Concurrent with the NFL’s announcement, Mike Novogratz pronounced Michael Saylor crypto’s Rookie of the Year during MicroStrategy’s bitcoin summit last week. If you are interested in what crypto firms had to say to corporate treasuries, I summarized my key takeaways here.

One recurring theme was that crypto and its ecosystem are growing at the speed of light and that it is staggering what people have to absorb to keep up. In other words, lots to cover again this week so I will get right into it.

In this week’s issue:

- Top story: Tesla invests $1.5B in crypto

- Hottest topic: the corporate opportunity

- Crypto firm specific news and stats from MicroStrategy’s summit

- Taking stock of the opportunity set for investment banks

- DeFi continues to thrive

- Regulators appeared grumpy towards bitcoin this week

And: momentum tracker, the week in charts, and the big picture

Top Story

Tesla invests $1.5B in bitcoin

This was already written when the BNY Mellon news broke this morning so I stuck with it. BNY covered below in Momentum Tracker.

- On Monday, Tesla announced that it bought $1.5B (approx. 7.7% of its cash) worth of bitcoin at some point this year and said it would soon start accepting payments in bitcoin.

- The announcements, buried in Tesla’s 2020 annual report, drove a ~20% surge in BTC’s price as investors anticipated other companies will soon join.

- It caused technical issues at exchanges like Coinbase, Gemini, Binance. Again.

- Given the market’s focus on Musk’s tweets, bitcoin pricing, and recent dramatic market moves, lawyers expect the SEC may have questions about the facts and circumstances of the purchase. In particular about the exact timing.

- Elon Musk wants clean power but Tesla’s carrying bitcoin’s dirty baggage. Elon Musk is a poster child of low-carbon technology. Yet the electric carmaker’s backing of bitcoin this week could turbo-charge global use of a currency that’s estimated to cause more pollution than a small country every year — Reuters.

Connecting the Dots

Hottest topic: the corporate opportunity

Corporate Treasuries have become a hot topic in institutional crypto after a number of high profile investments in the space from firms including MicroStrategy, Square, Marathon Patent Group, MassMutual, and now Tesla. Corporates are also considering crypto as a payment method and one has started staking. It seems like multiple companies are coming out with statements every day now. As expected, plenty of opinions. Here are some of the main stories in the past week.

- MicroStrategy virtually hosted more than 1,000 firms from more than 16 countries for a two-day bitcoin conference.

- Apple analyst Mitch Stevens at RBC Capital Markets suggested “When we think of the Apple Wallet, there is a clear opportunity in our view to create a buying and selling mechanism for crypto currencies.” Apple could adopt a closed system, effectively acting like an exchange, or an open system utilizing strike and the lightning network to reduce the cost of converting Fiat to crypto assets. RBC estimates it would cost Apple $500M to create an income stream of $44B. The firm could “synthetically pay for the development cost by acquiring the underlying asset” on its balance sheet (which would cause a BTC price increase). Interesting analysis.

- Twitter is thinking about bitcoin investment, hasn’t decided yet. In an interview with CNBC, CFO Ned Segal said Twitter had also considered how it might pay vendors or employees using bitcoin, should they ask to transact using the virtual currency. “We might consider whether we would be transferring dollars to bitcoin at the time of the transaction or if we wanted bitcoin on our balance sheet ready to complete that transaction,” Segal said.

- Reuters also reported that on General Motors Co’s earnings call on Wednesday, CEO Mary Barra, responding to a question about accepting bitcoin as payment for vehicles, said, “This is something we’ll monitor and we’ll evaluate. If there’s strong customer demand for it in the future, there’s nothing that precludes us from doing that.” Barra said “We don’t have any plans to invest in bitcoin. Full stop there.”

