Ryan Selkis noted this week how Clubhouse, the latest social media sensation, is “a big time suck.” It made me think how hard it has become to keep up with everything crypto. Between podcasts, webinars, video channels, news articles, blogs, newsletters, and Twitter…I mean who has the time?!

The activity in the crypto space is on fire too on the back of soaring institutional demand, renewed retail interest, and ridiculously fast innovation cycles in areas like DeFi. I can see it in the sheer volume of content I plough through each morning for the Daily (I get up before 5am PST every day to do it). To then come up with what is still a sizable list of headlines for you to skim 🤷🏻♀️

Anyway, as you guessed, not a short post this week as you got to stay on top.

To start on a lighter note, after taking a 1 (or was it 2) day break from Twitter, Elon Musk returned to endorse Dogecoin:

In this week’s issue

- The opportunity in primary markets

- GameStop and the case for blockchain-based settlement

- Surge in exchange volumes

- BTC and ETH held on exchanges drops to a multi-year low

- Investment products on the rise

- A picture is worth a thousand words

- Momentum tracker

The opportunity in primary markets

- Primary markets’ processes are notoriously ancient and inefficient including the bookbuilding process. A host of startups has been working on solutions in recent years (i.e. Agora, Nivaura, Primary Portal, Origin, Liquidnet DCM). The pre-issuance/settlement area seems to have the most traction at the moment.

- Blockchain company Axoni upped its Series B round this week with new investments from Deutsche Bank and UBS. It simultaneously announced a deal with DirectBooks, a startup owned by Deutsche Bank, Bank of America, Barclays, BNP Paribas, Citi, Goldman Sachs, JPMorgan, Morgan Stanley, and Wells Fargo. DirectBooks is building a shared infrastructure the banks now use to issue and sell corporate bonds. The platform went live in November 2020. Market observers estimate the platform currently processes just under $1B in bond proceeds in an average week. Lots of space to grow and it makes a lot of sense — in particular in the corporate investment-grade market where underwriting fees are low.

- So, why not go all the way and actually issue digitally native bonds? That’s an interesting question. Whereas the equities markets are very efficient (or not, see below!), the bond markets are not. As we discussed in December, it is obviously complicated from a regulatory, governance and technical perspective. Things like integrations with legacy systems, having an onramp, and aligning stakeholders. However, large players also kind of like things the way they are as the inefficiencies present opportunities to make money for both buy and sell-side. Although the times are changing with platforms like TruMid, MarketAxess and TradeWeb gaining market share fast.

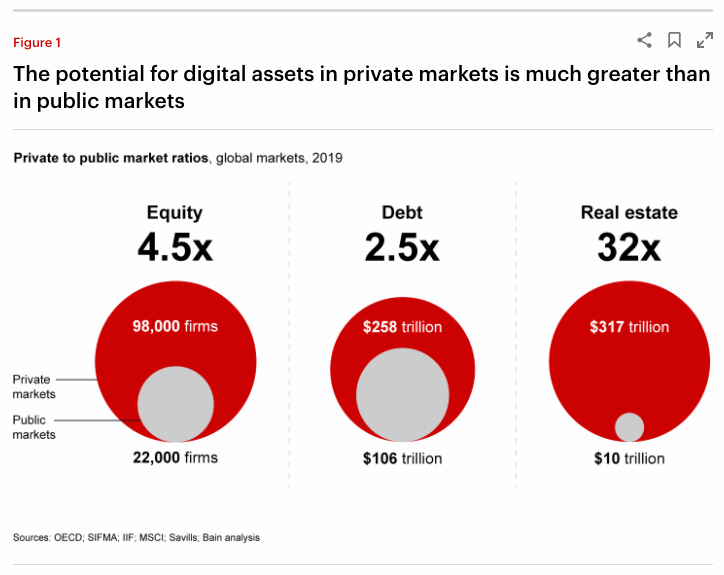

- One area that has been gaining traction and is expected to become more prominent soon is blockchain-based issuance of private equity and debt securities. TABB ran an article this week on a whitepaper by Texture Capital. The firm estimates that about 20,000 US companies raise $200B in capital in private markets every year. By contrast, $360B was raised in public markets in the US in 2020 according to Refinitiv data. The secondary market for private securities, however, is a tiny fraction of the size of public secondary markets. Bain highlighted this a few weeks back:

