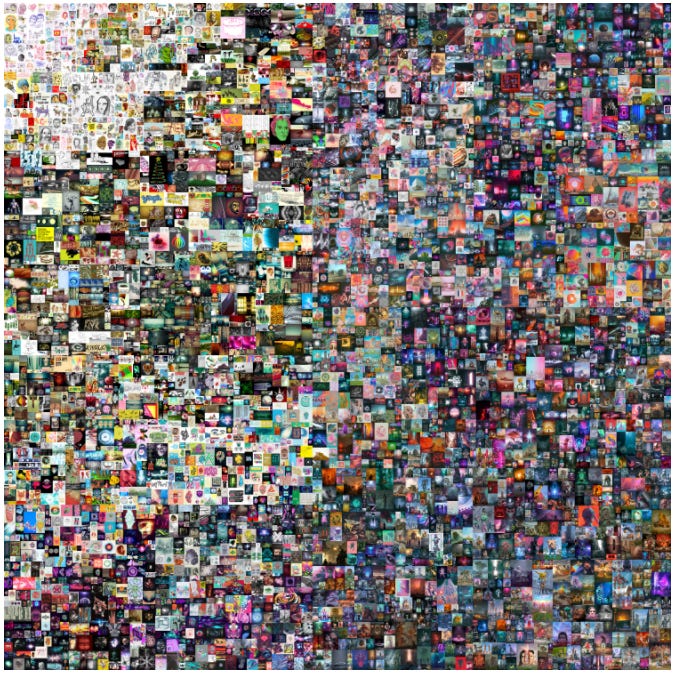

Well, the NFT craze went to a whole new level this week. Beeple’s “Everyday: The first 5000 days” NFT artwork sold for $69.3M in Christie’s auction. It is the 3rd biggest sale of any artwork by a living artist, EVER.

As a European, moving to America has given a whole new meaning to the word “football.” ⚽️ 🏈 I have gotten to love the NFL and Gronk is one of my favorites. You can imagine my excitement when Reuters reported he is to become the first pro athlete to launch a set of his own digital trading cards (NFTs). He told Reuters he expects the rarest one to fetch “millions.” I am not going to argue!

Elsewhere, a16z reportedly invested in a $20M round for OpenSea, an NFT marketplace. Legacy gaming giant Atari is building a casino in Ethereum’s virtual world Decentraland. It has leased a prime piece of virtual real estate in Decentraland’s “Vegas City,” which is set to open next month.

Just another week in crypto!

In this week’s issue:

- Top story: PayPal Acquires Curv for Nearly $200M

- What’s up with the US banks?

- Crypto exchanges and the liquidity problem

- And: momentum tracker, fundraising, valuation, and ETFs.

Top story: PayPal Acquires Curv for Nearly $200M

- PayPal announced on Monday it is acquiring digital asset security technology company Curv, reportedly for close to $200M. Curv’s MPC technology allows digital asset firms to transfer digital assets in a fast and secure way while maintaining control (the holy grail in crypto custody).

- PayPal is not intending to offer a custody service. It will rely on Curv’s technology to provide a security layer for its digital assets and to safely move them across borders. The technology allows PayPal to work with different custody providers.

- PayPal appears to have big ambitions related to the steep growth in payments through digital wallets and the emergence of CBDCs.

- On its recent Q4 earnings call PayPal had announced its new “crypto, blockchain and digital currencies” business unit and an extensive roadmap.

- On the same call it toned down speculations about volume drawn from itBit, the exchange run by PayPal’s crypto infrastructure partner Paxos.

- CEO Dan Schulman also said that PayPal’s crypto services will soon expand beyond “buy, sell, hold.”

What’s up with the US banks?

One of my predictions for 2021 was that larger banks will start offering crypto services. Goldman seems the only one “in” so far with the re-opening of a crypto trading desk this week, although it doesn’t do spot (yet). I think a number of large banks globally will follow soon and start offering crypto trading services, including spot.

Why? At the end of the day, the large banks:

- Are always looking to make money (and love volatility!), and there is a lot to be made in crypto;

- Will have to respond to client demand at a certain point (the institutions adopting crypto), and we are getting there;

- Don’t want to fall behind the curve vs. competitors as a slow adopter.

Now, what do we know about where the big US banks are currently at?