- JPMorgan sees Tesla bitcoin bet as too bold for others to follow. “Although we are skeptical that Tesla is a typical corporate and its example will be followed by more mainstream corporates, we recognize that Tesla’s announcement broadens corporate sponsorship.” The analysts say that the main issue is bitcoins volatility. Annualized vol of a typical corporate treasury portfolio is around 1%. A 1% allocation to bitcoin would increase this to 1.3%. The analysts don’t elaborate on this.

- Hot off the press by the WSJ “CFOs Hesitate to Invest in, Handle Bitcoin Due to Volatility”. “One of the risks is that it introduces something similar to currency volatility to the balance sheet and the day-to-day operations of the business,” said Verizon CFO Matthew Ellis. R. Scott Herren, Cisco CFO, said customers aren’t demanding to pay in bitcoin. Roxi Wen, the CFO of Mozilla, said she is following discussions around bitcoin, but doesn’t consider it an asset worth holding on the balance sheet. An SAP spokeswoman said the company would monitor future developments in terms of bitcoin as a potential strategic investment option.

- Deloitte offered guidance to corporate treasuries on accounting, tax and controls, in a brief report distributed by MicroStrategy.

- Uber may start accepting bitcoin and other cryptocurrencies, says CEO. He said that Uber will not be following in Tesla’s footsteps by putting Bitcoin on its balance sheet. “It was a conversation that happened that has been quickly dismissed. We’re going to keep our cash safe. We’re not in the speculation business,” he said.

- Fintech giant Adyen said it has no interest in bitcoin as a payment method. CEO Pieter van der Does said volatility in bitcoin and other cryptocurrencies makes them less viable for making transactions. He said his firm’s merchants aren’t requesting that it adds crypto payment functionality to its platform.

- Never mind bitcoin on corporate balance sheets, Deutsche Telekom (DT) has quietly started staking on blockchains. DT is one of the main data providers to Chainlink’s dominant DeFi oracle service. Its subsidiary MMS has begun staking on Dapper Labs’ Flow Network. “We gradually began to feel we were not focusing enough on public blockchains.This is where digital value will be moved in the future, and it’s really where a telco should be active,” Andreas Dittrich of DT said.

Crypto firm specific news and stats from MicroStrategy’s summit

As mentioned above, a number of crypto firms presented on the second day of MicroStrategy’s bitcoin conference for corporate Treasurers. Here are a few pieces of news + numbers + commentary on how firms see themselves.

- NYDIG will launch a data platform for its clients shortly. Perhaps on the back of its Digital Assets Data acquisition? CEO Robby Gutmann also noted a “shifting conversation from bitcoin the asset to bitcoin the network.” The firm wants to bring products that can help corporates “move money transparently, cheaply, instantaneously across the world.” Like RBC Capital Markets above, Ross Stevens spoke about Strike and the lightning network in this context. As reported last week, NYDIG expects to grow its client assets from $6B to beyond $25B by year end.

- Asked about Genesis’ plans for the future, CEO Michael Moro expressed the firm’s intention to continue to roll out traditional prime brokerage products including (1) capital introduction and (2) a fund admin business. It is also expanding geographically.

- Galaxy Digital employs 120 people now but CEO Mike Novogratz expects that number to grow to 160 in two months. They opened a bitcoin mining group to provide advice to miners on capital raising and derivatives hedging. The firm is also focused on geographic expansion. When speaking about their Sales & Trading business he said the firm trades $1B in tokens a day. It has a $1B+ balance sheet.

- Coinbase said it has $90B in assets on its platform, 1,200 employees, and 43M accounts. Brett Tejpaul couldn’t share much more news because of its SEC-mandated pre-listing quiet period.

- Paxos positions itself as an infrastructure brand and a partner for institutions that need a high quality service. Paxos pitch is that it allows these institutions to offer crypto to its clients quickly without having to build a capability in house. As is known, the firm counts PayPal and Revolut as its customers. The international market is important to them and the majority of their customers are outside the US.