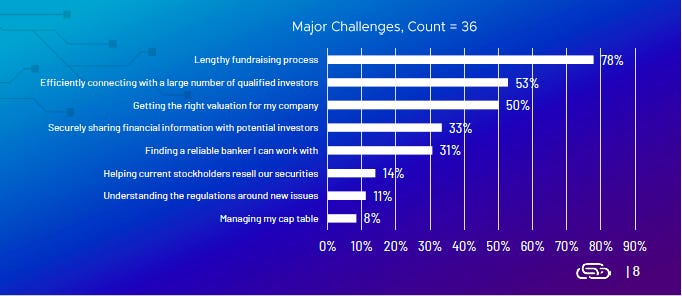

- Citing a recent survey (scope unclear) Texture Capital lays out six pain points executives experience when trying to tap the private markets for capital. Texture Capital leverages blockchain technology to operate a marketplace for investors to more efficiently and directly participate in private markets. Keep in mind it is a whitepaper so returns may be skewed, however, these issues are well known and clearly things blockchain can solve for.

- In a recent webinar by Blockworks Group “Bringing Public Market Liquidity to Private Market Securities”, the panel saw certainty of ownership (cap table management), transferability, and liquidity as primary advantages for issuing private equity securities on a blockchain. Whereas in 2017/18 there was a lack of issuer quality, market infrastructure, and protocols like ERC-20 and 1404 were immature, all of this has started to fall into place.

- However, secondary market trading remains the classic chicken and egg problem. AMMs as always available, automatic, programmable, global infrastructure could provide a potentially interesting solution here. However, there are a number of compliance problems to work through.

- Other potentially interesting benefits of blockchain-native securities? (1) Transparency: informational friction remains an important reason why companies stay private longer. We discussed “the living breathing quarterly report” last week. (2) bringing more people in as stakeholders is built into the psychology of crypto — something that I am very excited about as you know.

- Catalysts for this market to come to life? Anything that will trigger lots of people to onboard into the broader crypto ecosystem. This could be a high profile issuer, providing easy access to US stocks, or other proliferation of digital wallets.

I spent more than a decade in primary markets so this is a topic close to my heart. Stay tuned!

GameStop and the case for blockchain-based settlement

So, maybe equity markets aren’t THAT efficient after all. We touched upon the GameStop saga last week and there has been a lot more drama since. Although these are clearly extraordinary circumstances, two issues in particular are making the case for crypto and therefore got a lot of attention in the past week.

- The fact that 138% of the stock was sold short, which reflects a bookkeeping issue that is related to the market practice of T+2 delayed net settlement. In other words, the markets are never in sync. The issue is very similar to the now-infamous case of Dole Foods that got a lot of attention in the community a few years back. Imbalances like this put further downward pressure on the stock prices so longs (including mom and pop) get impacted disproportionately. This makes it an issue of market fairness;

- GameStop volatility forced Robinhood (and other online brokers) to halt trading of the stock. Conspiracy theorists said Citadel, who buys Robinhood’s order flow, told the brokerage to disable trading in GME to save Melvin Capital, bailed out by Citadel. That’s not what caused Robinhood to limit trading in GME. It was an issue with the clearinghouse where Robinhood had to put up additional collateral that it didn’t have. “The reality is that our archaic two-day trade settlement process, massive volumes, price volatility, poor regulation, and Robinhood’s own credit extension policies pushed the online broker to the brink of closure.”

