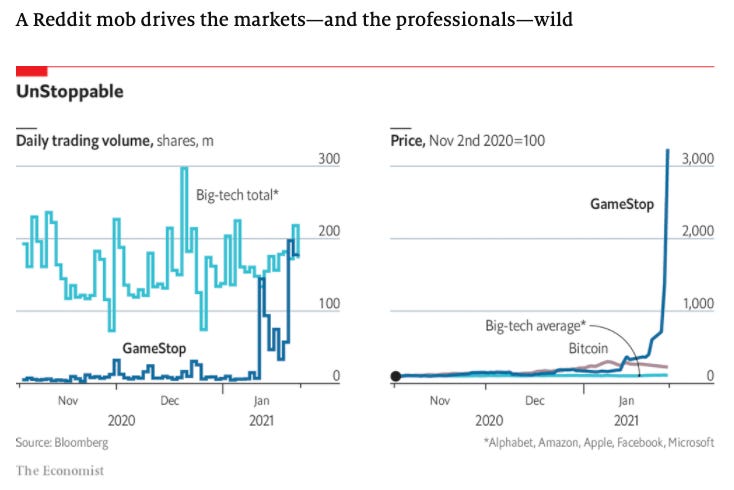

GameStop stole bitcoin’s Thunder: mainstream media headlines, social media buzz, calls for regulatory action, a commotion on Wall Street, and outages everywhere. Luckily it didn’t take long, because…it’s Doge Time!

Never a dull moment.

In this week’s issue

- Decentralized credit markets

- Trend watch: NFTs

- Interesting institutional perspectives on Bitcoin

- CBDC experiments are progressing

And: momentum tracker, food for thought top picks, the big picture, quote of the week.

Top Story: GameStop

It is literally everywhere so I won’t spend too much time on it but here are a few interesting headlines that illustrate the craze and…a connection to crypto.

- Redditors show Bitcoiners a thing or two about taunting regulators

- GameStop mania reveals power shift on Wall Street—and the pros are reeling

- What is the endgame for the GameStop trade?

- Crypto making case for DeFi after Robinhood stopped supporting $GM buys

- The GameStop fiasco proves we’re in a ‘meme stock’ bubble

- Crypto and WallStreetBets have the same spirit: a vision of truly free markets where *everyone* plays by the same rules

Connecting the dots

Decentralized credit markets

I have to admit that I am still playing catch up on DeFi. I will soon share some perspectives in the context of traditional finance. In the meanwhile, one topic that has repeatedly hit my radar in the last few weeks is the concept of decentralized credit markets. Credit markets don’t exist in DeFi today. Lending protocols like Compound are more like interest rate protocols that provide rates on capital (i.e. collateral) for borrowers and suppliers. These protocols are capital inefficient because of their over-collateralization requirement. What is needed is actual credit. Innovation in DeFi is underway here. Here are a few recent stories + other DeFi highlights this week.

- DeFi will eat corporate debt: corporate debt markets are being built on Ethereum, and it’s going to eat traditional finance (Bankless).

- Fixed income protocols : the next wave of DeFi innovation. In a guest post for Messari, Rahul Rai of Gamma Point Capital argues that the DeFi playing field is wide open for fixed-rate lending and interest rate derivatives. He dives into three areas: (1) fixed rate lending (yield curves): Yield Protocol, Notional Finance, UMA’s yUSD; (2) interest rate markets (IRS): Horizon Finance, Benchmark, Swivel; and (3) securitization / tranches (CLOs): BarnBridge, Saffron.

- Coindesk writes “CDO’s make their way into DeFi lending.” Opium Finance has released collateralized debt obligation products (CDOs) for Compound Finance’s automated lending markets .

- Paul Brody of E&Y made the “bold prediction” that by the end of 2021 at least one major financial institution will offer “some form of consumer DeFi, accessible through their single transactional window to a large consumer base.” Which companies? App services like Robinhood and PayPal. Brody sees “the ability to put money to work in an automated fashion” as the basis for DeFi’s value proposition.

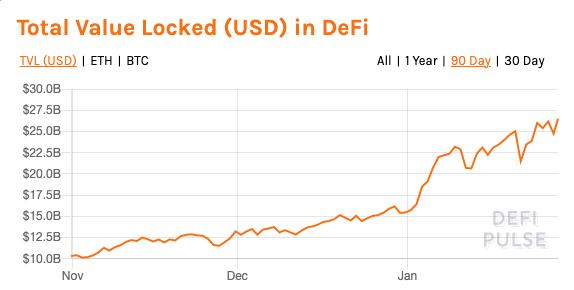

- Total Value Locked (TVL) in DeFi reached new heights at $26.5B on today

Trend Watch: NFTs

- Enjin and MetaverseMe are partnering to bring virtual fashion items to the Ethereum blockchain, creating a line of tradable NFTs representing clothing for Metaverse avatars. A limited-supply virtual fashion collection is up for grabs, while a new app allows holders to see it in the real world.