- Michael Sonnenstein said 85% of the $5.7B new AUM Grayscale raised in 2020 came from institutional investors. A lot of them were hedge funds.Their headcount tripled from a year ago. The firm plans to expand its product suite from 9 today and will be investing in its brand. It is planning a 4th national ad campaign.

- Kraken is growing very fast and is hiring for more than 100 roles according to CEO Jesse Powell. It saw its ATH volume day in January, beating its last ATH day by 5X.

- Vince Kwok of Binance compared his firm to “Google’‘ in terms of its breadth of products and services. Most other vendors (OTC, traders) end up hedging their flow on Binance. Therefore, the exchange views itself as the aggregator of liquidity in the industry. For clients this means they connect directly to the source, with “obvious cost benefits.” Two weeks ago, the firm announced Binance Pay: a borderless and secure payments platform that allows merchants to take crypto payments and receive stablecoin and fiat. It allows vendors to quickly plug in and support crypto payments for their clients.

Taking stock of the opportunity set for investment banks

Wall Street stays on crypto sidelines as Tesla boosts bitcoin according to Bloomberg. They have a point there. Although there is anecdotal evidence that investment banks are close to launching crypto custody and execution services, none of the major firms has made a move yet. So what is the current opportunity that Wall Street is missing out on?

Prime Brokerage, Sales & Trading. Institutions have clearly entered the space. We are still in the early innings but crypto prime brokers are booming. These businesses already have a one up on Wall Street when it comes to knowing the asset class and the markets. Now they are also helping Wall Street’s clients accumulate large positions, safekeep these, and make them productive.

Investment Banking.

- Against the backdrop of a pipeline of crypto IPOs building up, Wall Street has been getting calls from crypto native firms about running their listing processes.

- As banks and other financial institutions face more demand for crypto services from their customers, those that are behind the game may soon have to acquire crypto-native businesses to catch up (= M&A).

- And then there are the corporate treasuries acquiring bitcoin for their balance sheets. First, this is a c-suite decision and Wall Streets loves being the strategic advisor of choice for CFOs and other execs. Crypto PBs are cozying up here. Second, these crypto native firms have built out derivatives capabilities to allow corporates to hedge these positions or earn additional yield on them. They understand the risk. Corporate derivatives are a lucrative business for banks.

- Investment banks also like to bundle services like corporate loans and ECM deals with juicy fees. I give you a loan, you let me run your convertible bond deal (and pay me fees). Some banks rely on large balance sheets funded by consumer deposits to provide these loans. As pointed out by more and more people, digital wallets are rapidly gaining market share at the expense of bank accounts.

Wealth management. Further to the above, the solutions teams that are involved with corporate derivatives are also closely linked to the UNHWI’s that own and run these businesses. This is of particular important for the banks that have large wealth management businesses or private banks and banks with a large Asian footprint. These clients may go somewhere else for business, take (part of) their assets with them and give their investment banking business to someone else.

Conclusion: Wall Street can not afford to stay on the sidelines much longer.

DeFi continues to thrive

DeFi continues to develop at the speed of light. Here are some good sources to educate yourself on some of the basics and latest trends + news from this week.

- The St. Louis Fed posted an updated version of Fabian Schӓr’s paper that I read a while back and can recommend for a basic lay of the DeFi land.

- Laura Xie recently updated her Beginner’s guide to DeFi for TABB Forum. Ping me if you need further resources, I keep a library of educational DeFi material.

- MetaMask is earning $200k/day in Ethereum token swap fees. ConsenSys launched the swap function, a competitor to DEX aggregators, last Oct.

- ConsenSys introduces major upgrades to peer-to-peer exchange AirSwap that promotes full decentralization and guaranteed prices. The upgraded exchange will protect traders from both front-running and price slippage by leveraging an RFQ protocol and atomic swaps for settlement.

