Lots of snow and related inconveniences in the US this week so I hope those affected are staying well. Crypto seemed undisturbed by it all with both bitcoin and ether breaking fresh records. With that, the crypto market cap broke $1.5B, another milestone. All against a backdrop of every increasing institutional momentum. The snowball seems like a fitting metaphor this week 😁

In this week’s issue:

- How are true institutions accessing the crypto market?

- Unpacking MicroStrategy’s latest convertible bond

- NFTs are going mainstream

- Increasing gas cost problem for DEX adoption by “normal” users

- Momentum tracker

- Investment products continue their momentum

- Crypto firms are raising capital at unicorn valuations

How are true institutions accessing the crypto market?

So the institutions are finally here. As crypto market structure and infrastructure are fundamentally different from traditional markets, traditional systems to a large extent cannot be used to access crypto markets. Since the 2017 bull market a host of crypto startups have been working on building out a new institutional ecosystem. The maturity of this new infrastructure is often mentioned as one of the reasons why “this time it’s different.” There are a number of different ways institutions can access the market. As the institutional swell keeps on building, here is a look at what we “officially” know so far about how they have been getting exposure.

Direct exposure through the spot market. MicroStrategy, One River Asset Management, Ruffer Investments, and Tesla used Coinbase prime brokerage services to buy Bitcoin in the spot market. Coinbase used long running execution algorithms (smart order routers) to break the orders down across time and venues. NYDIG helped MassMutual ($100M for General Account) and Marathon Patent ($150M Corporate Treasury). Coinbase also mentioned endowments and macro hedge funds as prime clients in its annual report.

On a related note, Paypal and Revolut are using Paxos infrastructure to execute their (retail) clients orders. NYDIG has launched a similar service and has partnerships with Moven and Nymbus in place to bring bitcoin services to their digital banking clients. The latter announced this week that it raised $53M in Series C Funding.

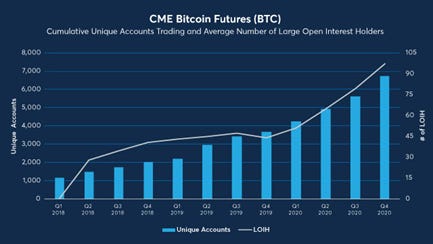

Exposure through crypto derivatives and crypto investment products. CME and regulated products like Grayscale fall into this camp. We know that Paul Tudor Jones, Renaissance Technologies, and Blackrock, amongst others, have gained exposure to bitcoin through the futures market. Although not explicitly stated, it is a relatively safe assumption that CME was the venue of choice. CME is highly regulated, a trusted brand, and institutions can access it through existing channels. CME bitcoin futures are also cash settled. All of this means that the institution eliminates a lot of the operational risk and complexity that comes with investing in the crypto spot markets. CME also had a banner year in 2020.

As reported last week, Grayscale CEO Michael Sonnenshein told Michael Saylor that 85% of the $5.7B new AUM Grayscale raised in 2020 came from institutional investors. A lot of them were hedge funds. Elsewhere, Sonnenshein recently said that they have seen a pick-up in interest from more traditional institutions like pensions and endowments. One of Bill Miller’s funds is also investing through Grayscale.

Finally, Coindesk reported that Bloomberg data is showing Goldman Sachs, ICAP, JPMorgan, and UBS buying Polkadot’s ETP (on behalf of institutional clients). ETPs, like Grayscale, are another way to get exposure to crypto. Flow Traders saw a significant uptick in interest in this category. And interestingly, as demonstrated by the 21Shares DOT ETP listed on SIX, this interest goes beyond bitcoin. Grayscale filed this week to register a new trust for DeFi Platform Yearn Finance.

Exposure through traditional securities. Finally, investors without a mandate to invest in crypto are seeking indirect exposure through crypto-related stocks and related securities. Morgan Stanley recently upped its investment in MicroStrategy, and one of Bill Miller’s funds invested in its convertible bond. Mining companies are also a well known avenue to get crypto exposure. CalPERS recently put a couple of millions into Riot (although spare change for them). Some of the upcoming public listings by crypto companies like Coinbase will be another way to get exposure to crypto.

And here are some headlines from this week:

- Diginex lets institutions trade crypto and equities under one roof

- Institutions Seek BTC Exposure Through Derivatives on Regulated Venues

- Tesla Tapped Coinbase for $1.5B Bitcoin Buy: Report

Unpacking MicroStrategy’s Latest Convertible Bond

MicroStrategy launched a $600M zero-coupon convertible bond offering under Rule 144A. The bonds were priced with a 50% conversion premium. The deal was upsized to $900M and can be increased by a further $100M if the greenshoe is exercised. This typically happens if the bonds are trading well in the aftermarket. The bonds have a 6-year maturity and MicroStrategy can call the bonds after 3 years subject to certain conditions. MicroStrategy has the option to settle any conversions in stock, cask, or a combination thereof.

