I had a very different version of Thursday Threads ready to go when I woke up this morning, but what do you do when Coinbase drops its S-1? This is a historic moment for crypto. The document provides unique insights into what is one of crypto’s oldest, most prominent companies, right at the center of the global crypto ecosystem.

So, I ditched some of what I was going to send you today and here are initial observations from the S-1. I intend to do a more detailed analysis on the weekend so look out for that.

Fun fact: its ticker will be “COIN”!

In this issue:

- Coinbase, a rare profitable unicorn

- The market correction

- Momentum tracker

- The week in charts

- The energy debate

Coinbase, a rare profitable unicorn

Coinbase filed its S-1 for a direct listing on Nasdaq (under symbol “COIN”) this morning. Goldman Sachs, JPMorgan, Allen & Co, and Citigroup are running the deal. I can’t wait for initiation reports from research analysts to come out after the blackout period (40 days post-IPO)!

As has been the trend for big tech companies listing, Coinbase will have a dual class share structure, under which its Class B shares have superior voting rights (20 vs. 1). There is no lock-up period. The company does not anticipate paying any dividends in the foreseeable future as it intends to spend on growth instead.

Key numbers show massive 2020 growth

Net revenue for 2020 came in at $1.1B for a net income of $322.3M. This compares to $482.9M and a 30.4M loss over 2019 representing a 136% increase in revenues yoy.

- $1.1B revenue consists of $1.096B transaction revenues (96%) and $45M in other “subscription and services” revenue of which $18.6M were custodial fees.

- The vast majority of 2020 revenue was generated from customers in the US (76%) and Europe (24%). This is very interesting and hardly surprising given the dominance of the Chinese platforms in Asia.

- $55.9M in transaction revenue was generated from their institutional business, up 85.9% from $30.1M in 2019. This is interesting, with 62% (per my calculations) of trading volume ($57M) coming from institutions! I guess the race for institutional clients is on…

- Since inception through Dec 31, 2020, Coinbase generated over $3.4B in total revenue

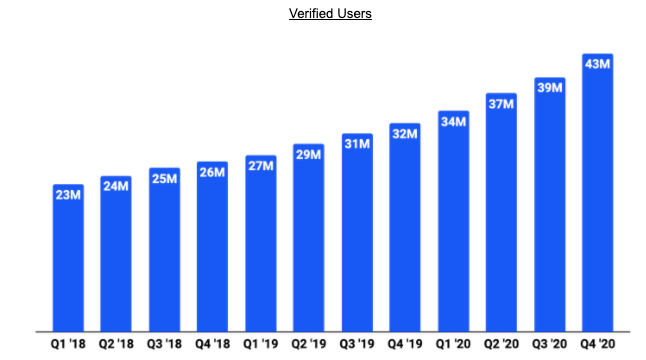

Users grew by 34.4% from 32M at the end of 2019 to 43M year end 2020. 2.8M of these users are transacting monthly, a 180% increase over 2019. The retail wallet that launched mid-2018 counted 2M users at the end of 2020.

- 43M retail users and 7,000 institutional customers across 100 countries, 115K ecosystem partners.

- Verified institutions grew 67%+ from ~4,200 to 7,000 from YE 2019 .

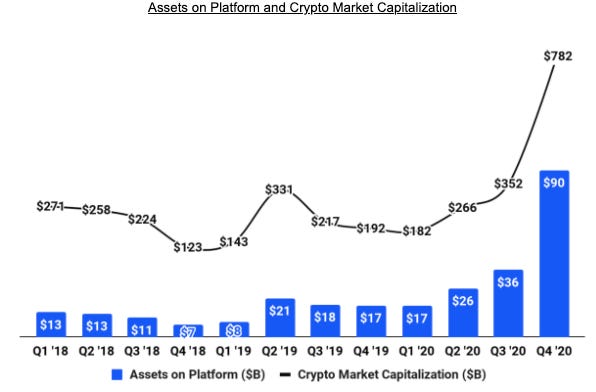

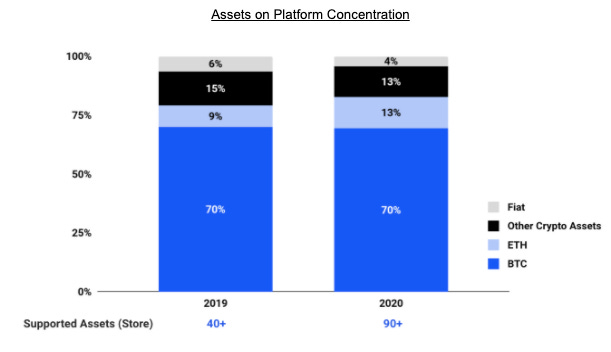

$90.3B assets on platform as of YE 2020 vs. $17M in 2019 (+432.2%)