- How did A LeBron James video highlight sell for $71,455? Sports card and digital collectibles markets are heating up. In recent weeks, at least three limited-edition NBA highlight video cards have sold for more than $30K on NBA Top Shot, a blockchain-based platform that allows fans to buy, sell and trade numbered versions of specific video highlights.

- Mark Cuban all-in on NFTs and other blockchain-based ideas for his Dallas Mavericks. “You can sell anything digital using NFT,” he tells CoinDesk, hinting at plans to sell an array of digital goods soon.

- Appraisal games and the NFT liquidity problem. How capital-efficient price discovery mechanisms will transform markets for non-fungibles and other illiquid assets, according to CoinFund.

- And a contrarian view: The unreasonable ecological cost of CryptoArt

Interesting Institutional Perspectives on Bitcoin

#ArkInvest

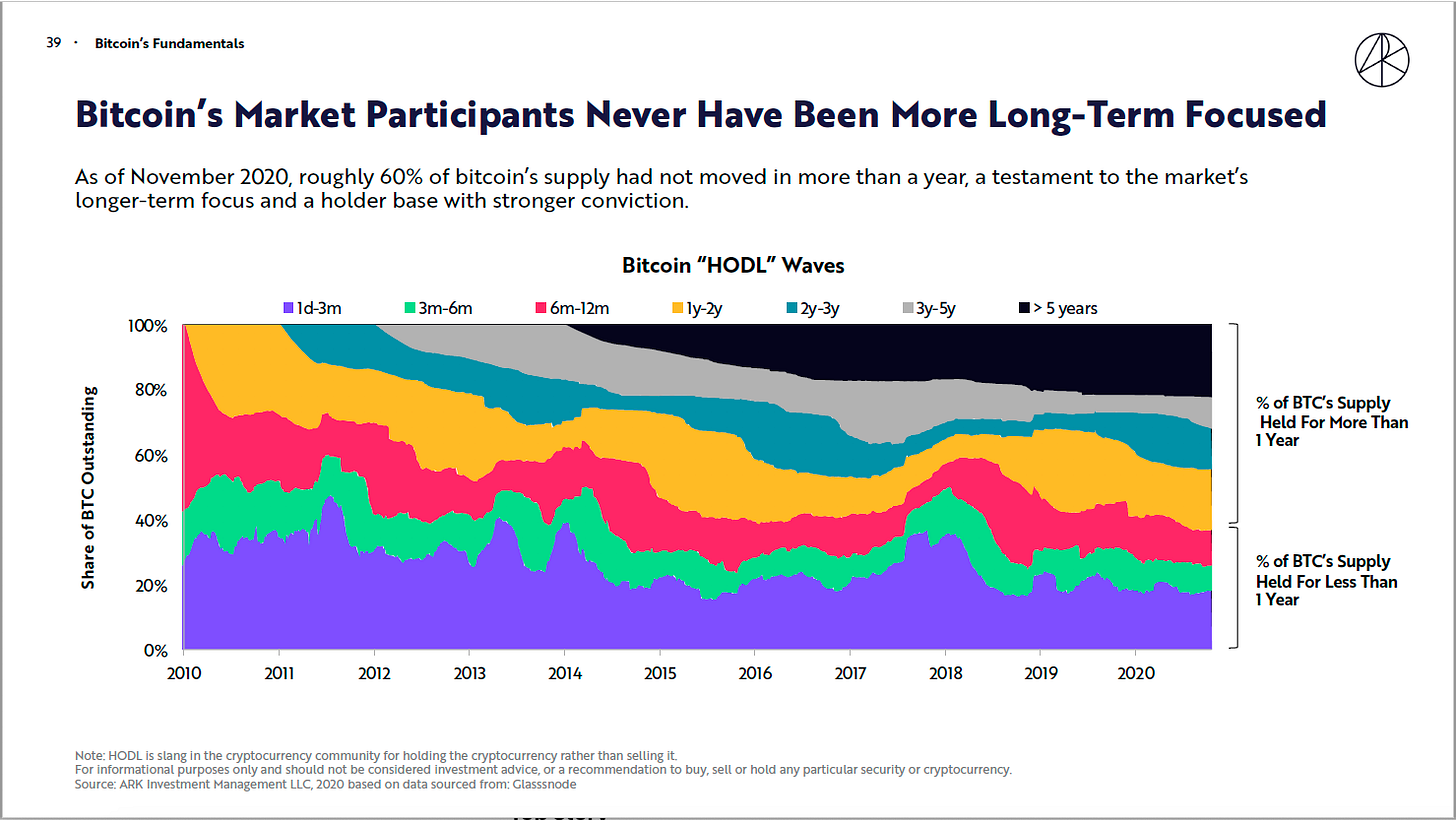

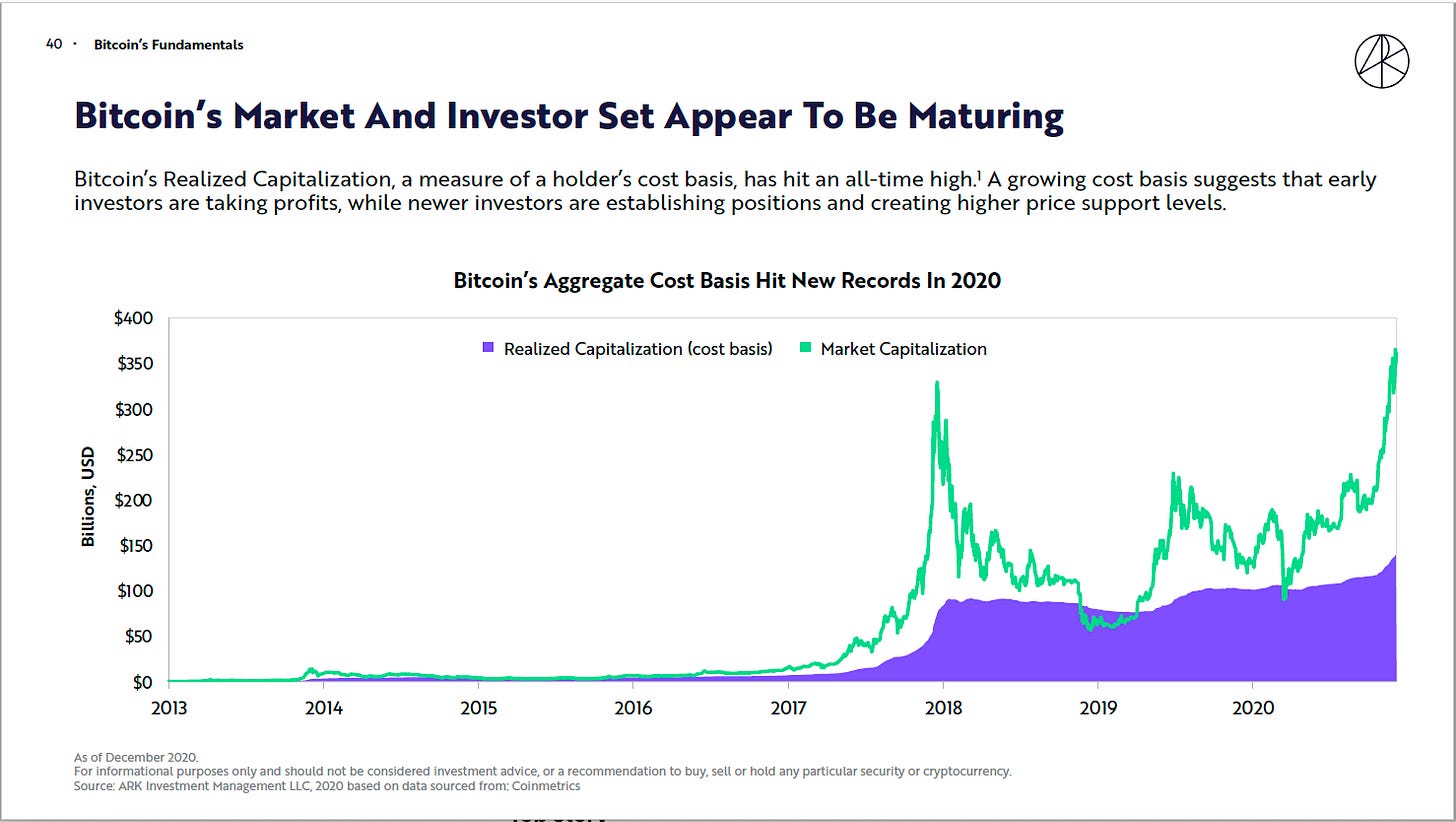

ArkInvest dedicated two sections to bitcoin in its annual “Big Ideas” report. As always, they are presenting some really interesting analyses and conclusions. Check out these charts.