Let’s unpack this:

- The bonds were issued under Rule 144A which represent a faster route to market than a registered offering. MicroStrategy did its last convertible bond just over two months ago. This is a very short window for primary markets. The use of proceeds of that offering was the same, buy more bitcoin. In my mind this signals that MicroStrategy believes that bitcoin will soon take off from current levels and may not come back to it.

- These are zero coupon bonds redeemable at 100%. The conversion premium is 50%. This means that if MicroStrategy’s stock price has increased by more than 50% at maturity (6 years from now), investors will elect to convert. Given MicroStrategy’s increasing exposure to bitcoin and the view that we all hold on bitcoin, this is almost certain to happen. If MicroStrategy elects to settle in stock, it will have done so at a 50% premium to today’s stock price, financing stock price growth with significantly less dilution than it would have done otherwise. Alternatively, if BTC has gone through the roof, it can elect to sell some to cash settle the bonds, which may be “spare change” by then and preferable. In other words, the firm is buying bitcoin with what could essentially be free debt.

- As discussed above, MicroStrategy’s convertible bonds are an alternative way for investors to gain exposure to bitcoin. Although the convertible bonds markets have been on fire, I would like to think that the substantial upsizing must reflect at least some demand from investors that are after bitcoin exposure. In particular given its recent December issue. Again, Bill Miller’s income strategy had done this in December.

- Another interesting aspect is that convertible bonds typically attract a distinct investor base that tends to care to a large extent about technicals and is relatively insensitive to use of proceeds. It would be hard to pull this off in the equity or corporate bond market.

- MicroStrategy will now be in the market, if not already, for another $1B of bitcoin. This will likely support the price of bitcoin in the near term. Coinbase had executed its previous trades using its execution algorithms (see above).

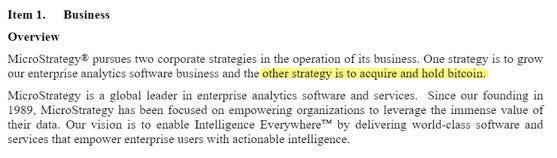

- Finally, Kevin Kelly of Delphi Digital flagged a notable addition to MicroStrategy’s corporate strategy in its latest 10K:

NFTs are going mainstream

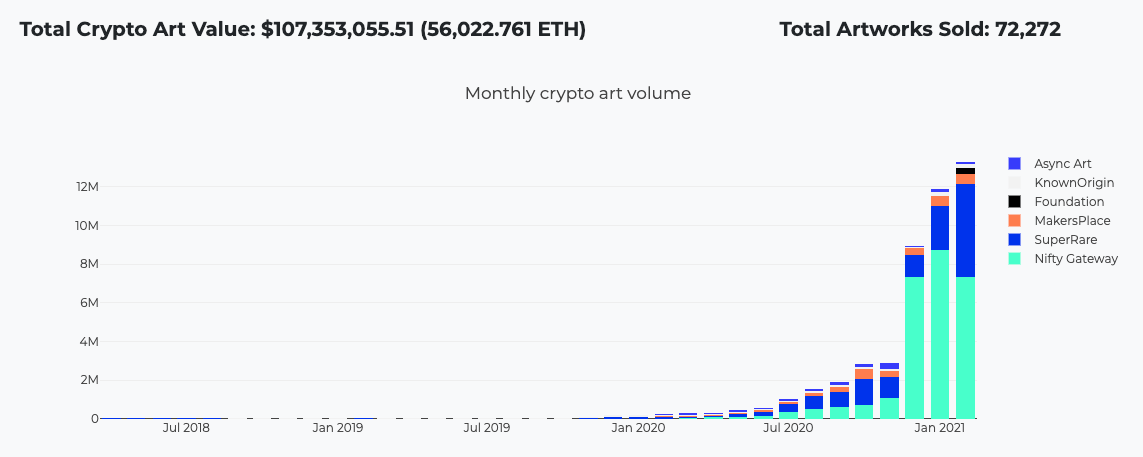

We are only halfway through February and Crypto Art sales have already topped those of January. According to https://cryptoart.io/data close to $110M in cumulative crypto sales were made so far. Last October, the digital artist Beeple, put a digital artwork in an edition of 100 up for sale. Each work cost $1, and the entire set sold out in less than one second. Today the NFTs are trading on Nifty Gateway for “well over $50,000.” Beepy has 1.8M Instagram followers.