- This represented 11.1% of crypto’s total market cap, increasing from 8.3% and 4.5% as of YE 2019 and 2018, respectively.

- Assets on Platform from institutions grew approximately 590% from about $6.5B to $44.8B over the same period. Taking total Assets on Platform of $90B, this represents about half.

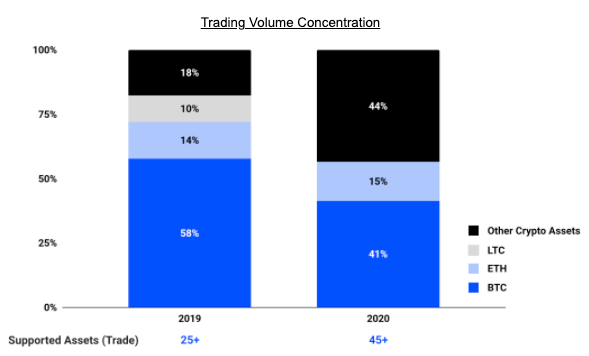

$193B in 2020 trading volume, up 141.7% from 2019. Since inception, Coinbase has processed $456B in volume on its platform.

- Bitcoin and Ethereum drove 56%+ of total trading volume

- A significant amount of the trading volume is derived from a relatively small number of customers.

Coinbase has grown from 199 employees as of YE 2017 to 1,249 employees as of Dec-31, 2020. The company is on an aggressive hiring spree.

With $1.06B in cash and cash equivalents the company is cash-rich. It holds $48.9M of USDC on its balance sheet which it sees as “an important liquidity resource”. Furthermore it holds crypto assets with a fair value of $187.9M ($62.3M cost basis) including $130.1M BTC, $23.8M ETH, and $34.M other crypto assets for “investment and operational purposes.”

A strong focus on growth

- Coinbase has applied to operate an ATS in the US that would allow it to trade crypto assets that are deemed “securities.”

- It anticipates that operating expenses will increase substantially in the foreseeable future: to hire additional employees, expand sales and marketing efforts, develop additional products and services, and expand its international business

- As part of its business strategy, Coinbase intends to continue making acquisitions to add specialized employees, complementary companies, products, services, licenses, or technologies. Interesting fact: now that the company will be listed it can use its stock as an acquisition currency, a key advantage of a public listing.

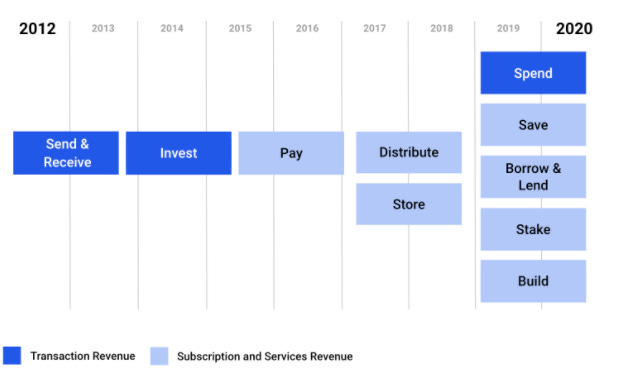

- Since late 2018, Coinbase has been focused on launching a suite of subscription products and services, such as Store, Stake, and Borrow & Lend. These products and services reduce dependence on transaction revenue, which is highly volatile.

- In the near term, the focus is on becoming the primary financial account for retail users to access the cryptoeconomy, touching every crypto transaction and building a one-stop shop for institutions, and solving our ecosystem partners’ diverse problems, including a lack of distribution, trust and usability, and the availability of easy-to-use and scalable infrastructure.

- Coinbase also wants to become the one-stop shop for institutions’ crypto asset investing needs.

