One of my favorite books of all time is Roger Lowenstein’s “When Genius Failed” about the rise and fall of Long-Term Capital Management (LTCM). As the Archegos drama unfolded this past week, the media were quick to draw a comparison to LTCM. It actually reminded me more of the final scenes of “The Big Short” where the bank is stuffing clients with a bad trade.

What happened? Large investment banks allowed Archegos Capital Management, the family office of a dubious former hedge fund manager, to take excessive risk involving lots of leverage. Certain second tier tech stock positions went pear-shaped, Archegos defaulted on margin calls, the banks had to liquidate positions, the stocks tanked, and the banks involved suffered material losses (some in the billions).

What does this have to do with crypto? The losses will put the spotlight on banks’ risk management practices and risk-taking in general. This may reduce banks’ risk appetite in the near term. My glass half-empty thinking is that this may delay banks’ plans to launch crypto services. Glass half full? The Economist speculated that “banks are desperately searching for profits. Rules drafted after the global financial crisis make it expensive for Wall Street banks to trade on their own account.” Crypto as an asset class should offer banks plenty of opportunity to build new, profitable services in coming years. And the ecosystem has matured to the extent that this can be done in a risk-controlled way that is up to institutional standards.

Goldman seems unwavered and determined to be a first-mover on offering crypto services to its clients. Mary Rich, global head of digital assets for Goldman’s private wealth management division told CNBC the firm is looking to offer crypto to its wealth management clients soon.

In this issue:

- 10 trends that underpinned institutional momentum in Q1

- By the numbers

- Momentum tracker

- Fund raising

10 trends that underpinned institutional momentum in Q1

Q4 was characterized by large institutional investors getting involved and declaring their love for bitcoin. Q1 built on that momentum in many different ways, building a solid foundation for the further institutionalization of the asset class. The consensus amongst most institutions is that crypto is here to stay.

Below are 10 trends that have been driving the institutional flywheel in Q1 and are a reflection of the continued strength of institutional demand.

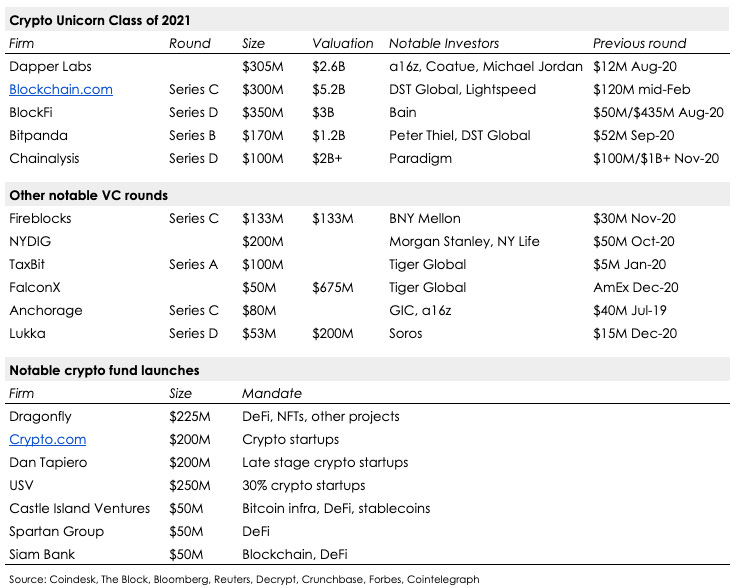

#1 Capital flowing into crypto: project funding, fund launches

Q1 saw a significant uptick in fundraising with capital flowing into projects, crypto infrastructure companies, and new funds. A number of new unicorns were born along the way 🦄 The table below shows selected notable fund raises.

Observations

Most of the VC rounds…

- Come on the heels of relatively recent funding rounds;

- Show a massive increase in valuation;

- Are backed by tier 1 financial institutions and funds;

- Are received by companies that underpin the institutional crypto ecosystem.

Which makes me interpret this funding activity as a reflection of the sheer amount of institutional demand, as well as the potential that these high profile backers see for crypto as an asset class.