Now Christie’s is getting a piece of it. On Tuesday, the auction house announced it would auction a work by Beeple, Everydays: The First 5000 Days. It will accept Ether as payment for the artwork’s principal price. “We’re at this precipice where crypto is going to be such a more established and mainstream mode of conducting business,” says Noah Davis of Christie’s.

NBA Top Shot is one reflection of the success of NFTs. Dapper Labs during its Feb 6 “Legendary Drop” sold roughly 2,300 collectibles packs in minutes with 25,000 users participating. There have been almost $70M in NBA Top Shot sales since its Oct launch, of which $60M were peer-to-peer. The first LeBron James “From the Top” highlights are sold for $100K. Dapper Labs is reportedly raising a $250M round at a valuation of ~$2B.

Top Legendary Moment Sales (January)

— NBA Top Shot (@nba_topshot) February 5, 2021

1. LeBron James Block, 1/59 (FTT Series 1 set): $100K

Collector spicy_seal2934

2. Zion Williamson Block, 1/50 (Holo MMXX Series 1 set): $100K

Collector jerlevine

3. LeBron James Block, 23/59 (FTT Series 1 set): $78K

Collector vegasfinds777 pic.twitter.com/IjXNj3YxWi

Another recent milestone: the largest NFT transaction to date. On Monday, a community member bought 9 Genesis parcels in Axie Infinity’s virtual land system for an aggregate of $1.5M. Yup, that’s right, $1.5M for a piece of virtual land, not for a real house (villa)! Elsewhere, Mark Cuban sold a gif for $81,000 and someone else bought a JPEG for $650,000.

NFTs baby, the future is here! 🔥🔥🔥

Here are a few interesting reads from this week:

- People Are Spending Millions on JPEGs, Tweets, And Other Crypto Collectibles

- NFTs make the internet ownable

- Digital Art, Crypto, & the Metaverse: Foreshadowing the Future of Virtual Worlds & Virtual Economies

Increasing gas cost problem for DEX adoption by “normal” users

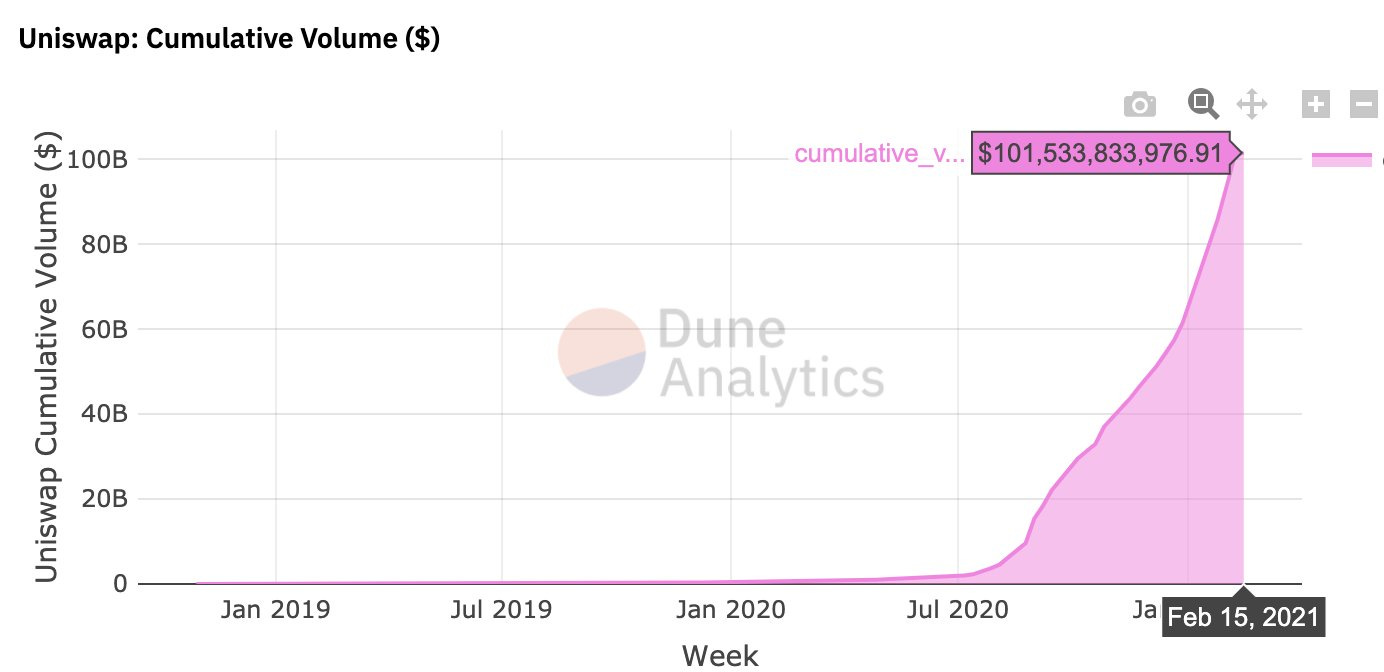

Decentralized exchanges (DEXs) have been on a roll since the liquidity mining frenzy started. Uniswap broke records this week becoming the first DEX to report $100B in cumulative volume.