Tagomi acquisition

- At the time of acquisition, Tagomi’s assets were valued at $77.2M for a total consideration of $41.8M and a goodwill of $22.5M. The goodwill balance was primarily attributed to the market presence, synergies, and the use of purchased technology to develop future products and technologies. The technology was valued at $6.6B, customer relationships at $400K and licenses at $350K.

- Tagomi held around $20B in customer custodial funds at the time of the acquisition.

Key business metrics

As the first business of its kind to go public, Coinbase has an opportunity to send industry standards for business evaluation metrics. Here are the metrics the firm is using to evaluate its business, measure its performance, identify trends affecting the business, and make strategic decisions. It will be interesting to see if research analysts agree.

Verified users on platform

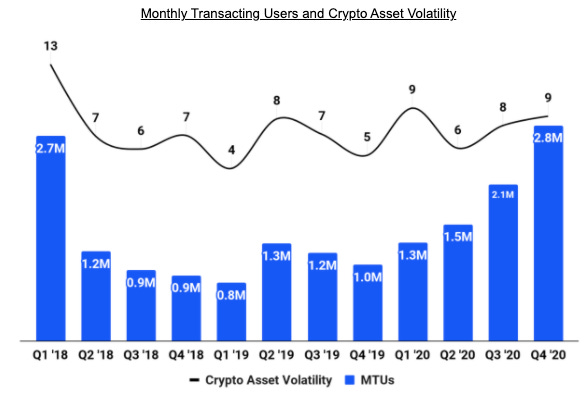

Monthly Transacting Users

MTUs represent our active and passive transacting base of retail users

Assets on Platform

Coinbase also provides a breakdown of its asset on platform by type

Trading Volume

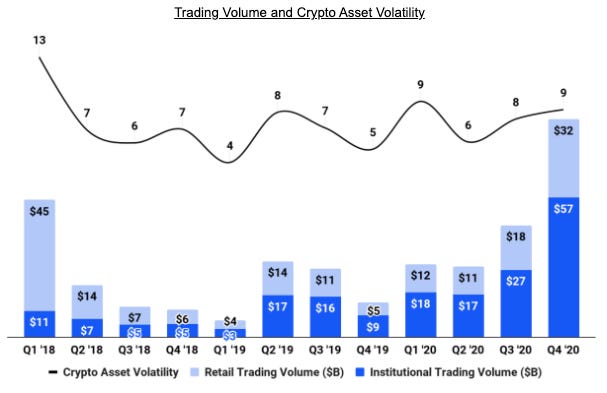

Trading Volume is directly correlated with transaction revenue and is influenced by both Bitcoin price and Crypto Asset Volatility. Retail Trading Volume is more influenced by Bitcoin price and Crypto Asset Volatility than institutional Trading Volume, and Coinbase experienced lower period over period fluctuations in volume from institutions.

Per my calculations from the above, 62% of 2020 trading volume came from institutions. Interestingly, this percentage stayed fairly constant throughout 2020, ranging from 60%-64%. However, it increased from 45% at the end of 2018 to 64% at the end of 2019.

Trading volume concentration

In 2020, other crypto assets contributed a greater share of Trading Volume. This growth was driven by the addition of over 20 crypto assets, including multiple DeFi crypto assets, which diversified Trading Volume away from Bitcoin and Ethereum.

Further analysis on the way…

Momentum tracker

- The number of global crypto users reached 106 million in January 2021.

- Galaxy Digital to launch research unit, expand headcount by 40%.

- $492M inflows last week for record $52.6B AUM, minor profit-taking.

- JPMorgan and Citi are using blockchain technology, and other banks are considering allowing clients to hold crypto in bank accounts, Bank of America research finds.

- 21Shares and Bitwise hit $1B in AUM. M31 Capital is looking to launch a new Bitcoin hedge fund.

- BNY Mellon Said to Hire Fireblocks for Bitcoin Custody Service.

- CoinShares to list shares on Sweden’s Nasdaq Firth North Growth Market — massively overlooked by the market. I will get to this next week. Separately, CoinShares Is Launching an Exchange-Traded ETH Product on SIX with $75M AUM.

- Square says it sold $4.57B BTC during 2020 via Cash App. Square CFO says 1M users bought bitcoin for the first time in January. BTC holdings now represent ~5% of $SQ’s total cash & marketable securities. Interesting in the context of the 106M users mentioned above. Finally, check out this tweet by John Street Capital and think back to the section about digital wallets in ArkInvest’s “Big Ideas 2021” report.