Goldman Sachs

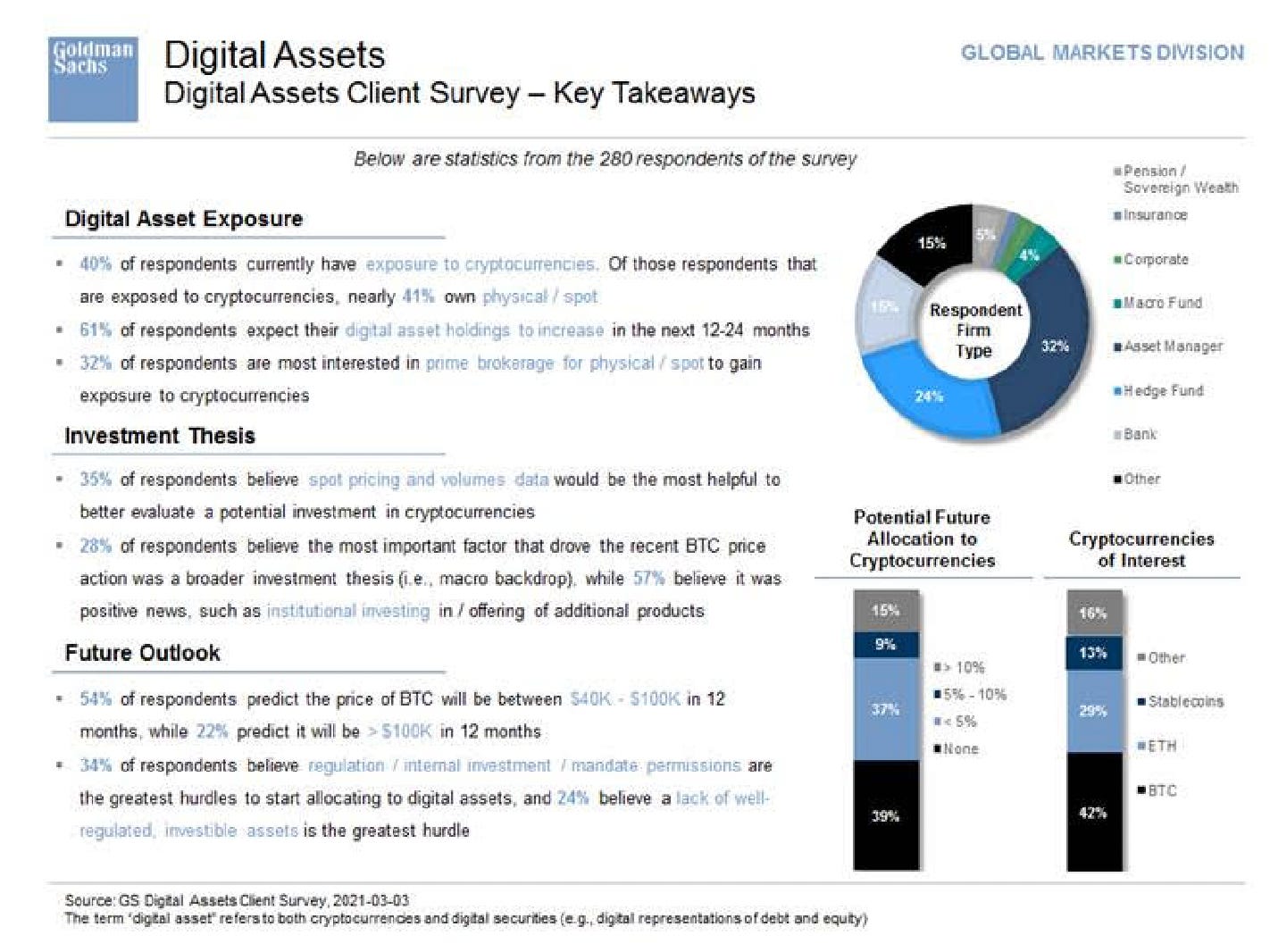

Goldman’s head of digital assets, Matthew McDermott, said earlier this week that the firm sees demand for bitcoin. It has fielded more than 300 conversations from clients including hedge funds, asset managers, macro funds, banks, corporate treasurers, insurance, and pension funds. Goldman is also seeing interest from wealth management and private banking clients. McDermott confirmed the bank is relaunching its crypto trading desk focusing on CME features and non-deliverable forwards, not spot. “And we’re also now disseminating bitcoin content to our institutional clients through our Marquee platform.”