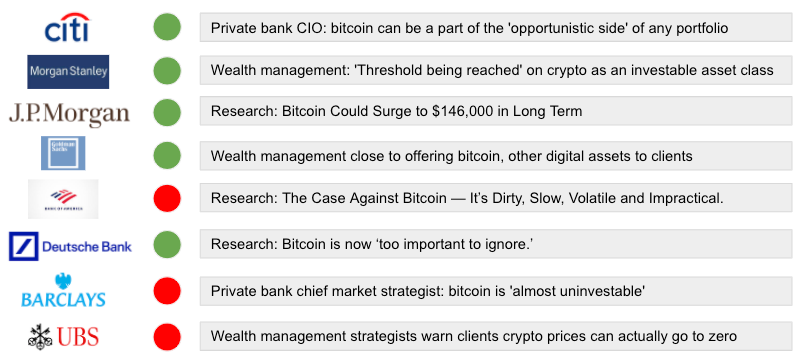

#2 Banks are speaking out on crypto, majority believes it is here to stay

#3 High profile financial institutions are getting involved

Below is a snapshot of some of the largest financial institutions that have gotten involved in crypto in Q1 through: launching crypto services (Goldman, Visa, Cboe), investment (Morgan Stanley, BNY Mellon), making acquisitions (Paypal/Curv), announcing intention to launch services in 2021 (Deutsche Bank, BNY Mellon), partnering (SBI), or otherwise.

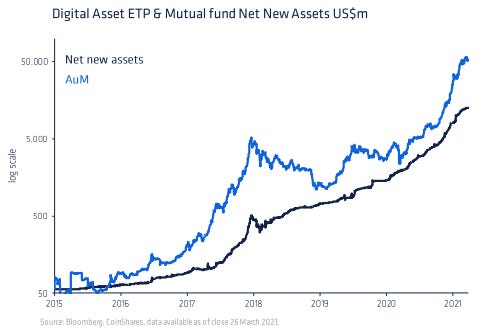

#4 Investment product AUM growth is reflection of institutional demand

In October, CoinShares started tracking fund flows for digital asset ETPs and mutual funds, measuring the net movement of cash into and out of these investment vehicles.

In traditional asset classes fund flows are considered an indicator of investor sentiment. Especially in the equities space, they have long been viewed as a meaningful investment signal. The idea is that inflows beget more inflows, leading to rising prices, and vice versa.

So far in 2021, fund flows have averaged $900M per day vs. $137M in 2020. Total AUM tracked by CoinShares stands at $52.2B from $7.5B mid-October when they started tracking. Grayscale, whose AUM contributes $42.6B to the total, has said that 85% of new AUM raised in 2020 came from institutional investors, a lot of them hedge funds.

Note that the chart below is on a log scale!

As reported before, the breadth of investment products has also increased, which is a reflection of institutional interest beyond bitcoin.

#5 Six highly reputable firms filed for a Bitcoin ETF

Six very reputable institutions filed with the SEC for a bitcoin ETF in the last 90 days, starting with VanEck on Dec 30th. Since then, Valkyrie Digital Assets, NYDIG, Wisdom Tree, Skybridge Capital, and Fidelity have followed. It was also announced that State Street will act as fund admin and transfer agent for VanEck, and Morgan Stanley will act as an AP for NYDIG. Furthermore, BlockFi and Grayscale are hiring for ETF focused roles, and Reuters reported that Goldman is exploring a bitcoin ETF.

Why does an ETF matter?

- It will open up easy access to bitcoin investment for the masses;

- APs will have to hedge their exposure with either spot or futures translating into a massive uptick in volume (and price!);

- Banks typically act as APs and will want a piece of the action and the profits.

The ball is in the SEC’s court…

# 6 Increasing visibility and profile of crypto firms through listing

As we discussed a few weeks ago, a number of crypto firms are now publicly listed and a pipeline of hopefuls is filling up. Below is the table (excluding miners) that I featured a few weeks back.

Why do listings matter?

- Visibility: to the general public, to institutions who can get familiar with the asset class and get indirect exposure, and to investment banks who have to start covering these firms (investment banking, research, corporate treasury) to not fall behind.

- Transparency: clients will have greater insight into the financial position of their crypto service providers (counterparties in certain instances), and, the increase in regulatory scrutiny formally requires strong corporate governance standards. Both are important in dealing with traditional institutions. At a macro level the performance of these firms can serve as a barometer for the broader ecosystem.

- Acquisition currency: the institutional interest in the space will likely trigger more consolidation. Publicly traded shares can serve as an attractive form of acquisition currency.

#7 Mainstream media embracing crypto

The Wall Street Journal, Reuters, Bloomberg, Forbes, the South China Morning Post and many other mainstream media are all running daily headlines on the asset class now. The Financial Times has also come around following the explosion of interest in NFTs.

On an institutional level that means that there is no getting around to at the very least have an informed opinion on the asset class to address investor demand. This is true for allocators, funds, and financial intermediaries. As many have pointed out, there is now more career risk associated with not investing in crypto within a reasonable time frame.

Another secondary effect that was very present this quarter is an influx of talent from Wall Street.