0/ $SQ had 36M monthly transacting active customers in Dec + 50% YoY. They are showing P2P network effects at scale with a CAC <$5/sh & +50% P2P tx YoY.

— John Street Capital (@JohnStCapital) February 23, 2021

To put that in perspective a retail checking account can cost a legacy bank $350-$1,500; a brokerage platform $750-$1,000. pic.twitter.com/nfyb4NTyul

Market correction

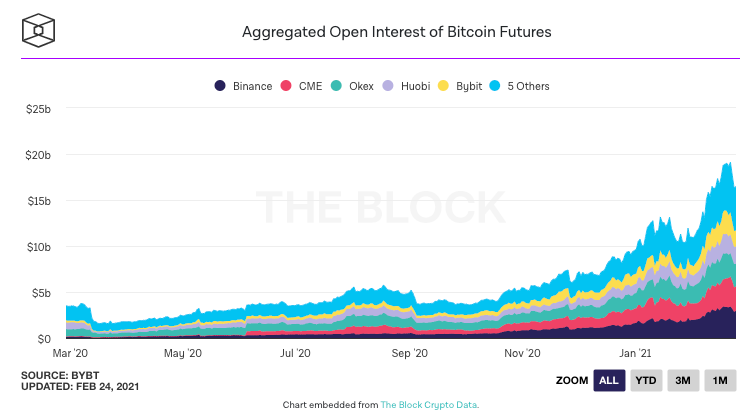

This week, crypto saw its worst market downturn since profit taking in early January. Bitcoin tanked 17% on Tuesday triggering the liquidation of leveraged bets and sparking a sell-off across cryptocurrency markets. Ether also dropped more than 20% to $1,410, down over 30% from last week’s record peak.

So what drove the sell-off?