Goldman President and COO John Waldron yesterday said the bank is exploring how it can meet rising customer demand to own and invest in bitcoin, while still staying on the right side of regulation. “Client demand is rising,” Waldron said. “We are regulated on what we can do. We continue to evaluate it … and engage on it.” Waldron said Goldman can custody digital assets “but can’t principle” them, and is in talks with regulators and central banks about how banks should be regulated when dealing with digital money. “The pandemic has been a significant accelerant,” Waldron said. “There is no question in our mind there will be more digital commerce … and (use of) digital money.”

Goldman’s Global Markets Division last week published results of a Digital Asset Clients Survey (with 280 respondents):

Reuters, quoting a source, reported last week that Goldman is also exploring the potential for a bitcoin ETF and has issued an RFI to explore digital asset custody. It is already trading 21Shares’s Polkadot ETP on the SIX Swiss Exchange and is also the lead bank for Coinbase’ direct listing on Nasdaq. In other words, they have investment bankers that are involved with the crypto sector.

JPMorgan

Although JPMorgan’s research team has been quite active in covering bitcoin there are no plans known to the public for its markets division to open a trading desk.

In February, JPMorgan co-president and COO Daniel Pinto told CNBC “If over time an asset class develops that is going to be used by different asset managers and investors, we will have to be involved,” and that “the demand isn’t there yet, but I’m sure it will be at some point.” He clarified that the firm’s decision would be informed by whether a critical mass of clients wanted the firm to trade bitcoin.

The Block, quoting sources, reported last October that JPMorgan has been engaging with digital asset firms including Fidelity and Paxos on sub-custody. Unconfirmed as of yet.

JPMorgan Chase on Tuesday filed for a structured product called the “Cryptocurrency Exposure Basket.” The basket includes 11 unequally weighted reference stocks of US-listed companies that offer exposure to crypto.

Like Goldman, JPMorgan has also been trading the Polkadot ETP.

Morgan Stanley

Andrew Peel, Morgan Stanley’s head of digital asset markets discussed the bank’s activity on a recent podcast. Peel said the bank has seen more “significant” interest in bitcoin from traditional financial services world since the end of 2020. Although the firm was considering opening a desk in 2018 it has put its focus on evolving “the ability to implement the developing crypto world functionality into traditional financial infrastructure.” It is involved with “some of the larger European exchange initiatives which are looking to use DLT, smart-contracts, automated processes of certain life cycle events for products.”

Sources have said that Morgan Stanley is not actively exploring crypto asset custody.

Morgan Stanley has increasingly sought indirect exposure to crypto initiatives:

- Morgan Stanley’s investment management arm boosted its stake in MicroStrategy to 10.9% late last year.

- Bloomberg, quoting sources, recently reported that Counterpoint Global, a unit of Morgan Stanley Investment Management, is exploring whether bitcoin would be a suitable option for its investors.

- NYDIG filed a Form S-1 registration statement for a Bitcoin ETF with the SEC mid-February. The submission lists NYDIG Trust Company LLC as the fund’s Bitcoin custodian and Morgan Stanley as an authorized participant (AP). APs act as market makers and typically have to buy the underlying spot instrument or hedge with derivatives.

- Morgan Stanley also participated as a lead investor in bitcoin prime broker NYDIGs $200M fundraise that was announced on Monday.

No recent news from Citi and BofA. However, Citi’s head of FX did contribute to its recent report on bitcoin (see #24).

Stay tuned!

Crypto exchanges and the liquidity problem

The crypto exchange landscape has been fragmented since the early days. Many shabby retail exchanges have disappeared since the 2017 boom. A number of new and more serious institutional and derivatives exchanges have launched in recent years, with different degrees of success. Unregulated derivatives exchanges like Deribit, FTX, Bybit, and Bit.com have been great at offering innovative products and attracting clients and liquidity with that. Regulated and spot exchanges have had a harder time to draw critical mass. Some have come and gone whereas others fight on. Bootstrapping liquidity and maintaining it is hard. Still, new players keep emerging and are creative in attracting attention and users. Here are a few relatively new players and how they are going about it.

- Nasdaq-listed Diginex launched Equos out of Singapore last year. It offers spot and derivatives trading. Equos recently hosted a “race for crypto” trading competition. It announced last week that it is planning to launch an exchange token soon, taking a page of the playbook of the unregulated Asia exchange giants. “We’re redefining the exchange token landscape with the launch of EQUOS Origin.” This is interesting given that Diginex is Nasdaq-listed. Coinbase also hinted at the potential for a future token in its S-1 but that is supposedly further off when there may be more regulatory clarity.