A number of interesting “real world” use cases are emerging for DEXs including stablecoin exchange and a potential source of liquidity for private equity and debt securities. Challenges remain to be solved before more widespread adoption is expected to take place. These include easier access and KYC. However, the more immediate issue is how to navigate record gas fees.

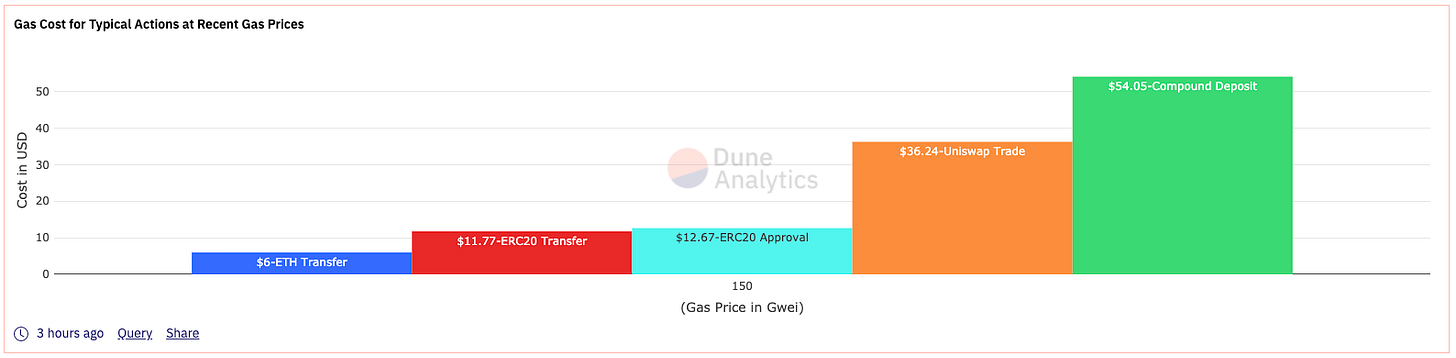

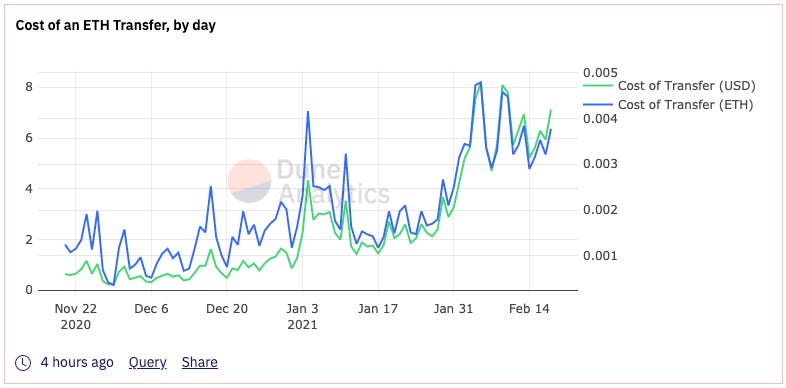

According to Dune Analytics data, aggregate DEX volume across Ethereum-based exchanges in the last 30 days was $59B. As on-chain transactions continue to grow, the Ethereum blockchain has become heavily overloaded, reflected in gas fees. AMMs like Uniswap execute trades on the blockchain. These fees increase with the usage of Ethereum itself and can cost over $100 at times. This is not a problem for liquidity miners that make hefty profits but does matter to “normal” users.

Eth2 is expected to provide relief but likely won’t launch in full until the end of the year. In the meanwhile there are a number of solutions skewed towards the tech savvy including layer-2 scaling solutions.

Cointelegraph ran an article on it this week. ZKSwap, a DEX built on ZK-Rollup technology, launched its mainnet as a layer-2 protocol on the Ethereum network.

Momentum tracker

- BlackRock has started to ‘dabble’ in crypto, says CIO

- ING-backed digital assets post-trade platform Pyctor is raising money. Pyctor provides the so-called “plumbing” or infrastructure that allow other platforms to handle their crypto and digital assets after trades have been completed. Pyctor is a collaboration involving ABN AMRO, BNP Paribas Securities Services, Citibank, Invesco, Société Générale – Forge, State Street, UBS and others.