Bitcoin’s market participants have never been more long term focused.

Maturing market and investor base creating higher price support levels.

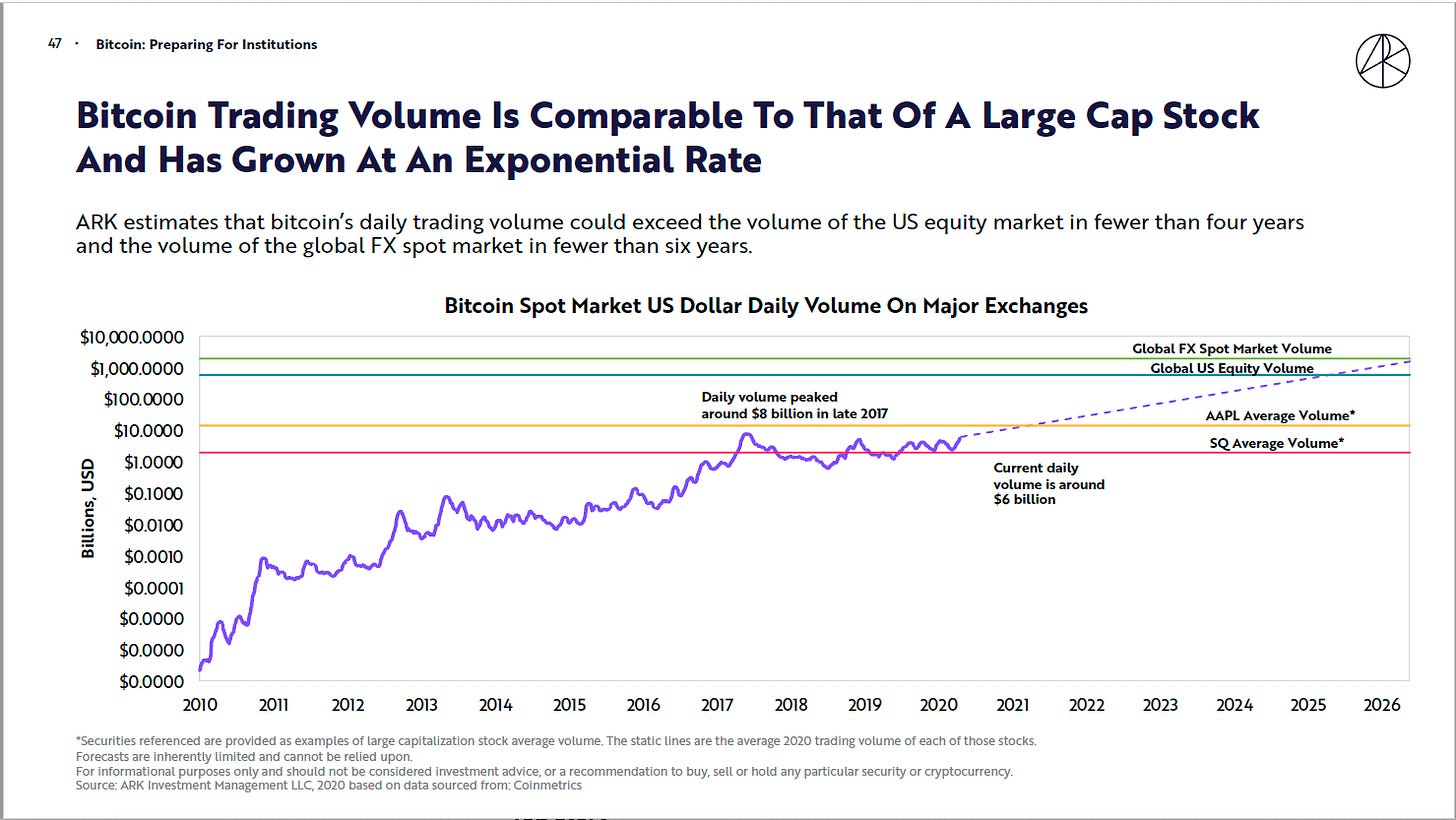

Bitcoin trading volume is comparable to that of a large cap stock and has grown at an exponential rate. ARK estimates that bitcoin’s daily trading volume could exceed the volume of the US equity market in fewer than four years and the volume of the global FX spot market in fewer than six years.