- 0x Labs closes $15M Series A led by Pantera as ZRX finds DeFi market fit. The new round comes off the successful launching of 0x’s DEX router, Matcha, which came out in June and has processed $2.7B in orders. UOP: Matcha expansion globally; build out 0x Labs’ trading desk business, Periscope Trading; and the professional-grade aggregation service, 0x API (which underlies offerings from companies such as ShapeShift, MetaMask and Zapper).

- Loopring sees 40,000 daily transactions as ethereum fees rise. Second-layer solutions like Loopring allow executing certain operations outside of the main blockchain—or “off-chain”—which, in turn, helps reduce the load on the main network. Layer two solutions offer faster transaction speeds and lower fees.

- Bloomberg and The Block ran stories about flash loans.

Regulators appeared grumpy towards bitcoin this week

- Janet Yellen says ‘misuse’ of cryptocurrencies like bitcoin is a growing problem.

- Christine Lagarde says it’s ‘very unlikely’ central banks will hold bitcoin in near future. She doesn’t consider bitcoin to be a real currency.

- Deputy Governor Bank of Canada: bitcoin bull run ‘speculative mania’. “Even in this increasingly digital economy, though, cryptocurrencies such as Bitcoin do not have a plausible claim to become the money of the future,” he said. Crypto is only good for “illicit transactions like money laundering, where anonymity trumps all other features.”

Momentum tracker

- Custody bank BNY Mellon said today it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients. “It is a big step for Wall Street’s back-office banks, whose concerns over regulatory, legal and stability risks left them reluctant to come into direct contact with crypto markets,” according to the WSJ. BNY is responding to customer demand. BNY is the first big custody bank to make such a move. BNY Mellon intends to begin offering these capabilities later this year. BNY executive Roman Regelman reckons it will be another three to five years before digital assets are fully integrated into Wall Street’s traditional infrastructure.

- Mastercard to support some cryptocurrencies on its network as it is seeing more people using cards to buy crypto assets. It also sees an increase in people using crypto cards to access and convert these assets into traditional currencies for spending.

- Bill Miller plans $400M Bitcoin investment via GBTC.

- Cboe Plans to Re-Enter Crypto Market. “We see the potential and interest, including from institutional investors, and we are planning how to re-enter,” CEO Edward Tilly said on the firm’s results call. “We are in the early stages and will be measured and cautious.”

- This week saw a host of new fund launches: Castle Island Ventures ($50M), Spartan Group ($50M VC), Thailand’s Siam Bank ($50M), Cadenza, North Island Ventures ($72M), and Kraken Ventures.

- Messari went live with its Enterprise offering this morning. Messari Enterprise is a comprehensive new platform that combines Messari’s existing best in class data with a new suite of tools and alerts to monitor key updates for 100+ networks and assets. The product has an impressive list of early subscribers consisting of 125+ of crypto’s finest organizations.

- Crypto market maker Heymeyer announces merger with Swiss trading firm Nortide Capital AG. The deal will create a new firm called Heymeyer Nortide AG. The merged firm will be based in Switzerland. The deal points to the broader market consolidation underway in the crypto market according to The Block. The firms have traded a combined $2B in notional trading volumes a month–a figure.