Why is settlement still T+2 in the equities markets? The technological capability to settle the securities same day has actually been there for over a decade. The problem is not just (1) the ancient multi-layered bookkeeping system, it is also (2) custody and (3) fiat. Blockchain based assets can provide gross real-time settlement, but that is not the only thing needed. Caitlin Long of Avanti Bank highlighted that custody must be fixed too. Asset managers are required to use custodians which require an IOU relationship. What is needed is direct ownership and custody as bailment where the custodian has temporary possession but not the title to the stock. The US state of Wyoming has authorized this already.

Yep—but @balajis *MUST* fix custody too. Asset mgrs are required to use custodians, which take advantage by forcing us into IOU relationship (BIG source of probs). *MUST* make stock custody like coat check/valet parking where owner keeps title to assets. #Wyoming authorized this! https://t.co/hyGfWqwK1M

— Caitlin Long 🔑 (@CaitlinLong_) January 29, 2021

Another issue lies with fiat (highlighted by Caitlin Long on a recent webinar). Payments processed through ACH can be clawed back for 90 days. My understanding is that this issue mainly lies with transactions processed through retail broker dealers. A commercial bank USD stablecoin that can provide fast settlement with legal finality could provide a solution here.

The man himself, Vlad Tenev, CEO and Co-Founder of Robinhood, also wrote a post and the title says it all: It’s Time for Real-Time Settlement. “The clearinghouse deposit requirements are designed to mitigate risk, but last week’s wild market activity showed that these requirements, coupled with an unnecessarily long settlement cycle, can have unintended consequences that introduce new risks.” The company will air a Super Bowl ad amid the saga 🏈

Regardless, crypto benefited from the event seeing a spike in account opening, trading and an upward price move in certain assets. It is reflecting a trend where individuals feel the system is not serving them: power is centralized and concentrated, and rules are opaque. You can see why crypto is an attractive alternative.

Conclusion: it’s complicated and issues won’t be resolved overnight, but it definitely put our industry and the solutions it can provide in the spotlight. This is highly relevant with a new administration coming in that is now looking at some of these issues.

Surge in exchange volumes

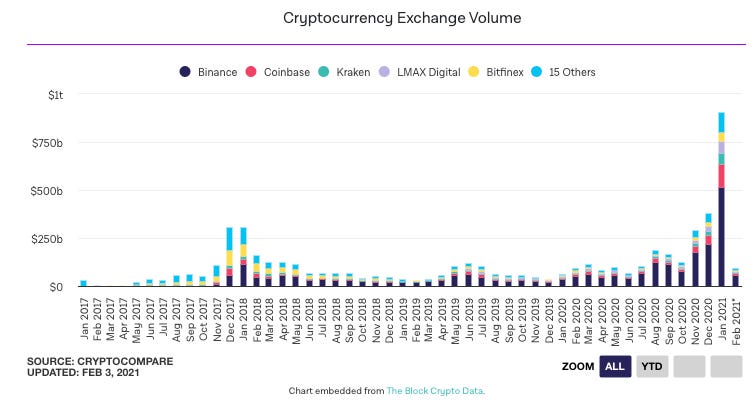

Also in the spotlight this week were crypto exchanges. Not for outages this time but because of a record January in terms of volume.

- Spot trading volume on cryptocurrency exchanges has crossed all previous records to reach over $900B in January.

- In a blog post addressing recent outages, Kraken said $56B was traded on its platform in January 2021 – more than all the volume transacted for the full year of 2019. This past weekend alone, it saw a 1,000%+ increase in signups. CEO Jesse Powell told Michael saylor this morning that the exchange had its ATH volume day last week, beating its previous record by 5X.