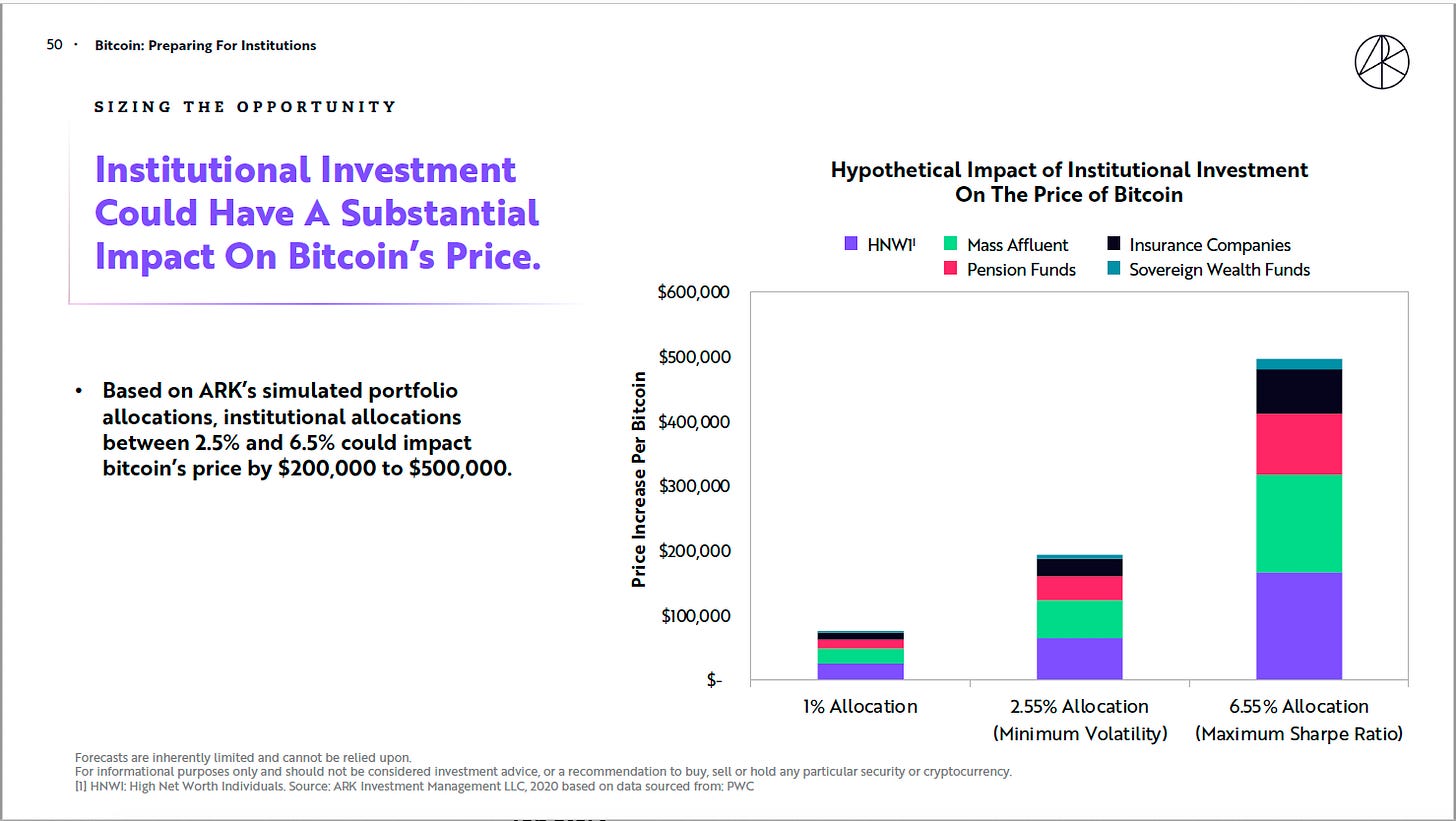

Institutional investment could have a substantial impact on bitcoin’s price. Based on ARK’s simulated portfolio allocations, institutional allocations between 2.5% and 6.5% could impact bitcoin’s price by $200,000 to $500,000.

#JPMorgan

Risks inherent in the microstructure of bitcoin markets

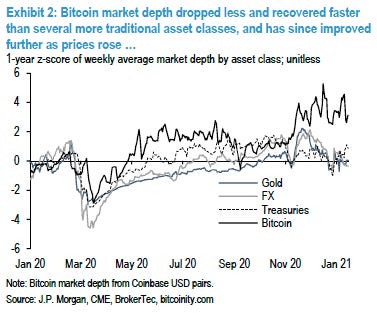

On-screen liquidity in Bitcoin markets has continued to improve and outpace more traditional asset classes on a relative basis…but, as with many global markets, the vast majority of this liquidity provision comes from high frequency-style traders who often end up fleeing when volatility picks up. A critical lesson of last March is no asset class, including US Treasuries, is ‘safer’ than the ability to exchange it for fiat cash at a reasonable cost. However, a sudden loss of confidence in USDT would likely generate a severe liquidity shock to Bitcoin markets.

