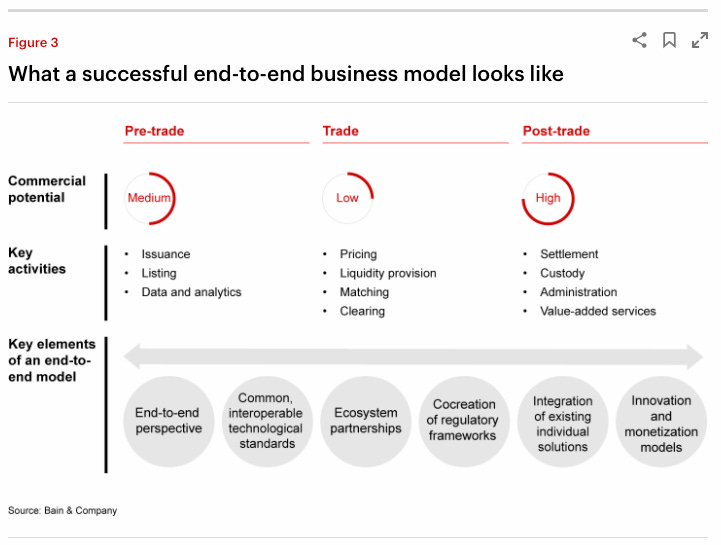

The biggest opportunities lie in private debt, equity and real estate, given their relative inefficiency compared with public market infrastructure. Private markets also offer the most significant commercial potential.

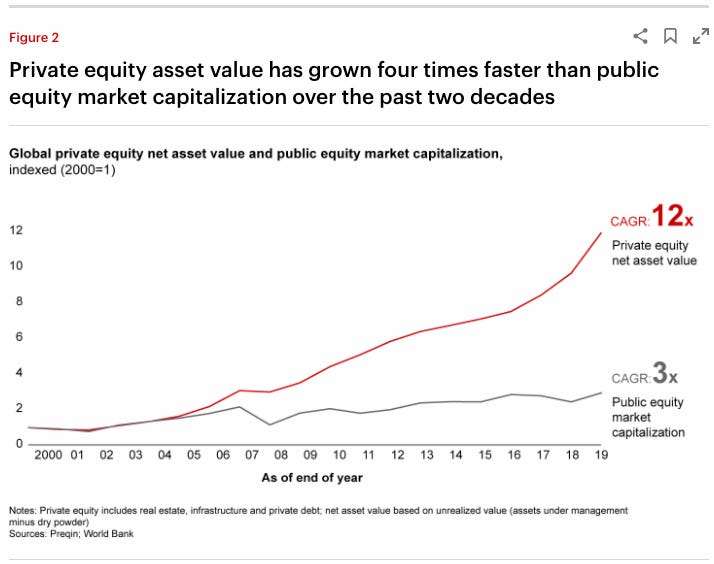

Over the past 20 years, the compound annual growth rate of private assets has been roughly four times that of publicly traded assets .

Incumbents will need to make decisions soon about how to participate, as it takes time to build an economically attractive business model and the required capabilities and partnerships.

Bain sees incumbents developing four useful business models:

- End-to-end institutional infrastructure operator. End-to-end solutions, such as those being developed by the Swiss stock exchange’s SIX Digital Exchange, Coinbase and Gemini, appear to hold the most promise.

- Digital asset broker-dealer. Increased digital asset adoption and market maturity will require broker-dealers and prime brokers serving the digital asset ecosystem

- Technology provider. With the evolution of the financial system toward DLT platforms and digital assets, technology has become a key ingredient for success.

- Specialist solution provider. e.g. Sygnum is using DLT to embed digital assets into regulated banking.

What it will take to succeed:

Coinbase is pegged for a valuation of up to $75B. Is that realistic?

Coinbase valuation will not only show the company’s true value, but also provide a benchmark for what other crypto firms are worth. So what price will investors put on the firm? The last formal valuation for Coinbase took place in 2018 — eons ago, in crypto years — following a $300M Series E round that put its valuation at $8B. It should be worth much more today — but how much more?

Benchmarks:

- Prediction markets like Polymarket: recent bets indicate $63B

- FTX futures: $75B

Bear views:

- Exposed to sudden industry crashes “that have defined the industry”.

- Threat from US regulators.

Bull views:

- Coinbase has claimed multiple quarters where it’s been profitable.

- It has developed other lines of business beyond trading. Crypto lending could grow enormously and “Coinbase, which is beginning to resemble a full-blown bank, will be a prime beneficiary.”

- Degree to which Coinbase dominates the US crypto industry. Both its large balance sheet enables acquisitions that will help stave off future competition and its longtime relationships with regulators are strong moats.

- The crypto industry has matured significantly since 2017.

The Big Picture

This WSJ article makes today’s markets sound like a casino

A new army of social media-enabled (retail) day traders is helping push stocks to records and turning companies into market sensations. These investors piggyback on each others’ ideas and trades, helping fuel the momentum that has propelled some companies to triple-digit or bigger gains in 2020. Social media (acting as echo chambers), an industry-wide move to commission-free trading, and easier access to risky instruments like options have helped this trend.

Shares of Chinese electric-vehicle maker NIO Inc. are an example. Though hardly a household name, NIO is among the most searched stocks on Google and #nio accumulated 35M+ views on TikTok. NIO’s ADR price increased from under $4 at the beginning of 2020 to $58.44 yesterday.

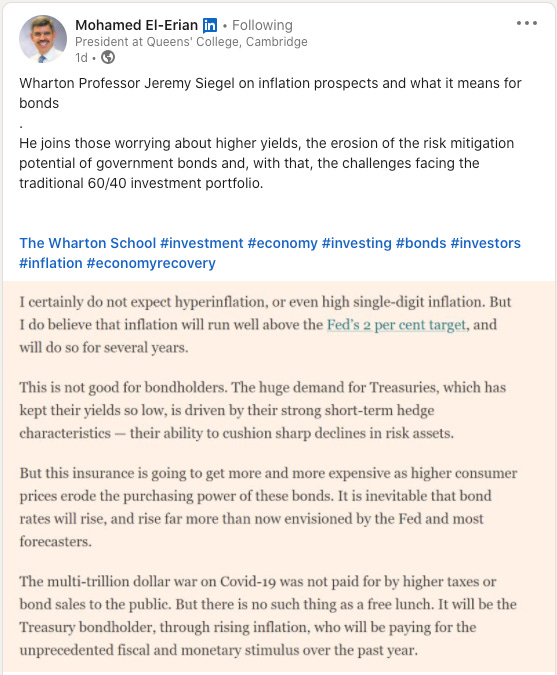

Higher inflation will hit bondholders and the 60/40 portfolio

Quote of the week

Larry Summers in an interview with David Westin on Bloomberg TV was asked if bitcoin is a bubble. This was his response:

“I’m not going to predict its fluctuations over the next six months, but I think some institutions like it, is here to stay. I don’t think that the whole thing is going to collapse. I think that having run up and then run way down, and then move back, it looks much more resilient, and therefore I think people are going to move towards it, and as people move towards it, given the finiteness of its supply, that’s going to be a factor working to raise prices.“

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.