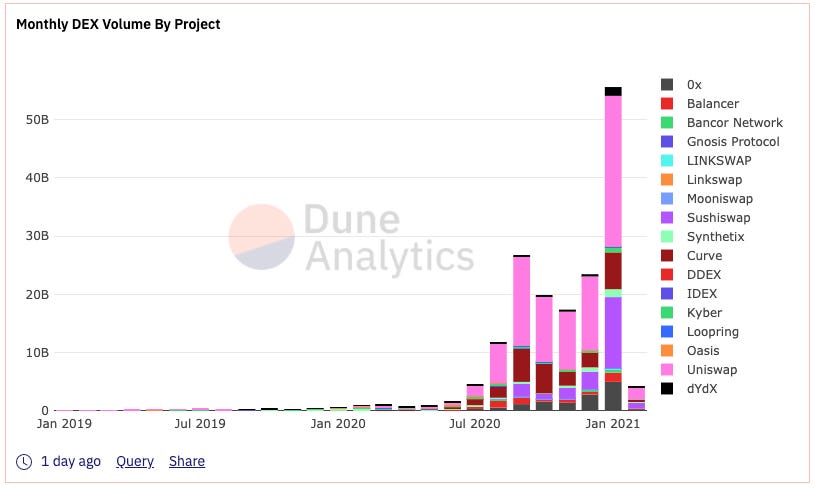

- Decentralized exchanges (DEX) painted a similar picture. DEXs closed out their biggest month ever, processing more than $63B in trading volume in January, according to data from Dune Analytics. That’s more than half the total volume from all of 2020 in January alone. With growing anger at Robinhood and other traditional trading platforms DeFi is in prime position to benefit from the anti-financial institution sentiment according to Coin Metrics.

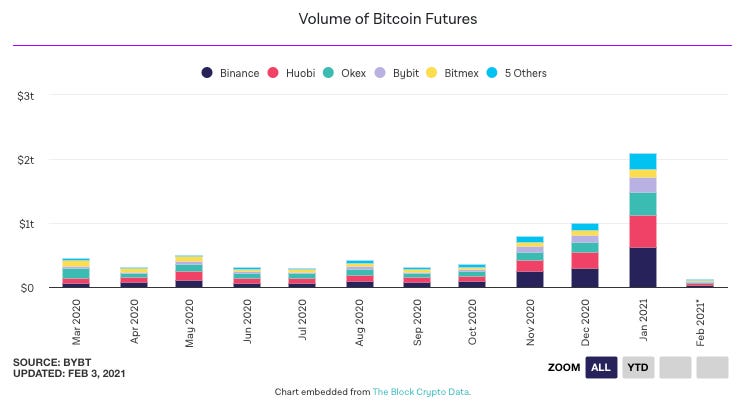

- The Bitcoin futures market exceeded $2T in monthly volume for January.

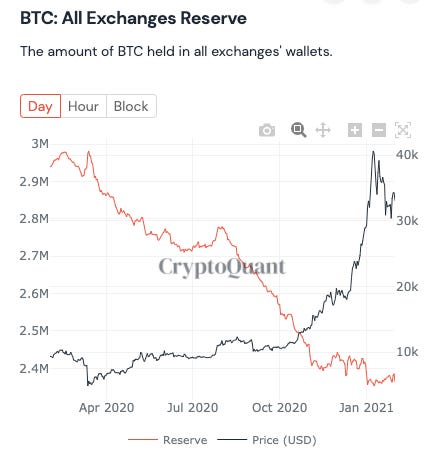

BTC and ETH held on exchanges drops to a multi-year low

Many analysts believe that the rapidly expanding DeFi sector, launch of Eth2 and increasing participation from institutional investors are the primary reasons for the drop in BTC and Ether held on centralized exchanges:

- TVL is reaching new highs every week. Data from DeFi Pulse shows that the majority of DeFi platforms are built on the Ethereum network and require Ether to transact with the protocol.

- A similar phenomenon is happening with BTC as holders looking to participate in the DeFi space without selling their Bitcoin have been wrapping them into ERC-20 synthetic versions of Ether.