The week in charts

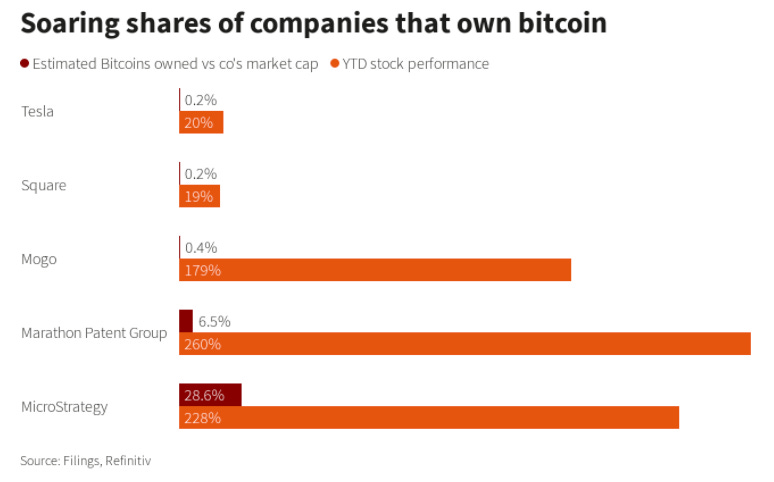

<blockquote class=”twitter-tweet”><p lang=”en” dir=”ltr”>Ladies and gents, "The Elon Candle".<a href=”https://twitter.com/hashtag/Bitcoin?src=hash&ref_src=twsrc%5Etfw”>#Bitcoin</a> <a href=”https://t.co/cdEzaIkMOj”>pic.twitter.com/cdEzaIkMOj</a></p>— Travis Kling (@Travis_Kling) <a href=”https://twitter.com/Travis_Kling/status/1358929541675163648?ref_src=twsrc%5Etfw”>February 9, 2021</a></blockquote> <script async src=”https://platform.twitter.com/widgets.js” charset=”utf-8″></script>Elon Musk’s bitcoin bet fuels gains in companies already invested

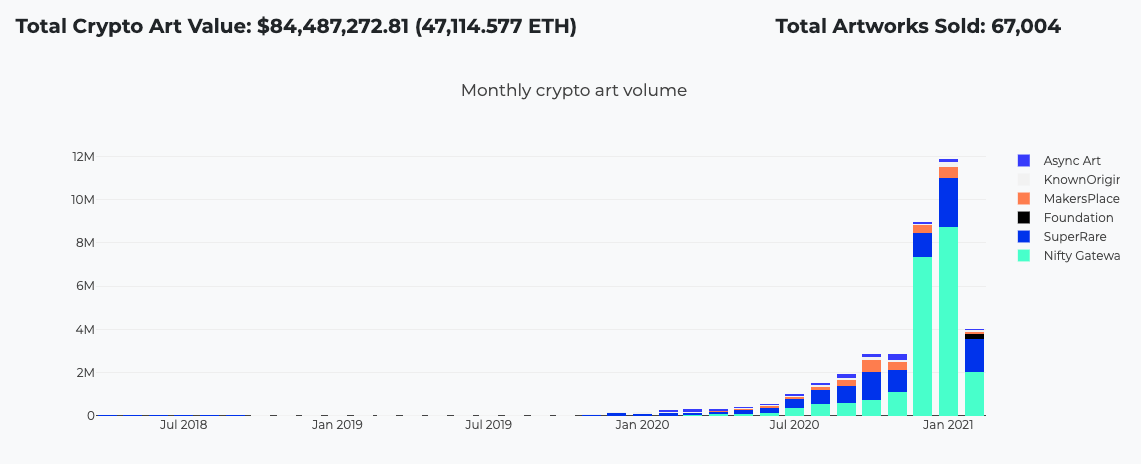

Crypto Art Sales on Ethereum Reach a Record $80 Million

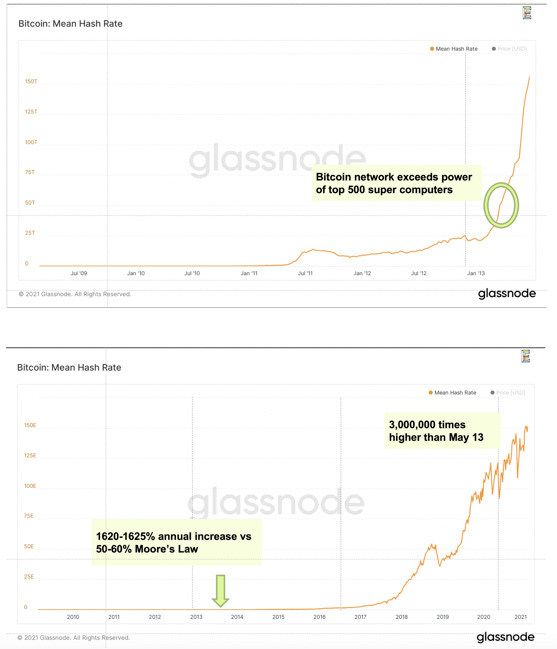

Bitcoin Has Power (The Exponential View)