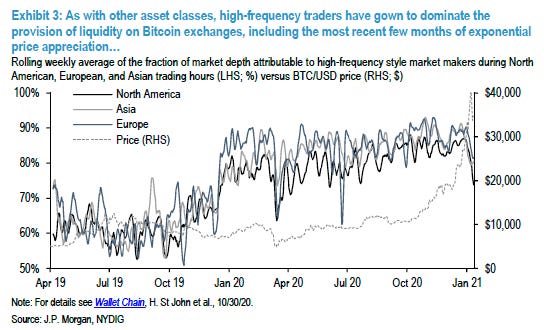

The report also contains a couple of interesting charts.

Bitcoin Market Depth

90%+ of visible depth over the last months is provided by HFT-style activity

#Bill Miller

Miller Value Income Strategy invested in MicroStrategy’s convertible bond which Bill calls “a unique opportunity.” Explaining the rationale in the Strategy’s quarterly letter, he made some very flattering and interesting comments about bitcoin. The letter is worth your reading time. Here are some of his points:

- Bitcoin’s total market capitalization today equates to just half of the global money printed during an average two-week period in 2020.

- Bitcoin has been the best performing asset over eight of the past ten calendar years, and its annualized performance has blown away the next-best performer, the Nasdaq, by a factor of ten over the past decade.

- A long-term candlestick chart shows progressively higher lows despite significant volatility, clearly representing growing demand from long-term holders willing to tolerate the swings. ArkInvest is made a similar point above.

- The world is ruled by fat-tail events, or seemingly improbable occurrences that have an outsized impact, and all indicators so far point to Bitcoin being one.

Naysayers

- Lloyd Blankfein, former Goldman CEO, thinks regulations are inevitable and may counteract bitcoin’s appeal. “If I were a regulator, I would be kind of hyperventilating at the success of it at the moment, and I’d be arming myself to deal with it.”

- BIS General Manager Agustin Carstens, a bitcoin critic, warned that “Investors must be cognizant that Bitcoin may well break down altogether.” According to Carstens, this is because the system becomes vulnerable to majority attacks as it gets close to its maximum supply of 21 million coins. “If digital currencies are needed, central banks should be the ones to issue them.”

- Scott Minerd keeps adjusting his target downwards (some have suggested towards his $20K entry target) 🤷🏻♀️

CBDC experiments are progressing

- Three more mass digital yuan trials in Chengdu, Suzhou, Shenzhen. The two-stage Chengdu trial will consist of 30M yuan ($4.6M) for offline usage and 20M yuan ($3M) for e-commerce on JD.com, China’s equivalent of Amazon. A simultaneous trial will take place in Suzhou City. Elsewhere, Shenzhen announced a third round of trials, as other areas are reportedly lobbying to be included in tests. Activity is picking up because of the upcoming Chinese New Year celebrations, presumably to stress test the system?

- China’s blockchain project BSN to pilot global CBDC system in 2021, partners with ConsenSys Quorum.

- In an analysis titled “Real-world tests of the digital yuan show how it could disrupt China’s mobile payment giants”, The Block says the Chinese government has sent mixed signals about whether the central bank digital currency will compete with Alipay and WeChat Pay. In a Messari webinar in December, Jeremy Allaire of Circle commented that DCEP largely exists to counter Alipay and Tencent duopoly.

- The Center for New American Security is making a similar point in a new report, and taking it a step further. DCEP will likely enable the Chinese Communist Party to strengthen its digital authoritarianism domestically and export its influence and standard-setting abroad. By eliminating some of the previous constraints on government data collection of private citizens’ transactions, DCEP represents a significant risk to the long-held standards of financial privacy upheld in free societies. The summary is worth a read (2-3 min).