- Data from the Eth2 Launch Pad shows that there are currently 2,907,298 Ether worth a total of $4.4B staked on the network earning an estimated APR of 9.2%.

Data firm CryptoQuants noted that massive Coinbase Pro outflows of ~$500M last week were likely caused by institutional investors buying through OTC desks. Founder Ki Young Ju speculated that it might be Guggenheim in which case their entry point would be around $32.4K. Meanwhile, Guggenheim’s CIO Scott Minerd is under fire on social media for expressing different views about Bitcoin, seemingly on either side of a big investment.

Crypto investment products on the rise

In its weekly fund flows report, CoinShares reported a total of $34B currently invested in investment products. AUM remains very focused on BTC ($24B) and other top coins. “Despite the increased perceived interest from investors in broadening their scope to other crypto assets, there has been little interest in multi-asset investment products with only US$500m of AUM, representing only 1.6% of passive investments.”

There were a number of new product offerings and developments this week:

- 21Shares launched the world’s first Polkadot ETP on SIX Exchange

- Bitwise filed for approval to publicly trade its Bitcoin Fund

- BlockFi registered a Bitcoin Trust with the SEC

- CrossTower launched a Bitcoin Fund to compete with Grayscale’s GBTC

- In related news, Gemini partnered with Genesis to offer 7.4% yield on customer deposits. The product is part of Gemini’s attempt to bring in new crypto investors with bank-like products.