- Crypto.com is firing from many angles. Its token has a current $4.6B market cap having grown multi-fold (multi!) this year. It appears to be spending a lot of money on marketing. I mean, sponsoring the Formula 1 can’t be cheap! It is also offering a referral program and has run many special offers.

- US-based CrossTower is offering a transparent low cost model and was founded by industry veterans. It announced earlier this week that it traded $150M+ in February, nearly tripling the volumes traded on the platform since October. It launched a new capital markets desk for institutional clients led by securities industry veteran Greg Bunn, formerly with Citadel. It has also launched a number of investment products including a bitcoin fund and structured products. It has over 55 institutional clients, including 17 market makers and 15 hedge funds representing over $25B AUM. Also check out their research: “DeFi Cash Cows.”

Elsewhere established exchanges continue to experience growing pains…

- Binance Pledges New Controls After 99% ‘Flash Crash’ in Polkadot Futures

- Coindesk dives into the details of the Kraken Ethereum flash crash, concluding:

“Kaiko didn’t find any conclusive evidence as to what caused the crash, either. Whether it was a technical glitch or a sudden run on the order book probably doesn’t matter. With price discovery taking place on multiple venues, technology risk is multiplied and liquidity is divided. Until capital is able to flow more freely into these fragmented markets, investors should expect more flash-crash events.“

Momentum Tracker

- DCG plans to invest up to $250M in Grayscale Bitcoin Trust

- $1.8B RIA Gerber Kawasaki will start investing in crypto via Gemini

- $6B Oslo-listed investment firm allocates $58M to Bitcoin and crypto ventures

- Bloomberg Terminal Adds Price Data for Chainlink and 5 Other Coins

- BitGo Wins NY Trust Charter Opening Door to Wall Street, Holds $30B+ AUC

- Siam Bank’s VC arm part of Anchorage’s Series C after announcing $50M VC Fund

- $1.1B quant fund manager Giant Steps bought a minority stake in Brazilian firm Polvo Technologies. Polvo develops machine-learning strategies to trade futures of Bitcoin and “similar assets.” Polvo’s algorithms will be part of a new fund Giant Steps will launch by mid-year to trade futures of Bitcoin and Ether. Giant Steps also plans to offer market-making services for crypto futures.

- Wealth managers frustrated, anxious for a piece of the bitcoin action: Reuters. The SEC does not yet recognize crypto assets as a security and has not ruled whether mutual funds can own them directly. This limits the number of options for regulated advisors and wealth managers. Most firms are unable to own bitcoin for their clients until they can hold it in an ETF or mutual fund that clears legal hurdles common for any investment.

Fundraising

- BlockFi Gets A $3B Valuation in $350M Series D Led by Bain. The deal increases the company’s private valuation to $3B, up from a $435M valuation when it raised a $50M Series C just six months ago. The platform currently manages more than $15B in assets. From a revenue just short of $100 million in 2020, it is on a run toward generating $500M in revenues in 2021. It has 250,000 clients today from 10,000 at the end of 2019. Staggering growth! CEO Zac Prince confirmed the company is “actively working on public market readiness” but did not disclose the timeline.

- NYDIG raises $200M from Morgan Stanley, New York Life, and others. It also appointed New York Life Chairman and CEO Ted Mathas to its Board of Directors.

- BlockTower raises $25M fund for DeFi.

- Alan Howard leads $25M Series A for Komainu, a crypto custodian JV between Nomura, CoinShares, and Ledger.

- Eco crypto app raises $26M from investors including a16z after fintech pivot.

- Bitcoin miner Cipher to go public via $2 billion SPAC merger.

- Talos raised $30M at pre-money valuation ~$100M led by a16z: The Block.

Valuation

- CoinShares started trading on Nasdaq First North GM Sweden today under ticker CS. As of 10.30am PST today it had a USD-equivalent market cap of $871M.

- Kraken Seeks $20 Billion Valuation in New Funding Round: Source.

- Sorry Coinbase, You’re Not Worth $100B — reportedly trading of Coinbase private shares in the secondary market has been indicative of a $100B valuation. Thomas Meyer argues that Coinbase is going to market at an opportune moment, but $100B is still a helluva lot of money in an industry teeming with competition.

- Celsius Network valued at $3.1B vs. $1.1B market cap: Alpha Sigma Capital

More ETF activity this week

- Grayscale has nine job postings for ETF-focused individuals.

- CI Galaxy Bitcoin ETF approved, launched on TSX Tuesday.

- ETC Group Ethereum ETP to List on Deutsche Boerse.

- Ninepoint Partners planning to convert its Bitcoin trust to an ETF.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.