- Morgan Stanley May Bet on Bitcoin in $150B Investment Arm. Counterpoint Global, known for its prowess in picking growth stocks, is exploring whether the cryptocurrency would be a suitable option for its investors, according to people with knowledge of the matter. Moving ahead with investments would require approval by the firm and regulators.

- Deutsche Bank Quietly Plans to Offer Crypto Custody, Prime Brokerage. The bank’s game plan was hidden in plain sight in a widely overlooked report by the World Economic Forum. Deutsche said it has completed a proof of concept and is aiming for an MVP in 2021, while exploring global client interest for a pilot initiative.

- Japan’s SBI in talks to set up crypto JV with foreign financial firms, its CEO said. Kitao said at least two deals were under discussion, but declined to elaborate on possible partners. “Definitely,” Kitao said, when asked whether the business would become one of SBI’s key earners. “To become number one in the world, our choice is buying a leading company or creating an alliance with major global companies,” he said. “Our M&A strategy will not be something like taking minority stakes in many companies.”

- JPMorgan will offer bitcoin trading if there is client demand, says COO. “If over time an asset class develops that is going to be used by different asset managers and investors, we will have to be involved,” Pinto told CNBC in an interview published Friday. “The demand isn’t there yet, but I’m sure it will be at some point.”

- Miami Officially Considers Putting Government Funds in Bitcoin. Miami Mayor Francis Suarez proposed paying municipal workers and collecting taxes in Bitcoin, expanding a campaign to promote crypto. Suarez also wants the city to analyze the feasibility to invest some government funds in Bitcoin.

- Amazon Preparing to Launch a ‘Digital Currency’ Project in Mexico. Job postings describe a walled garden-type digital currency that could roll out in emerging economies. “This product will enable customers to convert their cash into digital currency using which customers can enjoy online services including shopping for goods and/or services like Prime Video,” one job post said of Amazon’s “new payment product.”

- Mastercard Launches Prepaid Card for World’s First CBDC in the Bahamas.

Investment products continue their momentum

This week saw a number of new fund launches (again). Notably, diversity is increasing. Until recently, funds were mainly focused on the top coins, as highlighted by Jeff Dorman of Arca and CoinShares. Firms are also hiring and setting up new asset management divisions. These are important steps toward growing the market cap of the crypto universe outside of the top coins.

In time, diversity will draw more institutional investors into the space. Although for now the main access point may be investment products, once the market cap grows, I expect institutions to put additional resources into the space. In other words, it will get them over the barrier of the operational risk and hassle and invest into tokens like DeFi directly. This will then drive a powerful feedback loop of adoption, investment, growth, and change for capital markets at large. Given the speed of innovation cycles in crypto, this time may come sooner than we think. Late 2021, early 2022 is not out of the question in my mind.

“You’re seeing the initial flicker of a new technology that could significantly disrupt a lot of what traditional Wall Street makes money on, making it more efficient, more open, more accessible and more functional. And we’re at the early stages of that,” Bitwise CIO Matt Hougan told CoinDesk.

- NYDIG files for US Bitcoin ETF, with Morgan Stanley on board

- Bitwise Launches DeFi Crypto Index Fund. At launch, the fund’s top holdings include tokens backing an Ethereum-based lending protocol and a decentralized exchange – AAVE and UNI – which each carry an initial weighting of around 25%. Lending protocol token MKR and derivatives protocol token SNX come in around 10%.

- Grayscale Files to Register Trust for DeFi Platform Yearn Finance.

- Grayscale is also looking to double its headcount after 3 C-suite hires.

- BlockFi seeks key hires for its new asset management unit. The firm filed for a bitcoin trust last week.

Crypto firms are raising capital at unicorn valuations

- BlockFi raising $150M Series D at $2.85B pre-money valuation: sources

- Dapper Labs Raising $250M+ at $2B Valuation: Report

- Blockchain.com raises $120M strategic growth round led by macro investors. The institutional funding is set to back an increasingly institutional-centric company. Blockchain.com now makes enough cash from its institutional clients to cover all global operating costs and expects that business to continue “growing exponentially.”

- SBI Investing ‘Eight-Figure’ Sum in Swiss Crypto Bank Sygnum. Sygnum has now raised around $30M in the last six months and will use the proceeds to grow the firm’s AUA, which stood at $500M+ last month. Other use of proceeds include the commercialization of a tokenization platform and secondary market trading facility, as well as expanding the firm’s open banking API infrastructure and adding new custody features.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.