- BTC and many altcoins trading in extremely overbought territory

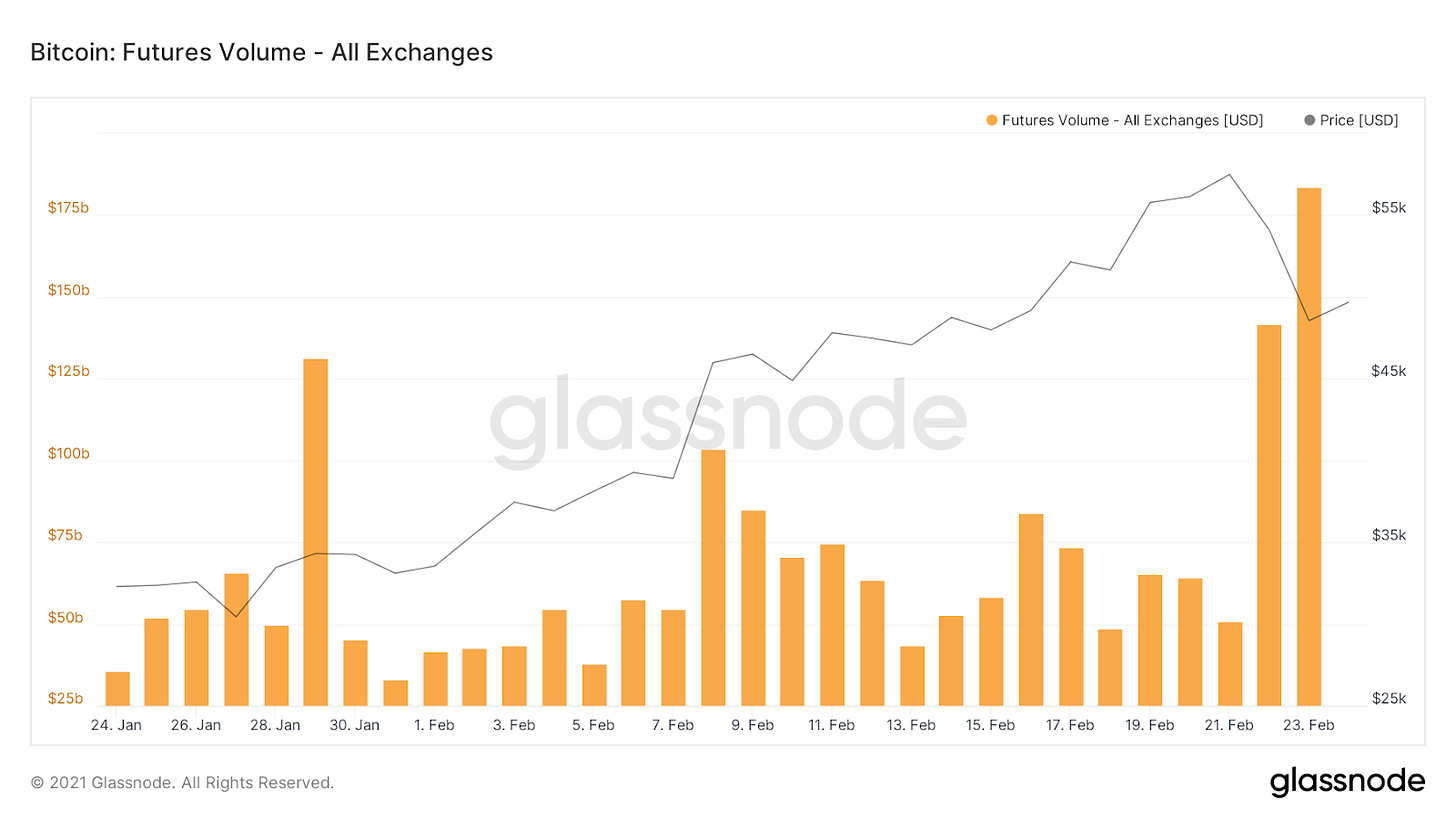

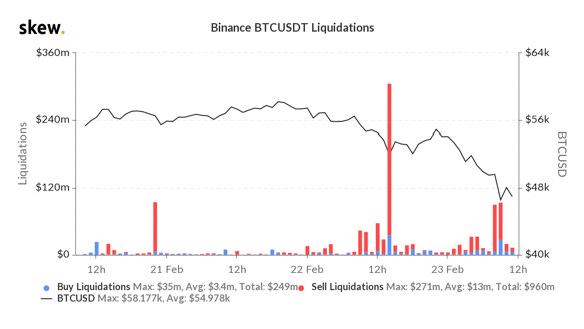

- Elevated levels of leverage (see charts below) triggering stop-loss orders leading to a sudden surge in market volatility

- Janet Yellen’s comments that bitcoin is “an extremely inefficient way of conducting transactions” and “a highly speculative asset, and I think people should beware. It can be extremely volatile, and I do worry about potential losses that investors in it could suffer.”

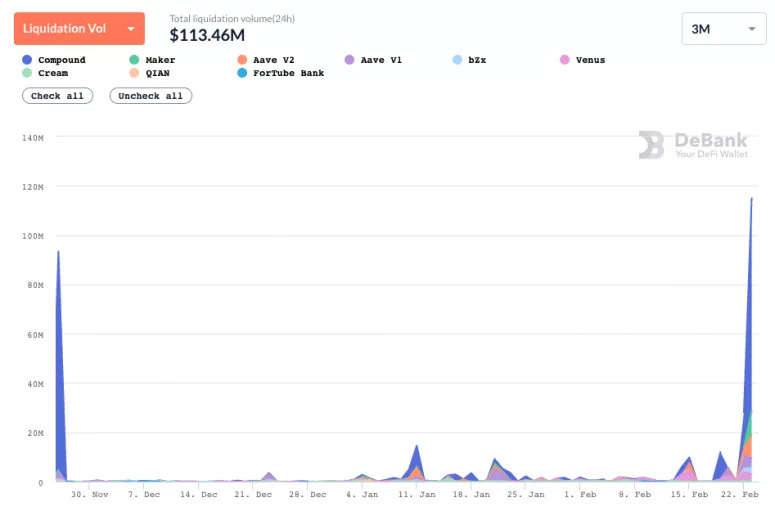

Crypto futures market saw record $5.77B in liquidations on Monday

By comparison, March 2020’s so-called “Black Thursday” saw a total of $4.1B worth of liquidations. BTC’s price drop was significantly lower at 17% vs. nearly 50% last March. This could point to a more mature futures market against the backdrop of a more distributed volume profile compared to March when BitMEX dominated the market.