In May 2013, the hash rate (processing power) of the bitcoin network exceeded that of the 500 most powerful supercomputers. Today, the hash rate of the network is 3,000,000 times greater. This represents an annual compounded growth of around 1620%. (The green arrow on the bottom chart shows the point in May 2013 that is circled on the top chart.)

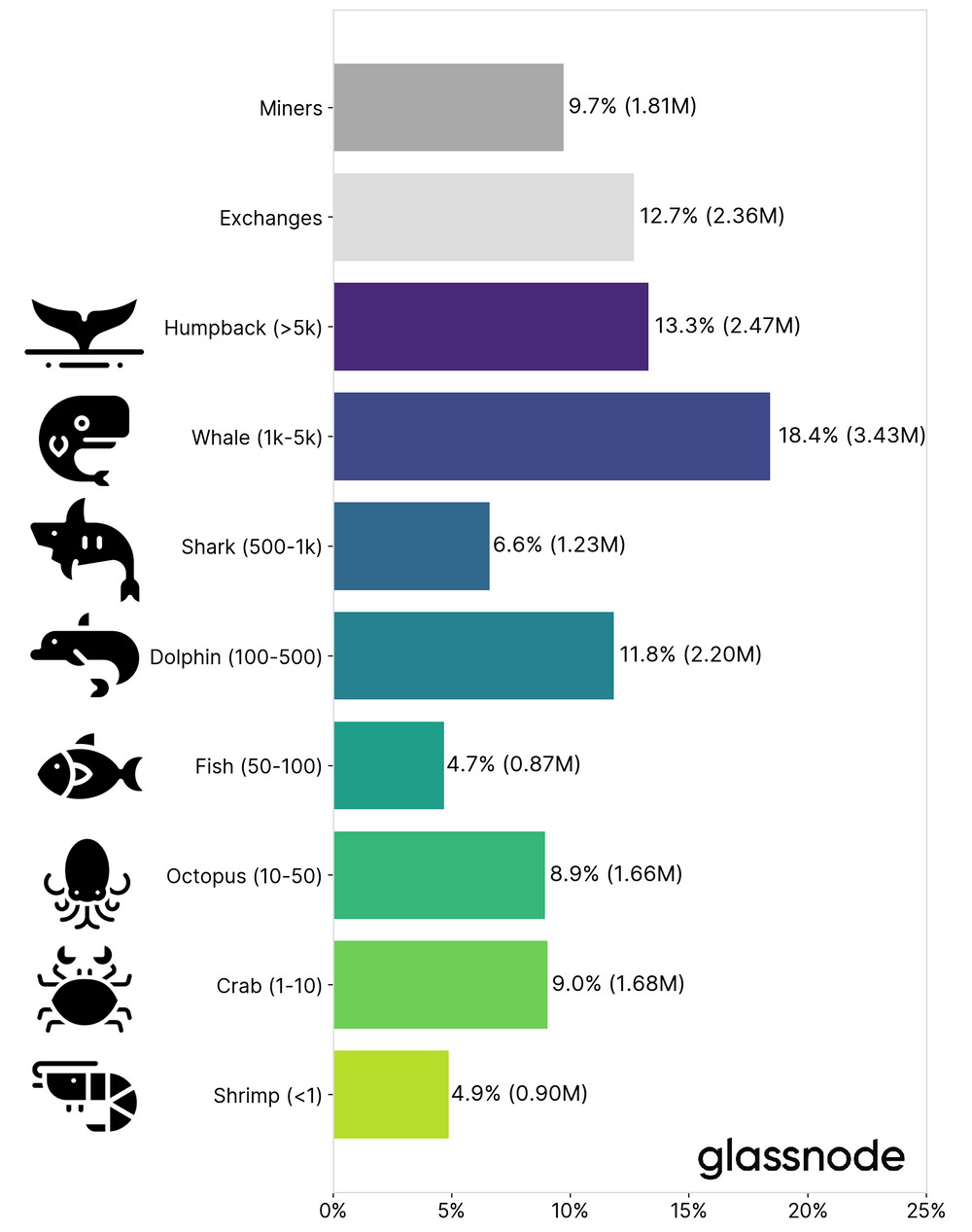

Bitcoin Supply Distribution (Glassnode)

The Big Picture (charts going forward?)

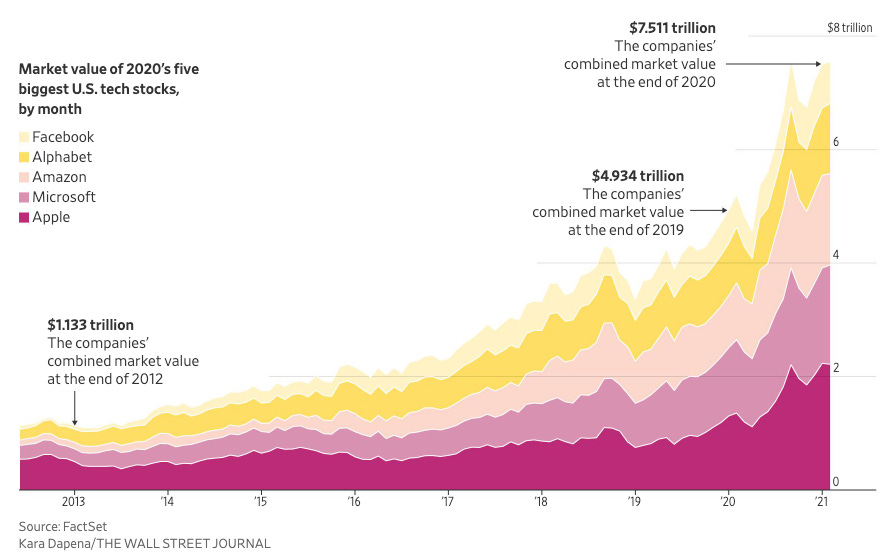

How Big Tech Got Even Bigger (WSJ)