#8 Significant increase in exchange, broker, and lending volumes

Public crypto and FinTech companies, crypto exchanges, lenders, and other providers have all drafted an extremely positive picture of the crypto transaction volumes they are seeing. Many have commented that institutional demand has been a driving factor.

Some numbers that illustrate the growing transactional volumes in these areas:

- Coinbase traded $193B in 2020, up 141.7% from 2019 per their S-1.

- Galaxy reported yesterday that counterparty trading volumes were up over 80% in Q4 2020 from Q3 and over 230% year-over-year from the prior-year Q4 2019. Their loan book grew by 300%+ to $110M at year-end and is currently close to $400M with gross new origination growing an additional 400% to approximately $560M. As a market maker Galaxy is trading $1.5B+ per day in volume now across venues.

- Square and Robinhood said in Feb that they respectively added 1M and 6M new crypto customers 2021 YTD. With the total number of users conservatively estimated around 100 million at the start of the year, these numbers are significant.

- Crypto lenders BlockFi ($15B), Celsius Network ($10B) and Nexo ($5B) recently hit milestones in AUM. Combined, they now hold $30B in AUM.

- Genesis reported $7.6B loan originations, $8.1B spot traded, $4.5B derivatives over Q4.

- Bloomberg recently reported that FalconX processes ~$6B in volume per month for institutional investors.

And some charts…

Paradigm monthly Block Options and Futures Volumes (USD)

Paradigms is a popular platform for doing derivatives block trades OTC. Their clients are institutions. Note that a substantial part of volumes has been driven by new clients.

Monthly crypto spot exchange volumes

Market-wide aggregate open interest of bitcoin futures

I can go on and on here, to the options markets, decentralized exchanges, but you get the picture: massive growth.

#9 The sudden rise of the NFT

NFTs went from zero to the moon in the last month. Everyone jumped on the wagon once it started rolling: Mark Cuban, Lindsay Lohan, professional athletes, artist, Christies, Charmin toilet paper, Batman, and Time magazine. I think that when we look back a year from now, this may well have been the watershed moment for broader user adoption of crypto applications. It also put a big spotlight on the space and I think it is safe to say that everyone including grandma knows about NFTs now. And that’s why it matters in the context of this discussion.

Some numbers just for fun.

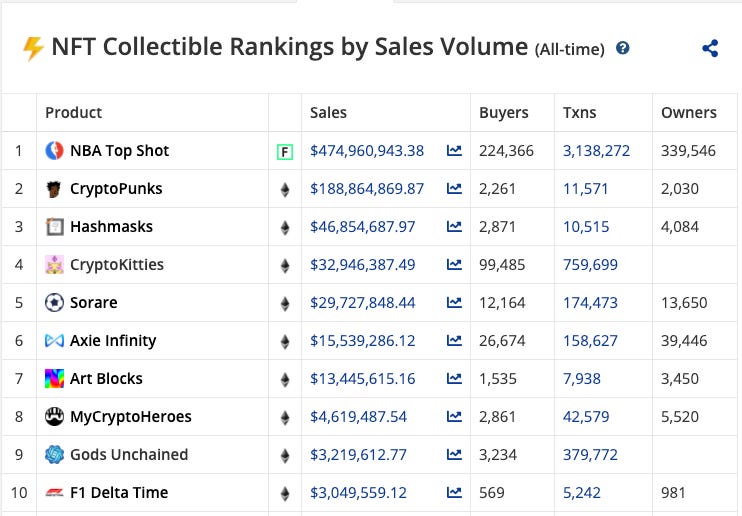

NFT collectible rankings by https://cryptoslam.io/

A lot of the sales were made in the last 3-6 months e.g. NBA Top Shot sold $210M in the last 30 days.