A picture is worth a thousand words

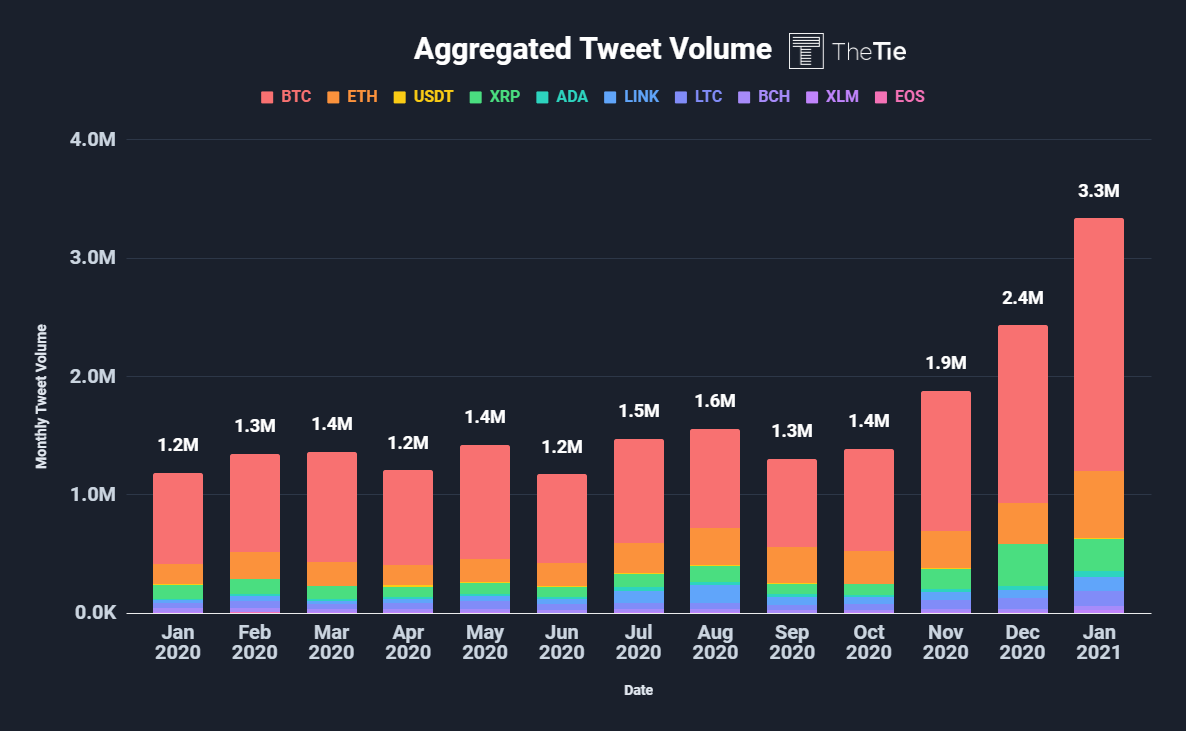

Aggregated tweet volume has been steadily rising since September

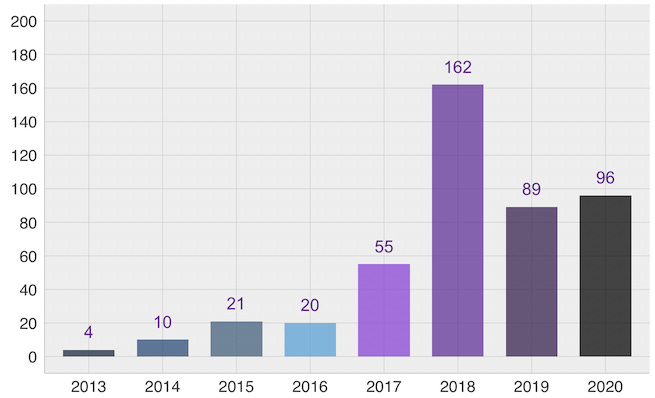

TokenData Crypto M&A Volume

The firm will soon be publishing their annual M&A report digging into all crypto M&A deals from 2020 in addition to looking ahead.

New weekly crypto subreddit subscribers

Crypto subreddits are seeing a huge uptick in new subscribershttps://t.co/dtti4GEZuS pic.twitter.com/VvgbTe002Z