Technology giants such as Alphabet, Amazon and Apple are more dominant than a year ago thanks to a greater reliance on their services during the pandemic. The forces propelling them to new heights are expected to outlast Covid-19.

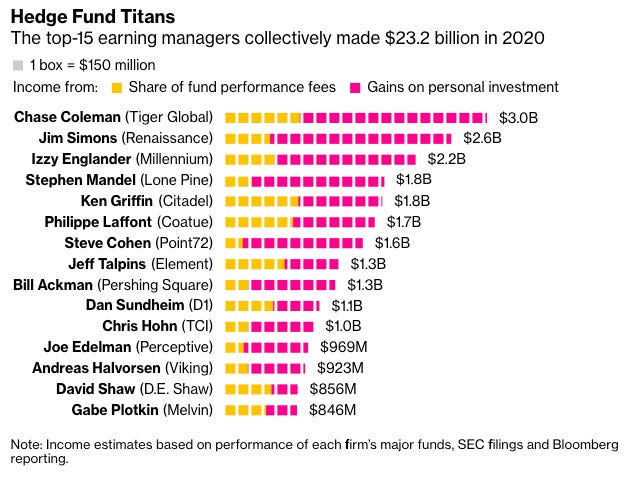

The top-15 earning managers collectively made $23.2B in 2020

That 15 people — all of them men — could earn so much so quickly starkly illustrates the widening rift between the ultra-rich and everyone else at a time of heightened unemployment and division over the scope of government response.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.