DeFi lending platforms liquidate record $115m in loans as ETH drops

75% of liquidations came from lending platform Compound.

A number of exchanges and brokers — including Binance and eToro — suffered outages or experienced other technology problems. They weren’t the only ones, all of the Fed‘s wire and ACH systems went down yesterday. This, in turn, caused Gemini, Kraken and Coinbase to experience ACH and FedWire delays.

Seeing another ATH system traffic, 50% higher than the previous ATH. Most systems held up. Some spot API had temporary delays. Seems to have recovered. Some Futures API errors still. The team is on it.

— CZ 🔶 Binance (@cz_binance) February 22, 2021

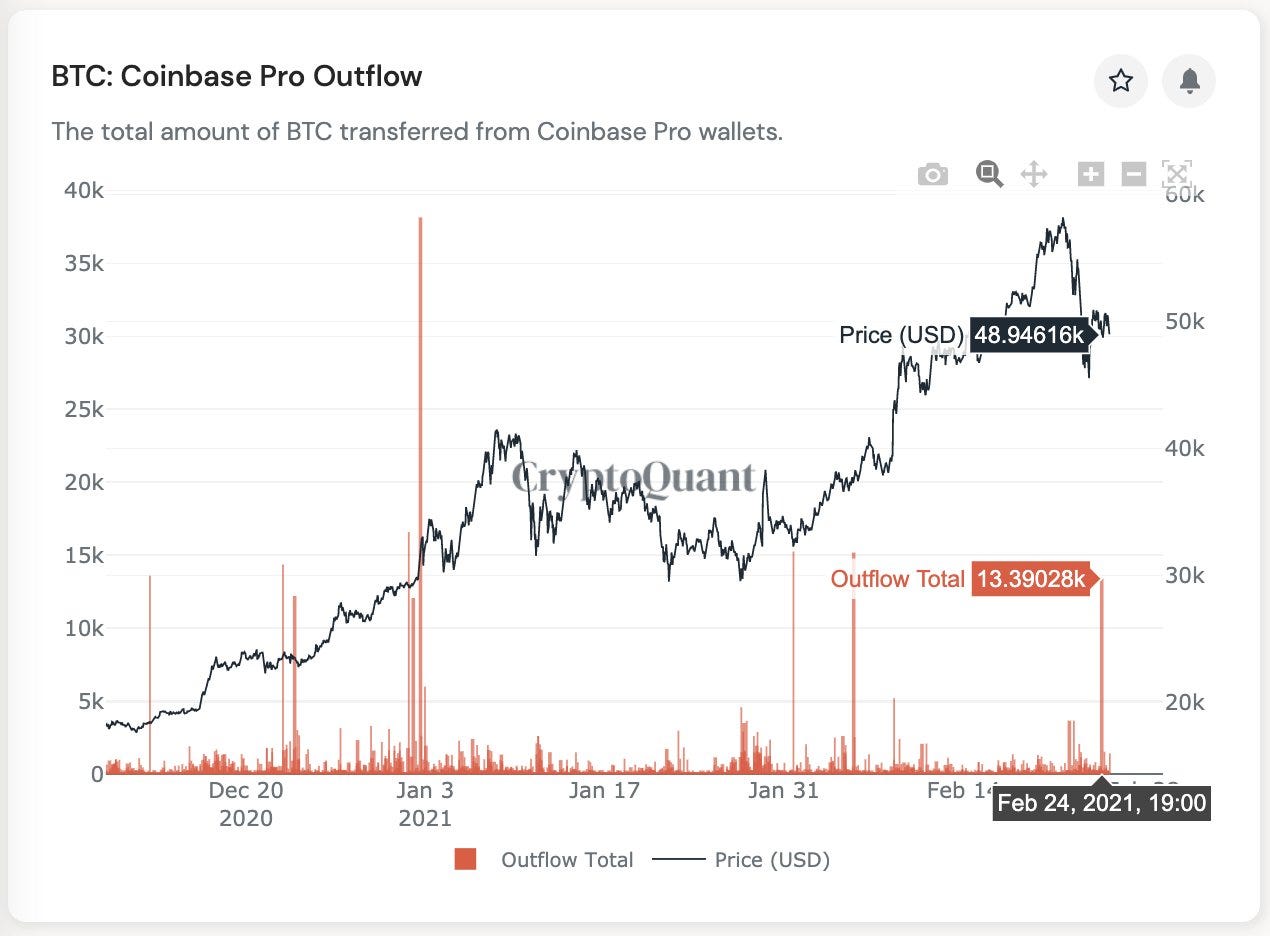

Large Coinbase outflows on Wed were seen as institutions buying the dip

Market observers see strong bullish signals in large Coinbase outflows into Coinbase custody wallets which were taken for institutional buying at $48K.