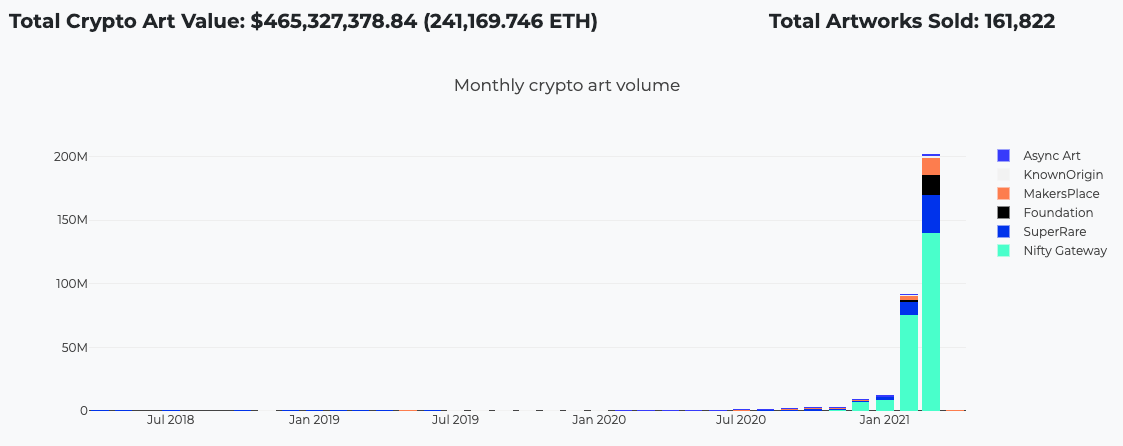

Crypto art sales data by cryptoart.io/data

#10 Focus on environmental impact

Not so much underpinning institutional momentum, but it does matter to traditional institutions and deserves a shout out given the attention the topic has been getting recently.

This quarter also saw a lot of back and forward debate over the environmental impact of Bitcoin and other cryptoassets. I wrote about this before and it probably warrants another post to report on how the debate has progressed since.

There are a lot of reasons why this matters but in the context of institutional investment it does because of ESG which is a very hot topic for institutional investors globally. There is a lot of misunderstanding about the comparative environmental impact of cryptoassets and that has the potential to hurt. It is important that as an industry we have clarity on this topic.

Stay tuned.

By the numbers

- $2T: the total market cap crypto is flirting with — it would be a new record

- $1.5B: revenue earned by BTC miners in March thus far

- $10,631.36: the price of BTC 6 months ago

- $8B: drop in Coinbase reserves in 3 months, underscoring HODLing

- 16%: the % of total market value of all stablecoins held by exchanges ($10B+)

Momentum tracker

- Goldman close to offering crypto to wealth management clients.

- Binance adds two former FATF members to its team of advisors. Binance has been signaling an increased focus on institutional standards amidst a reported investigation by the CFTC.

- Visa moves to allow payment settlements using USDC. It said on Monday it will allow the use of the USDC stablecoin to settle transactions on its payment network. The firm launched the pilot program with payment and crypto platform Crypto.com and plans to offer the option to more partners later this year.

- Deribit launches volatility index DVOL, will offer futures on index soon. “Whilst in traditional market’s, the volatility index is known as a “fear gauge”, when looking at implied volatility in Bitcoin, we instead refer to this volatility index as an “action gauge” as Bitcoin options often have positive skew and the large moves are often expected on the upside as well as downside,” the exchange said.

- CoinShares doubled its earnings in 2020, is now managing $4.5B.