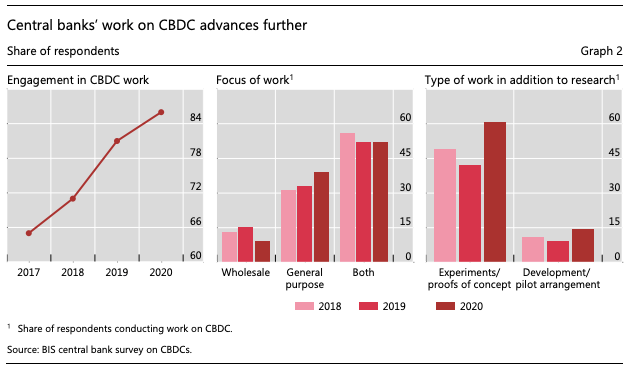

- In its annual CBDC survey, the Bank for International Settlements concludes that 20% of the world’s population will likely experience CBDCs within 3 years.

Momentum tracker

- Hot of the press: ‘Bitcoin won’t escape our scrutiny’ — Bridgewater is exploring an alt-cash fund in the face of money devaluation.

- Planned fund launches: Pantera is moving to launch a new fund aimed at institutional bitcoin investors. USV Launches $250M fund, plans to invest 30% in crypto startups. Galaxy Digital is launching a suite of Ethereum funds.

- Ninepoint Partners raised $180M in Bitcoin Trust IPO on Toronto Stock Exchange.

- Harvard, Yale, Brown, Michigan Endowments have been buying bitcoin for at least a year, according to Coindesk quoting sources. They have done so directly through accounts held at Coinbase and other exchanges. Coinbase also mentioned activity by endowments in its annual report but didn’t specify names.

- Pantera founder and CEO Dan Morehead said on The Scoop podcast that Pantera has been fielding calls from endowments, too.

- Genesis Q4 Report: $7.6B loan originations, $8.1B spot traded, $4.5B derivatives, $5B in assets at Year End.

- CoinShares fund flows: “Investment product inflows last week hit a record total of US$1.31B following a period of minor outflows. We believe investors have been very price-conscious this year due to the speed at which prices in Bitcoin achieved new highs. The recent price weakness, prompted by recent comments from Secretary of the US Treasury Janet Yellen and the unfounded concerns of a double spend, now look to have been a buying opportunity with inflows breaking all-time weekly inflows.”

- Binance report: over 100 million people are now crypto users. Amongst key reasons to buy crypto: part of a long-term investment strategy (55%), distrust of the current financial system (38%), ST-trading opportunities (31%), and FOMO (27%).

- ‘Frothy Squared’: crypto firms are lining up to tap market mania. A signal that we are close to the end of a bull run? Bloomberg, citing Renaissance Capital, is listing potential candidates: Coinbase, eToro, MicroBT, Gemini, Bitmain Technologies and Bitfury. Names to add to that pipeline: BlockFi and DCG have come up elsewhere. That makes 8.

- London-based Wintermute, an algorithmic liquidity provider for digital assets, closed a $20M Series B led by Lightspeed Venture Partners with participation from Pantera. “Wintermute has grown almost 25x since we led the Series A round just six months ago,” Lightspeed said in a press statement. “That rarely happens.”

Food for thought

Digital wallets represent $4.6t opportunity in your pocket (ArkInvest)

Another relevant and fascinating topic from ArkInvest’s “Big Ideas 2021” report. Ark believes Venmo, Cash App, and venture-funded startups are likely to upend traditional banking by activating the mobile phones — the bank branches — in users’ pockets and handbags.

- In the US, digital wallet users are surpassing the number of deposit account holders at the largest financial institutions.

- Digital wallets can acquire customers for a fraction of banks’ customer acquisition costs.

- Bank branch costs are rising while their utility is decreasing.

Today, digital wallets are beginning to penetrate the full traditional financial services stack, including brokerage and lending. Digital wallets could serve as lead generation platforms for commercial activity beyond financial products.

The Revolution Will Not Be Reported Quarterly

I often think about the future of primary markets, new forms of capital, and the role of public companies, if any, in all of that. There has been a lot of debate around topics such as private vs. public markets, SPACs, direct listings, and securities regulation in the context of crypto. One thing is for sure, quarterly reporting is burdensome and the cost attached to regulatory compliance is high. Both have a lot to do with providing transparency to investors. In that context, I found this post by Dune Analytics (and its title!) interesting.

In legacy finance, the only thing you have real-time data on is trading activity. Data on how products and businesses are actually performing at a fundamental level is reserved for quarterly reports. This data is old. In contrast, financial products built on blockchains are truly digital, effectively providing real-time data dashboards aka “the living breathing quarterly report.”

The Big Picture

Bubble Fears Everywhere But All Investors Can Do Is Keep Buying

- Wall Street names including Citi, JPMorgan warning of excess but no one wants to miss out on gains when markets keep rallying.