— The Block (@TheBlock__) January 29, 2021

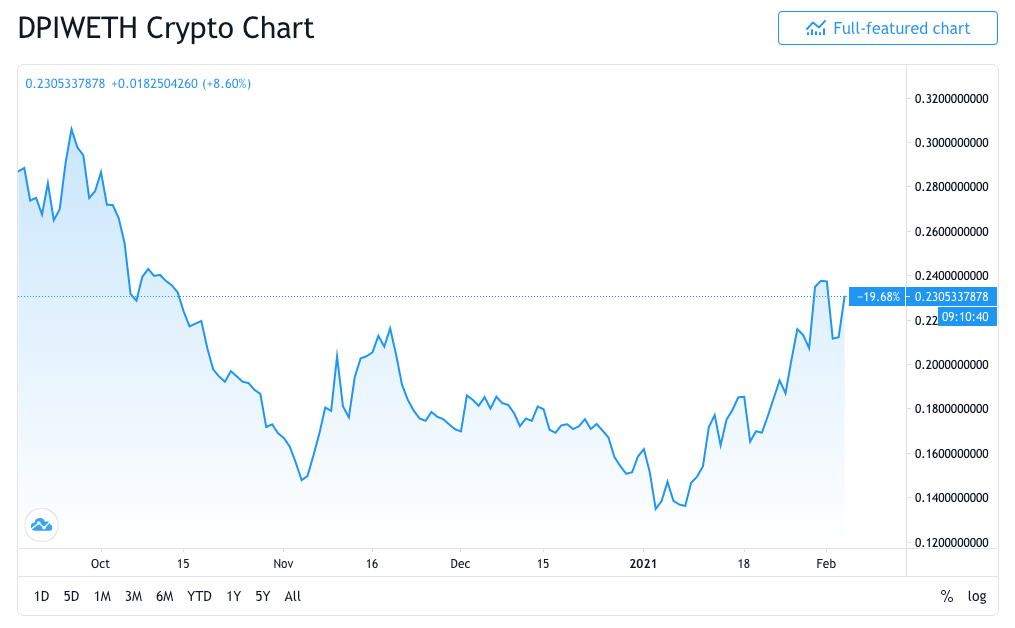

DeFi season is upon us if a rising DPI / ETH ratio is a guide

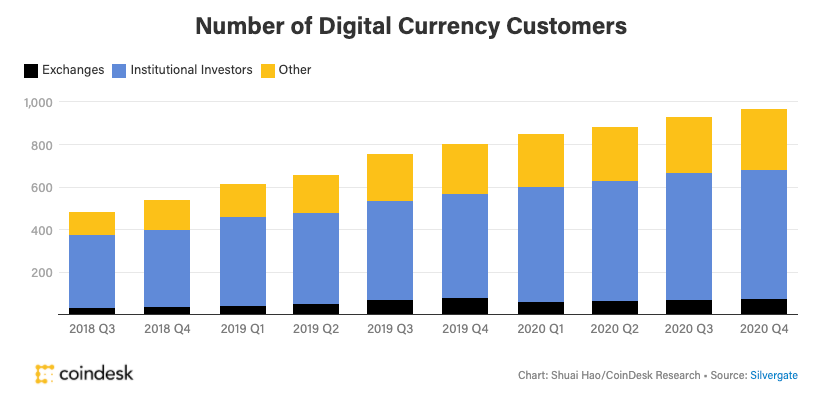

Silvergate Bank accepted $2.9B in new deposits in 4Q20

The majority of these new deposits came from crypto exchanges. The Silvergate Exchange Network (SEN), a fiat on-ramp for bitcoin markets, processed 90,763 transactions and transferred $59.2 billion over the network.