The equity markets didn’t fare much better with a sell-off in tech stocks as investors betting on a pandemic comeback rotated out of Big Tech and piled into cyclical stocks. Tesla’s 17% was taken as a response to bitcoin’s drop by some market observers. Reuters reported the stock “slumped 17% the week through Wednesday off record-high levels, as Bitcoin, in which Tesla invested $1.5 billion, pulled back sharply.” Tech rebounded after Fed Chairman Jerome Powell came to the rescue pledging anew to support the economic recovery by keeping interest rates low. And everyone lived happily ever after!

The week in charts

Ethereum is on pace to settle $1.6 trillion in transactions for Q1 2021

Ethereum is on pace to settle $1.6 trillion in transactions for Q1 2021.

— Ryan Watkins (@RyanWatkins_) February 24, 2021

In the last 12 months it has settled $2.1 trillion in transactions.

Incredible scale for a technology that critics claimed couldn’t scale. pic.twitter.com/dAvZBRJgRX

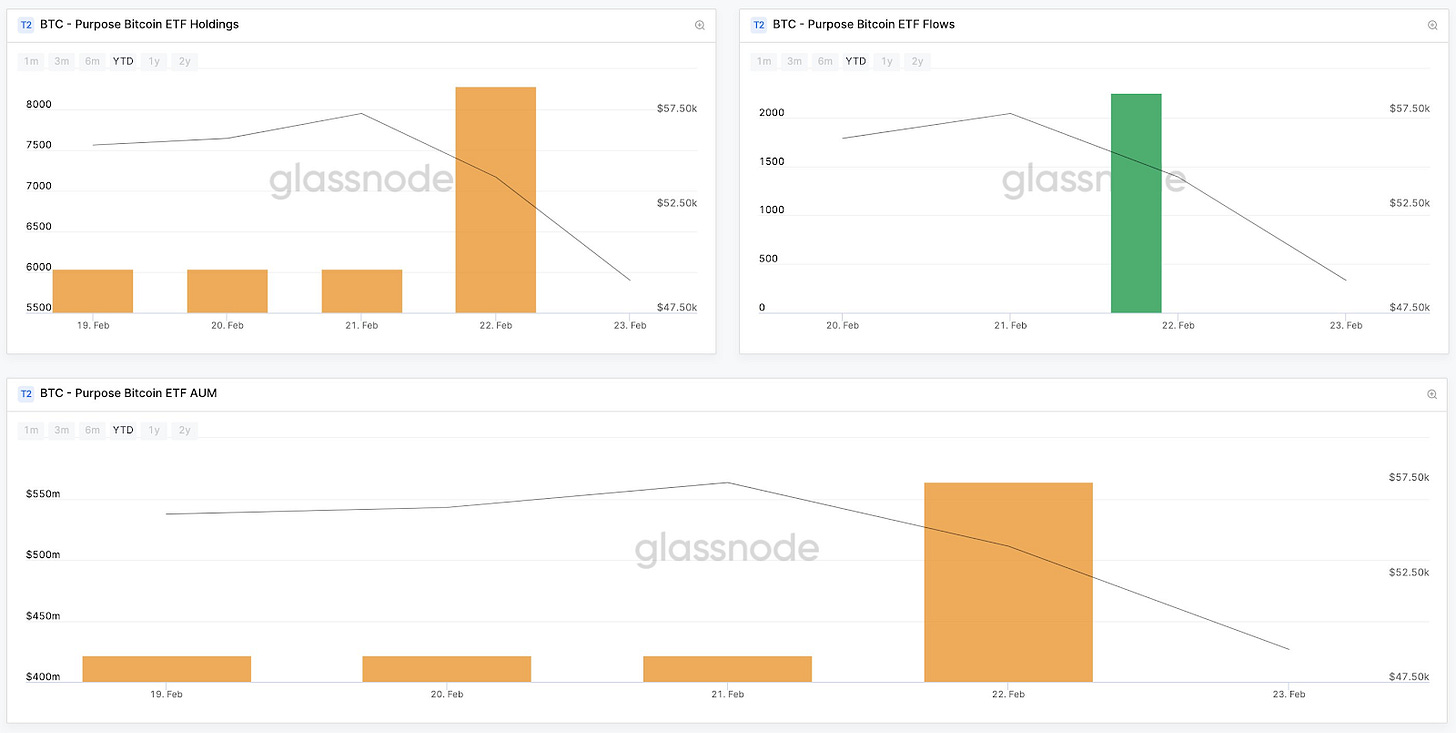

North America’s first Bitcoin ETF sees explosive debut

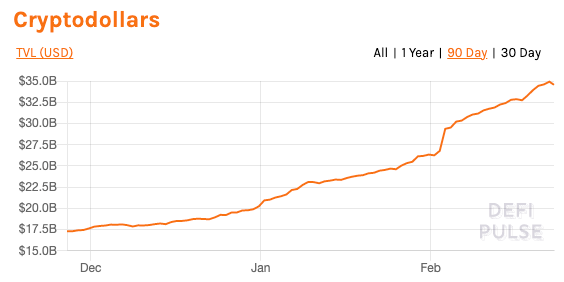

DeFi Pulse is introducing Cryptodollars (that continue to break records)

The new page is dedicated to measuring the amount of tokenized dollars in DeFi. The following cryptodollars are currently included: USDT, USDC, DAI, BUSD, PAX, HUSD, TUSD, sUSD, GUSD, MUSD, and DUSD.

Bitcoin Futures volumes reach new ATH daily volume of $180M

A single Binance instrument (BTCUSDT perpetual swap stablecoin margined) saw nearly $1B of long positions being called over three days

The energy debate

I noted a lot of buzz about Bitcoin and climate change in recent weeks. The regulators now jumped on to it too and so did Bill Gates 😬

“I don’t think that bitcoin … is widely used as a transaction mechanism,” Janet Yellen told CNBC’s Andrew Ross Sorkin at a New York Times DealBook conference. “To the extent it is used I fear it’s often for illicit finance. It’s an extremely inefficient way of conducting transactions, and the amount of energy that’s consumed in processing those transactions is staggering.”