- Surveys reveal what investors are saying, but market-based indicators reflect what investors are actually doing. Market-based indicators show increasing speculation: retail traders are fueling the most speculative trading strategies, the market for new issues is booming, short interest in the SPDR S&P 500 ETF Trust is near decade lows.

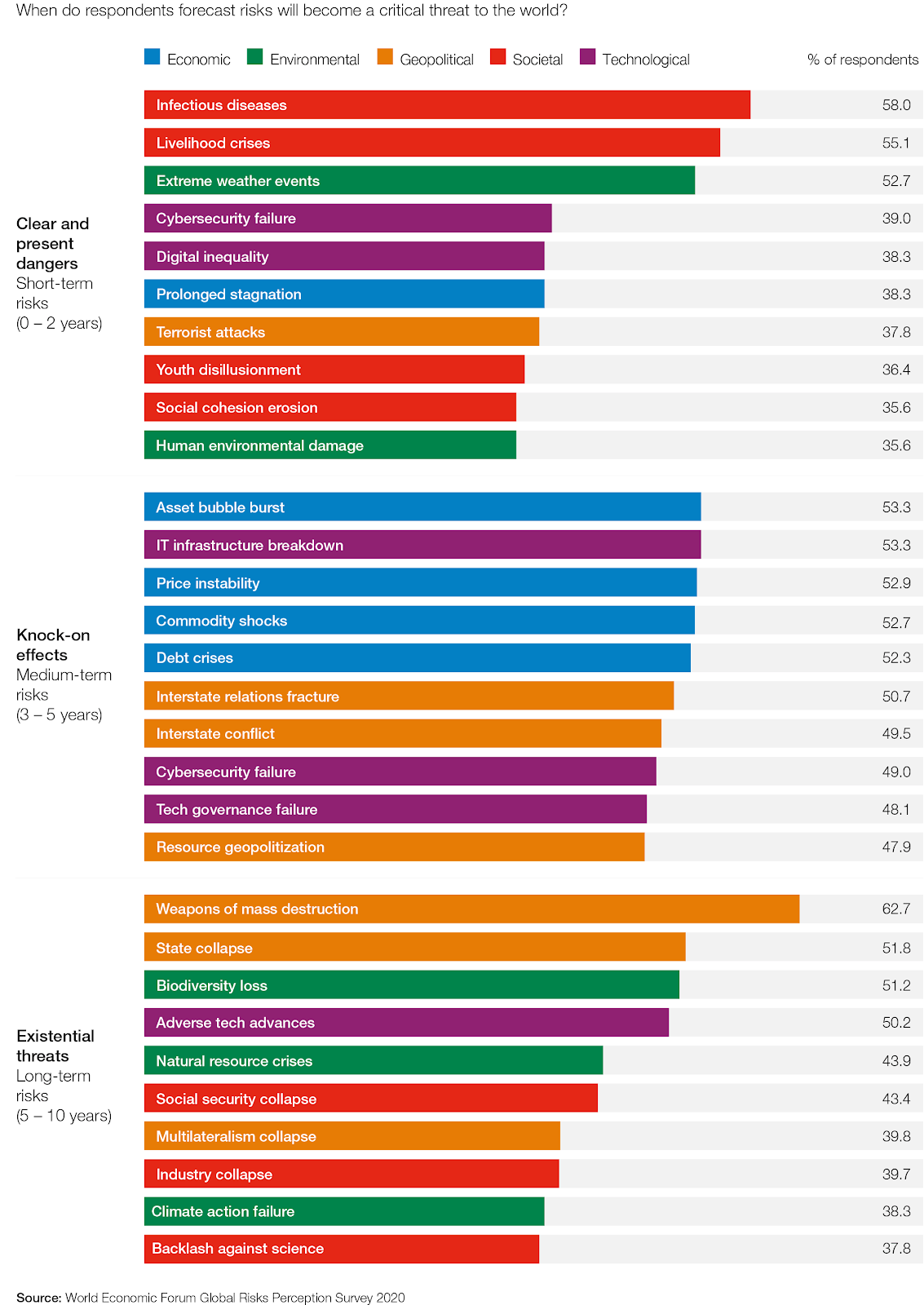

The Shifting Perception of Global Threats (WEF)

Quote of the Week

Legendary economist Mohamed El-Erian has made candid admissions on his crypto trading in an interview with the Centre for the Study of Financial Innovation. The globally respected economist admits he failed to consider a few technical details in his crypto trading

“I bought at $5,000 and then sold at $19,000 thinking that I was the smartest person around. I had only looked at the technicals, at the overshoot. Little did I know that in the next four weeks, it would double in price at $38,000 and make me look like a complete idiot!”

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.