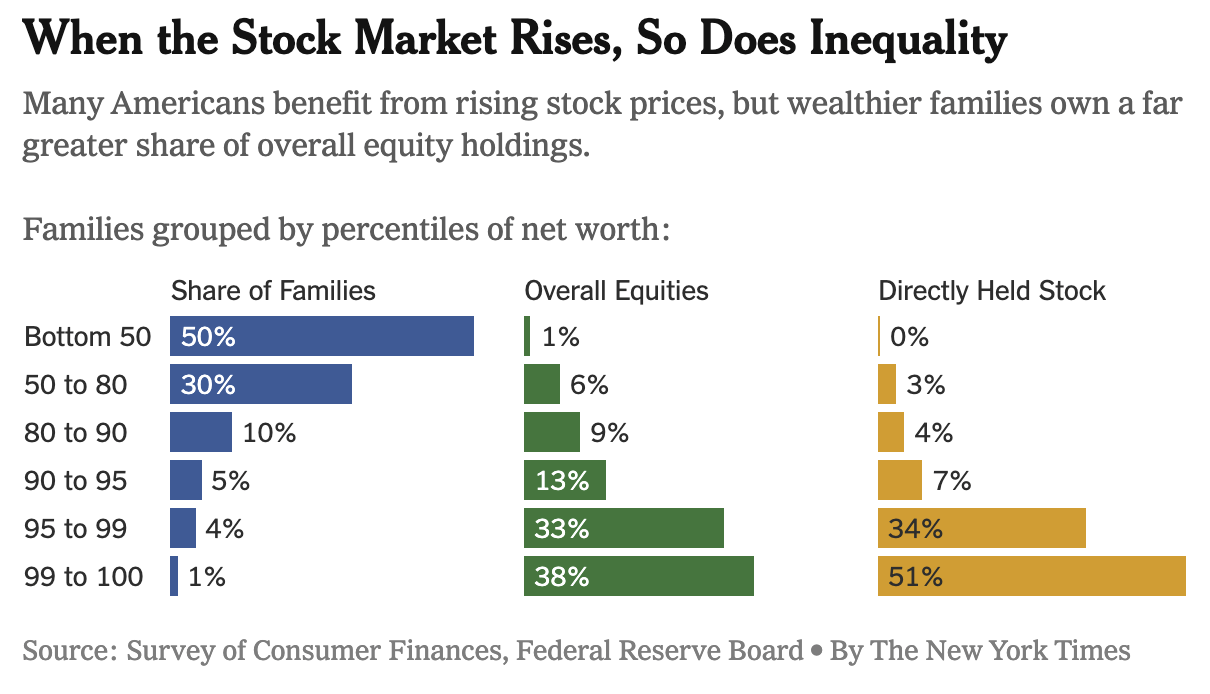

When the stock market rises, so does inequality

Momentum tracker

- CME Group to start Ether futures Feb 8 pending final approval. JPMorgan analysts say initial volumes are likely to be low. The listing of Ether futures may also see “negative price dynamics.”

- Elon Musk says bitcoin “on the verge” of being more widely accepted. He made the comments during a Clubhouse session that drew thousands of listeners. The comments followed his use of the “#bitcoin” tag on his Twitter profile on Friday, which pushed BTC up 14%.

- PayPal Q4 transaction revenue rose 11.8% in 1st report since adding crypto. Customers who bought crypto through the platform have been logging in twice as much as they were before. “The volume of crypto traded on our platform greatly exceeded our projections,” PayPal CEO Dan Schulman said. CFO John Rainey said that the firm’s appetite for acquisitions is a “multi-year” strategy, but that it’s in a good position to make one.

- Visa reveals details on crypto strategy in Q1 earnings call. CEO Alfred Kelly said his firm is preparing its payments network to handle both traditional cryptocurrencies and fiat-backed digital currencies. For the first segment, Visa will work with “wallets and exchanges to enable users to purchase these currencies using their Visa credentials or to cash out onto a Visa credential to make a fiat purchase at any of the 70 million merchants where Visa is accepted globally”. On #2 Kelly said “We think of digital currencies running on public blockchains as additional networks, just like RTP or ACH networks. But we see them as part of our network of network strategy.”

- Visa also announced a partnership with Anchorage and neobank First Boulevard. The bank will pilot Visa’s crypto APIs that enable banks to offer crypto custody and trading services to their customers. The pilot program is aiming to provide “an easy bridge to crypto assets and blockchain networks.”

- Speaking at MicroStrategy’s “Bitcoin for Corporations” summit, NYDIG founder Ross Stevens said he expects to hold $25B in bitcoin for institutional clients by year end from $6B today. NYDIG has 280 institutional clients and 96 more in the pipeline. They can onboard about 75 per month. Holding their reserves in BTC has given parent company Stone Ridge Asset Management an edge over other firms as fiat has been depreciating against the digital currency. He mentioned M&A as one such area. NYDIG has rapidly established itself as one of the top prime brokers for bitcoin indeed. Another interesting point he highlighted (NYDIG’s CEO mentioned it on a recent podcast, too) as “Chapter 2” is the potential they see in bitcoin as an open source monetary network. He gave the example of transferring $1,000 cross-border using Strike, NYDIG, and the lightning network.

- After his favorable comments last week, Mark Cuban wrote about crypto on his blog in a post titled “The Store of Value Generation is Kicking Your Ass and You Don’t Even Know it” which got people excited.

- Goldman meanwhile remains skeptical. It’s head of investment strategy said the wild swings in the price of Bitcoin prove it’s not a real unit of value, though blockchain technology “is here to stay.” “Just because everybody piles into an idea and talks it up doesn’t mean it’s a store of value,” Sharmin Mossavar-Rahmani said during a briefing Wednesday on the group’s 2021 outlook.

- Morgan Stanley’s head of digital assets Andrew Peel broke down the firm’s crypto ambitions on the Base Layer podcast. The bank is working with exchanges in Europe on implementing crypto tech into traditional market infrastructure. Unlike other large banks, Morgan Stanley is not actively exploring crypto asset custody.

- BlockFi generated nearly $100M in revenue during 2020. According to company documents reviewed by The Block Research, BlockFi now has over $8 billion in total client balances.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.