It is unfortunate that the headlines involving Yellen and crypto have been driven by negatives and not by the many positives it can bring to society and financial markets. Bitcoin undeniably requires a lot of energy but not all energy is created equal. I am by no means an expert in this but wanted to arm you with a few bullets from the stuff I have come across. Just in

- Bitcoin is an incredibly Dirty Business according to Bloomberg. If it were a country, its annualized estimated carbon footprint would be comparable to New Zealand at about 37M tons of carbon dioxide.

- What Bloomberg gets wrong about bitcoin’s climate footprint: Nic Carter. It’s undeniable that the Bitcoin blockchain has a carbon footprint. Some bitcoins are mined with non-renewable energy, although plenty is mined with hydro, nuclear, or otherwise-vented natural gas, too. Carter argues that (1) comparing bitcoin to Visa is not an apples-to-apples comparison. Bitcoin is a full-stack monetary system with no outside dependencies; Visa is a small part of the U.S. dollar stack. (2) Metrics like the “per-transaction energy cost” are misleading because transactions themselves do not cost energy; nor does bitcoin’s CO2 footprint scale with transactional count.

- Cointelegraph highlights research conducted by CoinShares. The report concludes that the Bitcoin network obtains 74% of its electricity from renewable sources. It also noted that many renewable energy generators are poorly located and underutilized, and thus, Bitcoin mining has become the only viable use for this electricity.

- Here are a couple of additional thoughts from a private community that I am part of. (1) Computers in data centers rely on the local energy mix which in many cases is rather green nowadays, with data centers being built where renewable energy is ample. (2) According to analyses bitcoin is an improvement over gold. The gold industry requires way more energy than the Bitcoin industry – and has additional downsides for the environment.

- Ross Stevens of Stone Ridge also highlighted that BTC is solving a math problem, it is not a transportation problem (channel energy geographically). It can therefore be done anywhere. The opportunity is to monetize isolated cheap and clean energy sources that are currently untapped because they are not in close proximity to civilization.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.