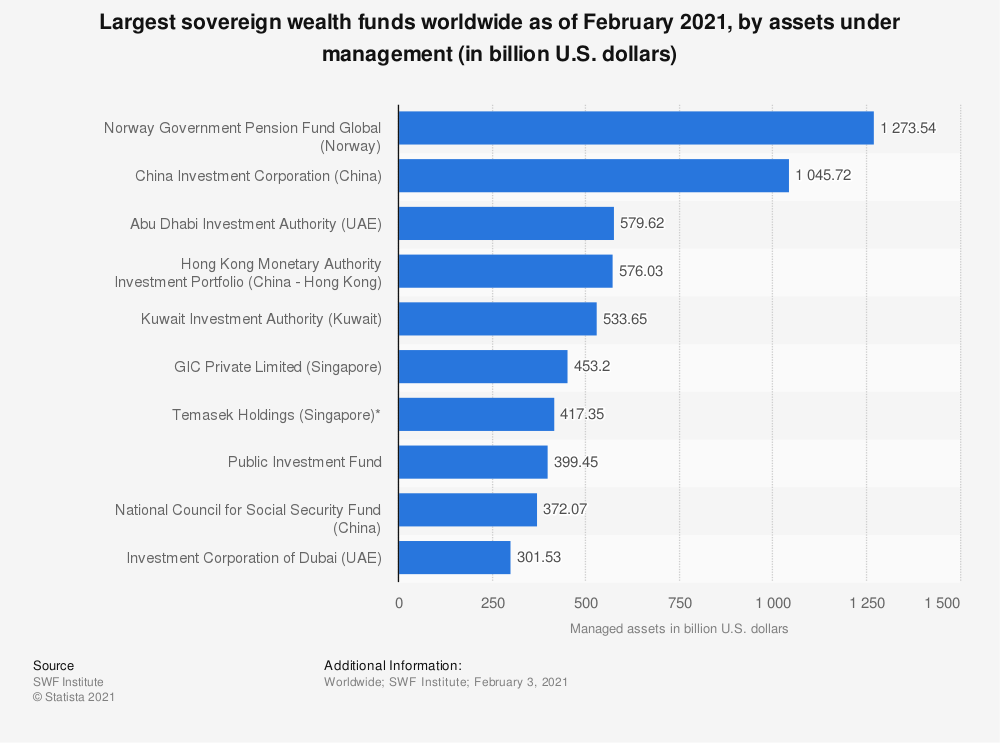

- Sovereign Wealth Funds (SWFs) are looking to buy bitcoin. NYDIG CEO Robbie Gutmann told Raoul Pal that his firm has been having conversations with SWFs about possible Bitcoin investments. Pal responded that Temasek has been buying freshly minted bitcoin from miners. See below for an overview of the largest SWFs.

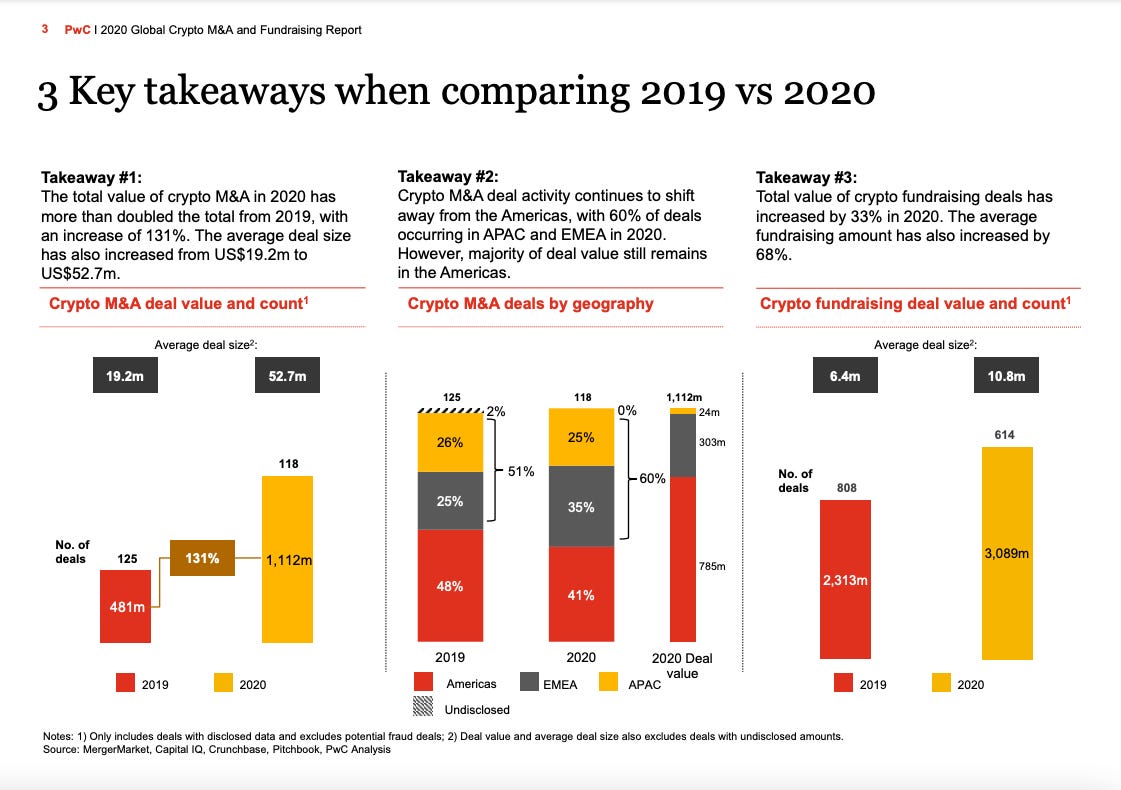

- Crypto M&A more than doubled to $1.1B in 2020: PwC

Fund raising

- Dapper Labs Raised $305M at $2.6B valuation from a16z, Coatue, NBA players.

- Chainalysis valued at $2B+ after new $100M Series D led by Paradigm.

- Digital asset bank Avanti raises $37M in Series A ahead of launch.

- Solana Ecosystem raises $40M in strategic investments from OKEx, MXC.

- Dragonfly launches new $225M fund to invest in DeFi, NFT, other projects.

- Crypto wallet startup imToken raises $30M in Series B.

Disclaimer: any views expressed are my own and do not represent the views of my employer. The content in this newsletter is based on information from publicly available sources.